Concept explainers

Average Uncollectible Account Losses and

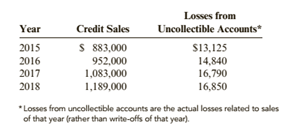

The accountant for Porile Company prepared the following data for sales and losses from uncollectible accounts:

Required:

1. Calculate the average percentage of losses from uncollectible accounts for 2015 through 2018.

2. Assume that the credit sales for 2019 are $1,260,000 and that the weighted average percentage calculated in Requirement 1 is used as an estimate of loses from uncollectible accounts for

2019 credit sales. Determine the bad debt expense for 2019 using the percentage of credit sales method.

3. CONCEPTUAL CONNECTION Do you believe this estimate of bad debt expense is reasonable?

4. CONCEPTUAL CONNECTION How would you estimate 2019 bad debt expense if losses from uncollectible accounts for 2018 were What other action would management consider?

(a)

Credit Sales Method:

The method named percentage of credit sales method is the method in which the bad debts are computed on the basis of percentage of sales.

Uncollectible accounts:

These are those accounts which reflect that amount of credit sales which is not to be collected i.e. bad debts.

To calculate:

The average percentage of loss rate for each year from

Answer to Problem 65E

The loss Rate over the period is:

| Year of Sales | Loss Rate Percentage |

The average percentage of loss rate is

Explanation of Solution

The Porile Company has a glass store which sells on credit. The data of past four years showing its credit sales and losses from uncollectible accounts are as follows:

| Year of Sales | Credit Sales |

Losses from Uncollectible Accounts |

This is given in the question.

The loss rate from uncollectible accounts for the Porile Company is as follows:

| Year of Sales | Credit Sales |

Losses from Uncollectible Accounts |

Loss Rate Percentage |

| Average Percentage of losses |

(b)

Credit Sales Method:

The method named percentage of credit sales method is the method in which the bad debts are computed on the basis of percentage of sales.

Uncollectible accounts:

These are those accounts which reflect that amount of credit sales which is not to be collected i.e. bad debts.

To calculate:

The loss rate for estimating the bad debt for

Answer to Problem 65E

The loss rate for estimating the bad debt in the year

Explanation of Solution

The Porile Company has a glass store which sells on credit. The data of past four years showing its credit sales and losses from uncollectible accounts are as follows:

| Year of Sales | Credit Sales |

Losses from Uncollectible Accounts |

The credit sales given in the question is

The loss rate for estimating the bad debt in the year

| Year | Credit Sales |

Losses from Uncollectible Accounts |

Loss Rate Percentage | Weights | Weighted Average of Loss |

So, the bad debt expense to be recognised:

(c)

Credit Sales Method:

The method named percentage of credit sales method is the method in which the bad debts are computed on the basis of percentage of sales.

Uncollectible accounts:

These are those accounts which reflect that amount of credit sales which is not to be collected i.e. bad debts.

The reasonability of estimate of the bad debt expense.

Answer to Problem 65E

The estimation of the bad debts for

Explanation of Solution

The method of calculating the average percentage of loss rate used is the weighted average method which is used for the reason that the amount of uncollectible accounts are on increasing trend. In this trend, this method is the best for calculation. Thus, it can be said that this bad debt expense is reasonable in nature.

(d)

Credit Sales Method:

The method named percentage of credit sales method is the method in which the bad debts are computed on the basis of percentage of sales.

Uncollectible accounts:

These are those accounts which reflect that amount of credit sales which is not to be collected i.e. bad debts.

The estimation of bad debt and the reaction of the management for the bad debt of

Answer to Problem 65E

The bad debt expense should not be computed as per weighted average percentage. The company should go for ascertain a specified percentage to calculate the bad debt.

Explanation of Solution

The Porile Company has a glass store which sells on credit. The losses from uncollectible in

The bad expense for the year

Want to see more full solutions like this?

Chapter 5 Solutions

Cornerstones of Financial Accounting

- How many actual direct labor hours were worked ?arrow_forwardDon't use ai given answer accounting questionsarrow_forwardPhoenix Industries has twelve million shares outstanding, generates free cash flows of $75 million each year, and has a cost of capital of 12%. It also has $50 million of cash on hand. Phoenix wants to decide whether to repurchase stock or invest the cash in a project that generates free cash flows of $3 million each year. Should Phoenix invest or repurchase the shares? A) Repurchase B) Invest C) Indifferent between options D) Cannot say for surearrow_forward

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning