Concept explainers

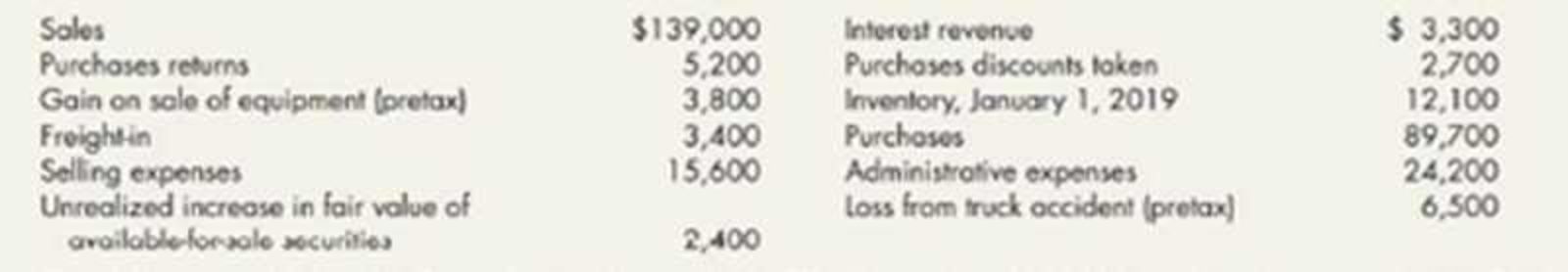

Cost of Goods Sold, Income Statement. and Statement of Comprehensive Income Gaskin Company derives the following items from its adjusted

The following; additional information is also available. The December 31, 2019, ending inventory is $14,700. During 2019, 4,200 shares of'common stock were outstanding the entire year. The income tax rate а 30% on all items of income.

Required:

- 1. As a supporting document for Requirements 2 and 3, prepare a separate schedule for Gaskin’s cost of goods sold.

- 2. Prepare a 2019 single-step income statement.

- 3. Prepare a 2019 multiple-step income statement.

- 4. Prepare a 2019 statement of comprehensive income.

1.

Prepare a schedule for Company G’ cost of goods sold.

Explanation of Solution

Cost of goods sold: Cost of goods sold is the total of all the expenses incurred by a company to sell the goods during the given period.

Schedule of cost of goods sold is a report which reports cost of goods sold in a detailed manner.

Prepare a schedule for Company G’ cost of goods sold.

| Company G | ||

| Schedule 1: Cost of goods sold | ||

| For the year ended December 31, 2019 | ||

| Particulars | Amount ($) | Amount ($) |

| Beginning inventory | $12,100 | |

| Purchases | $89,700 | |

| Freight-in | $3,400 | |

| Cost of purchase | $93,100 | |

| Less: Purchases returns | ($5,200) | |

| Less: Purchase discount takes | ($2,700) | |

| Net purchases | $85,200 | |

| Cost of goods available for sale | $97,300 | |

| Less: Ending inventory | ($14,700) | |

| Cost of goods sold | $82,600 | |

Table (1)

2.

Prepare a single step income statement for Company G for the year ended December 31, 2019.

Explanation of Solution

Single-step income statement: It is an income statement format in which a single subtotal of all revenue items are listed in one column, and a single subtotal of all expense items including cost of goods sold are listed in another column. Thus, the subtotal of all expense items is deducted from the subtotal of all revenue items to arrive at the net income at the bottom of the statement.

Prepare a single-step income statement for Company G for the year ended December 31, 2019.

| Company G | ||

| Single-Step Income Statement | ||

| For the Year Ended December 31, 2019 | ||

| Particulars | Amount | Amount |

| ($) | ($) | |

| Revenues: | ||

| Sales | $139,000 | |

| Interest revenue | $3,300 | |

| Gain on sale of equipment | $3,800 | |

| Total revenues (A) | $146,100 | |

| Expenses: | ||

| Cost of goods sold | $82,600 | |

| Selling expenses | $15,600 | |

| Administrative expense | $24,200 | |

| Loss from truck accident | $6,500 | |

| Income tax expense (1) | $5,160 | |

| Total expenses (B) | $134,060 | |

| Net income | $12,040 | |

| Number of common shares (D) | 4,200 shares | |

| Earnings per share | $2.87 | |

Table (3)

Working note (1):

Calculate the income tax expense:

3.

Prepare a multi-step income statement for Company G for the year ended December 31, 2019.

Explanation of Solution

Multi step income statement: A multiple step income statement refers to the income statement that shows the operating and non-operating activities of the business under separate head. In different steps of the multi-step income statement, principal operating activities are reported that starts from the record of sales revenue with all contra sales revenue account like sales returns, allowances and sales discounts.

Prepare a multi-step income statement for Company G for the year ended December 31, 2019.

| Company G | ||

| Multi-Step Income Statement | ||

| For the Year Ended December 31, 2019 | ||

| Particulars | Amount | Amount |

| ($) | ($) | |

| Sales | $139,000 | |

| Less: Cost of goods sold | $82,600 | |

| Gross profit | $56,400 | |

| Operating expenses: | ||

| Selling expenses | $15,600 | |

| General and administrative expenses | $24,200 | |

| Total operating expenses | $39,800 | |

| Operating income | $16,600 | |

| Other items | ||

| Gain on sale of equipment | $3,800 | |

| Loss from truck accident | ($6,500) | |

| Interest revenue | $3,300 | $600 |

| Income before income tax | $17200 | |

| Less: Income taxes @30% | ($5,160) | |

| Net income (A) | $12,040 | |

| Number of common shares (B) | 4,200 shares | |

| Earnings per share | $2.87 | |

Table (2)

4.

Prepare a statement of comprehensive income for the year ended December 31, 2019.

Explanation of Solution

Prepare a statement of comprehensive income for the year ended December 31, 2019.

| Company G | ||

| Statement of comprehensive income | ||

| For the Year Ended December 31, 2019 | ||

| Particulars | Amount | Amount |

| ($) | ($) | |

| Net income | $12,040 | |

| Other comprehensive income: | ||

| Unrealized increase in fair value of available for sale securities | $1,680 | |

| Comprehensive income | $13,720 | |

Table (4)

Want to see more full solutions like this?

Chapter 5 Solutions

Intermediate Accounting: Reporting And Analysis

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning