Financial and Managerial Accounting - Workingpapers

15th Edition

ISBN: 9781337912112

Author: WARREN

Publisher: CENGAGE L

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 5, Problem 6MAD

Analyze and compare Kroger and Tiffany

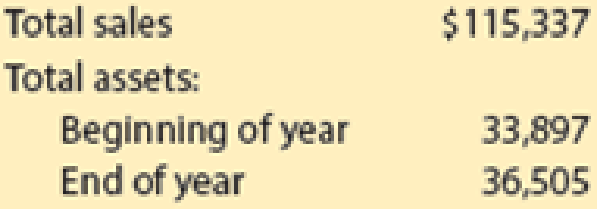

The Kroger Company (KR), a national supermarket chain, reported the following data (in millions) in its financial statements for a recent year:

a. Compute the asset turnover ratio. Round to two decimal places.

b. Tiffany & Co. (TIF) is a large North American retailer of jewelry. Tiffany’s asset turnover ratio is 0.78. Why would Tiffany’s asset turnover ratio be lower than that of Kroger?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

none

Tutor please provide answer

Wellness medical group has total equity of solve this problem general Accounting

Chapter 5 Solutions

Financial and Managerial Accounting - Workingpapers

Ch. 5 - Prob. 1DQCh. 5 - Can a business earn a gross profit but incur a net...Ch. 5 - The credit period during which the buyer of...Ch. 5 - What is the meaning of (A) 1/15, n/60; (B) n/30;...Ch. 5 - How are sales to customers using MasterCard and...Ch. 5 - What is the nature of (A) a credit memo issued by...Ch. 5 - Who is responsible for freight when the terms of...Ch. 5 - Name three accounts that would normally appear in...Ch. 5 - Audio Outfitter Inc., which uses a perpetual...Ch. 5 - Assume that Audio Outfitter Inc. in Discussion...

Ch. 5 - Gross profit During the current year, merchandise...Ch. 5 - Purchases transactions Elkhorn Company purchased...Ch. 5 - Prob. 3BECh. 5 - Freight terms Determine the amount to be paid in...Ch. 5 - Transactions for buyer and seller Shore Co. sold...Ch. 5 - Adjusting entries Hahn Flooring Company uses a...Ch. 5 - Asset turnover ratio Financial statement data for...Ch. 5 - Determining gross profit During the current year,...Ch. 5 - Determining cost of goods sold For a recent year,...Ch. 5 - Chart of accounts Monet Paints Co. is a newly...Ch. 5 - Purchase-related transactions The Stationery...Ch. 5 - Purchase-related transactions A retailer is...Ch. 5 - Purchase-related transactions The debits and...Ch. 5 - Prob. 7ECh. 5 - Purchase-related transactions Journalize entries...Ch. 5 - Sales-related transactions, including the use of...Ch. 5 - Customer refund Senger Company sold merchandise of...Ch. 5 - Prob. 11ECh. 5 - Prob. 12ECh. 5 - Sales-related transactions The debits and credits...Ch. 5 - Prob. 14ECh. 5 - Determining amounts to be paid on invoices...Ch. 5 - Sales-related transactions Showcase Co., a...Ch. 5 - Purchase-related transactions Based on the data...Ch. 5 - Prob. 18ECh. 5 - Prob. 19ECh. 5 - Normal balances of accounts for retail business...Ch. 5 - Income statement and accounts for retail business...Ch. 5 - Adjusting entry for inventory shrinkage Omega Tire...Ch. 5 - Adjusting entry for customer refunds, allowances,...Ch. 5 - Adjusting entry for customer refunds, allowances,...Ch. 5 - Income statement for retail business The following...Ch. 5 - Determining amounts for items omitted from income...Ch. 5 - Multiple-step income statement On March 31, 20Y9,...Ch. 5 - Multiple-step income statement The following...Ch. 5 - Single-step income statement Summary operating...Ch. 5 - Closing the accounts of a retail business From the...Ch. 5 - Closing entries; net income Based on the data...Ch. 5 - Closing entries On July 31, the close of the...Ch. 5 - Prob. 33ECh. 5 - Prob. 34ECh. 5 - Appendix 1 Adjusting entry for gross method The...Ch. 5 - Appendix 1 Discount taken in next fiscal year...Ch. 5 - Prob. 37ECh. 5 - Rules of debit and credit for periodic inventory...Ch. 5 - Journal entries using the periodic inventory...Ch. 5 - Identify items missing in determining cost of...Ch. 5 - Cost of goods sold and related items The following...Ch. 5 - Cost of goods sold Based on the following data,...Ch. 5 - Cost of goods sold Based on the following data,...Ch. 5 - Appendix 2 Cost of goods sold Identify the errors...Ch. 5 - Closing entries using periodic inventory system...Ch. 5 - Purchase-related transactions using perpetual...Ch. 5 - Sales-related transactions using perpetual...Ch. 5 - Sales and purchase-related transactions using...Ch. 5 - A Sales and purchase-related transactions for...Ch. 5 - Multiple-step income statement and balance sheet...Ch. 5 - Single-step income statement and balance sheet...Ch. 5 - Appendix 2 Purchase-related transactions using...Ch. 5 - Sales and purchase-related transactions using...Ch. 5 - Appendix 2 PR 5-9A Sales and purchase-related...Ch. 5 - 2. Net income, 185,000 Appendix 2 PR 5-10A...Ch. 5 - Purchase-related transactions using perpetual...Ch. 5 - Sales-related transactions using perpetual...Ch. 5 - Sales and purchase-related transactions using...Ch. 5 - Sales and purchase-related transactions for seller...Ch. 5 - Multiple-step income statement and balance sheet...Ch. 5 - Single-step income Statement and balance sheet...Ch. 5 - Purchase-related transactions using periodic...Ch. 5 - Sales and purchase-related transactions using...Ch. 5 - Appendix 2 Sales and purchase-related transactions...Ch. 5 - Appendix 2 PR 5-10B Periodic inventory accounts,...Ch. 5 - Palisade Creek Co. is a retail business that uses...Ch. 5 - Analyze and compare Amazon.com and Netflix...Ch. 5 - Analyze Dollar General Dollar General Corporation...Ch. 5 - Compare Dollar Tree and Dollar General The asset...Ch. 5 - Analyze and compare CSX, Union Pacific, and YRC...Ch. 5 - Analyze Home Depot The Home Depot (HD) reported...Ch. 5 - Analyze and compare Kroger and Tiffany The Kroger...Ch. 5 - Prob. 7MADCh. 5 - Ethics in Action Margie Johnson is a staff...Ch. 5 - Prob. 2TIFCh. 5 - Prob. 5TIFCh. 5 - Prob. 6TIFCh. 5 - Prob. 7TIF

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Financial ratio analysis; Author: The Finance Storyteller;https://www.youtube.com/watch?v=MTq7HuvoGck;License: Standard Youtube License