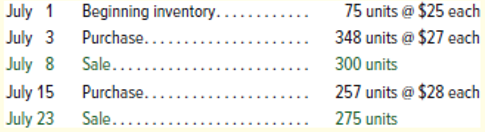

Use the following information from Marvel Company for the month of July to answer questions 1 through 4.

1. Perpetual: Assume that Marvel uses a perpetual FIFO inventory system. What is the dollar value of its ending inventory?

- $2,940

- $2,685

- $2,625

- $2,852

- $2,705

Perpetual Inventory System:

The perpetual inventory system is that system of accounting the inventory in which the inventory is verified physically. This is done so that the lost and misplaced items are also recorded. The entries are made through merchandise accounts.

The dollar value of the ending inventory using FIFO.

Explanation of Solution

Option a, $2,940 is correct.

Given,

The company uses perpetual FIFO inventory system.

Calculation of the value of ending inventory:

| Date | Goods purchased | Cost of goods sold | Inventory balance |

| July 1 | |||

| July 3 | 348 units | ||

| July 8 | |||

| July 15 | 257 units | ||

| July 23 | |||

| $15,527 | $2,940 |

The value of the ending inventory is $2,940.

Thus, option a is correct.

Want to see more full solutions like this?

Chapter 5 Solutions

FINANCIAL ACCT.FUND.(LOOSELEAF)

- I need the correct answer to this general accounting problem using the standard accounting approach.arrow_forwardMao Company had 45,000 units of ending inventory recorded at $12.75 per unit using FIFO method. Current replacement cost is $8.40 per unit. Which amount should be reported as Ending Merchandise Inventory on the balance sheet using lower-of-cost-or-market rule?arrow_forwardAssume that Madonna Enterprises has sales of 750,000, sales discounts of 25,000, net income of 65,000, and cost of goods sold of 520,000. Gross profit and operating expenses are, respectively: a. 205,000 and 140,000 b. 230,000 and 165,000 c. 205,000 and 165,000 d. 230,000 and 140,000arrow_forward

- Please show me the valid approach to solving this financial accounting problem with correct methods.arrow_forwardCan you solve this financial accounting question with accurate accounting calculations?arrow_forwardAt Brighton Corp., as of September 30, the company has net sales of $520,000 and a cost of goods available for sale of $410,000. Compute the estimated cost of the ending inventory, assuming the gross profit rate is 35%.arrow_forward

- Provide solutionarrow_forwardAgrani Enterprises manufactured 5,000 units of product during April. According to the standard costing system, each unit should require 3 labor hours at $18 per hour. During the month, the company actually used 14,800 labor hours and paid $271,840 for direct labor. Calculate the labor efficiency variance and labor rate variance for the month.arrow_forwardDuring September, Department W started and completed 92,000 units and also finished 41,000 units that were 65% completed on August 31. On September 30, Department W's ending inventory consisted of 35,000 units that were 40% completed. All manufacturing costs are incurred at a uniform rate throughout Department W's production process. Compute the number of equivalent full units of production for Department W during September. [ Use FIFO method]arrow_forward

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,