Concept explainers

Support department cost allocation —comparison

Refer to your answers to Exercises 7-9. Compare the total support department costs allocated to each production department under each cost allocation method. Which production department is allocated the most support department costs (a) under the direct method, (b) under the sequential method, and (c) under the reciprocal services method?

EX 19-7 Support department cost allocation—direct method

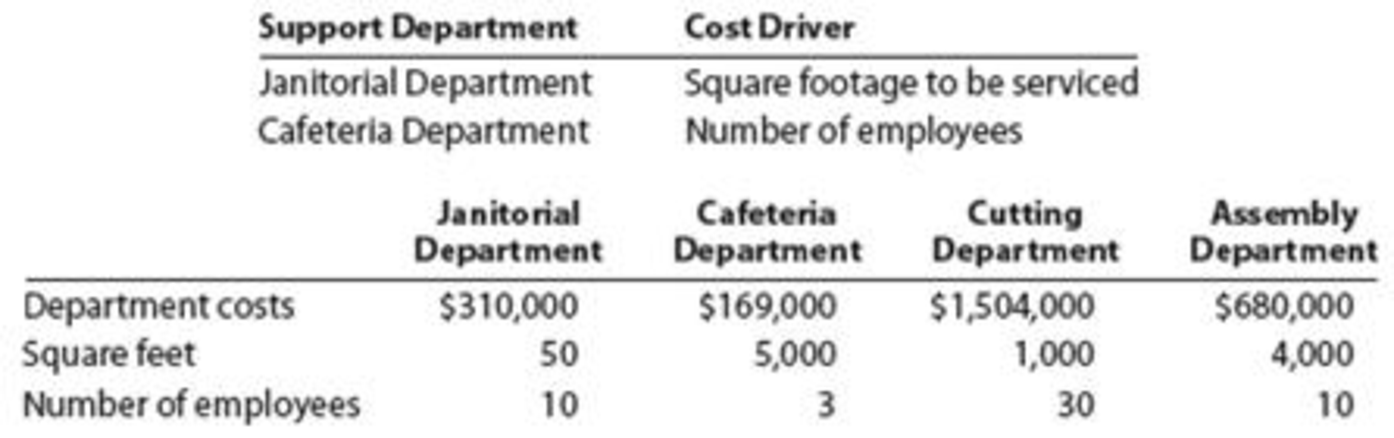

Becker Tabletops has two support departments (Janitorial and Cafeteria) and two production departments (Cutting and Assembly). Relevant details for these departments are as follows:

Allocate the support department costs to the production departments using the direct method.

EX 19-8 Support department cost allocation—sequential method

Refer to the information provided for Becker Tabletops in Exercise 7. Allocate the support department costs to the production departments using the sequential method. Allocate the support department with the highest department cost first.

EX 19-9 Support department cost allocation —reciprocal services method

Refer to the information provided for Becker Tabletops in Exercise 7. Allocate the support department costs to the production departments using the reciprocal services method.

Identify the production department with greater department cost allocation under each method.

Explanation of Solution

Cost allocation:

The cost allocation refers to the process of allocating the costs associated with the production of the products mainly indirectly and are generally ignored. The main objective of cost allocation is to ensure proper pricing of the products. This can be done by several methods.

(a) The direct method:

Compute the costs allocated from the support departments.

Cutting Department Total Cost:

Assembly Department Total Cost:

Under the direct method the Assembly department has been allocated the greater costs from the support departments.

Working Notes:

Janitorial Department Cost Allocation:

Compute the allocation of costs from Janitorial Department to Cutting Department:

The costs from Janitorial Department that should be allocated to Cutting department is $62,000.

Compute the allocation of costs from Janitorial Department to Assembly Department:

The cost allocated from Janitorial Department to Assembly department is $248,000.

Cafeteria Department Cost Allocation:

Compute the allocation of costs from Cafeteria Department to Cutting Department:

The costs allocated from Cafeteria Department to Cutting department is $126,750.

Compute the allocation of costs from Cafeteria Department to Assembly Department:

The cost allocated from Cafeteria Department to Assembly department is $42,250.

(b) The sequential method:

Compute the costs allocated from the support departments.

Cutting Department Total Cost:

Assembly Department Total Cost:

Under the sequential method the Cutting department has been allocated the greater costs from the support departments.

Working Notes:

Janitorial Department Cost Allocation:

Compute the allocation of costs from Janitorial Department to Cafeteria Department:

The cost allocated from Janitorial Department to Cafeteria department is $155,000.

Compute the allocation of costs from Janitorial Department to Cutting Department:

The costs allocated from Janitorial Department to Cutting department is $31,000.

Compute the allocation of costs from Janitorial Department to Assembly Department:

The cost allocated from Janitorial Department to Assembly department is $124,000.

Cafeteria Department Total Cost:

The total costs of Cafeteria Department are $324,000.

Compute the allocation of costs from Cafeteria Department to Cutting Department:

The costs allocated from Cafeteria Department to Cutting department is $243,000.

Compute the allocation of costs from Cafeteria Department to Assembly Department:

The cost allocated from Cafeteria Department to Assembly department is $81,000.

(c) The reciprocal services method:

Compute the costs allocated from the support departments.

Cutting Department Total Cost:

Assembly Department Total Cost:

Under the reciprocal services method the Cutting department has been allocated the greater costs from the support departments.

Working Notes:

Janitorial Department Cost to be allocated:

The total Janitorial Department costs include 20% of the Cafeteria department costs as,

Therefore, the Cafeteria Department cost is,

Cafeteria Department Cost to be allocated:

The total Cafeteria Department costs include 50% of the Janitorial department costs as,

Therefore, the Cafeteria Department cost is,

Substitute the equation for J into the C equation:

Substitute the value of C into the J equation:

Janitorial Department Cost Allocation:

Compute the allocation of costs from Janitorial Department to Cafeteria Department:

The cost allocated from Janitorial Department to Cafeteria Department is $191,000.

Compute the allocation of costs from Janitorial Department to Cutting Department:

The cost allocated from Janitorial Department to Cutting Department is $38,200.

Compute the allocation of costs from Janitorial Department to Assembly Department:

The cost allocated from Janitorial Department to Assembly Department is $152,800.

Cafeteria Department Cost Allocation:

Compute the allocation of costs from Cafeteria Department to Janitorial Department:

The cost allocated from Cafeteria Department to Janitorial Department is $72,000.

Compute the allocation of costs from Cafeteria Department to Cutting Department:

The cost allocated from Cafeteria Department to Cutting Department is $216,000.

Compute the allocation of costs from Cafeteria Department to Assembly Department:

The cost allocated from Cafeteria Department to Assembly Department is $72,000.

Want to see more full solutions like this?

Chapter 5 Solutions

Managerial Accounting

- Bansai, age 66, retires and receives a $1,450 per month annuity from his employer's qualified pension plan. Bansai made $87,600 of after-tax contributions to the plan before retirement. Under the simplified method, Bansai's number of anticipated payments is 240. What is the amount includible in income in the first year of withdrawals assuming 12 monthly payments? A. $10,560 B. $12,540 C. $17,400 D. $8,220arrow_forwardWhat is the cost of goods sold?arrow_forwardCan you help me find the accurate solution to this financial accounting problem using valid principles?arrow_forward

- Please provide the solution to this general accounting question using proper accounting principles.arrow_forwardI am looking for help with this general accounting question using proper accounting standards.arrow_forwardCan you demonstrate the accurate method for solving this General accounting question?arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning