Financial and Managerial Accounting - Workingpapers

15th Edition

ISBN: 9781337912112

Author: WARREN

Publisher: CENGAGE L

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 5, Problem 32E

Closing entries

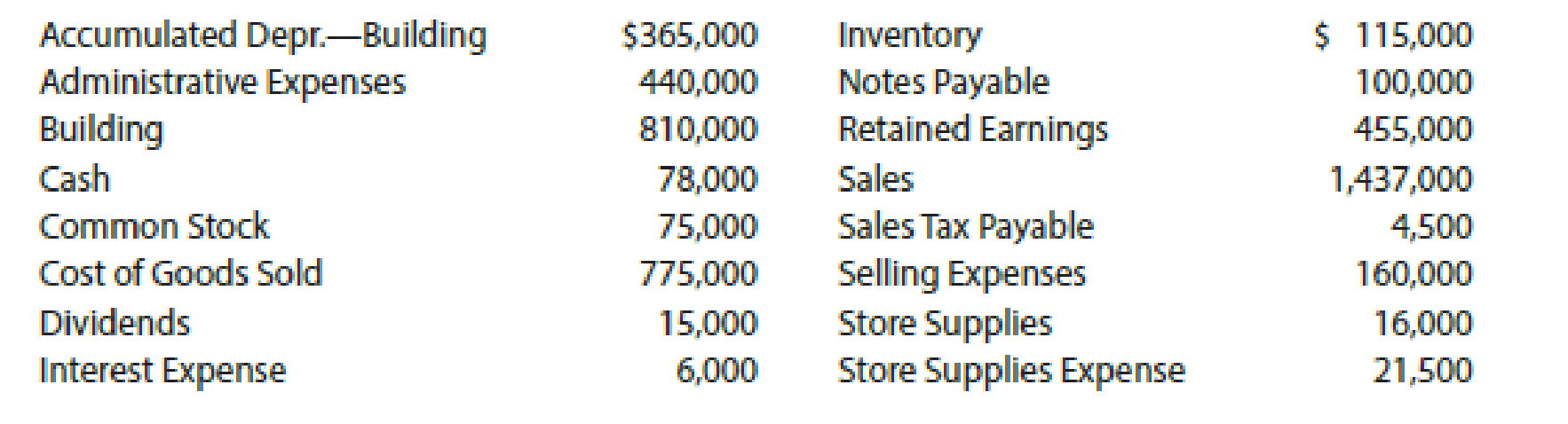

On July 31, the close of the fiscal year, the balances of the accounts appearing in the ledger of Serbian Interiors Company, a furniture retailer, are as follows:

Prepare the July 31 closing entries for Serbian Interiors Company.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

None

answer

general accounting

Chapter 5 Solutions

Financial and Managerial Accounting - Workingpapers

Ch. 5 - Prob. 1DQCh. 5 - Can a business earn a gross profit but incur a net...Ch. 5 - The credit period during which the buyer of...Ch. 5 - What is the meaning of (A) 1/15, n/60; (B) n/30;...Ch. 5 - How are sales to customers using MasterCard and...Ch. 5 - What is the nature of (A) a credit memo issued by...Ch. 5 - Who is responsible for freight when the terms of...Ch. 5 - Name three accounts that would normally appear in...Ch. 5 - Audio Outfitter Inc., which uses a perpetual...Ch. 5 - Assume that Audio Outfitter Inc. in Discussion...

Ch. 5 - Gross profit During the current year, merchandise...Ch. 5 - Purchases transactions Elkhorn Company purchased...Ch. 5 - Prob. 3BECh. 5 - Freight terms Determine the amount to be paid in...Ch. 5 - Transactions for buyer and seller Shore Co. sold...Ch. 5 - Adjusting entries Hahn Flooring Company uses a...Ch. 5 - Asset turnover ratio Financial statement data for...Ch. 5 - Determining gross profit During the current year,...Ch. 5 - Determining cost of goods sold For a recent year,...Ch. 5 - Chart of accounts Monet Paints Co. is a newly...Ch. 5 - Purchase-related transactions The Stationery...Ch. 5 - Purchase-related transactions A retailer is...Ch. 5 - Purchase-related transactions The debits and...Ch. 5 - Prob. 7ECh. 5 - Purchase-related transactions Journalize entries...Ch. 5 - Sales-related transactions, including the use of...Ch. 5 - Customer refund Senger Company sold merchandise of...Ch. 5 - Prob. 11ECh. 5 - Prob. 12ECh. 5 - Sales-related transactions The debits and credits...Ch. 5 - Prob. 14ECh. 5 - Determining amounts to be paid on invoices...Ch. 5 - Sales-related transactions Showcase Co., a...Ch. 5 - Purchase-related transactions Based on the data...Ch. 5 - Prob. 18ECh. 5 - Prob. 19ECh. 5 - Normal balances of accounts for retail business...Ch. 5 - Income statement and accounts for retail business...Ch. 5 - Adjusting entry for inventory shrinkage Omega Tire...Ch. 5 - Adjusting entry for customer refunds, allowances,...Ch. 5 - Adjusting entry for customer refunds, allowances,...Ch. 5 - Income statement for retail business The following...Ch. 5 - Determining amounts for items omitted from income...Ch. 5 - Multiple-step income statement On March 31, 20Y9,...Ch. 5 - Multiple-step income statement The following...Ch. 5 - Single-step income statement Summary operating...Ch. 5 - Closing the accounts of a retail business From the...Ch. 5 - Closing entries; net income Based on the data...Ch. 5 - Closing entries On July 31, the close of the...Ch. 5 - Prob. 33ECh. 5 - Prob. 34ECh. 5 - Appendix 1 Adjusting entry for gross method The...Ch. 5 - Appendix 1 Discount taken in next fiscal year...Ch. 5 - Prob. 37ECh. 5 - Rules of debit and credit for periodic inventory...Ch. 5 - Journal entries using the periodic inventory...Ch. 5 - Identify items missing in determining cost of...Ch. 5 - Cost of goods sold and related items The following...Ch. 5 - Cost of goods sold Based on the following data,...Ch. 5 - Cost of goods sold Based on the following data,...Ch. 5 - Appendix 2 Cost of goods sold Identify the errors...Ch. 5 - Closing entries using periodic inventory system...Ch. 5 - Purchase-related transactions using perpetual...Ch. 5 - Sales-related transactions using perpetual...Ch. 5 - Sales and purchase-related transactions using...Ch. 5 - A Sales and purchase-related transactions for...Ch. 5 - Multiple-step income statement and balance sheet...Ch. 5 - Single-step income statement and balance sheet...Ch. 5 - Appendix 2 Purchase-related transactions using...Ch. 5 - Sales and purchase-related transactions using...Ch. 5 - Appendix 2 PR 5-9A Sales and purchase-related...Ch. 5 - 2. Net income, 185,000 Appendix 2 PR 5-10A...Ch. 5 - Purchase-related transactions using perpetual...Ch. 5 - Sales-related transactions using perpetual...Ch. 5 - Sales and purchase-related transactions using...Ch. 5 - Sales and purchase-related transactions for seller...Ch. 5 - Multiple-step income statement and balance sheet...Ch. 5 - Single-step income Statement and balance sheet...Ch. 5 - Purchase-related transactions using periodic...Ch. 5 - Sales and purchase-related transactions using...Ch. 5 - Appendix 2 Sales and purchase-related transactions...Ch. 5 - Appendix 2 PR 5-10B Periodic inventory accounts,...Ch. 5 - Palisade Creek Co. is a retail business that uses...Ch. 5 - Analyze and compare Amazon.com and Netflix...Ch. 5 - Analyze Dollar General Dollar General Corporation...Ch. 5 - Compare Dollar Tree and Dollar General The asset...Ch. 5 - Analyze and compare CSX, Union Pacific, and YRC...Ch. 5 - Analyze Home Depot The Home Depot (HD) reported...Ch. 5 - Analyze and compare Kroger and Tiffany The Kroger...Ch. 5 - Prob. 7MADCh. 5 - Ethics in Action Margie Johnson is a staff...Ch. 5 - Prob. 2TIFCh. 5 - Prob. 5TIFCh. 5 - Prob. 6TIFCh. 5 - Prob. 7TIF

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Provide correct optionarrow_forwardJohn was a civil servant with the Trinidad & Tobago (T&T) Government for over 30 years and retired 5 years ago. He is in receipt of a monthly pension. John also received a lump sum on retirement and invested part of this in a small retail business in downtown San Fernando. He retails designer clothing and perfumes and manages to make a modest profit, after deduction of business expenses. John invested the remainder of his pension lump sum in the Unit Trust Corporation of Trinidad and Tobago and is in receipt of monthly dividends. John receives a monthly pension of $6,000. The retail business has a financial year- end of 31 December and in the fiscal year 2011 he made a taxable profit of $100,000. In the fiscal year 2011 in T&T there is a personal allowance of $60,000 and the rate of Income tax is 25%. John no longer qualifies for any of the other deductions available to individuals and receives his pension after deduction of tax under the P.A.Y.E. system. In 2011, John…arrow_forwardHi expert please give me answer general accounting questionarrow_forward

- Calculate the total revenuearrow_forwardhow much is net income?arrow_forwardPLEASE HELP. ALL THE BOXES THAT ARE OUTLINED IN RED ARE INCORRECT/FORMATTED WRONG. PLS DO NOT JUST GIVE ME THE SAME ANSWERS SOMETHING IS WRONG. LOOK AT THE IMAGE AND SEE MY PREVIOUS attempt, AND GO OFF THAT PLS BECAUSE THIS IS MY FINAL ATTEMPTarrow_forward

- Please help. all boxes that are red either are formatted wrong or have the wrong inputs. please do not give me the same answers in the photo as obviously they're red/wrong.arrow_forwardThe gross profit percentage would be closest to:arrow_forwardneed correct answer of this general accountingarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY