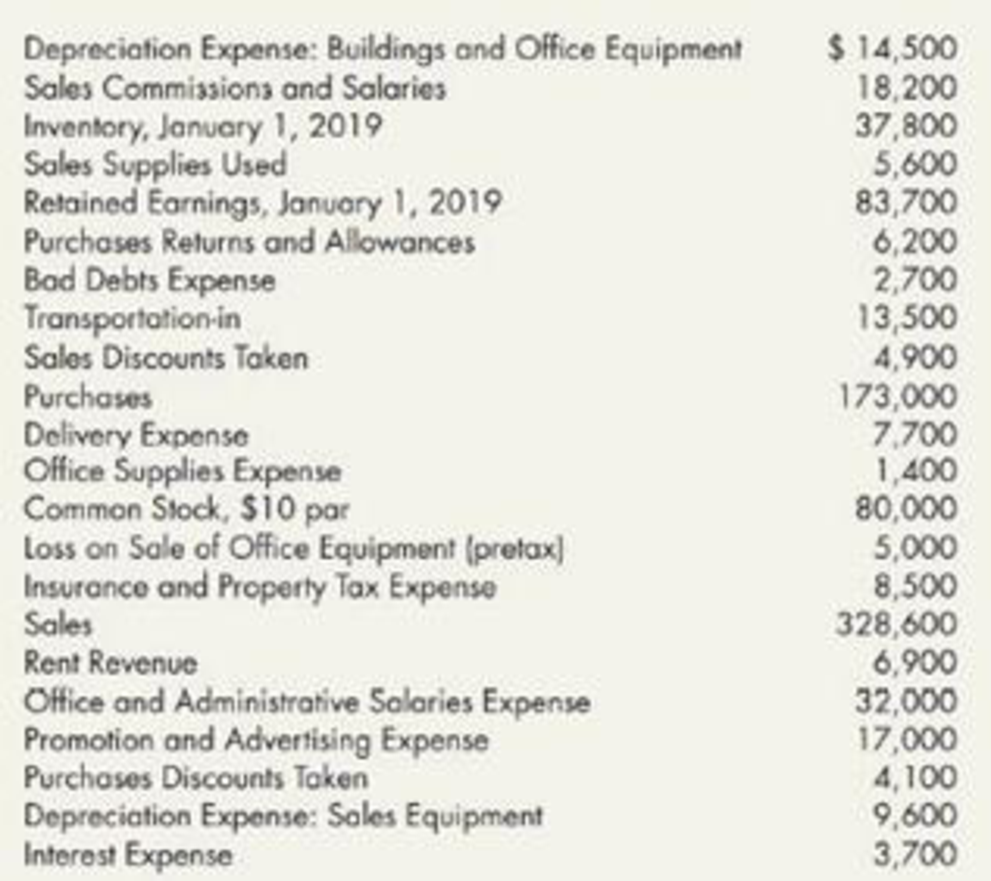

Comprehensive: Income Statement and Supporting Schedules The following s a partial list of the account balances, after adjustments, of Silvoso Company on December 31, 2019:

The following information is also available:

- 1. The company declared and paid a $0.60 per share cash dividend on its common stock. The stock was outstanding the entire year.

- 2. A physical count determined that the December 31, 2019, ending inventory is $34,100.

- 3. A tornado destroyed a warehouse, resulting in a pretax loss of $12,000. The last tornado in this area had occurred 10 years earlier.

- 4. On May 1, 2019, the company sold an unprofitable division (R). From January through April, Division R (a major component of the company) had incurred a pretax operating loss of $8,700. Division R was sold at a pretax gain of $10,000.

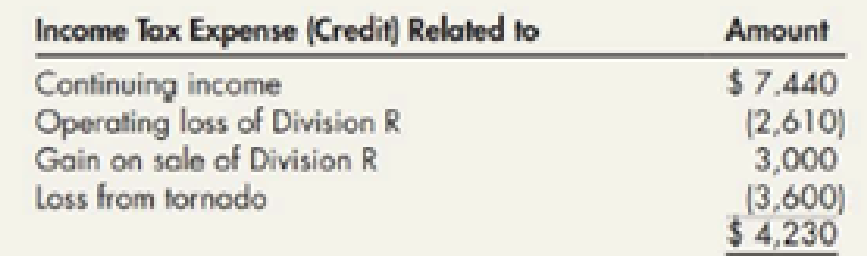

- 5. The company is subject to a 30% income tax rate. Its income tax expense for 2019 totals $4,230. The breakdown is as follows:

- 6. The company had average shareholders’ equity of $150,000 during 2019.

Required:

- 1. As supporting documents for Requirement 2, prepare separate supporting schedules for cost of goods sold, selling expenses, general and administrative expenses, and

depreciation expense. - 2. Prepare a 2019 multiple-step income statement for Silvoso. Include any related note to the financial statements.

- 3. Prepare a 2019

retained earnings statement. - 4. Next Level What was Silvoso’s return on common equity for 2019? What is your evaluation of Silvoso’s return on common equity if last year it was 10%?

1.

Provide supporting schedules for cost of goods sold, selling expenses, general and administrative expenses, and depreciation expense.

Explanation of Solution

Cost of goods sold: Cost of goods sold is the total of all the expenses incurred by a company to sell the goods during the given period.

Schedule of cost of goods sold is a report which reports cost of goods sold in a detailed manner.

Provide the schedule of cost of goods sold:

| Company S | ||

| For the Year Ended December 31, 2019 | ||

| Schedule 1: Cost of goods sold | ||

| Particulars | Amount | Amount |

| ($) | ($) | |

| Beginning inventory | $37,800 | |

| Add: Purchases | $173,000 | |

| Transportation in | $13,500 | |

| Cost of purchases | $186,500 | |

| Less: Purchase discount taken | ($4,100) | |

| Purchases returns and allowances | ($6,200) | |

| Net purchases | $176,200 | |

| Cost of goods available for sale | $214,000 | |

| Less: Ending inventory | ($34,100) | |

| Cost of goods sold | $179,900 | |

Table (1)

Provide the schedule of selling expenses:

| Company S | ||

| For the Year Ended December 31, 2019 | ||

| Schedule 2: Selling Expenses | ||

| Particulars | Amount ($) | Amount ($) |

| Selling expenses: | ||

| Sales commission salaries | $18,200 | |

| Sales supplies used | $5,600 | |

| Delivery expense | $7,700 | |

| Promotion and advertising expense | $17,000 | |

| Total selling expenses | $48,500 | |

Table (2)

Provide the schedule of general and administrative expenses:

| Company S | ||

| For the Year Ended December 31, 2019 | ||

| Schedule 3: General and Administrative Expenses | ||

| Particulars | Amount ($) | Amount ($) |

| General and Administrative Expenses: | ||

| Bad debt expense | $2,700 | |

| Office supplies expense | $1,400 | |

| Insurance and property tax expense | $8,500 | |

| Office and administrative salaries expenses | $32,000 | |

| Total General and Administrative Expenses | $44,600 | |

Table (3)

Provide the schedule of depreciation expenses:

| Company S | ||

| For the Year Ended December 31, 2019 | ||

| Schedule 4: Depreciation Expenses | ||

| Particulars | Amount ($) | Amount ($) |

| Depreciation Expenses: | ||

| Building and office equipment | $14,500 | |

| Sales equipment | $9,600 | |

| Total depreciation expense | $24,100 | |

Table (4)

2.

Provide a multi-step income statement for the year 2019.

Explanation of Solution

Multi step income statement: A multiple step income statement refers to the income statement that shows the operating and non-operating activities of the business under separate head. In different steps of the multi-step income statement, principal operating activities are reported that starts from the record of sales revenue with all contra sales revenue account like sales returns, allowances and sales discounts.

Prepare a multi-step income statement for the year 2019.

| Company S | ||

| Income Statement | ||

| For the Year Ended December 31, 2019 | ||

| Particulars | Amount | Amount |

| ($) | ($) | |

| Sales | $328,600 | |

| Less: Sales discount taken | ($4,900) | |

| Net sales | $323,700 | |

| Less: Cost of goods sold | ($179,900) | |

| Gross profit | $143,800 | |

| Operating expenses: | ||

| Selling expenses | ($48,500) | |

| General and administrative expenses | ($44,600) | |

| Depreciation | ($24,100) | |

| Total operating expense | ($117,200) | |

| Operating income | $26,600 | |

| Other item: | ||

| Rent revenue | $6,900 | |

| Interest expense | ($3,700) | |

| Loss on sale of office equipment | ($5,000) | |

| Loss due to tornado | ($12,000) | |

| Pretax income from continuing operations | $12,800 | |

| Less: Income tax expense (1) | ($3,840) | |

| Income from continuing operation | $8,960 | |

| Result from discontinued operations: | ||

| Loss from operation of discontinued Division R (2) | ($6,090) | |

| Gain on sale of Division R (3) | $7,000 | |

| Income from discontinuing operation | $910 | |

| Net income | $9,870 | |

| Components of income | Earnings per common share | |

| Income from continuing operation (5) | $1.12 | |

| Result from discontinuing operation (6) | $0.11 | |

| Net income | $1.23 | |

Table (5)

Working note (1):

Calculate an amount of income taxes:

Working note (2):

Calculate loss from operation of discontinuing Division R:

Working note (3):

Calculate gain on sale of Division R:

Working note (4):

Calculate the number of common shares:

Working note (5):

Calculate income from continuing operation earnings per common share:

Working note (6):

Calculate income from discontinuing operation earnings per common share:

3.

Provide a retained earnings statement for the year 2019.

Explanation of Solution

Statement of Retained Earnings: Statement of retained earnings shows, the changes in the retained earnings, and the income left in the company after payment of the dividends, for the accounting period.

Provide a retained earnings statement for the year 2019.

| Company S | ||

| Statement of retained earning | ||

| For the Year Ended December 31, 2019 | ||

| Particulars | Amount($) | Amount($) |

| Retained earnings, January 1, 2019 | $83,700 | |

| Add: Net income | $9,870 | |

| Subtotal | $93,570 | |

| Less: Cash dividends declared | ($4,800) | |

| Retained earnings, December 31, 2019 | $88,770 | |

Table (6)

4.

Evaluate the return on common equity if it was 10% last year for Company S.

Explanation of Solution

Return on equity ratio: It is a profitability ratio that measures the profit generating ability of the company from the invested money of the shareholders. The formula to calculate the return on equity is as follows:

Evaluate the return on common equity for 2019:

Thus, the return on common equity is 6.58%.

During 2018, the return on common equity is 10%. This return has been decreased by 3% in the year 2019. The decrease in return on common equity is due to discontinue in the segment due to the tornado which incurred severe loss to the company.

Want to see more full solutions like this?

Chapter 5 Solutions

Intermediate Accounting: Reporting And Analysis

- What is the expected dividend next year of this financial accounting question?arrow_forwardSituational(Accidental) vs Predatory Fraud The two main categories of fraudsters are predatory and situational (accidental). Distinguish between these two categories of scammers. Analyze the different instruments and methods that criminals frequently use to transfer funds related to money flow concealment. Make sure to reply to a minimum of one post made by your peers.arrow_forwardneed correct answer this general accountingarrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning