College Accounting (Book Only): A Career Approach

13th Edition

ISBN: 9781337280570

Author: Scott, Cathy J.

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

thumb_up100%

Chapter 5, Problem 5E

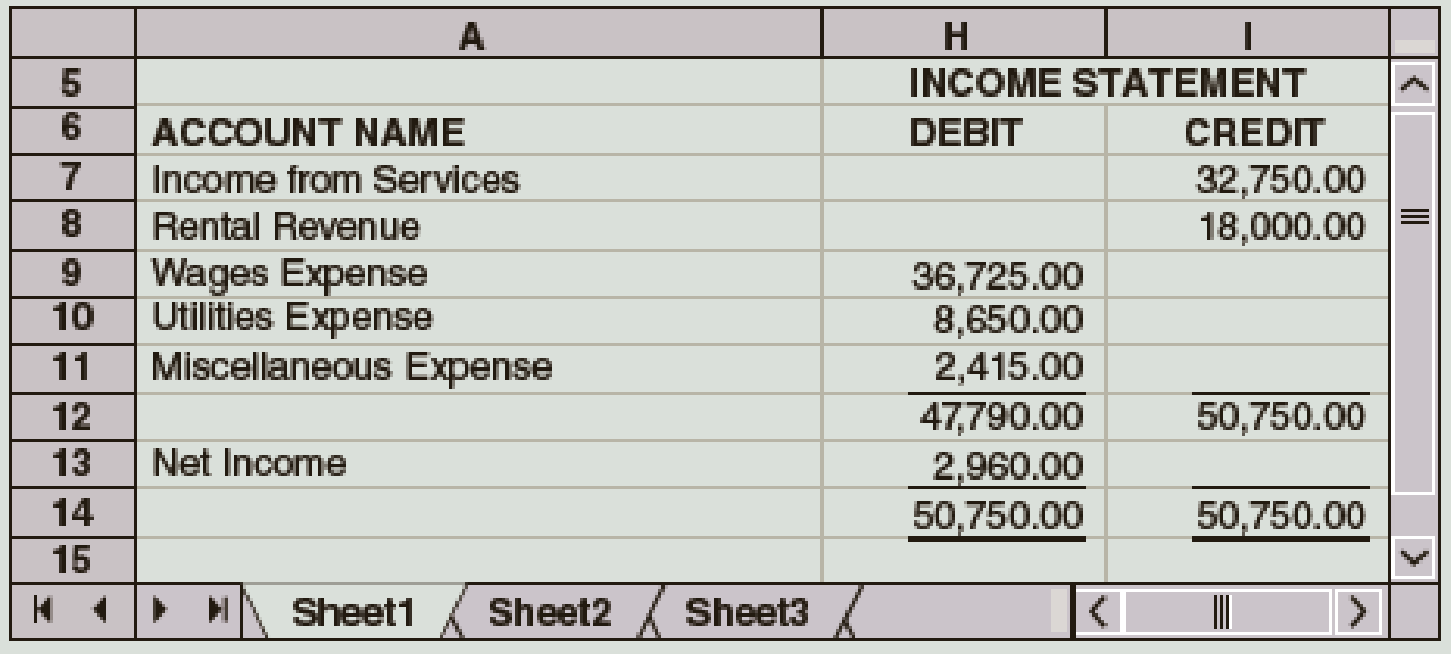

The Income Statement columns of the work sheet of Redfax Company for the fiscal year ended December 31 follow. During the year, D. Redfax withdrew $12,000. Journalize the closing entries.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Please help with accounting

For Eckstein Company, the predetermined overhead rate is 118% of direct labor cost. During the month, Eckstein incurred $119,000 in factory labor costs, of which $98,200 is direct labor and $26,400 is indirect labor. The actual overhead incurred was $132,600. Compute the amount of manufacturing overhead applied during the month. Determine the amount of under- or overapplied manufacturing overhead.??

Provide answer with calculation

Chapter 5 Solutions

College Accounting (Book Only): A Career Approach

Ch. 5 - What is the third step in the accounting cycle?...Ch. 5 - Which of the following accounts would be closed...Ch. 5 - If Income from Services had a 20,400 credit...Ch. 5 - Which of the following accounts would appear on a...Ch. 5 - Under the cash basis of accounting, which of the...Ch. 5 - Prob. 6QYCh. 5 - Number in order the following steps in the...Ch. 5 - List the steps in the closing procedure in the...Ch. 5 - What is the purpose of closing entries? What is a...Ch. 5 - What are real accounts? What are nominal accounts?...

Ch. 5 - What is the purpose of the Income Summary account?...Ch. 5 - What is the purpose of the post-closing trial...Ch. 5 - Write the third closing entry to transfer the net...Ch. 5 - Prob. 8DQCh. 5 - Prob. 9DQCh. 5 - Classify the following accounts as real...Ch. 5 - The ledger accounts after adjusting entries for...Ch. 5 - As of December 31, the end of the current year,...Ch. 5 - The Income Statement columns of the work sheet of...Ch. 5 - The Income Statement columns of the work sheet of...Ch. 5 - After all revenue and expenses have been closed at...Ch. 5 - Identify whether the following accounts would be...Ch. 5 - Considering the following events, determine which...Ch. 5 - Indicate with an X whether each of the following...Ch. 5 - Prepare a statement of owners equity for The...Ch. 5 - Prob. 1PACh. 5 - The partial work sheet for Ho Consulting for May...Ch. 5 - The account balances of Bryan Company as of June...Ch. 5 - Williams Mechanic Services prepared the following...Ch. 5 - Prob. 1PBCh. 5 - The partial work sheet for Emil Consulting for...Ch. 5 - The account balances of Miss Beverlys Tutoring...Ch. 5 - Toms Catering Services prepared the following work...Ch. 5 - Rather than going directly to college, some...Ch. 5 - Prob. 2ACh. 5 - The post-closing trial balance submitted to you by...Ch. 5 - You are preparing a post-closing trial balance for...Ch. 5 - The bookkeeper has completed a work sheet and has...Ch. 5 - This problem is designed to enable you to apply...Ch. 5 - This problem is designed to enable you to apply...Ch. 5 - After the adjusting entries are recorded and...

Additional Business Textbook Solutions

Find more solutions based on key concepts

1-1. Define marketing and outline the steps in the marketing process. (AASCB: Communication)

Marketing: An Introduction (13th Edition)

CHAPTER CASE

S&S Air’s Mortgage

Mark Sexton and Todd Story, the owners of S&S Air, Inc., were impressed by the ...

Essentials of Corporate Finance (Mcgraw-hill/Irwin Series in Finance, Insurance, and Real Estate)

Assume you are a CFO of a company that is attempting to race additional capital to finance an expansion of its ...

Financial Accounting, Student Value Edition (5th Edition)

The flowchart for the process at the local car wash. Introduction: Flowchart: A flowchart is a visualrepresenta...

Principles of Operations Management: Sustainability and Supply Chain Management (10th Edition)

Mary Williams, owner of Williams Products, is evaluating whether to introduce a new product line. After thinkin...

Operations Management: Processes and Supply Chains (12th Edition) (What's New in Operations Management)

Real options and its types. Introduction: The net present value is the variation between present cash inflows v...

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781305084087

Author:Cathy J. Scott

Publisher:Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

The KEY to Understanding Financial Statements; Author: Accounting Stuff;https://www.youtube.com/watch?v=_F6a0ddbjtI;License: Standard Youtube License