FINANCIAL ACCT.FUND.(LOOSELEAF)

7th Edition

ISBN: 9781260482867

Author: Wild

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 5, Problem 6PSA

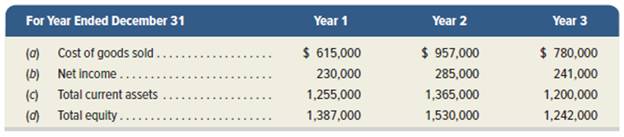

Analysis of inventory errors

Navajo Company’s financial statements show the following. The company recently discovered that in making physical counts of inventory, it had made the following errors: Year 1 ending inventory is understated by $56,000 and Year 2 ending inventory is overstated by $20,000.

Required

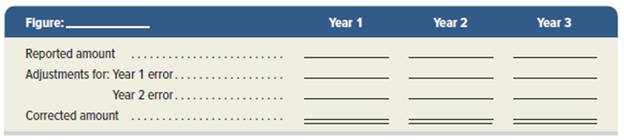

- For each key financial statement figure (a),(b),(c), and (d) above-prepare a table similar to the following to show the adjustments necessary to correct the reported amounts.

- What is the total error in combined net income for the three-year period resulting from the inventory errors? Explain.

Check (1) Corrected net income: Year 1, $286,000; Year 2, $209,000; Year 3, $261,000

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

The comparative balance sheets and an income statement for Raceway Corporation follow.

Balance Sheets

As of December 31

Year 2

Year 1

Assets

Cash

$ 6,300

$ 48,400

Accounts receivable

10,200

7,260

Inventory

45,200

56,000

Prepaid rent

700

2,140

Equipment

140,000

144,000

Accumulated depreciation

(73,400)

(118,000)

Land

116,000

50,000

Total assets

$ 245,000

$ 189,800

Liabilities

Accounts payable (inventory)

$ 37,200

$ 40,000

Salaries payable

12,200

10,600

Stockholders’ equity

Common stock, $50 par value

150,000

120,000

Retained earnings

45,600

19,200

Total liabilities and stockholders’ equity

$ 245,000

$ 189,800

Income Statement

For the Year Ended December 31, Year 2

Sales

$ 480,000

Cost of goods sold

(264,000)

Gross profit

216,000

Operating expenses

Depreciation expense

(11,400)

Rent expense

(7,000)

Salaries expense

(95,200)

Other operating expenses

(76,000)

Net income

$ 26,400

Other Information

Purchased…

Please help holy tamale I have been staring at this for hours.

Could you explain the steps for solving this financial accounting question accurately?

Chapter 5 Solutions

FINANCIAL ACCT.FUND.(LOOSELEAF)

Ch. 5 - Use the following information from Marvel Company...Ch. 5 - Use the following information from marvel company...Ch. 5 - Use the following information from Marvel Company...Ch. 5 - Use the following information from Marvel company...Ch. 5 - Periodic: A company reports the following...Ch. 5 - Prob. 6MCQCh. 5 - Prob. 1DQCh. 5 - Prob. 2DQCh. 5 - Prob. 3DQCh. 5 - Prob. 4DQ

Ch. 5 - Prob. 5DQCh. 5 - Prob. 6DQCh. 5 - Prob. 7DQCh. 5 - Prob. 8DQCh. 5 - Prob. 9DQCh. 5 - Prob. 10DQCh. 5 - Prob. 11DQCh. 5 - Prob. 12DQCh. 5 - Prob. 1QSCh. 5 - Prob. 2QSCh. 5 - Prob. 3QSCh. 5 - Prob. 4QSCh. 5 - Prob. 5QSCh. 5 - Prob. 6QSCh. 5 - Prob. 7QSCh. 5 - Prob. 8QSCh. 5 - Prob. 9QSCh. 5 - Prob. 10QSCh. 5 - Prob. 11QSCh. 5 - Prob. 12QSCh. 5 - Prob. 13QSCh. 5 - Prob. 14QSCh. 5 - Prob. 15QSCh. 5 - Prob. 16QSCh. 5 - Prob. 17QSCh. 5 - Prob. 18QSCh. 5 - Prob. 19QSCh. 5 - Prob. 20QSCh. 5 - Prob. 21QSCh. 5 - Prob. 22QSCh. 5 - Prob. 23QSCh. 5 - Prob. 1ECh. 5 - Prob. 2ECh. 5 - Prob. 3ECh. 5 - Prob. 4ECh. 5 - Prob. 5ECh. 5 - Prob. 6ECh. 5 - Prob. 7ECh. 5 - Prob. 8ECh. 5 - Prob. 9ECh. 5 - Prob. 10ECh. 5 - Prob. 11ECh. 5 - Prob. 12ECh. 5 - Prob. 13ECh. 5 - Prob. 14ECh. 5 - Prob. 15ECh. 5 - Prob. 16ECh. 5 - Prob. 17ECh. 5 - Prob. 18ECh. 5 - Prob. 19ECh. 5 - Perpetual: Alternative cost flows P1 Warnerwoods...Ch. 5 - Periodic: Alternative cost flows P3 Refer to the...Ch. 5 - Perpetual: Alternative cost flows P1 Montoure...Ch. 5 - Prob. 4PSACh. 5 - Prob. 5PSACh. 5 - Analysis of inventory errors A2 Navajo Company’s...Ch. 5 - Prob. 7PSACh. 5 - Periodic: Income comparisons and cost flows A1P3...Ch. 5 - Prob. 9PSACh. 5 - Prob. 10PSACh. 5 - Prob. 1PSBCh. 5 - Prob. 2PSBCh. 5 - Prob. 3PSBCh. 5 - Prob. 4PSBCh. 5 - Lower of cost or market P2 A physical inventory of...Ch. 5 - Analysis of inventory errors A2 Hallam Company’s...Ch. 5 - Prob. 7PSBCh. 5 - Periodic: Income comparisons and cost flows A1P3...Ch. 5 - Prob. 9PSBCh. 5 - Prob. 10PSBCh. 5 - Prob. 5SPCh. 5 - Prob. 1AACh. 5 - Prob. 2AACh. 5 - Prob. 3AACh. 5 - Prob. 1BTNCh. 5 - Prob. 2BTNCh. 5 - Prob. 3BTNCh. 5 - Prob. 4BTNCh. 5 - Prob. 5BTNCh. 5 - Visit four retail stores with another classmate....

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- I need help with this General accounting question using the proper accounting approach.arrow_forwardPlease explain the solution to this general accounting problem with accurate principles.arrow_forwardKindly help me with this General accounting questions not use chart gpt please fast given solutionarrow_forward

- I am searching for the correct answer to this Financial accounting problem with proper accounting rules.arrow_forwardI am looking for the correct answer to this Financial accounting question with appropriate explanations.arrow_forwardEcho Tone Technologies reports annual sales of $90,000, and it expects sales to increase to $135,000 next year. The company has a degree of operating leverage (DOL) of 4.2. By what percentage should net income increase? A. 70% B. 189% C. 150% D. 210%arrow_forward

- Please provide the accurate answer to this general accounting problem using valid techniques.arrow_forwardNo chatgpt Which account will appear in the post-closing trial balance?A. Rent ExpenseB. Sales RevenueC. DividendsD. Capitalarrow_forwardI need help with this financial accounting question using the proper accounting approach.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Chapter 6 Merchandise Inventory; Author: Vicki Stewart;https://www.youtube.com/watch?v=DnrcQLD2yKU;License: Standard YouTube License, CC-BY

Accounting for Merchandising Operations Recording Purchases of Merchandise; Author: Socrat Ghadban;https://www.youtube.com/watch?v=iQp5UoYpG20;License: Standard Youtube License