Support activity cost allocation

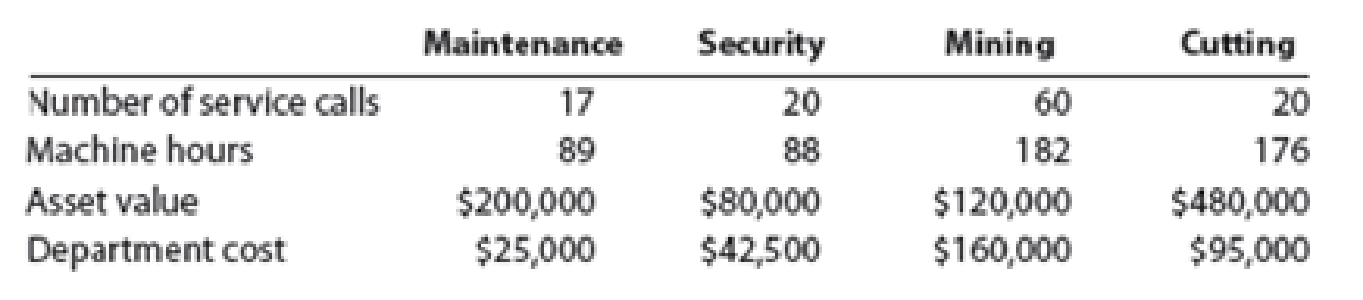

Jake’s Gems mines and produces diamonds, rubies, and other gems. The gems are produced by way of the Mining and Cutting activities. These production activities are supported by the Maintenance and Security activities. Security costs are allocated to the production activities based on asset value. Maintenance costs are normally allocated based on machine hours. However, Maintenance costs typically correlate more with the number of service calls. Information regarding the activities is provided in the following table:

Instructions

1. Should Maintenance costs continue to be allocated based on machine hours? Why would a different driver be more appropriate?

2. Based on your response to part (1), determine the total costs allocated from each support activity to the other activities using the reciprocal services method and the most appropriate cost driver for Maintenance.

3. Jake’s Gems is considering cutting costs by switching to a simpler support activity cost allocation method. Using the information provided and given your response to part (2), determine if switching to the direct method would significantly alter the production activity costs.

a.

Identify the cost driver to allocate maintenance costs and whether or not to use the machine hours as the cost driver.

Explanation of Solution

Cost Driver: The cost driver refers to the all the activities on which the money is spent to produce the product or the service. It has a cause-effect relationship with the resources utilized in production. The cost drivers are used to form the activity cost pools.

The support department costs in the production are the indirect costs that difficult to identify and be associated to the concerned cost drivers. Hence, it is difficult to apply support department costs to the products.

Machine hours are not an accurate cost driver and must not be used. Service calls must be used as it a more appropriate cost driver as maintenance department is associated more with the service calls rather than the machine hours.

b.

Compute the total cost of each production department after allocating all support costs to the production departments using the cost driver chosen in part a.

Explanation of Solution

Maintenance Department Cost to be allocated:

The total Maintenance Department costs include 25% of the Security department costs as,

Therefore, the Security Department cost is,

Security Department Cost to be allocated:

The total Security Department costs include 20% of the Maintenance department costs as,

Therefore, the Security Department cost is,

Substitute the equation for M into the S equation:

Substitute the value of S into the M equation:

Maintenance Department Cost Allocation:

Compute the allocation of costs from Maintenance Department to Security Department:

The cost allocated from Maintenance Department to Security Department is $7,500.

Compute the allocation of costs from Maintenance Department to Cutting Department:

The cost allocated from Maintenance Department to Cutting Department is $7,500.

Compute the allocation of costs from Maintenance Department to Mining Department:

The cost allocated from Maintenance Department to Mining Department is $22,500.

Security Department Cost Allocation:

Compute the allocation of costs from Security Department to Maintenance Department:

The cost allocated from Security Department to Maintenance Department is $12,500.

Compute the allocation of costs from Security Department to Cutting Department:

The cost allocated from Security Department to Cutting Department is $30,000.

Compute the allocation of costs from Security Department to Mining Department:

The cost allocated from Security Department to Mining Department is $7,500.

Total Costs of Production Departments:

Compute the total cost of the Cutting Department:

The total costs of the Cutting department are $132,500.

Compute the total cost of the Mining Department:

The total costs of the Pruning department are $190,000.

c.

Identify the impact on the costs if company switches to simpler cost allocation method than the one used in part (b).

Explanation of Solution

Maintenance Department Cost Allocation:

Compute the allocation of costs from Maintenance Department to Cutting Department:

The cost from Maintenance Department that should be allocated to Cutting department is $6,250.

Compute the allocation of costs from Maintenance Department to Mining Department:

The cost allocated from Maintenance Department to Pruning department is $18,750.

Security Department Cost Allocation:

Compute the allocation of costs from Security Department to Cutting Department:

The cost allocated from Security Department to Cutting department is $34,000.

Compute the allocation of costs from Security Department to Pruning Department:

The cost allocated from Security Department to Pruning department is $8,500.

Total Costs of Production Departments:

Compute the total cost of the Cutting Department:

The total costs of the Cutting department are $135,250.

Compute the total cost of the Mining Department:

The total costs of the Pruning department are $187,250.

The switch from the existing method to the direct method would ensure the reduction of cost also there is a very little change in the costs being allocated amongst the two methods.

Want to see more full solutions like this?

Chapter 5 Solutions

Managerial Accounting

- Can you explain this general accounting question using accurate calculation methods?arrow_forwardPlease explain the solution to this financial accounting problem with accurate explanations.arrow_forwardI need assistance with this general accounting question using appropriate principles.arrow_forward

- Please help me solve this general accounting question using the right accounting principles.arrow_forwardI am searching for the correct answer to this general accounting problem with proper accounting rules.arrow_forwardI am searching for the correct answer to this financial accounting problem with proper accounting rules.arrow_forward

- Can you help me solve this general accounting question using valid accounting techniques?arrow_forwardPlease provide the solution to this general accounting question using proper accounting principles.arrow_forwardI am looking for help with this general accounting question using proper accounting standards.arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College