Concept explainers

Comprehensive: Income Statement and

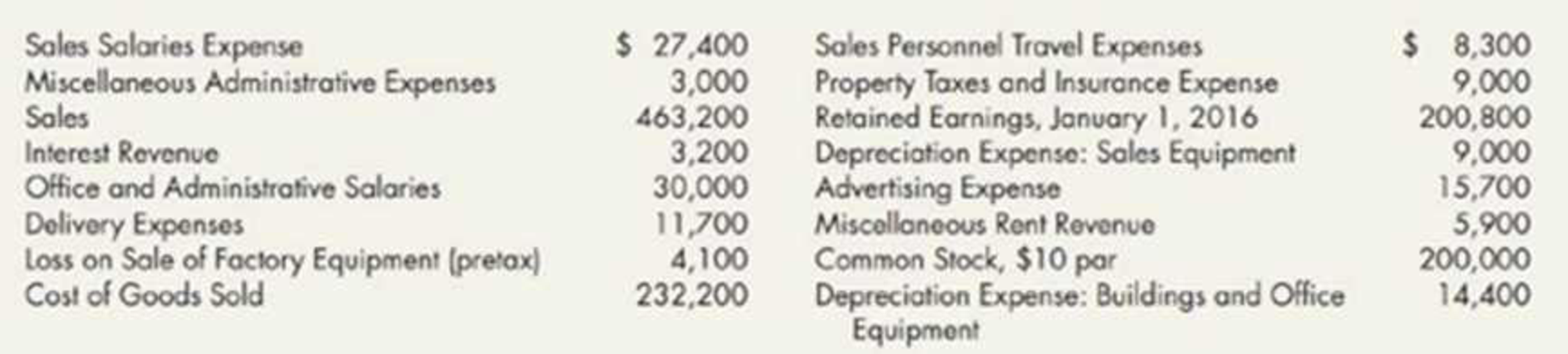

The following information is also available but is not reflected in the preceding accounts:

- a. The company sold Division E (a major component of the company) on August 2, 2019. During 2019, Division E had incurred a pretax loss from operations of $16,000. However, because the acquiring company could vertically integrate Division E into its facilities, Milwaukee Manufacturing was able to recognize a $42,000 pretax gain on the sale.

- b. On January 2, 2019, without warning, a foreign country expropriated a factory of Milwaukee Manufacturing which had been operating in that country. As a result of that expropriation, the company has incurred a pretax loss of $30,000.

- c. The common stock was outstanding for the entire year. A cash dividend of $1.20 per share was declared and paid in 2019.

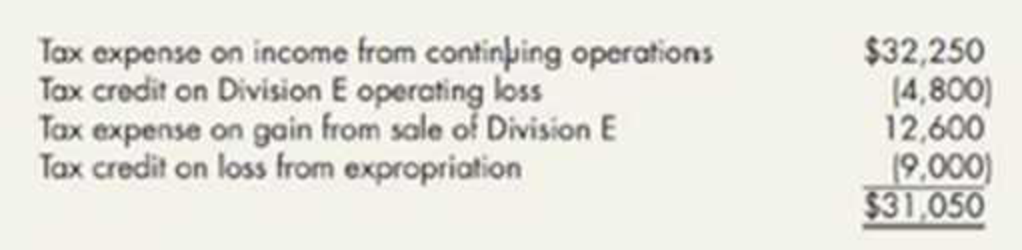

- d. The 2019 income tax expense totals $31,050 and consists of the following:

Required:

- 1. As supporting documents for Requirement 2, prepare separate supporting schedules for selling expenses and for general and administrative expenses (include

depreciation expense where applicable in these schedules). - 2. Prepare а 2019 multiple-step income statement for Milwaukee Manufacturing.

- 3. Prepare a 2019 retained earnings statement.

- 4. Next Level What was Milwaukee Manufacturing’s return on common equity for 2019 if its average shareholders’ equity during 2019 was $500,000? What is your evaluation of this return on common equity if its “target” for 2019 was 15%?

- 5. Next Level Discuss how Milwaukee Manufacturing’s income statement in Requirement 2 might be different if it used IFRS.

1.

Prepare a separate schedule for both selling and general and administrative expenses of Company M for the year ended December 31, 2019.

Explanation of Solution

Expenses: Expenses are costs incurred for the operations of a business. The costs incurred for generating revenues are rent expense, depreciation expense, general and administrative expenses, selling expenses, and utilities expense.

Prepare a separate schedule for both selling and general and administrative expenses of Company M for the year ended December 31, 2019 as follows:

| Company M | |

| For Year Ended December 31, 2019 | |

| Schedule 1: Selling Expenses | |

| Particulars | Amounts ($) |

| Sales salaries expense | $27,400 |

| Delivery expenses | 11,700 |

| Sales personnel travel expenses | 8,300 |

| Depreciation expense: sales equipment | 9,000 |

| Advertising expense | 15,700 |

| Total selling expenses | $72,100 |

| Schedule 2: General and Administrative Expenses | |

| Depreciation expense: buildings and office equipment | $14,400 |

| Office and administrative salaries | 30,000 |

| Property taxes and insurance expense | 9,000 |

| Miscellaneous administrative expenses | 3,000 |

| Total general and administrative expenses | $56,400 |

Table (1)

2.

Prepare a multi-step income statement of Company M for the year ended December 31, 2019.

Explanation of Solution

Multi-step income statement: The income statement represented in multi-steps with several subtotals, to report the income from principal operations, and separate the other expenses and revenues which affect net income, is referred to as multi-step income statement.

Prepare a multi-step income statement of Company M for the year ended December 31, 2019 as follows:

| Company M | ||

| Income Statement | ||

| For Year Ended December 31, 2019 | ||

| Particulars | Amounts ($) | Amounts ($) |

| Sales | 463,200 | |

| Less: Cost of goods sold | (232,200) | |

| Gross profit | 231,000 | |

| Less: Operating expenses: | ||

| Selling expenses (Schedule 1) | 72,100 | |

| General and administrative expenses (Schedule 2) | 56,400 | |

| Total operating expenses | (128,500) | |

| Operating income | 102,500 | |

| Less: Other items: | ||

| Interest revenue | 3,200 | |

| Miscellaneous rent revenue | 5,900 | |

| Loss from expropriation | (30,000) | |

| Loss on sale of factory equipment | (4,100) | (25,000) |

| Pretax income from continuing operations | 77,500 | |

| Less: Income tax expense (1) | (23,250) | |

| Income from continuing operations | 54,250 | |

| Results from discontinued operations: | ||

| Loss from operations of discontinued Division E (2) | (11,200) | |

| Gain on sale of Division E (3) | 29,400 | 18,200 |

| Net income (a) | 72,450 | |

| Number of common shares (b) | 20,000 shares | |

| Earnings per Common Share | $3.62 | |

Table (2)

Working note (1):

Compute the amount of income tax expense:

Working note (2):

Compute the loss from operations of discontinued Division E:

Working note (3):

Compute the Gain on sale of Division E:

3.

Prepare a retained earnings statement of Company M for the year ended December 31, 2019.

Explanation of Solution

Retained earnings: Retained earnings are that portion of profits which are earned by a company but not distributed to stockholders in the form of dividends. These earnings are retained for various purposes like expansion activities, or funding any future plans.

Prepare a retained earnings statement of Company M for the year ended December 31, 2019 as follows:

| Statement of Retained Earnings | |

| For Year Ended December 31, 2019 | |

| Particulars | Amount ($) |

| Retained earnings as on January 1,2019 | $200,800 |

| Add: Net income | 72,450 |

| 273,250 | |

| Less: Cash dividends (4) | (24,000) |

| Retained earnings as on December 31, 2019 | $249,250 |

Table (3)

Working note (4):

Compute the amount of cash dividend:

4.

Ascertain the return on common equity of Company M for 2019 and comment.

Explanation of Solution

Return on equity (ROE): This financial ratio evaluates a company’s efficiency in using stockholders’ equity to generate net income. So, ROE is a tool used to measure the performance of a company.

Ascertain the return on common equity of Company M for 2019 as follows:

Working note (5):

Compute the average shareholder’s equity:

The return on shareholders’ equity of Company M for the year 2019 is 17.0%, which is above the target of 15%. However, Company M had results from discontinued operations in 2019. The target return falls short to 12.8%

5.

State the manner in which the income statement of Company M given in requirement 2 gets differs, if it uses IFRS.

Explanation of Solution

The presentation and the content of the income statement might differ as follows:

- Either the single-step or multiple-step format could have been used.

- The term “Turnover” could have been used instead of sales.

- The expenses might be classified by their nature rather than their function.

- To adjust the depreciation expense, if it has revalued its property.

Want to see more full solutions like this?

Chapter 5 Solutions

Intermediate Accounting: Reporting And Analysis

- Define in detail the following in relation to Organizational Ethics. The Ethical Culture of an organization. Define these Five Signs of Ethical Collapse a) Pressure to maintain the numbers b) Fear of reprisals c) Loyalty to the boss d) Innovations e) Goodness in some areas, atones for evil in othersarrow_forwardCalculate the stock in the beginningarrow_forwardI need help with this problem and accountingarrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning