Concept explainers

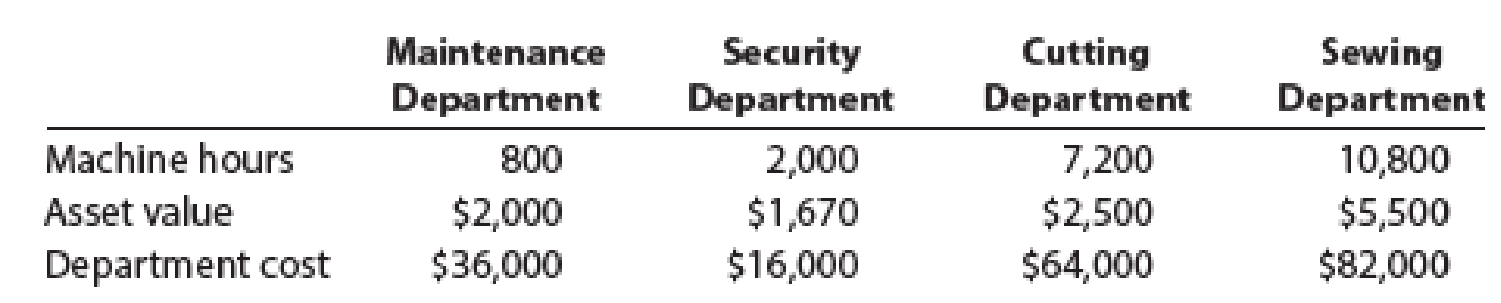

Davis Snowflake & Co. produces Christmas stockings in its Cutting and Sewing departments. The Maintenance and Security departments support the production of the stockings. Costs from the Maintenance Department are allocated based on machine hours, and costs from the Security Department are allocated based on asset value. Information about each department is provided in the following table:

Determine the total cost of each production department after allocating all support department costs to the production departments using the reciprocal services method.

Compute the total cost of each production department after allocating all support costs to the production departments.

Explanation of Solution

Cost allocation:

The cost allocation refers to the process of allocating the costs associated with the production of the products mainly indirectly and are generally ignored. The main objective of cost allocation is to ensure proper pricing of the products. This can be done by several methods.

Maintenance Department Cost to be allocated:

The total Maintenance Department costs include 20% of the Security department costs as,

Therefore, the Security Department cost is,

Security Department Cost to be allocated:

The total Security Department costs include 10% of the Maintenance department costs as,

Therefore, the Security Department cost is,

Substitute the equation for M into the S equation:

Substitute the value of S into the M equation:

Maintenance Department Cost Allocation:

Compute the allocation of costs from Maintenance Department to Security Department:

The costs allocated from Maintenance Department to Security Department is $4,000.

Compute the allocation of costs from Maintenance Department to Cutting Department:

The costs allocated from Maintenance Department to Cutting Department is $14,400.

Compute the allocation of costs from Maintenance Department to Sewing Department:

The costs allocated from Maintenance Department to Sewing Department is $21,600.

Security Department Cost Allocation:

Compute the allocation of costs from Security Department to Maintenance Department:

The costs allocated from Security Department to Maintenance Department is $4,000.

Compute the allocation of costs from Security Department to Cutting Department:

The costs allocated from Security Department to Cutting Department is $5,000.

Compute the allocation of costs from Security Department to Sewing Department:

The costs allocated from Security Department to Sewing Department is $11,000.

Total Costs of Production Departments:

Compute the total cost of the Cutting Department:

The total costs of the Cutting department are $83,400.

Compute the total cost of the Sewing Department:

The total costs of the Sewing department are $114,600.

Want to see more full solutions like this?

Chapter 5 Solutions

Managerial Accounting

- Hello tutor please provide correct answer general accounting question with correct solution do fastarrow_forwardI want to this question answer for General accounting question not need ai solutionarrow_forwardPlease given correct answer for General accounting question I need step by step explanationarrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning