Concept explainers

Complete five-step procedure and journalize result (Learning Objectives 3 &4)

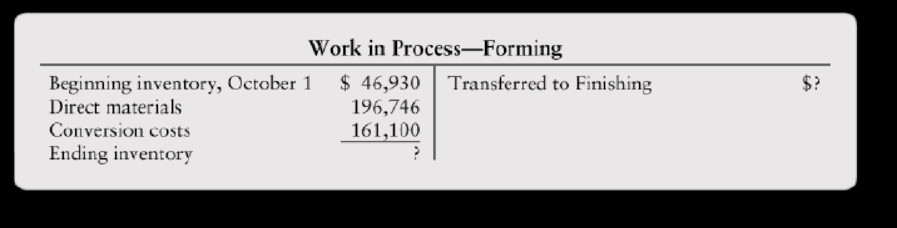

The following information was taken from the ledger of Cleveland Foundry:

5.2-37 Full Alternative Text

The Forming Department had 10,150 partially complete units in beginning work in process inventory. The department started work on 71,050 units during the month and ended the month with 8,200 units still in work in process. These unfinished units were 60% complete as to direct materials but 20% complete as to conversion work. The beginning balance of $46,930 consisted of $21,430 of direct materials and $25,500 of conversion costs.

Requirement

Journalize the transfer of costs to the Finishing Department. (Hint: Complete the five-step

Want to see the full answer?

Check out a sample textbook solution

Chapter 5 Solutions

Managerial Accounting (5th Edition)

- Please explain the solution to this general accounting problem using the correct accounting principles.arrow_forwardI need guidance with this general accounting problem using the right accounting principles.arrow_forwardPlease help me solve this financial accounting problem with the correct financial process.arrow_forward

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning