Concept explainers

First-stage allocation, time-driven activity-based

| Wages and salaries | $480,000 |

| 60,000 | |

| Rent | 120,000 |

| Other overhead | 240,000 |

| Total overhead costs | $900,000 |

Marshall has established four activity cost pools and the following budgeted activity for each cost pool:

| Activity Cost Pool | Activity Measure | Budgeted Total Activity for the Year |

| Direct manufacturing labor support | Number of direct manufacturing labor-hours | 30,000 direct manufacturing labor-hours |

| Order processing | Number of customer orders | 500 orders |

| Design support | Number of custom design-hours | 2,490 custom design-hours |

| Other | Facility-sustaining costs allocated to orders based on direct manufacturing labor-hours | 30,000 direct manufacturing labor-hours |

Some customer orders require more complex designs, while others need simple designs. Marshall estimates that it will do 120 complex designs during a year, which will each take 11.75 hours for a total of 1,410 design-hours. It estimates it will do 180 simple designs, which will each take 6 hours for a total of 1,080 design-hours.

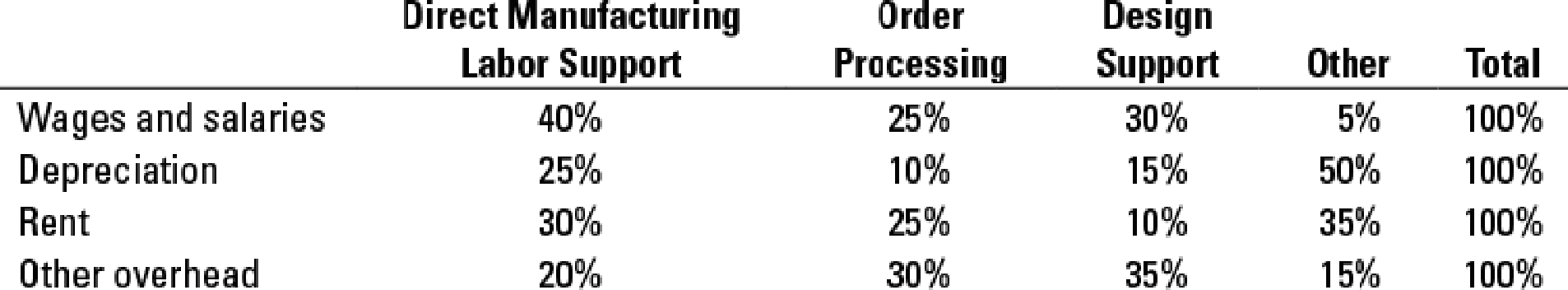

Paul Napoli, Marshall’s controller, has prepared the following estimates for distribution of the overhead costs across the four activity-cost pools:

Order 277100 consists of four different metal products. Three products require a complex design and one requires a simple design. Order 277100 requires $4,550 of direct materials and 80 direct manufacturing labor-hours

- 1. Allocate the overhead costs to each activity cost pool. Calculate the activity rate for each pool

Required

- 2. Determine the cost of Order 277100.

- 3. How does activity-based costing enhance Marshall’s ability to price its orders? Suppose Marshall used a simple costing system to allocate all overhead costs to orders on the basis of direct manufacturing labor-hours. How might this have affected Marshall’s pricing decision for Order 227100?

- 4. When designing its activity-based costing system. Marshall uses time-driven activity-based costing system (TDABC) for its design department. What does this approach allow Marshall to do? How would the cost of Order 277100 have been different if Marshall had used the number of customer designs rather than the number of custom design-hours to allocate costs to different customer orders? Which cost driver do you prefer for design support? Why?

Learn your wayIncludes step-by-step video

Chapter 5 Solutions

Horngren's Cost Accounting, Student Value Edition (16th Edition)

Additional Business Textbook Solutions

Operations Management

Fundamentals of Management (10th Edition)

Intermediate Accounting (2nd Edition)

Principles of Operations Management: Sustainability and Supply Chain Management (10th Edition)

FUNDAMENTALS OF CORPORATE FINANCE

- Amy is evaluating the cash flow consequences of organizing her business entity SHO as an LLC (taxed as a sole proprietorship), an S corporation, or a C corporation. She used the following assumptions to make her calculations: a) For all entity types, the business reports $22,000 of business income before deducting compensation paid to Amy and payroll taxes SHO pays on Amy's behalf. b) All entities use the cash method of accounting. c) If Amy organizes SHO as an S corporation or a C corporation, SHO will pay Amy a $5,000 annual salary (assume the salary is reasonable for purposes of this problem). For both the S and C corporations, Amy will pay 7.65 percent FICA tax on her salary and SHO will also pay 7.65 percent FICA tax on Amy's salary (the FICA tax paid by the entity is deductible by the entity). d) Amy's marginal ordinary income tax rate is 35 percent, and her income tax rate on qualified dividends and net capital gains is 15 percent. e) Amy's marginal self-employment tax rate is…arrow_forwardInformation pertaining to Noskey Corporation’s sales revenue follows: November 20X1 (Actual) December 20X1 (Budgeted) January 20X2 (Budgeted)Cash sales $ 115,000 $ 121,000 $ 74,000Credit sales 282,000 409,000 208,000Total sales $ 397,000 $ 530,000 $ 282,000Management estimates 5% of credit sales to be uncollectible. Of collectible credit sales, 60% is collected in the month of sale and the remainder in the month following the month of sale. Purchases of inventory each month include 70% of the next month’s projected total sales (stated at cost) plus 30% of projected sales for the current month (stated at cost). All inventory purchases are on account; 25% is paid in the month of purchase, and the remainder is paid in…arrow_forwardMirror Image Distribution Company expects its September sales to be 20% higher than its August sales of $163,000. Purchases were $113,000 in August and are expected to be $133,000 in September. All sales are on credit and are expected to be collected as follows: 40% in the month of the sale and 60% in the following month. Purchases are paid 20% in the month of purchase and 80% in the following month. The cash balance on September 1 is $23,000. The ending cash balance on September 30 is estimated to be:arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College