Concept explainers

ABC, product costing at banks, cross-subsidization. United Savings Bank (USB) is examining the profitability of its Premier Account, a combined savings and checking account. Depositors receive a 2% annual interest rate on their average deposit. USB earns an interest rate spread of 3% (the difference between the rate at which it lends money and the rate it pays depositors) by lending money for home-loan purposes at 5%. Thus. USB would gain $60 on the interest spread if a depositor had an average Premier Account balance of $2,000 in 2017 ($2, 000 × 3% = $60).

The Premier Account allows depositors unlimited use of services such as deposits, withdrawals, checking accounts, and foreign currency drafts.

Depositors with Premier Account balances of $1,000 or more receive unlimited free use of services. Depositors with minimum balances of less than $1,000 pay a $22-a-month service fee for their Premier Account.

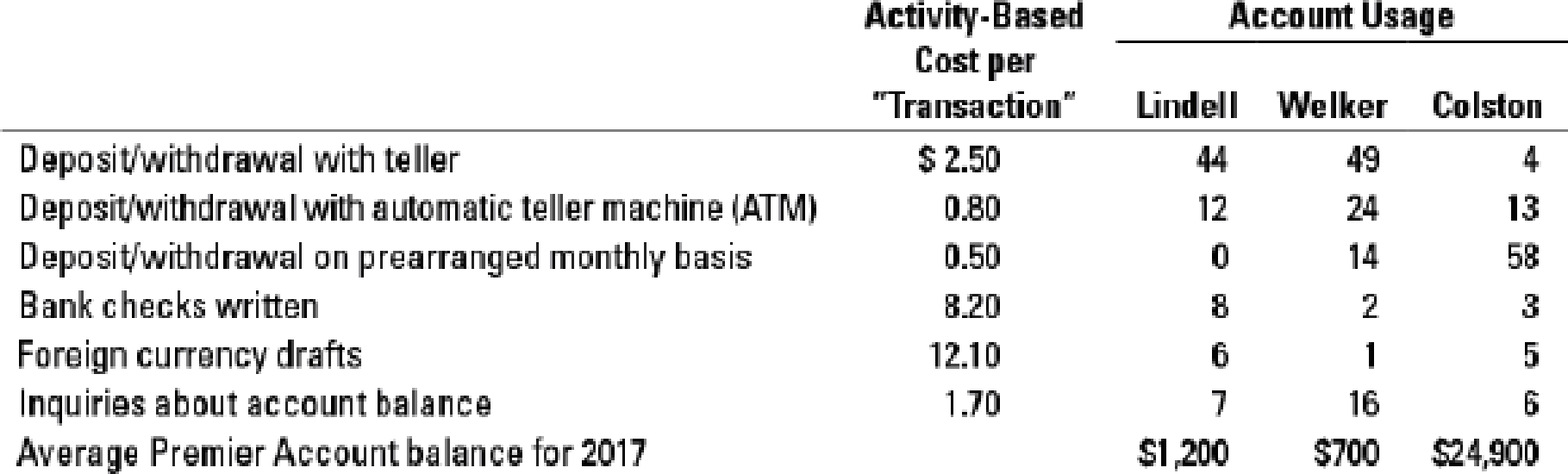

USB recently conducted an activity-based costing study of its services. It assessed the following costs for six individual services. The use of these services in 2017 by three customers is as follows:

Assume Lindell and Colston always maintain a balance above $1,000, whereas Welker always has a balance below $1,000.

- 1. Compute the 2017 profitability of the Lindell, Welker, and Colston Premier Accounts at USB.

Required

- 2. Why might USB worry about the profitability of Individual customers if the Premier Account product offering is profitable as a whole?

- 3. What changes would you recommend for USB’s Premier Account?

Want to see the full answer?

Check out a sample textbook solution

Chapter 5 Solutions

Horngren's Cost Accounting, Student Value Edition (16th Edition)

- The Tin company uses the straight-line method to depreciate its equipment. On May 1, 2018, the company purchased some equipment for $200,000. The equipment is estimated to have a useful life of ten years and a salvage value of $20,000. How much depreciation expense should Tin record for the equipment in the adjusting entry on December 31, 2018? Answerarrow_forwardFinancial Accounting Question please answerarrow_forwardPlease provide answerarrow_forward

- Explore the concept of accounting flexibility and its impact on the reliability and usefulness of financial information. While adaptability in accounting methods can allow organizations to better reflect their unique circumstances, it may also introduce the risk of selective application or manipulation. Discuss the appropriate balance between standardization and customization in accounting practices, and the safeguards that can be implemented to preserve the integrity of financial reporting.arrow_forwardColton Inc. is a merchandising company. Last month, the company's cost of goods sold was $85,600. The company's beginning merchandise inventory was $18,200, and its ending merchandise inventory was $30,500. What was the total amount of the company's merchandise purchases for the month? Answer this questionarrow_forwardCash receipts from accounts receivable collection in June?arrow_forward

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning