Concept explainers

First-stage allocation, time-driven activity-based costing, service sector. LawnCare USA provides lawn care and landscaping services to commercial clients. LawnCare USA uses activity-based costing to bid on jobs and to evaluate their profitability. LawnCare USA reports the following budgeted annual costs:

| Wages and salaries | $360,000 |

| 72,000 | |

| Supplies | 120,000 |

| Other |

288,000 |

| Total overhead costs | $840,000 |

John Gilroy, controller of LawnCare USA, has established four activity cost pools and the following budgeted activity for each cost pool:

| Activity Cost Pool | Activity Measure | Total Activity for the Year |

| Estimating jobs | Number of job estimates | 250 estimates |

| Lawn care | Number of direct labor-hours | 10,000 direct labor-hours |

| Landscape design | Number of design hours | 500 design hours |

| Other | Facility-sustaining costs that are not allocated to jobs | Not applicable |

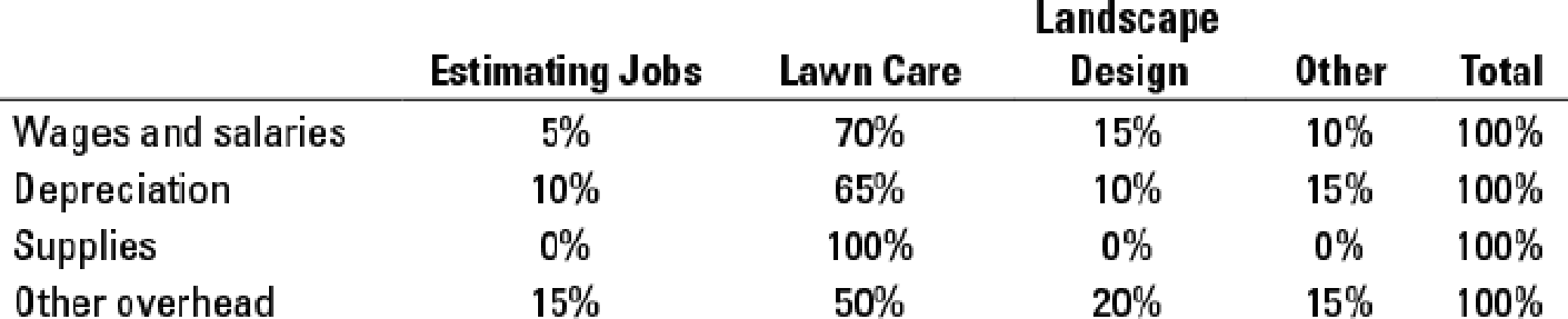

Gilroy estimates that LawnCare USA’s costs are distributed to the activity-cost pools as follows:

Sunset Office Park, a new development in a nearby community, has contacted LawnCare USA to provide an estimate on landscape design and annual lawn maintenance. The job is estimated to require a single landscape design requiring 40 design hours in total and 250 direct labor-hours annually. LawnCare USA has a policy of pricing estimates at 150% of cost.

- 1. Allocate LawnCare USA’s costs to the activity-cost pools and determine the activity rate for each pool.

Required

- 2. Estimate total cost for the Sunset Office Park job. How much would LawnCare USA bid to perform the job?

- 3. LawnCare USA does 30 landscape designs for its customers each year. Estimate the total cost for the Sunset Office park job if LawnCare USA allocated costs of the Landscape Design activity based on the number of landscape designs rather than the number of landscape design-hours. How much would LawnCare USA bid to perform the job? Which cost driver do you prefer for the Landscape Design activity? Why?

- 4. Sunset Office Park asks LawnCare USA to give an estimate for providing its services for a 2-year period. What are the advantages and disadvantages for LawnCare USA to provide a 2-year estimate?

Learn your wayIncludes step-by-step video

Chapter 5 Solutions

Horngren's Cost Accounting, Student Value Edition (16th Edition)

Additional Business Textbook Solutions

Financial Accounting, Student Value Edition (5th Edition)

Principles of Operations Management: Sustainability and Supply Chain Management (10th Edition)

Essentials of Corporate Finance (Mcgraw-hill/Irwin Series in Finance, Insurance, and Real Estate)

Corporate Finance (4th Edition) (Pearson Series in Finance) - Standalone book

Intermediate Accounting (2nd Edition)

Business Essentials (12th Edition) (What's New in Intro to Business)

- Q.No.05arrow_forwardFinancial Accountingarrow_forward2.7.12 - Sai Company manufactures and sells a single product. The company's total sales are $150,000 and they sell their product at $30 per unit. Their total fixed expenses are $13,500 and their total operating income is $16,500. How many units were sold? Answerarrow_forward

- 5 pointsarrow_forwardSeaside Manufacturing Inc. estimated its manufacturing overhead costs for 2023 to be $450,000, based on 150,000 estimated machine hours. The actual machine hours for 2023 were 160,000. The manufacturing overhead account contains debit entries totaling $465,000. Determine whether the manufacturing overhead for 2023 was overallocated or underallocated. (Round your immediate calculations to one decimal place.)arrow_forwardGeneral Accounting Questionarrow_forward

- Hi expert please give me answer general accounting questionarrow_forwardBabu Company completes job #928 which has a standard of 610 labor hours at a standard rate of $19.30 per hour. The job was completed in 590 hours and the average actual labor rate was $19.10 per hour. What is the labor rate variance? Don't Use Aiarrow_forwardWhat was the margin for the past year?arrow_forward

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning