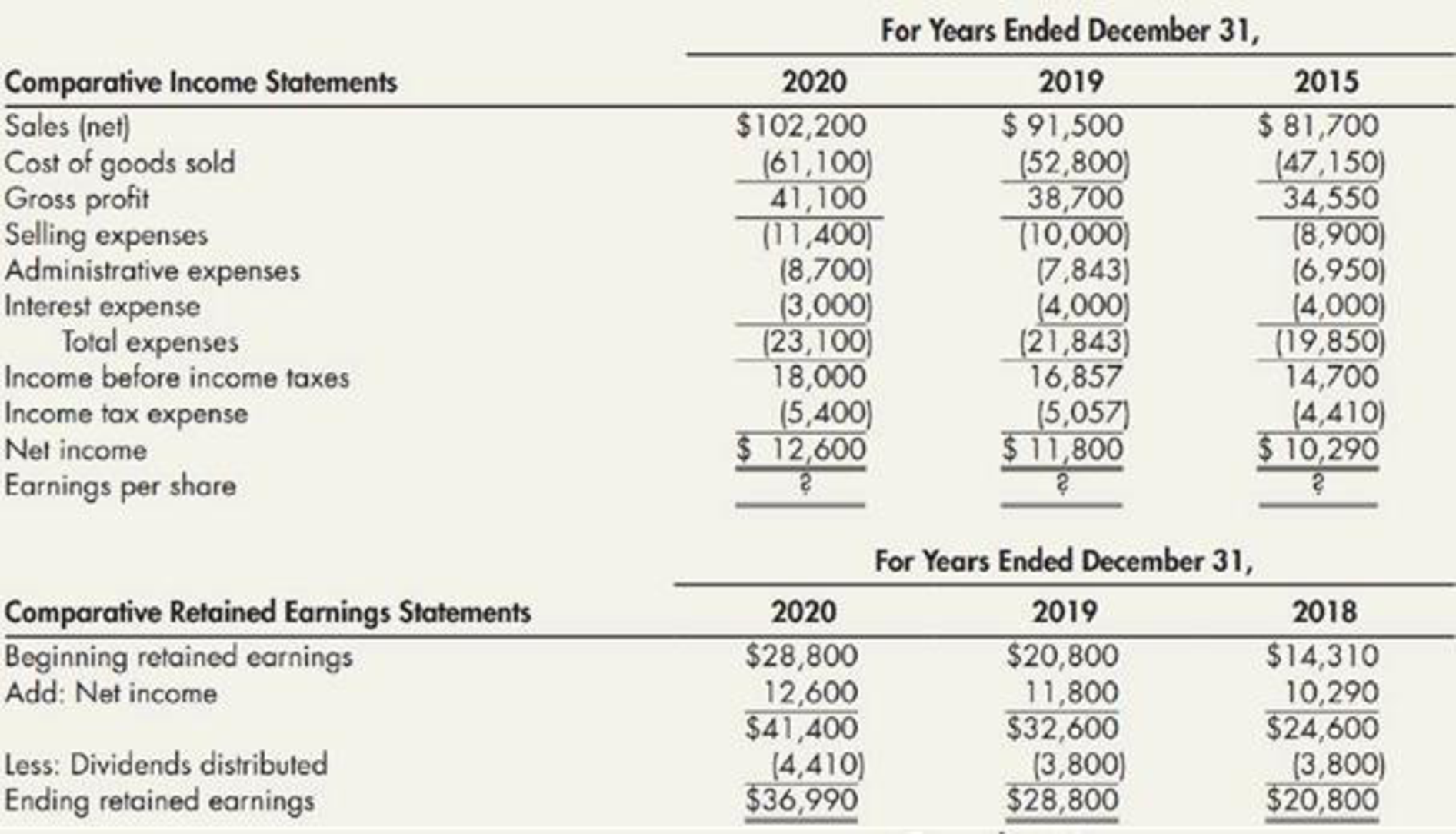

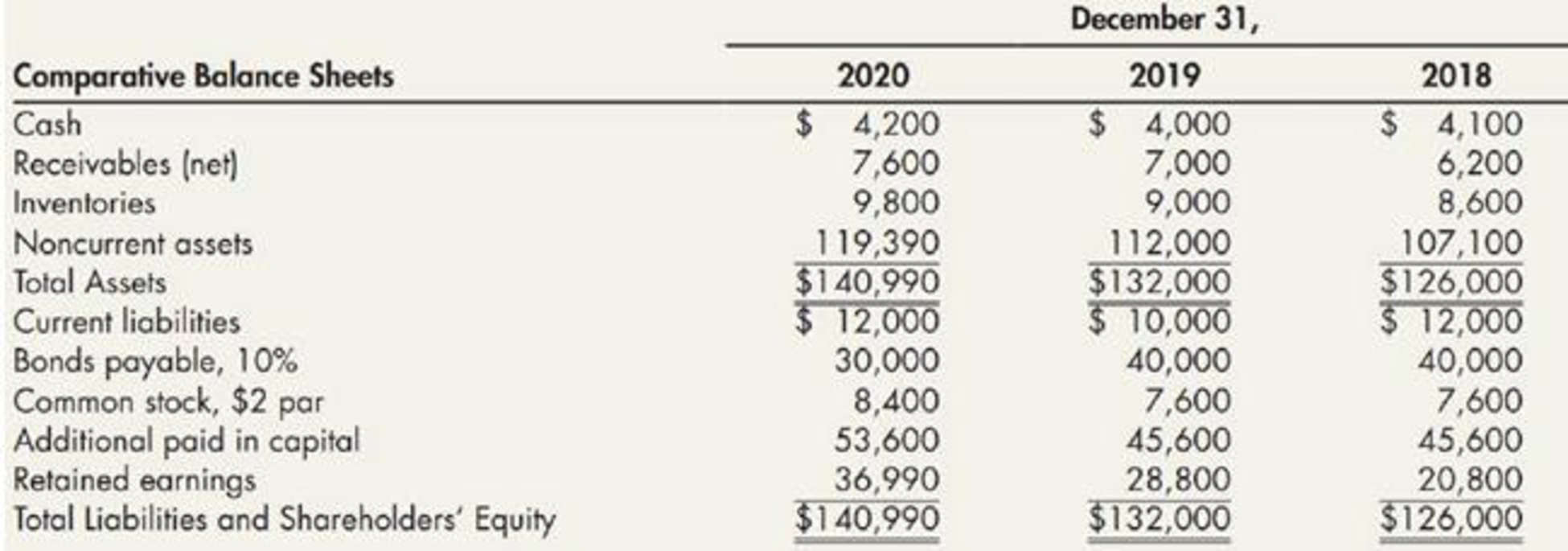

Rate of Change Analyses and Ratios Analyses The following are Cohen Company’s comparative financial statements for 2020, 2019, and 2018:

Additional information: Credit sales were 65% of net sales in 2019 and 60% in 2020. At the beginning of 2020, 400 shares of common stock were issued, the first sale of stock in several years.

Cohen is concerned. Although it increased the dividends paid per share by 5% in 2020 and its 2020 net income is higher than 2019 net income, the market price of its common stock dropped from $22 per share at the beginning of 2020 to $21 per share at year-end.

Required:

- 1. For 2019 and 2020, prepare rate of change analyses for the income statements and

balance sheets of Cohen using a year-to-year approach. - 2. For 2019 and 2020, compute the following ratios; (a) current, (b) inventory turnover, (c) receivables turnover, (d) net profit margin, (e) earnings per share, (f) return on total assets, (g) return on shareholders’ equity, and (h) debt-to-assets.

- 3. Next Level Based on your results, discuss the possible reasons for the decrease in the market price per share in 2020.

1.

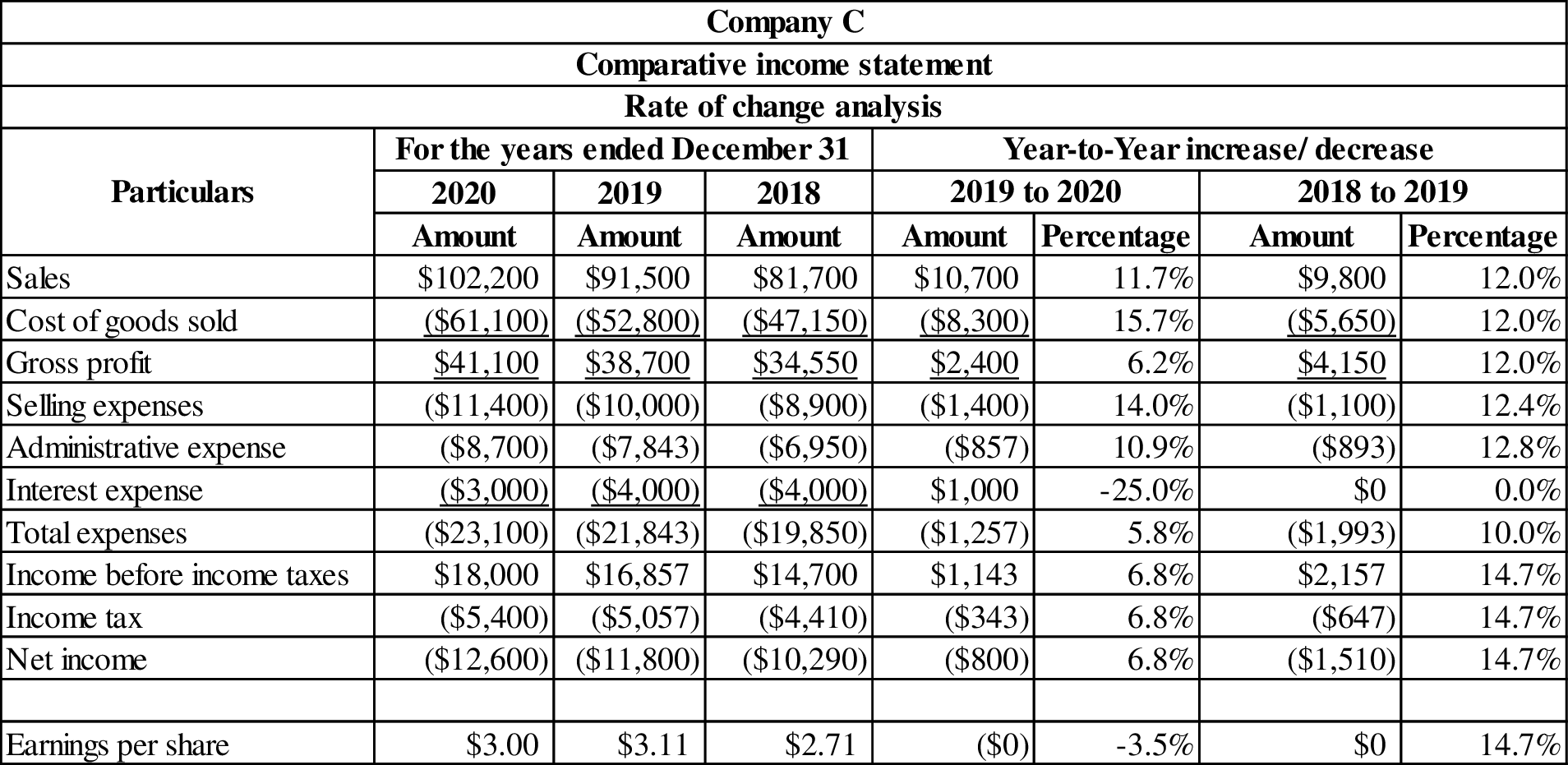

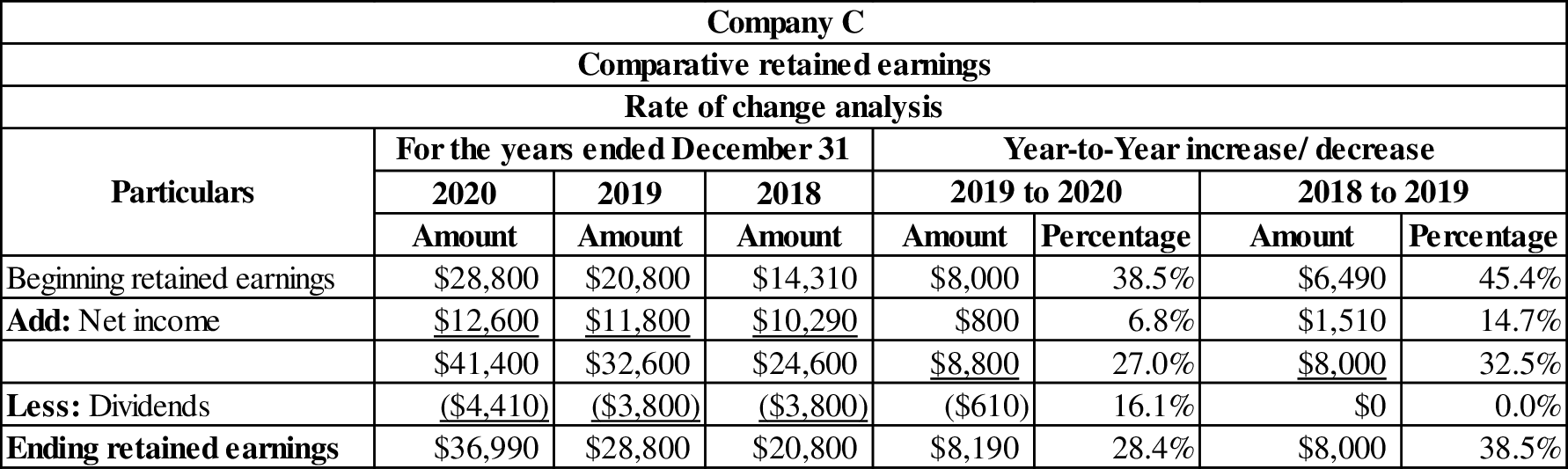

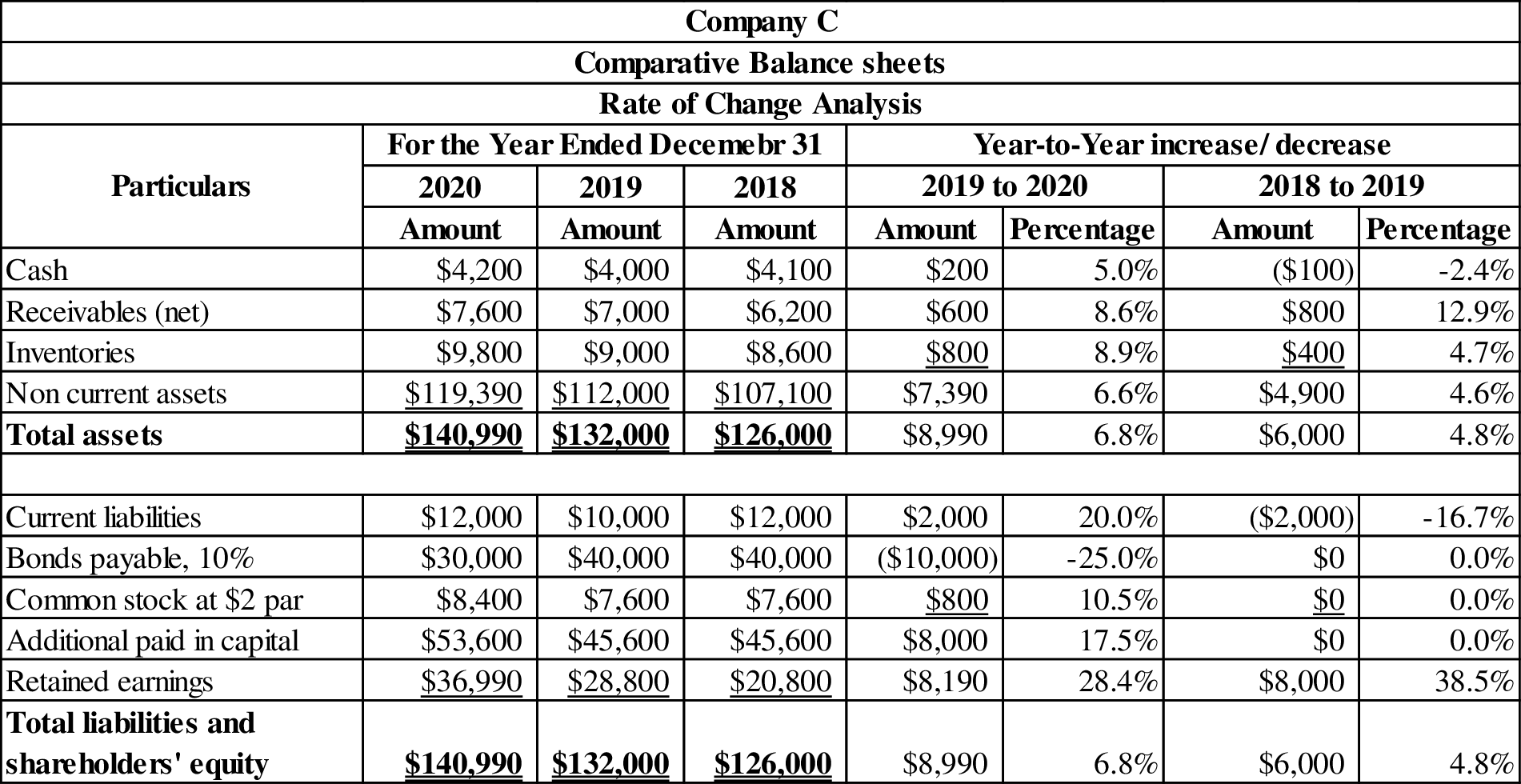

Prepare rate of change analyses for the income statements and balance sheets of Company C for 2019 and 2020 using the year to year approach.

Explanation of Solution

Balance Sheet: Balance Sheet is one of the financial statements which summarize the assets, the liabilities, and the Shareholder’s equity of a company at a given date. It is also known as the statement of financial status of the business.

Income statement: The financial statement which reports revenues and expenses from business operations and the result of those operations as net income or net loss for a particular time period is referred to as income statement.

Prepare rate of change analyses for the income statements of Company C for 2019 and 2020 using the year to year approach:

Table (1)

Prepare rate of change analyses for the retained earnings of Company C for 2019 and 2020 using the year to year approach:

Table (2)

Prepare rate of change analyses for the balance sheets of Company C for 2019 and 2020 using the year to year approach:

Table (3)

2. (a)

Compute current ratio for 2019 and 2020.

Explanation of Solution

Current ratio: Current ratio is one of the liquidity ratios, which measures the capacity of the company to meet its short-term obligations using its current assets. Current ratio is calculated by using the formula:

Compute current ratio for 2019 and 2020:

| Ratios and Formula | 2020 | 2019 |

|

Current ratio: |

Table (4)

2. (b)

Compute inventory turnover for 2019 and 2020.

Explanation of Solution

Inventory Turnover Ratio: This ratio is a financial metric used by a company to quantify the number of times inventory is used or sold during the accounting period. It is calculated by using the formula:

Compute inventory turnover for 2019 and 2020:

| Ratios and Formula | 2020 | 2019 |

|

Inventory turnover: Average inventory: |

|

|

Table (5)

2. (c)

Compute receivable turnover for 2019 and 2020.

Explanation of Solution

Receivables turnover ratio: Receivables turnover ratio is mainly used to evaluate the collection process efficiency. It helps the company to know the number of times the accounts receivable is collected in a particular time period. This ratio is determined by dividing credit sales and average accounts receivables.

Compute receivable turnover for 2019 and 2020:

| Ratios and Formula | 2020 | 2019 |

|

Receivables turnover: Average accounts receivable: |

|

|

Table (6)

2. (d)

Compute net profit margin for 2019 and 2020.

Explanation of Solution

Net profit margin: It is one of the profitability ratios. Profit margin ratio is used to measure the percentage of net income that is being generated per dollar of revenue or sales.

Compute net profit margin for 2019 and 2020:

| Ratios and Formula | 2020 | 2019 |

|

Net profit margin: |

Table (7)

2. (e)

Compute earnings per share for 2019 and 2020.

Explanation of Solution

Earnings per Share: Earnings per share help to measure the profitability of a company. Earnings per share are the amount of profit that is allocated to each share of outstanding stock.

Compute earnings per share for 2019 and 2020:

| Ratios and Formula | 2020 | 2019 |

|

Earnings per share: |

Table (8)

2. (f)

Compute return on total assets ratio for 2019 and 2020.

Explanation of Solution

Return on total assets: Return on investments (assets) is the financial ratio which determines the amount of net income earned by the business with the use of total assets owned by it. It indicates the magnitude of the company’s earnings with relative to its total assets. Return on investment is calculated as follows:

Compute return on total assets for 2019 and 2020:

| Ratios and Formula | 2020 | 2019 |

|

Return on total assets: Average total assets: |

|

|

Table (9)

Working note: 1 Determine the after tax rate:

| Ratios and Formula | 2020 | 2019 |

|

After tax rate: |

Table (10)

2. (g)

Compute return on common stockholders’ equity for 2019 and 2020.

Explanation of Solution

Return on common stockholders’ equity ratio: It is a profitability ratio that measures the profit generating ability of the company from the invested money of the shareholders. The formula to calculate the return on equity is as follows:

Compute return on common stockholders’ equity for 2019 and 2020:

| Ratios and Formula | 2020 | 2019 |

|

Return on common stockholders’ equity: Average stockholders’ equity: |

|

|

Table (11)

2. (h)

Compute debt to assets for 2019 and 2020.

Explanation of Solution

Debt to assets ratio: The debt to asset ratio shows the relationship between total asset and the total liability of the company. Debt ratio reflects the financial strategy of the company. It is used to measure the percentage of company’s assets that are financed by long term debts. Debt to assets ratio is calculated by using the formula:

Compute debt to assets for 2019 and 2020:

| Ratios and Formula | 2020 | 2019 |

|

Debt to assets ratio: |

Table (12)

3.

Explain the possible reasons for the decrease in the market price per share in 2020.

Explanation of Solution

The probable reason for the decrease in the market price per share in 2020:

- The current ratio, receivable turnover ratio, net profit margin ratio, return on total assets, return on shareholders’ equity and earnings per share ratio in year 2020 are less than the result provided in the year of 2019.

- The financial condition of the company is not as strong as it was in 2019 because earnings per share of Company C have decreased from $3.11(2019) to $3 (2020) and the debt to assets ratio has also decreased from 37.9% (2019) to $29.8% (2020).

Want to see more full solutions like this?

Chapter 5 Solutions

Intermediate Accounting: Reporting And Analysis

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning