Concept explainers

This problem is designed to enable you to apply the knowledge you have acquired in the preceding chapters. In accounting, the ultimate test is being able to handle data in real life situations. This problem will give you valuable experience.

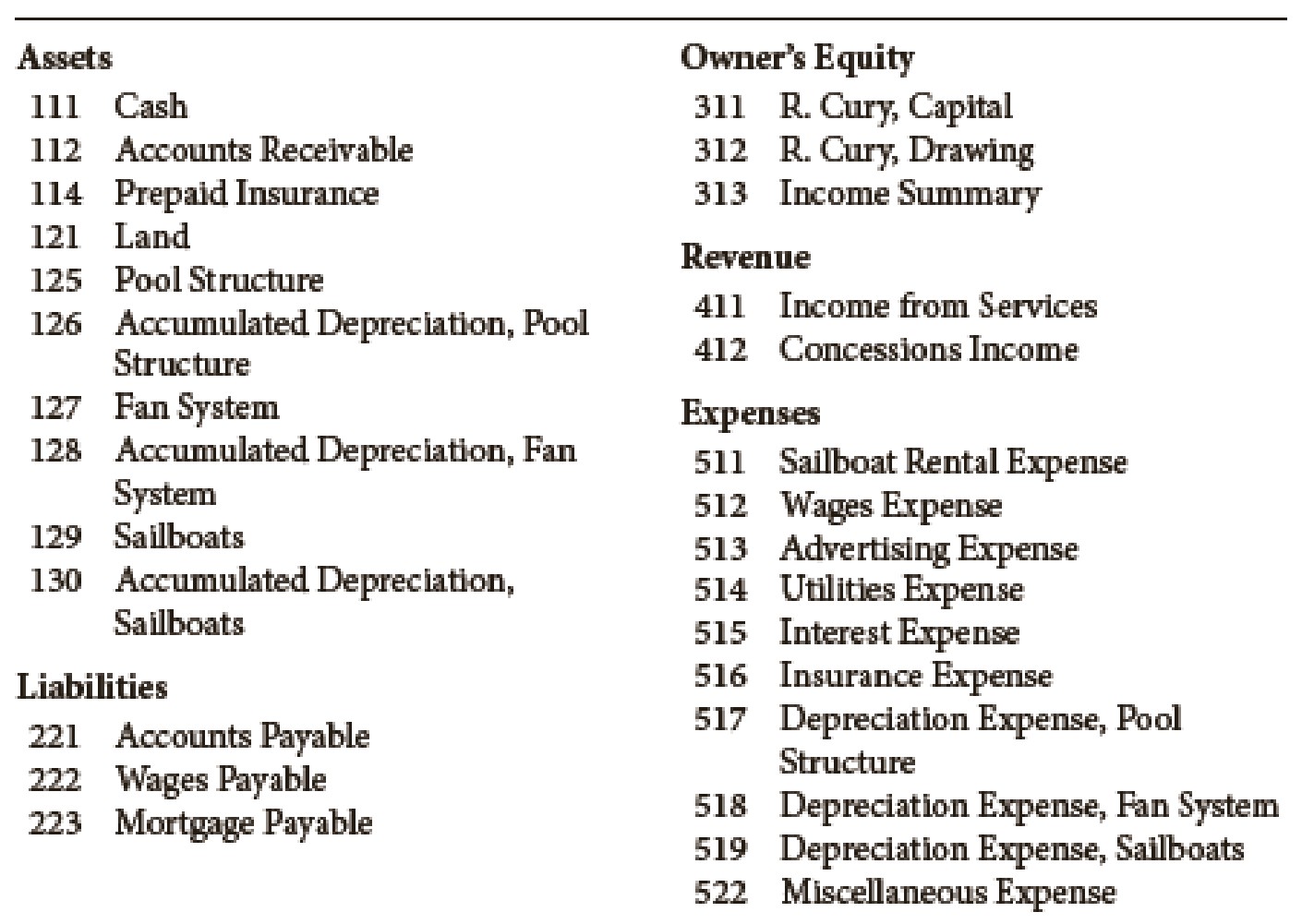

CHART OF ACCOUNTS

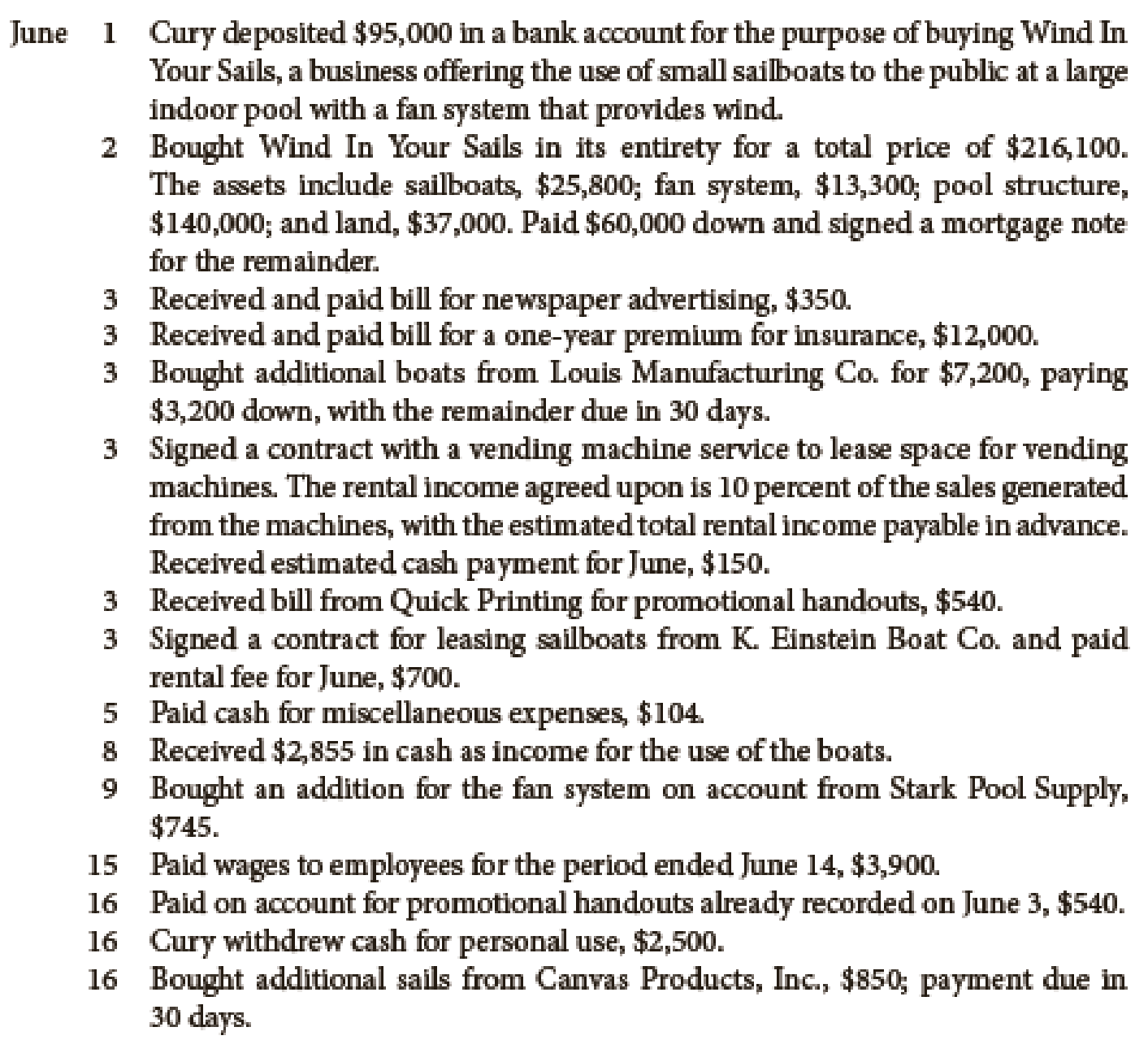

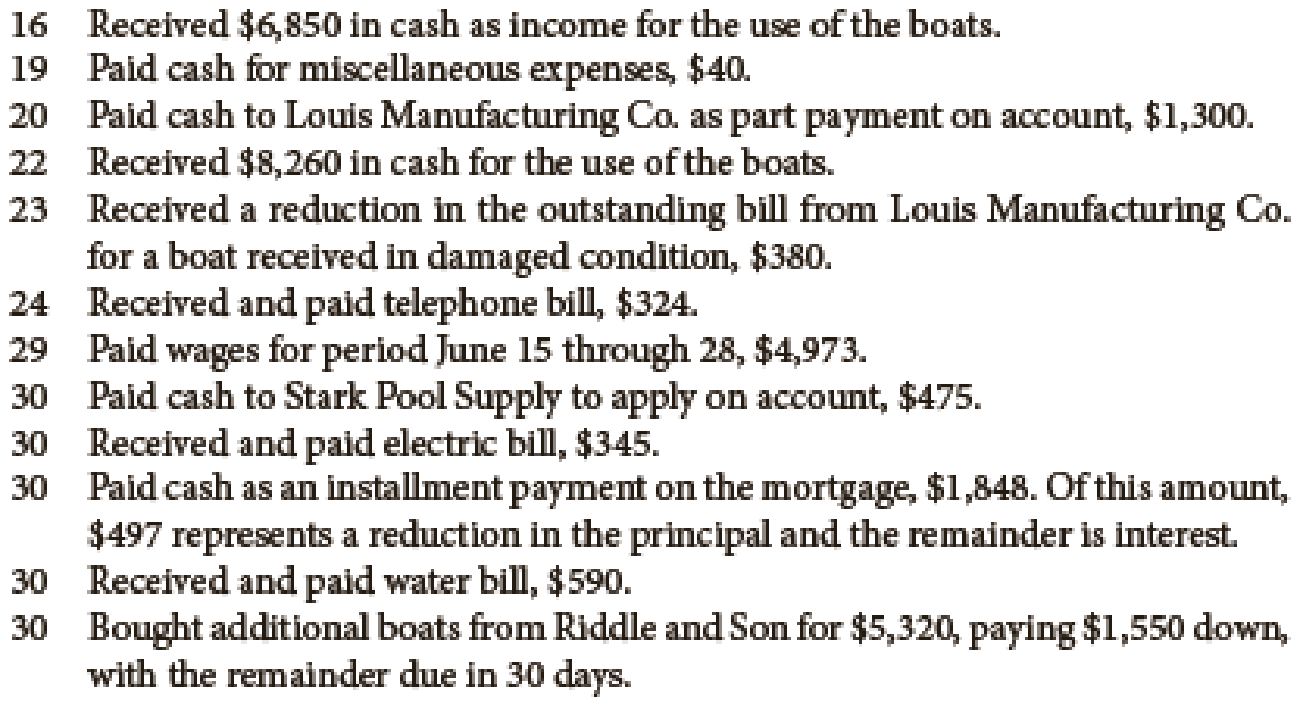

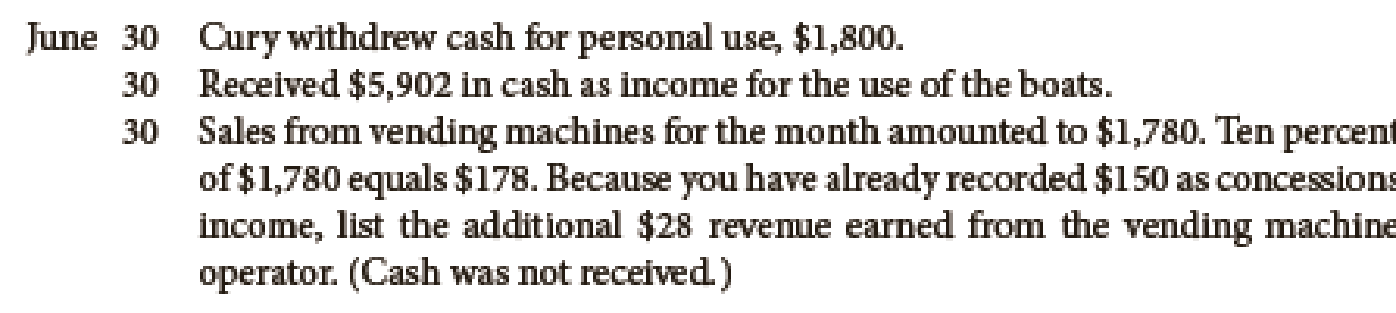

You are to record transactions in a two-column general journal. Assume that the fiscal period is one month. You will then be able to complete all of the steps in the accounting cycle.

When you are analyzing the transactions, think them through by visualizing the T accounts or by writing them down on scratch paper. For unfamiliar types of transactions, specific instructions for recording them are included. However, reason them out for yourself as well. Check off each transaction as it is recorded.

Required

- 1. Journalize the transactions. (Start on page 1 of the general journal if using Excel or Working Papers.)

- 2. Post the transactions to the ledger accounts. (Skip this step if using CLGL.)

- 3. Prepare a

trial balance . (If using a work sheet, use the first two columns.) - 4. Data for the adjustments are as follows:

- a. Insurance expired during the month, $1,000.

- b.

Depreciation of pool structure for the month, $715. - c. Depreciation of fan system for the month, $260.

- d. Depreciation of sailboats for the month, $900.

- e. Wages accrued at June 30, $810.

Your instructor may want you to use a work sheet for these adjustments.

- 5. Journalize

adjusting entries . - 6. Post adjusting entries to the ledger accounts. (Skip this step if using CLGL.)

- 7. Prepare an adjusted trial balance

- 8. Prepare the income statement

- 9. Prepare the statement of owner’s equity.

- 10. Prepare the

balance sheet . - 11. Journalize closing entries.

- 12.

Post closing entries to the ledger accounts. (Skip this step if using CLGL.) - 13. Prepare a post-dosing trial balance.

Check Figure

Trial balance total, $281,858; net income, $7,143; post-dosing trial balance total, $263,341

1.

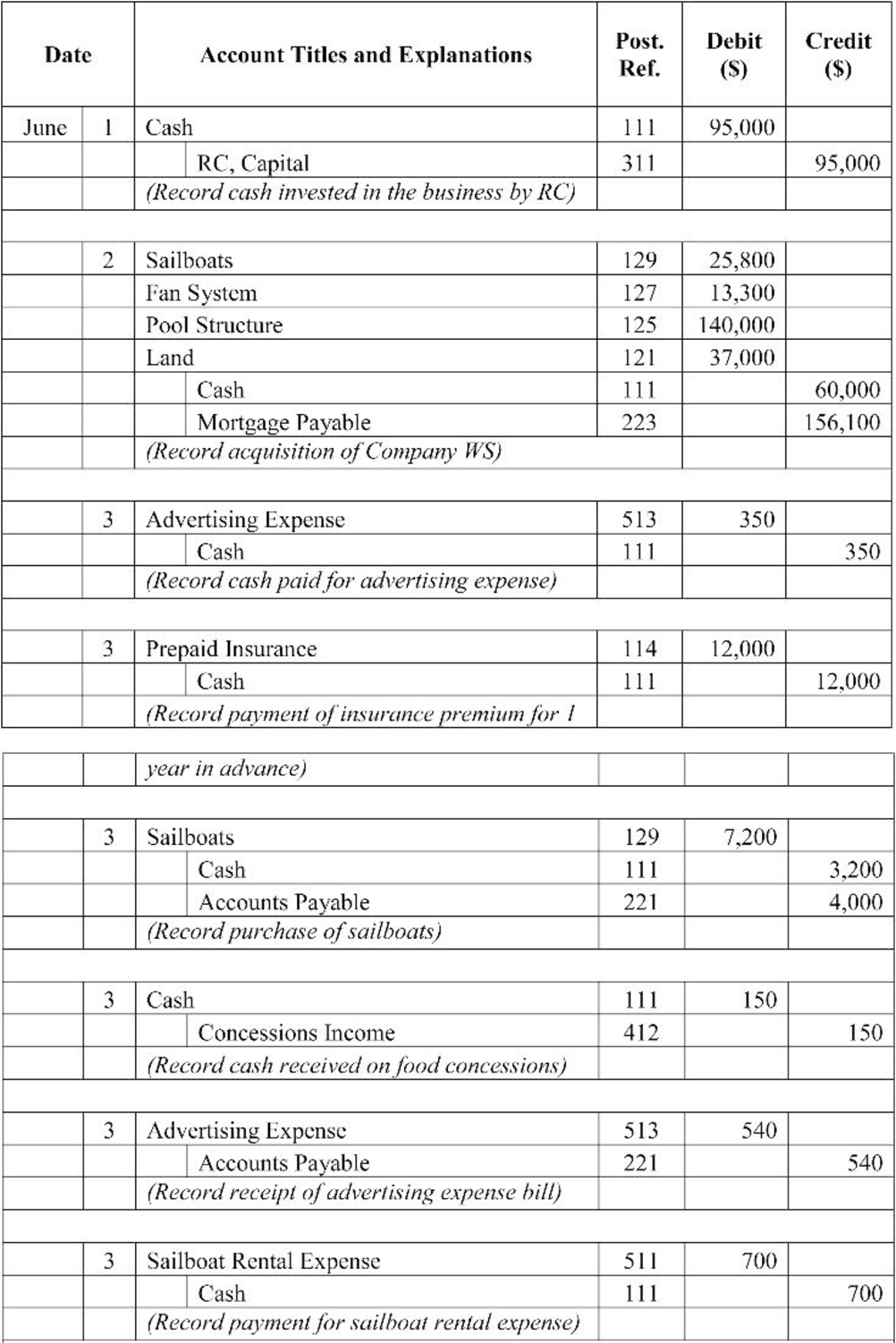

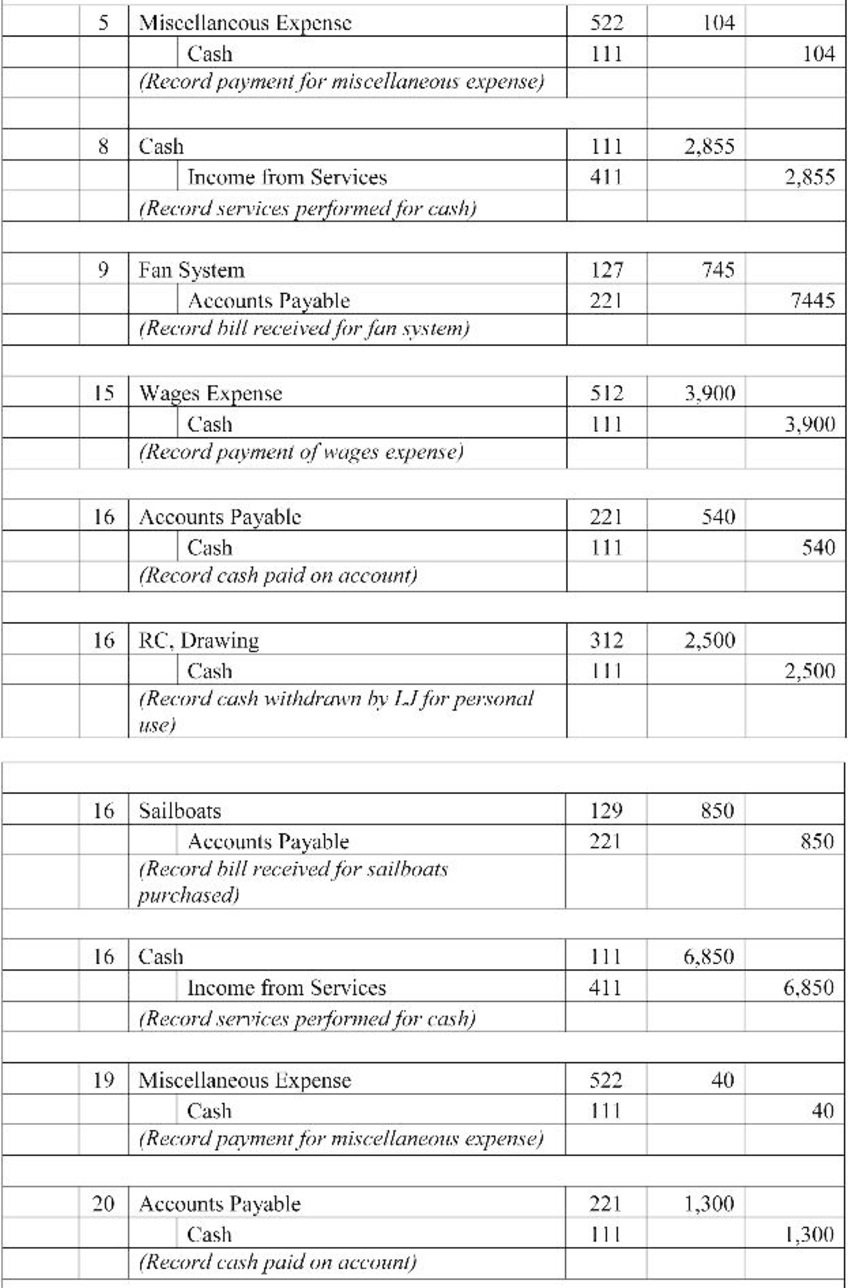

Prepare journal entries for the given transactions for Company WS.

Explanation of Solution

Journal entry: Journal entry is a set of economic events which can be measured in monetary terms. These are recorded chronologically and systematically.

Debit and credit rules:

- Debit an increase in asset account, increase in expense account, decrease in liability account, and decrease in stockholders’ equity accounts.

- Credit decrease in asset account, increase in revenue account, increase in liability account, and increase in stockholders’ equity accounts.

Prepare journal entries for the given transactions for Company WS.

Table (1)

2.

Post the journalized transactions in the ledger accounts of the general ledger.

Explanation of Solution

Ledger: Ledger is a book in which the accounts are summarized and grouped from the transactions recorded in the journal.

Post the journalized transactions in the ledger accounts of the general ledger.

| ACCOUNT Cash ACCOUNT NO. 111 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| June | 1 | 1 | 95,000 | 95,000 | |||

| 2 | 1 | 60,000 | 35,000 | ||||

| 3 | 1 | 350 | 34,650 | ||||

| 3 | 1 | 12,000 | 22,650 | ||||

| 3 | 1 | 3,200 | 19,450 | ||||

| 3 | 1 | 150 | 19,600 | ||||

| 3 | 1 | 700 | 18,900 | ||||

| 5 | 2 | 104 | 18,796 | ||||

| 8 | 2 | 2,855 | 21,651 | ||||

| 15 | 2 | 3,900 | 17,751 | ||||

| 16 | 2 | 540 | 17,241 | ||||

| 16 | 2 | 2,500 | 14,711 | ||||

| 16 | 3 | 6,850 | 21,561 | ||||

| 19 | 3 | 40 | 21,521 | ||||

| 20 | 3 | 1,300 | 20,221 | ||||

| 22 | 3 | 8,260 | 28,481 | ||||

| 24 | 3 | 324 | 28,157 | ||||

| 29 | 3 | 4,973 | 23,184 | ||||

| 30 | 3 | 475 | 22,709 | ||||

| 30 | 3 | 345 | 22,364 | ||||

| 30 | 4 | 1,848 | 20,516 | ||||

| 30 | 4 | 590 | 19,926 | ||||

| 30 | 4 | 1,550 | 18,376 | ||||

| 30 | 4 | 1,800 | 16,576 | ||||

| 30 | 4 | 5,902 | 22,478 | ||||

Table (2)

| ACCOUNT Accounts Receivable ACCOUNT NO. 112 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| June | 30 | 4 | 28 | 28 | |||

Table (3)

| ACCOUNT Prepaid Insurance ACCOUNT NO. 114 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| June | 3 | 1 | 12,000 | 12,000 | |||

Table (4)

| ACCOUNT Land ACCOUNT NO. 121 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| June | 2 | 1 | 37,000 | 37,000 | |||

Table (5)

| ACCOUNT Pool Structure ACCOUNT NO. 125 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| June | 2 | 1 | 140,000 | 140,000 | |||

Table (6)

| ACCOUNT Fan System ACCOUNT NO. 127 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| June | 2 | 1 | 13,300 | 13,300 | |||

| 9 | 1 | 745 | 14,045 | ||||

Table (7)

| ACCOUNT Sailboats ACCOUNT NO. 129 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| June | 2 | 1 | 25,800 | 25,800 | |||

| 3 | 1 | 7,200 | 33,000 | ||||

| 16 | 2 | 850 | 33,850 | ||||

| 23 | 3 | 380 | 33,740 | ||||

| 30 | 4 | 5,320 | 38,790 | ||||

Table (8)

| ACCOUNT Accounts Payable ACCOUNT NO. 221 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| June | 3 | 1 | 4,000 | 4,000 | |||

| 3 | 1 | 540 | 4,540 | ||||

| 9 | 2 | 745 | 5,285 | ||||

| 16 | 2 | 540 | 4,745 | ||||

| 16 | 2 | 850 | 5,595 | ||||

| 20 | 3 | 1,300 | 4,295 | ||||

| 23 | 3 | 380 | 3,915 | ||||

| 30 | 3 | 475 | 3,440 | ||||

| 30 | 4 | 3,770 | 7,210 | ||||

Table (9)

| ACCOUNT Mortgage Payable ACCOUNT NO. 223 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| June | 2 | 1 | 156,100 | 156,100 | |||

| 30 | 4 | 497 | 155,603 | ||||

Table (10)

| ACCOUNT RC, Capital ACCOUNT NO. 311 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| June | 1 | 1 | 95,000 | 95,000 | |||

Table (11)

| ACCOUNT RC, Drawing ACCOUNT NO. 312 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| June | 16 | 2 | 2,500 | 2,500 | |||

| 31 | 4 | 1,800 | 4,300 | ||||

Table (12)

| ACCOUNT Income from Services ACCOUNT NO. 411 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| June | 8 | 2 | 2,855 | 2,855 | |||

| 16 | 2 | 6,850 | 9,705 | ||||

| 22 | 3 | 8,260 | 17,965 | ||||

| 30 | 3 | 5,902 | 23,867 | ||||

Table (13)

| ACCOUNT Concessions Income ACCOUNT NO. 412 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| June | 3 | 1 | 150 | 150 | |||

| 30 | 2 | 28 | 178 | ||||

Table (14)

| ACCOUNT Sailboat Rental Expense ACCOUNT NO. 511 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| June | 3 | 1 | 700 | 700 | |||

Table (15)

| ACCOUNT Wages Expense ACCOUNT NO. 512 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| June | 15 | 2 | 3,900 | 3,900 | |||

| 29 | 3 | 4,973 | 8,873 | ||||

Table (16)

| ACCOUNT Advertising Expense ACCOUNT NO. 513 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| June | 3 | 1 | 350 | 350 | |||

| 3 | 1 | 540 | 890 | ||||

Table (17)

| ACCOUNT Utilities Expense ACCOUNT NO. 514 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| June | 24 | 3 | 324 | 324 | |||

| 30 | 3 | 345 | 669 | ||||

| 30 | 4 | 590 | 1,259 | ||||

Table (18)

| ACCOUNT Interest Expense ACCOUNT NO. 515 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| June | 30 | 3 | 1,351 | 1,351 | |||

Table (19)

| ACCOUNT Miscellaneous Expense ACCOUNT NO. 522 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| June | 5 | 2 | 104 | 104 | |||

| 19 | 3 | 40 | 144 | ||||

Table (20)

3.

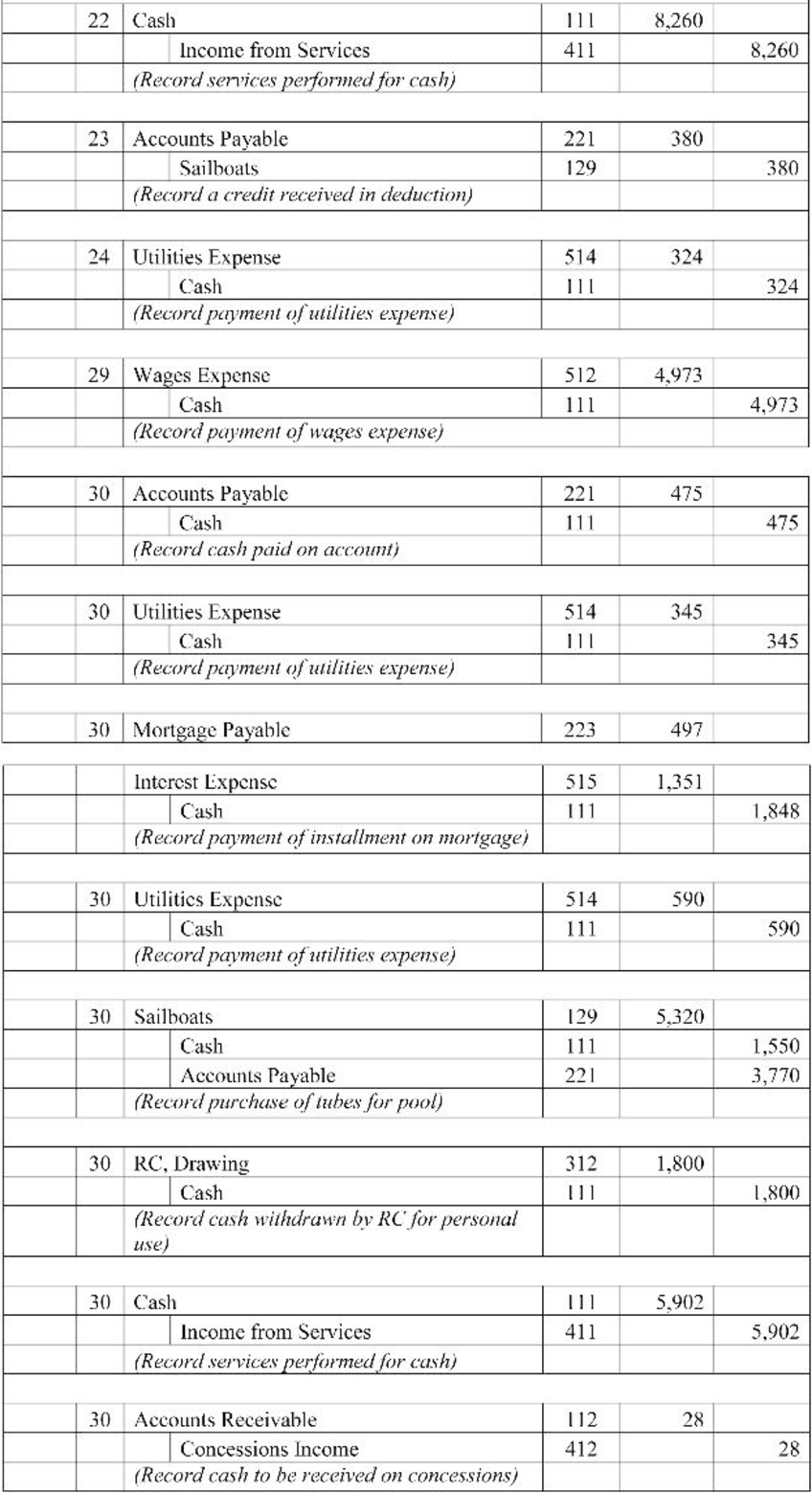

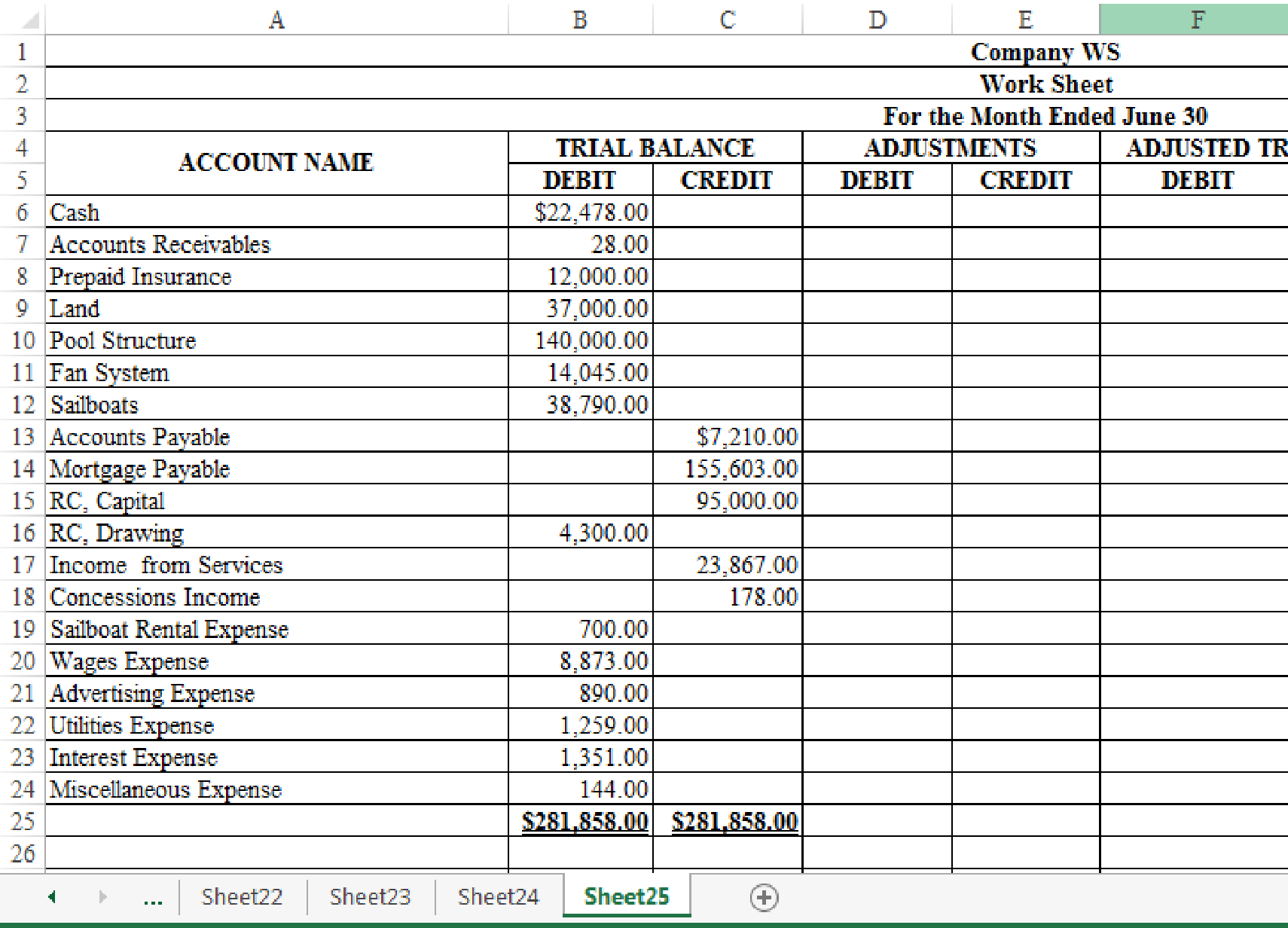

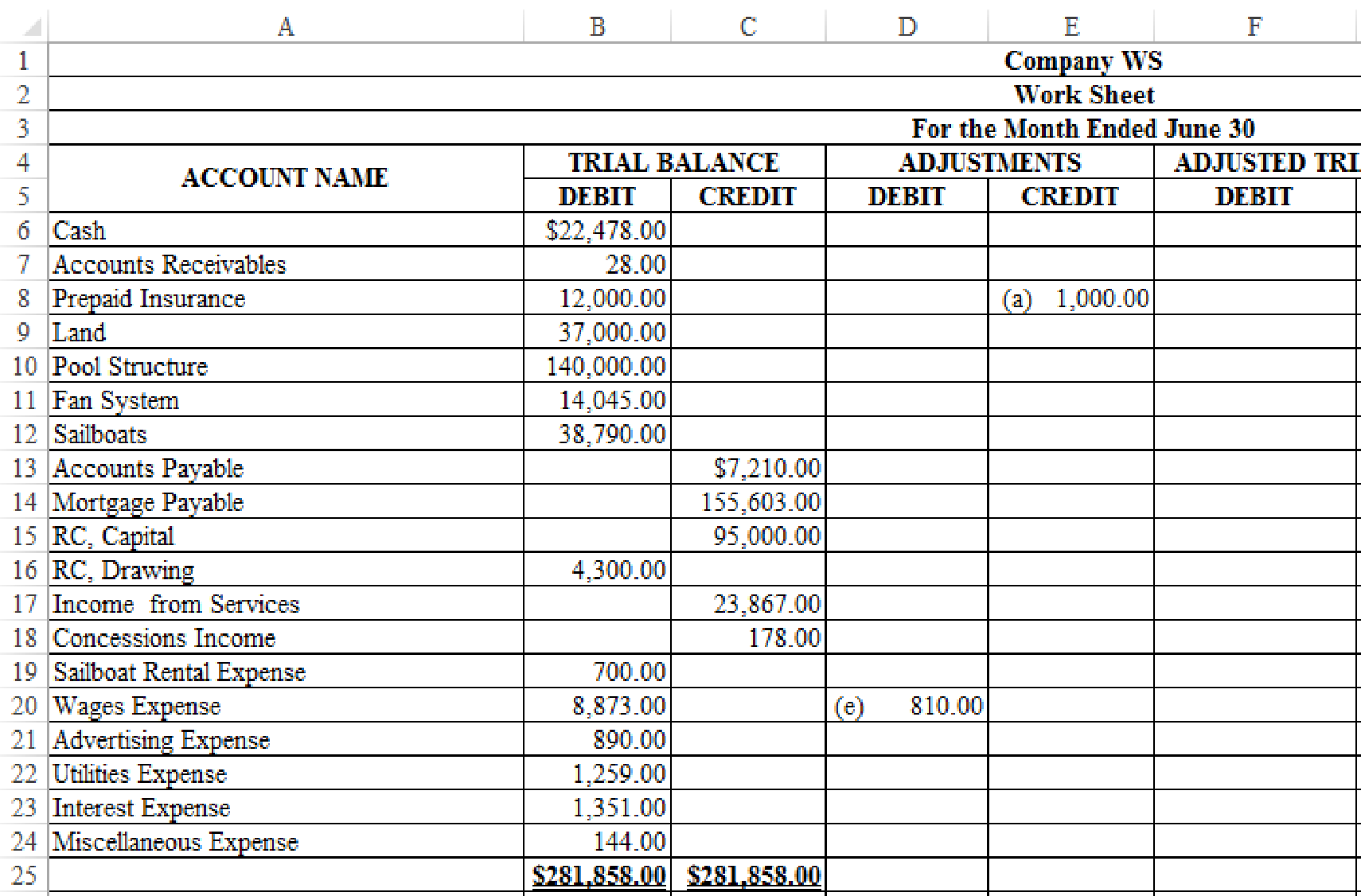

Prepare trial balance on the work sheet, from the account balances in Part (2).

Explanation of Solution

Worksheet: Worksheet is an accounting tool that helps accountants to record adjustments and up-date balances required to prepare financial statements. Worksheet is a central place where trial balance, adjustments, adjusted trial balance, income statement, and balance sheet are presented.

Trial balance: Trial balance is a summary of all the asset, liability, and equity accounts and their balances.

Prepare trial balance on the work sheet, from the account balances in Part (2).

Figure – (1)

4.

Indicate the given adjustments on the worksheet for Company BO for the month ended July 31, 20--.

Explanation of Solution

Worksheet: Worksheet is an accounting tool that helps accountants to record adjustments and up-date balances required to prepare financial statements. Worksheet is a central place where trial balance, adjustments, adjusted trial balance, income statement, and balance sheet are presented.

Indicate the given adjustments on the worksheet for Company BO for the month ended July 31, 20--.

Figure-(2)

5.

Prepare adjusting journal entries for Company WS.

Explanation of Solution

Adjusting entries: Adjusting entries are those entries which are recorded at the end of the year, to update the income statement accounts (revenue and expenses) and balance sheet accounts (assets, liabilities, and owners’ or stockholders’ equity) to maintain the records according to accrual basis principle and matching concept.

Prepare adjusting journal entries for Company WS.

Adjusting entry (a) for the prepaid insurance:

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| June | 30 | Insurance Expense | 516 | 1,000 | ||

| Prepaid Insurance | 114 | 1,000 | ||||

| (Record part of prepaid insurance expired) | ||||||

Table (21)

Description:

- Insurance Expense is an expense account. Since expenses decrease equity, equity value is decreased, and a decrease in equity is debited.

- Prepaid Insurance is an asset account. Since amount of insurance is expired, asset account decreased, and a decrease in asset is credited.

Adjusting entry (b) for the depreciation expense for pool structure:

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| June | 30 | Depreciation Expense, Pool Structure | 517 | 715 | ||

| Accumulated Depreciation, Pool Structure | 126 | 715 | ||||

| (Record depreciation expense) | ||||||

Table (22)

Description:

- Depreciation Expense, Pool Structure is an expense account. Since expenses decrease equity, equity value is decreased, and a decrease in equity is debited.

- Accumulated Depreciation, Pool Structure is a contra-asset account, and contra-asset accounts would have a normal credit balance, hence, the account is credited.

Adjusting entry (c) for the depreciation expense for fan system:

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| June | 30 | Depreciation Expense, Fan System | 518 | 260 | ||

| Accumulated Depreciation, Fan System | 128 | 260 | ||||

| (Record depreciation expense) | ||||||

Table (23)

Description:

- Depreciation Expense, Fan System is an expense account. Since expenses decrease equity, equity value is decreased, and a decrease in equity is debited.

- Accumulated Depreciation, Fan System is a contra-asset account, and contra-asset accounts would have a normal credit balance, hence, the account is credited.

Adjusting entry (d) for the depreciation expense for sailboats:

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| June | 30 | Depreciation Expense, Sailboats | 519 | 900 | ||

| Accumulated Depreciation, Sailboats | 130 | 900 | ||||

| (Record depreciation expense) | ||||||

Table (24)

Description:

- Depreciation Expense, Sailboats is an expense account. Since expenses decrease equity, equity value is decreased, and a decrease in equity is debited.

- Accumulated Depreciation, Sailboats is a contra-asset account, and contra-asset accounts would have a normal credit balance, hence, the account is credited.

Adjusting entry (e) for the wages expense:

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| June | 30 | Wages Expense | 512 | 810 | ||

| Wages Payable | 222 | 810 | ||||

| (Record accrued wages expenses) | ||||||

Table (25)

Description:

- Wages Expense is an expense account. Since expenses decrease equity, equity value is decreased, and a decrease in equity is debited.

- Wages Payable is a liability account. Since amount of payables has increased, liability decreased, and an increase in liability is credited.

6.

Post the adjusting entries journalized in Part (5) in the ledger accounts of general ledger.

Explanation of Solution

Post the adjusting entries journalized in Part (5) in the ledger accounts of general ledger.

| ACCOUNT Prepaid Insurance ACCOUNT NO. 114 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| June | 2 | 1 | 12,000 | 12,000 | |||

| 31 | Adjusting | 1,000 | 11,000 | ||||

Table (26)

| ACCOUNT Accumulated Depreciation, Pool Structure ACCOUNT NO. 125 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| June | 30 | Adjusting | 715 | 715 | |||

Table (27)

| ACCOUNT Accumulated Depreciation, Fan System ACCOUNT NO. 128 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| June | 30 | Adjusting | 260 | 260 | |||

Table (28)

| ACCOUNT Accumulated Depreciation, Sailboats ACCOUNT NO. 130 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| June | 30 | Adjusting | 900 | 900 | |||

Table (29)

| ACCOUNT Wages Payable ACCOUNT NO. 222 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| June | 30 | Adjusting | 810 | 810 | |||

Table (30)

| ACCOUNT Wages Expense ACCOUNT NO. 512 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| June | 15 | 2 | 3,900 | 3,900 | |||

| 29 | 3 | 4,973 | 8,873 | ||||

| 30 | Adjusting | 810 | 9,683 | ||||

Table (31)

| ACCOUNT Insurance Expense ACCOUNT NO. 517 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| June | 30 | Adjusting | 2 | 1,000 | 1,000 | ||

Table (32)

| ACCOUNT Depreciation Expense, Pool Structure ACCOUNT NO. 517 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| June | 30 | Adjusting | 715 | 715 | |||

Table (33)

| ACCOUNT Depreciation Expense, Fan System ACCOUNT NO. 518 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| June | 30 | Adjusting | 260 | 260 | |||

Table (34)

| ACCOUNT Depreciation Expense, Sailboats ACCOUNT NO. 519 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| June | 30 | Adjusting | 900 | 900 | |||

Table (35)

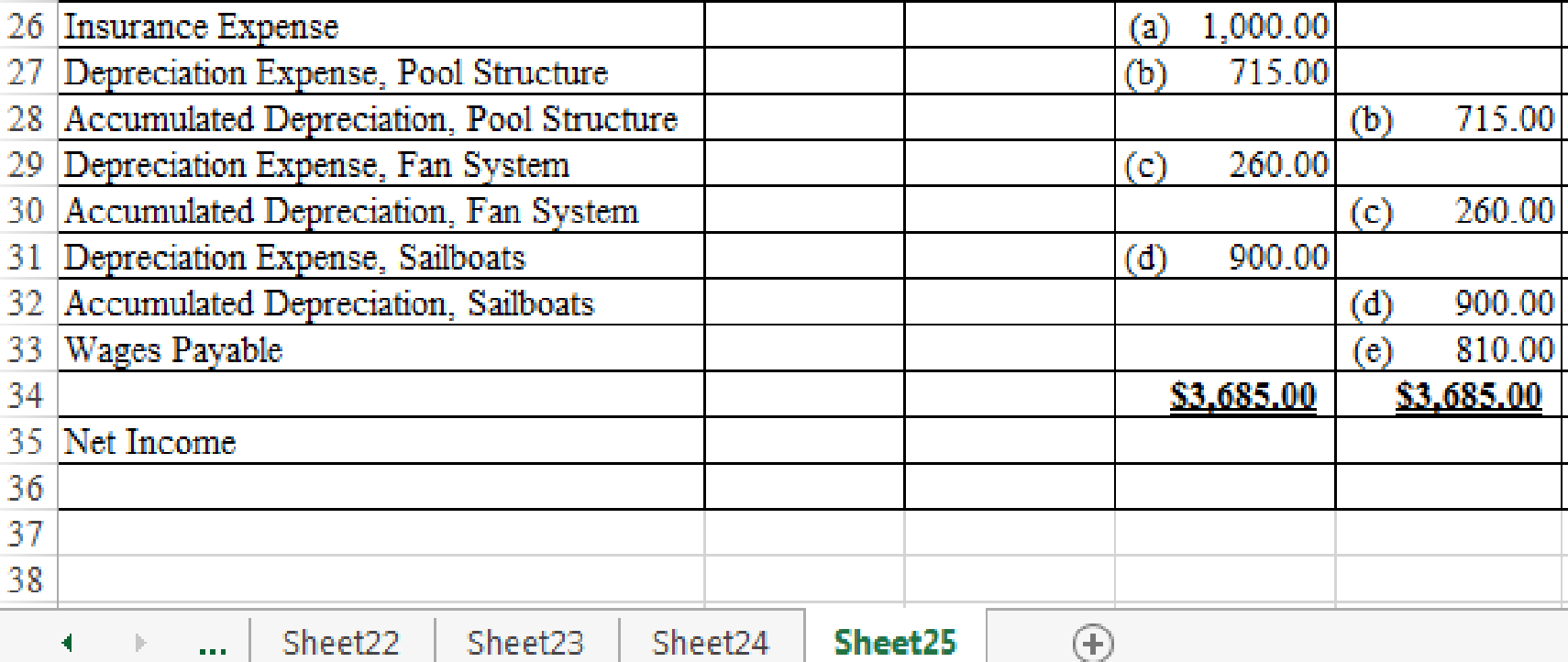

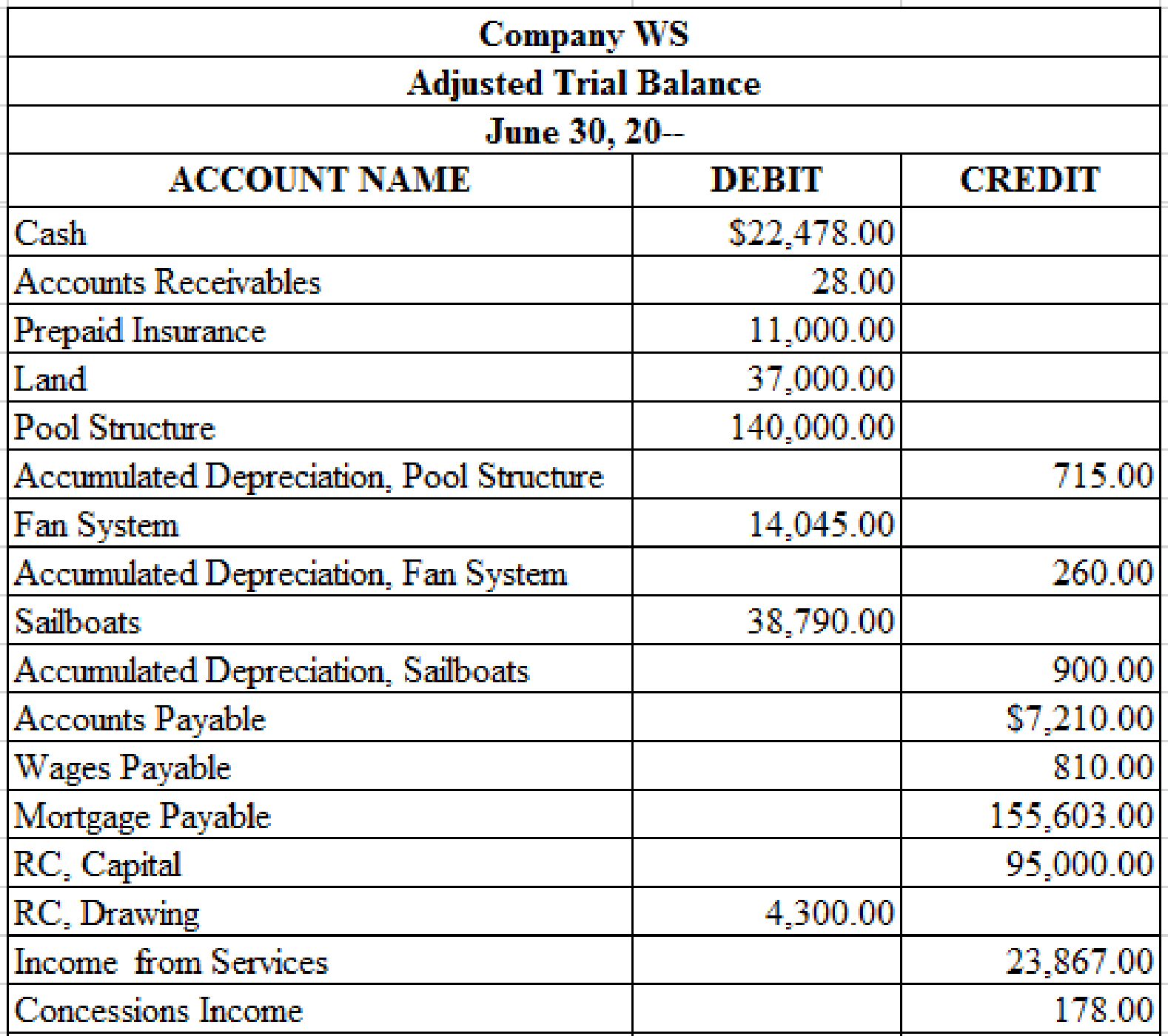

7.

Prepare an adjusted trial balance for Company WS as at June 30, 20--, based on the account balances derived in Parts (2) and (6).

Explanation of Solution

Adjusted trial balance: The trial balance which reflects the adjusting entries and incorporates the effect of all adjustments in the ledger accounts, is referred to as adjusted trial balance.

Prepare an adjusted trial balance for Company WS as at June 31, 20--, based on the account balances derived in Parts (2) and (6).

Figure - (3)

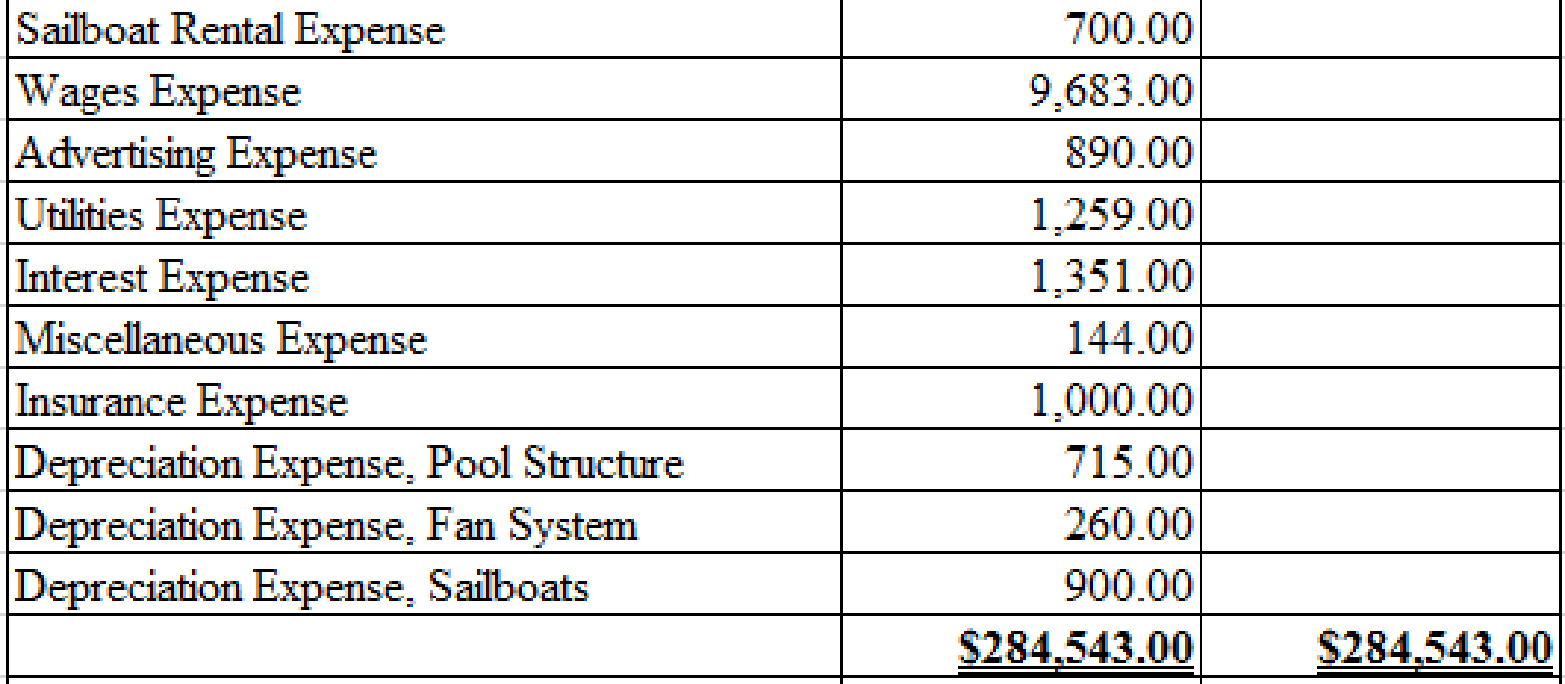

8.

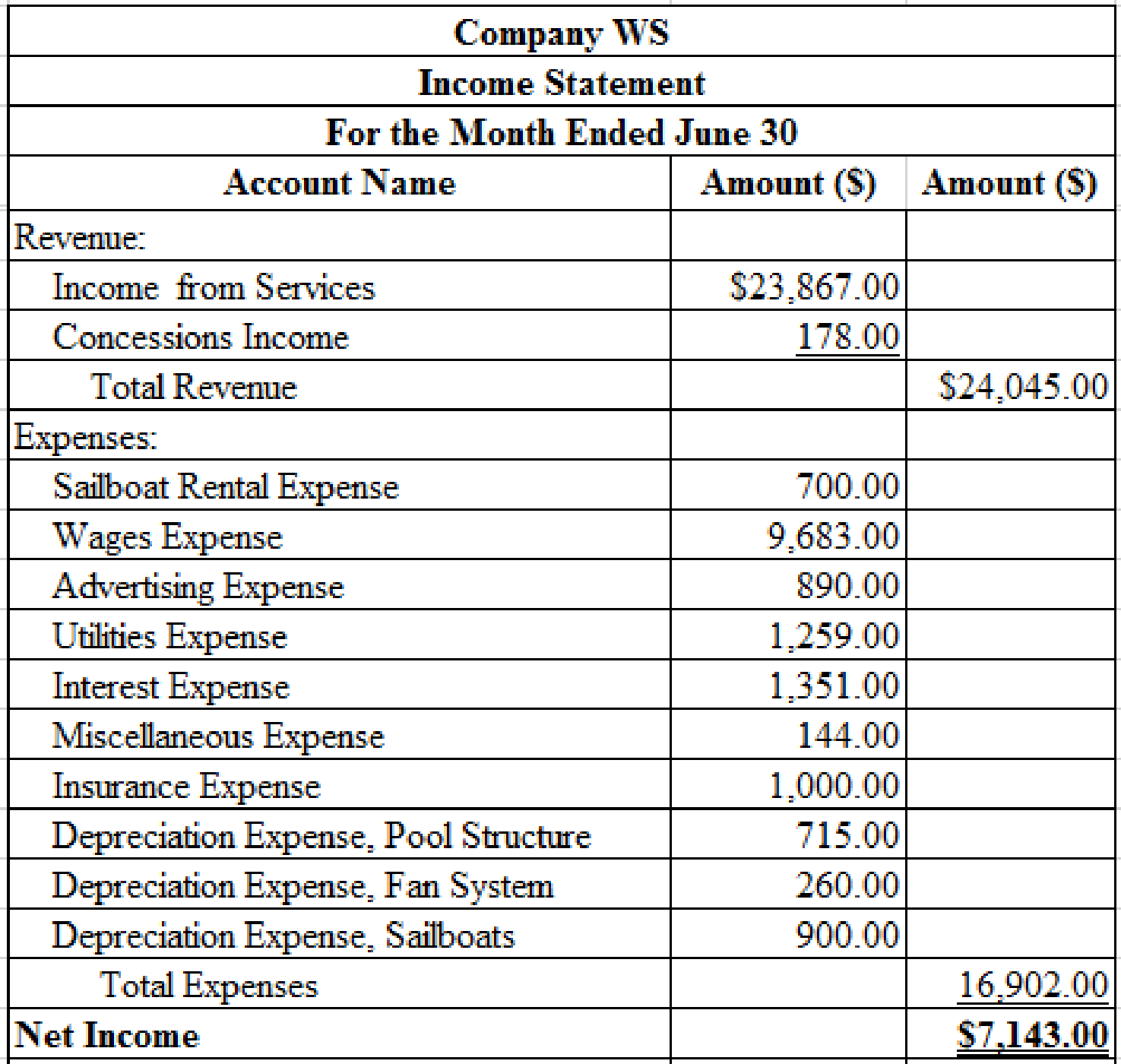

Prepare an income statement of Company WS for the month ended June 30, based on the account balances derived in Parts (2) and (6).

Explanation of Solution

Income statement: The financial statement which reports revenues and expenses from business operations, and the result of those operations as net income or net loss for a particular time period is referred to as income statement.

Prepare an income statement of Company WS for the month ended June 30.

Figure - (4)

9.

Prepare a statement of owners’ equity of Company WS, based on the account balances derived in Parts (2) and (6), and net income computed in Part (8).

Explanation of Solution

Statement of owners’ equity: This statement reports the beginning owner’s equity and all the changes which led to ending owners’ equity. Additional capital, net income from income statement is added to, and drawings are deducted from beginning owner’s equity to arrive at the end result, ending owner’s equity.

Prepare a statement of owners’ equity for Company WS for the month ended June 30.

| Company WS | ||

| Statement of Owners’ Equity | ||

| For the Month Ended June 30, 20-- | ||

| RC, Capital, June 1, 20-- | $0 | |

| Investments during June | $95,000 | |

| Net income for June | 7,143 | |

| 102,143 | ||

| Less: Withdrawals for June | 4,300 | |

| Increase in capital | 97,893 | |

| RC, Capital, June 30, 20-- | $97,843 | |

Table (36)

10.

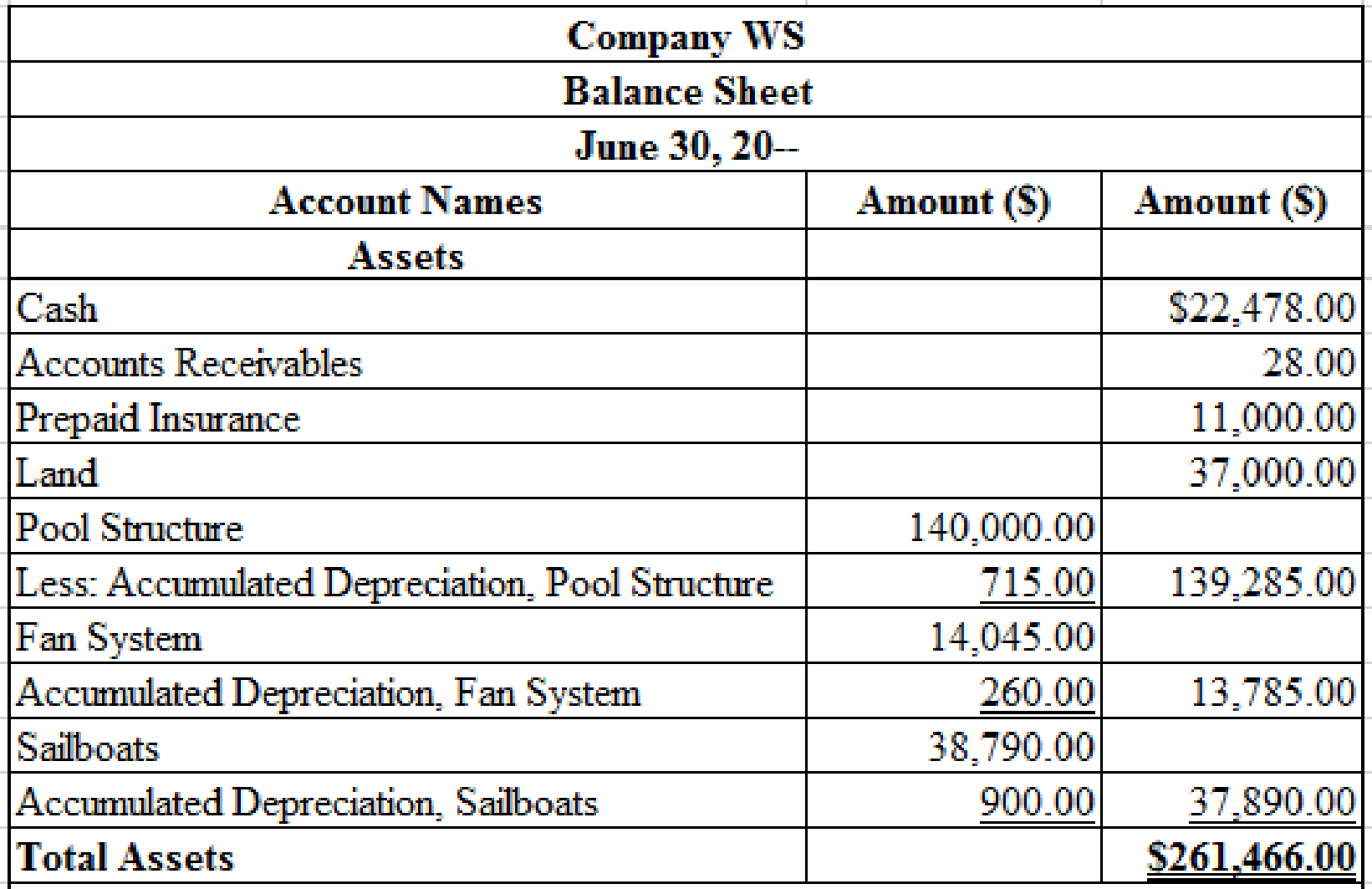

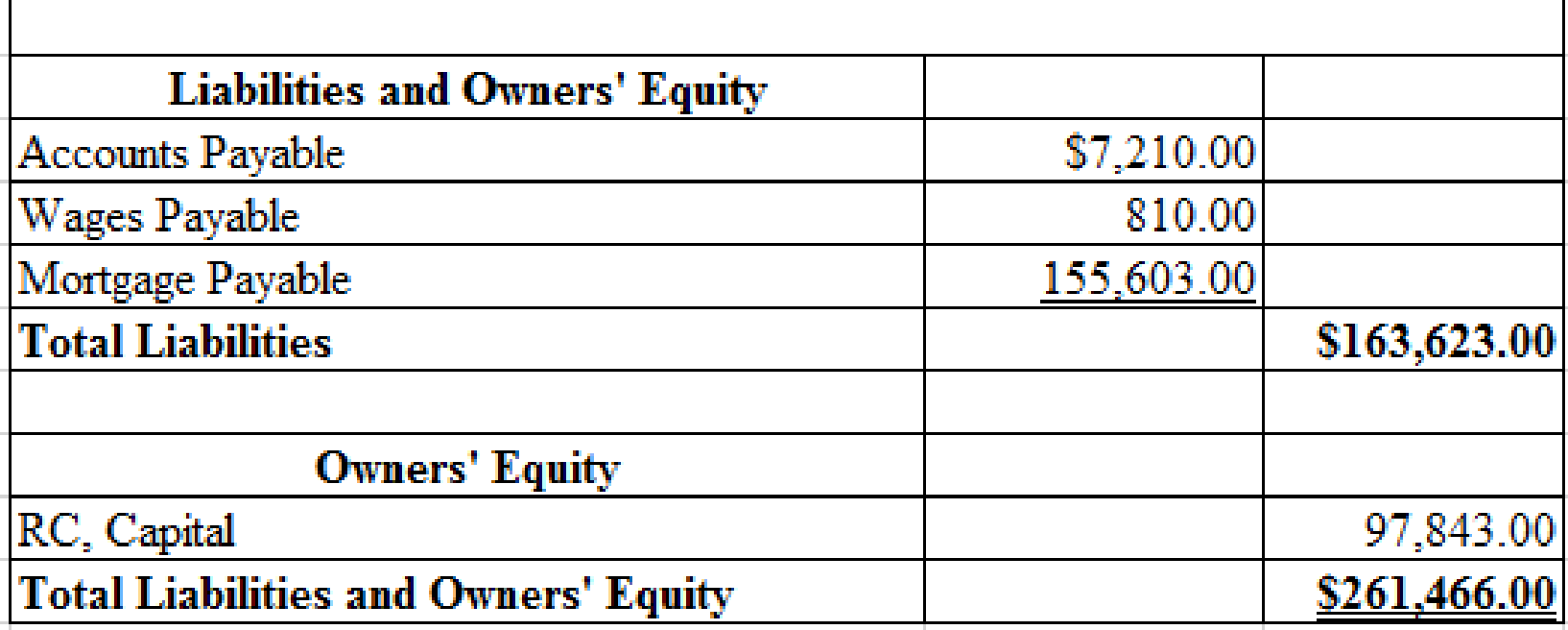

Prepare a balance sheet for Company WS, based on the account balances derived in Parts (2) and (6), and capital of the owner from the statement of owners’ equity prepared in Part (9).

Explanation of Solution

Balance sheet: This financial statement reports a company’s resources (assets) and claims of creditors (liabilities) and owners (owners’ equity) over those resources. The resources of the company are assets which include money contributed by owners and creditors. Hence, the main elements of the balance sheet are assets, liabilities, and owners’ equity.

Prepare the balance sheet for Company WS as at June 30, 20--.

Table (37)

11.

Prepare closing entries numbering the entries 1 through 4.

Explanation of Solution

Closing entries: The journal entries prepared to close the temporary accounts to capital account are referred to as closing entries. The revenue, expense, and drawing accounts are referred to as temporary accounts because the information and figures in these accounts is held temporarily and consequently transferred to permanent account at the end of accounting year.

Steps in closing procedure:

- 1. Close the revenue accounts to Income Summary account.

- 2. Close the expense accounts to Income Summary account.

- 3. Close the Income Summary account and transfer the net income or net loss balance to the Capital account.

- 4. Close the Drawing account to Capital account.

Prepare closing entries numbering the entries 1 through 4.

Entry 1:

| Date | Account Titles and Explanations | Post. Ref. | Debit ($) | Credit ($) | ||

| June | 30 | Income from Services | 411 | 23,867 | ||

| Concessions Income | 412 | 178 | ||||

| Income Summary | 313 | 24,045 | ||||

| (Record closing of revenue to Income Summary account) | ||||||

Table (38)

Description:

- Income from Services and Concessions Income are revenue accounts. Revenue account has a normal credit balance. Since revenue is closed to Income Summary account, the account is debited.

- Income Summary is a clearing account which closes revenue, expense, drawings, and net of revenues and expenses to capital accounts. The account is credited to hold the transferred balance from revenue account.

Entry 2:

| Date | Account Titles and Explanations | Post. Ref. | Debit ($) | Credit ($) | ||

| June | 30 | Income Summary | 313 | 16,902 | ||

| Sailboat Rental Expense | 511 | 700 | ||||

| Wages Expense | 512 | 9,683 | ||||

| Advertising Expense | 513 | 890 | ||||

| Utilities Expense | 514 | 1,259 | ||||

| Interest Expense | 515 | 1,351 | ||||

| Insurance Expense | 516 | 1,000 | ||||

| Depreciation Expense, Pool Structure | 517 | 715 | ||||

| Depreciation Expense, Fan System | 518 | 260 | ||||

| Depreciation Expense, Sailboats | 519 | 900 | ||||

| Miscellaneous Expense | 522 | 144 | ||||

| (Record closing of expenses to Income Summary account) | ||||||

Table (39)

Description:

- Income Summary is a clearing account which closes revenue, expense, drawings, and net of revenues and expenses to capital accounts. The account is debited to hold the transferred balance from expense accounts.

- All expense accounts have a normal debit balance. Since expenses are closed to Income Summary account, the accounts are credited.

Entry 3:

| Date | Account Titles and Explanations | Post. Ref. | Debit ($) | Credit ($) | ||

| June | 30 | Income Summary | 313 | 7,143 | ||

| RC, Capital | 311 | 7,143 | ||||

| (Record closing of net income to capital account) | ||||||

Table (40)

Description:

- Income Summary is a clearing account which closes revenue, expense, drawings, and net of revenues and expenses to capital accounts. Since net income is closed, the account is reversed, hence, the Income Summary account is debited.

- RC, Capital is a capital account. Since net income is transferred to the account, the value increased, and an increase in capital is credited.

Entry 4:

| Date | Account Titles and Explanations | Post. Ref. | Debit ($) | Credit ($) | ||

| June | 30 | RC, Capital | 311 | 4,300 | ||

| RC, Drawing | 312 | 4,300 | ||||

| (Record closing of drawing to capital account) | ||||||

Table (41)

Description:

- RC, Capital is a capital account. Since drawings is transferred to the account, the value decreased, and a decrease in capital is debited.

- RC, Drawing is a capital account. Since drawings is transferred, the account is credited to reverse the previously debited effect.

12.

Post the closing entries to ledger accounts.

Explanation of Solution

Post the closing entries to ledger accounts.

| ACCOUNT RC, Capital ACCOUNT NO. 311 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| June | 1 | 1 | 95,000 | 95,000 | |||

| 30 | Closing | 7,143 | 102,143 | ||||

| 30 | Closing | 4,300 | 97,843 | ||||

Table (42)

| ACCOUNT RC, Drawing ACCOUNT NO. 312 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| June | 16 | 2 | 2,500 | 2,500 | |||

| 30 | 4 | 1,800 | 4,300 | ||||

| 30 | Closing | 4,300 | 0 | ||||

Table (43)

| ACCOUNT Income from Services ACCOUNT NO. 411 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| June | 8 | 2 | 2,855 | 2,855 | |||

| 16 | 2 | 6,850 | 9,705 | ||||

| 22 | 3 | 8,260 | 17,965 | ||||

| 30 | 3 | 5,902 | 23,867 | ||||

| 30 | Closing | 23,867 | 0 | ||||

Table (44)

| ACCOUNT Concessions Income ACCOUNT NO. 412 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| June | 3 | 2 | 150 | 150 | |||

| 30 | 2 | 28 | 178 | ||||

| 30 | Closing | 178 | 0 | ||||

Table (45)

| ACCOUNT Sailboat Rental Expense ACCOUNT NO. 511 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| June | 3 | 1 | 700 | 700 | |||

| 30 | Closing | 700 | 0 | ||||

Table (46)

| ACCOUNT Wages Expense ACCOUNT NO. 512 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| June | 15 | 2 | 3,900 | 3,900 | |||

| 29 | 3 | 4,973 | 8,873 | ||||

| 30 | Adjusting | 4 | 810 | 9,683 | |||

| 30 | Closing | 5 | 9,683 | 0 | |||

Table (47)

| ACCOUNT Advertising Expense ACCOUNT NO. 513 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| June | 3 | 1 | 350 | 350 | |||

| 3 | 1 | 540 | 890 | ||||

| 30 | Closing | 890 | 0 | ||||

Table (48)

| ACCOUNT Utilities Expense ACCOUNT NO. 514 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| June | 24 | 3 | 324 | 324 | |||

| 30 | 3 | 345 | 669 | ||||

| 30 | 4 | 590 | 1,259 | ||||

| 30 | Closing | 1,259 | 0 | ||||

Table (49)

| ACCOUNT Interest Expense ACCOUNT NO. 515 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| June | 30 | 4 | 1,351 | 1,351 | |||

| 30 | Closing | 1,351 | 0 | ||||

Table (50)

| ACCOUNT Miscellaneous Expense ACCOUNT NO. 522 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| June | 5 | 2 | 104 | 104 | |||

| 19 | 3 | 40 | 144 | ||||

| 30 | Closing | 144 | 0 | ||||

Table (51)

| ACCOUNT Insurance Expense ACCOUNT NO. 517 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| June | 30 | Adjusting | 4 | 1,000 | 1,000 | ||

| 30 | Closing | 5 | 1,000 | 0 | |||

Table (52)

| ACCOUNT Depreciation Expense, Pool Structure ACCOUNT NO. 517 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| June | 30 | Adjusting | 715 | 715 | |||

| 30 | Closing | 715 | 0 | ||||

Table (53)

| ACCOUNT Depreciation Expense, Fan System ACCOUNT NO. 519 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| June | 30 | Adjusting | 260 | 260 | |||

| 30 | Closing | 260 | 0 | ||||

Table (54)

| ACCOUNT Depreciation Expense, Sailboats ACCOUNT NO. 519 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| June | 30 | Adjusting | 900 | 900 | |||

| 30 | Closing | 900 | 0 | ||||

Table (55)

| ACCOUNT Income Summary ACCOUNT NO. 313 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| June | 30 | Closing | 24,045 | 24,045 | |||

| 30 | Closing | 16,902 | 7,143 | ||||

| 30 | Closing | 7,143 | 0 | ||||

Table (56)

13.

Prepare a post-closing trial balance for Company WS as at June 30, 20--.

Explanation of Solution

Post-closing trial balance: Post-closing trial balance is a summary of all the asset, liability, and capital accounts and their balances, after the closing entries are prepared. So, post-closing trial balance reports the balances of permanent accounts only.

Prepare a post-closing trial balance for Company WS as at June 30, 20--.

| Company WS | ||

| Post-Closing Trial Balance | ||

| July 31, 20-- | ||

| Account Names | Debit ($) | Credit ($) |

| Cash | $22,478 | |

| Accounts Receivables | 28 | |

| Prepaid Insurance | 11,000 | |

| Land | 37,000 | |

| Pool Structure | 140,000 | |

| Accumulated Depreciation, Pool Structure | $715 | |

| Fan System | 14,045 | |

| Accumulated Depreciation, Fan System | 260 | |

| Sailboats | 38,790 | |

| Accumulated Depreciation, Sailboats | 900 | |

| Accounts Payable | 7,210 | |

| Wages Payable | 810 | |

| Mortgage Payable | 155,603 | |

| RC, Capital | 97,843 | |

| $263,341 | $263,341 | |

Table (57)

Want to see more full solutions like this?

Chapter 5 Solutions

College Accounting (Book Only): A Career Approach

Additional Business Textbook Solutions

Accounting Information Systems (14th Edition)

Essentials of MIS (13th Edition)

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

Principles of Operations Management: Sustainability and Supply Chain Management (10th Edition)

Financial Accounting, Student Value Edition (5th Edition)

Engineering Economy (17th Edition)

- Regal Properties (RP) just acquired land and a building for a single sum of $500,000. An independent appraisal determined the fair values of the assets (if purchased separately) at $350,000 for the land and $250,000 for the building. Prepare the journal entry in table format to record the purchase of the land and building. Need answerarrow_forwardProvide Right answerarrow_forwardgeneral accountingarrow_forward

- expert of account answerarrow_forwardRJ Industries purchased a tract of land for use as a factory site. The purchase price was $850000. RJ also incurred the following costs: Cost to raze an old warehouse ($75000), legal fees related to the purchase contract ($12000), and proceeds from the sale of salvaged materials ($9000). What amount should be reported as the cost of the land? Helparrow_forwardBaltimore Manufacturing completes job #725, which has a standard of 720 labor hours at a standard rate of $20.50 per hour. The job was completed in 600 hours, and the average actual labor rate was $21.80 per hour. What is the labor efficiency (quantity) variance? (A negative number indicates a favorable variance and a positive number indicates an unfavorable variance.)arrow_forward

- hello teacher please solve questionsarrow_forwardLarkspur Manufacturing Company observed that, during its busiest month of 2022, maintenance costs totaled $18,500, resulting from the production of 40,000 units. During its slowest month, $13,000 in maintenance costs were incurred, resulting from the production of 25,000 units. Use the high-low method to estimate the maintenance cost that the company will incur if it produces 30,000 units. (Calculation in 2 decimal)arrow_forwardWhat is the cost of the land?arrow_forward

- hi expert please help mearrow_forwardA company purchased a high-speed industrial centrifuge at a cost of $370,000. Shipping costs totaled $12,000. Foundation work to house the centrifuge cost $7,400. An additional water line had to be run to the equipment at a cost of $3,300. Labor and testing costs totaled $6,300. Materials used up in testing cost $3,800. The capitalized cost is?arrow_forwardIf the liabilities of a business increased RM60,000 during a period of time and the owner's equity in the business decreased RM20,000 during the same period, the assets of the business must have:arrow_forward

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Pkg Acc Infor Systems MS VISIO CDFinanceISBN:9781133935940Author:Ulric J. GelinasPublisher:CENGAGE L

Pkg Acc Infor Systems MS VISIO CDFinanceISBN:9781133935940Author:Ulric J. GelinasPublisher:CENGAGE L