The Effect of Adjustments

Assume you are the accountant for Austin Industries. Ellis Austin, the owner of the company, is in a hurry to receive the financial statements for the year ended December 31, 2019, and asks you how soon they will be ready. You tell him you have just completed the

If the income statement were prepared using trial balance amounts, the net income would be $95,560. A review of the company's records reveals the following information:

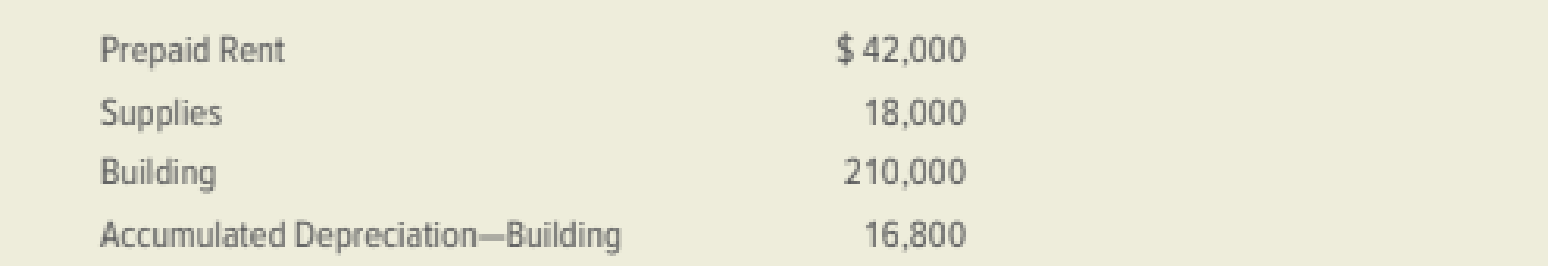

- 1. Rent of $42,000 was paid on July 1, 2019, for 12 months.

- 2. Purchases of supplies during the year totaled $8,000. An inventory of supplies taken at year-end showed supplies on hand of $2,720.

- 3. The building was purchased three years ago and has an estimated life of 30 years.

- 4. No adjustments have been made to any of the accounts during the year.

Write a memo to Mr. Austin explaining the effect on the financial statements of omitting the adjustments. Indicate the change to net income that results from the adjusting entries.

Want to see the full answer?

Check out a sample textbook solution

Chapter 5 Solutions

COLLEGE ACCOUNTING ETEXT+CONNECT ACCESS

- hello teacher please solve questions general accountingarrow_forwardCampbell Soup Company reported pension expense of $94 million and contributed $81.5 million to the pension fund. Prepare Campbell's journal entry to record pension expense and funding, assuming campbell has no OCI amounts.arrow_forwardProvide accounting questionarrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning