College Accounting (Book Only): A Career Approach

13th Edition

ISBN: 9781337280570

Author: Scott, Cathy J.

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

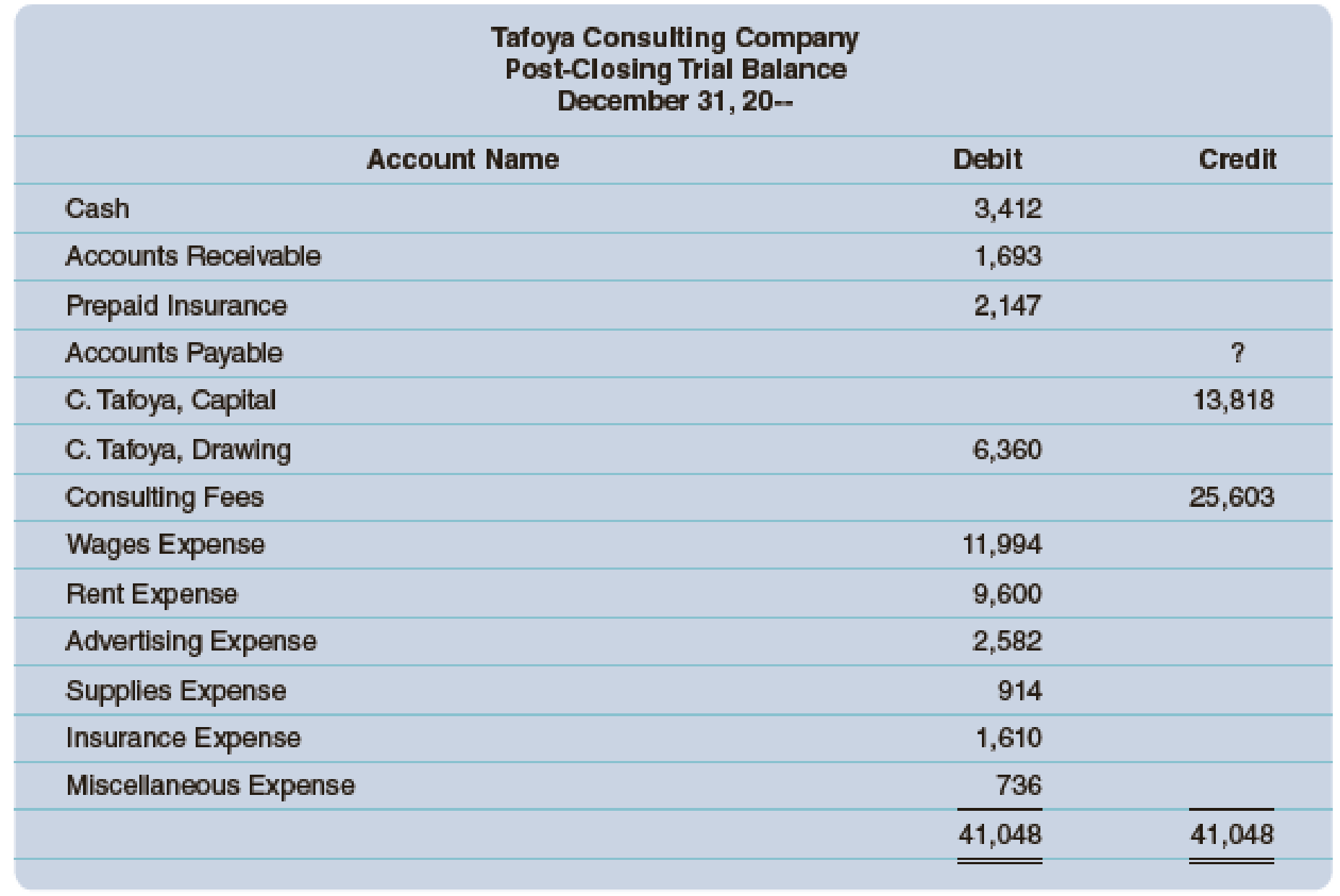

Chapter 5, Problem 3A

The post-closing

- a. Analyze the work and prepare a response to what you have reviewed.

- b. Journalize the closing entries.

- c. What is the net income or net loss?

- d. Is there an increase or a decrease in Capital?

- e. What would be the ending amount of Capital?

- f. What is the new balance of the post-closing trial balance?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

KIARA LIMITED

STATEMENT OF FINANCIAL POSITION AS AT 31 DECEMBER:

ASSETS

Property, plant and equipment (cost)

Accumulated depreciation

Long-term investments

Inventory

Accounts receivable

Company tax paid in advance

Bank

EQUITY AND LIABILITIES

2024

2023

R

R

2 490 000

1 620 000

(630 000)

660 000

1 050 000

1 230 000

30 000

(480 000)

450 000

1 290 000

900 000

0

750 000

660 000

5 580 000

4 440 000

Ordinary share capital

2 700 000

2 000 000

Retained income

1 500 000

1 158 000

Long-term loan from Kip Bank (15%)

900 000

1 000 000

Accounts payable

480 000

228 000

Company tax payable

0

54 000

5 580 000

4 440 000

ADDITIONAL INFORMATION

All purchases and sales are on credit.

Interim dividends paid during the year amounted to R150 750.

Credit terms of 3/10 net 60 days are granted by creditors.

Accounting Question

REQUIRED

Study the information given below and answer the following questions. Where discount factors are required

use only the four decimals present value tables that appear after the formula sheet or in the module guide.

Ignore taxes.

5.1 Calculate the Accounting Rate of Return on average investment of the second alternative

(expressed to two decimal places).

5.2 Determine which of the two investment opportunities the company should choose by

calculating the Net Present Value of each alternative. Your answer must include the

calculation of the present values and NPV.

5.3 Calculate the Internal Rate of Return of the first alterative (expressed to two decimal

places). Your answer must include two net present value calculations (using consecutive

rates/percentages) and interpolation.

INFORMATION

The management of Bentall Incorporated is considering two investment opportunities:

(5 marks)

(9 marks)

(6 marks)

The first alternative involves the purchase of a new machine for R900 000 which…

Chapter 5 Solutions

College Accounting (Book Only): A Career Approach

Ch. 5 - What is the third step in the accounting cycle?...Ch. 5 - Which of the following accounts would be closed...Ch. 5 - If Income from Services had a 20,400 credit...Ch. 5 - Which of the following accounts would appear on a...Ch. 5 - Under the cash basis of accounting, which of the...Ch. 5 - Prob. 6QYCh. 5 - Number in order the following steps in the...Ch. 5 - List the steps in the closing procedure in the...Ch. 5 - What is the purpose of closing entries? What is a...Ch. 5 - What are real accounts? What are nominal accounts?...

Ch. 5 - What is the purpose of the Income Summary account?...Ch. 5 - What is the purpose of the post-closing trial...Ch. 5 - Write the third closing entry to transfer the net...Ch. 5 - Prob. 8DQCh. 5 - Prob. 9DQCh. 5 - Classify the following accounts as real...Ch. 5 - The ledger accounts after adjusting entries for...Ch. 5 - As of December 31, the end of the current year,...Ch. 5 - The Income Statement columns of the work sheet of...Ch. 5 - The Income Statement columns of the work sheet of...Ch. 5 - After all revenue and expenses have been closed at...Ch. 5 - Identify whether the following accounts would be...Ch. 5 - Considering the following events, determine which...Ch. 5 - Indicate with an X whether each of the following...Ch. 5 - Prepare a statement of owners equity for The...Ch. 5 - Prob. 1PACh. 5 - The partial work sheet for Ho Consulting for May...Ch. 5 - The account balances of Bryan Company as of June...Ch. 5 - Williams Mechanic Services prepared the following...Ch. 5 - Prob. 1PBCh. 5 - The partial work sheet for Emil Consulting for...Ch. 5 - The account balances of Miss Beverlys Tutoring...Ch. 5 - Toms Catering Services prepared the following work...Ch. 5 - Rather than going directly to college, some...Ch. 5 - Prob. 2ACh. 5 - The post-closing trial balance submitted to you by...Ch. 5 - You are preparing a post-closing trial balance for...Ch. 5 - The bookkeeper has completed a work sheet and has...Ch. 5 - This problem is designed to enable you to apply...Ch. 5 - This problem is designed to enable you to apply...Ch. 5 - After the adjusting entries are recorded and...

Additional Business Textbook Solutions

Find more solutions based on key concepts

1-1. Define marketing and outline the steps in the marketing process. (AASCB: Communication)

Marketing: An Introduction (13th Edition)

Fundamental and Enhancing Characteristics. Identify whether the following items are fundamental characteristics...

Intermediate Accounting (2nd Edition)

How is activity-based costing useful for pricing decisions?

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

11-9. Identify a company with a product that interests you. Consider ways the company could use customer relati...

Business Essentials (12th Edition) (What's New in Intro to Business)

E6-14 Using accounting vocabulary

Learning Objective 1, 2

Match the accounting terms with the corresponding d...

Horngren's Accounting (12th Edition)

Explain how to derive a total expenditures (TE) curve.

Macroeconomics

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- REQUIRED Use the information provided below to answer the following questions: 4.1 Calculate the weighted average cost of capital (expressed to two decimal places). Your answer must include the calculations of the cost of equity, preference shares and the loan. 4.2 Calculate the cost of equity using the Capital Asset Pricing Model (expressed to two decimal places). (16 marks) (4 marks) INFORMATION Cadmore Limited intends raising finance for a proposed new project. The financial manager has provided the following information to determine the present cost of capital to the company: The capital structure consists of the following: ■3 million ordinary shares issued at R1.50 each but currently trading at R2 each. 1 200 000 12%, R2 preference shares with a market value of R2.50 per share. R1 000 000 18% Bank loan, due in March 2027. Additional information The company's beta coefficient is 1.3. The risk-free rate is 8%. The return on the market is 18%. The Gordon Growth Model is used to…arrow_forwardA dog training business began on December 1. The following transactions occurred during its first month. Use the drop-downs to select the accounts properly included on the income statement for the post-closing balancesarrow_forwardWhat is the expected return on a portfolio with a beta of 0.8 on these financial accounting question?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781305084087

Author:Cathy J. Scott

Publisher:Cengage Learning

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY