Concept explainers

1.

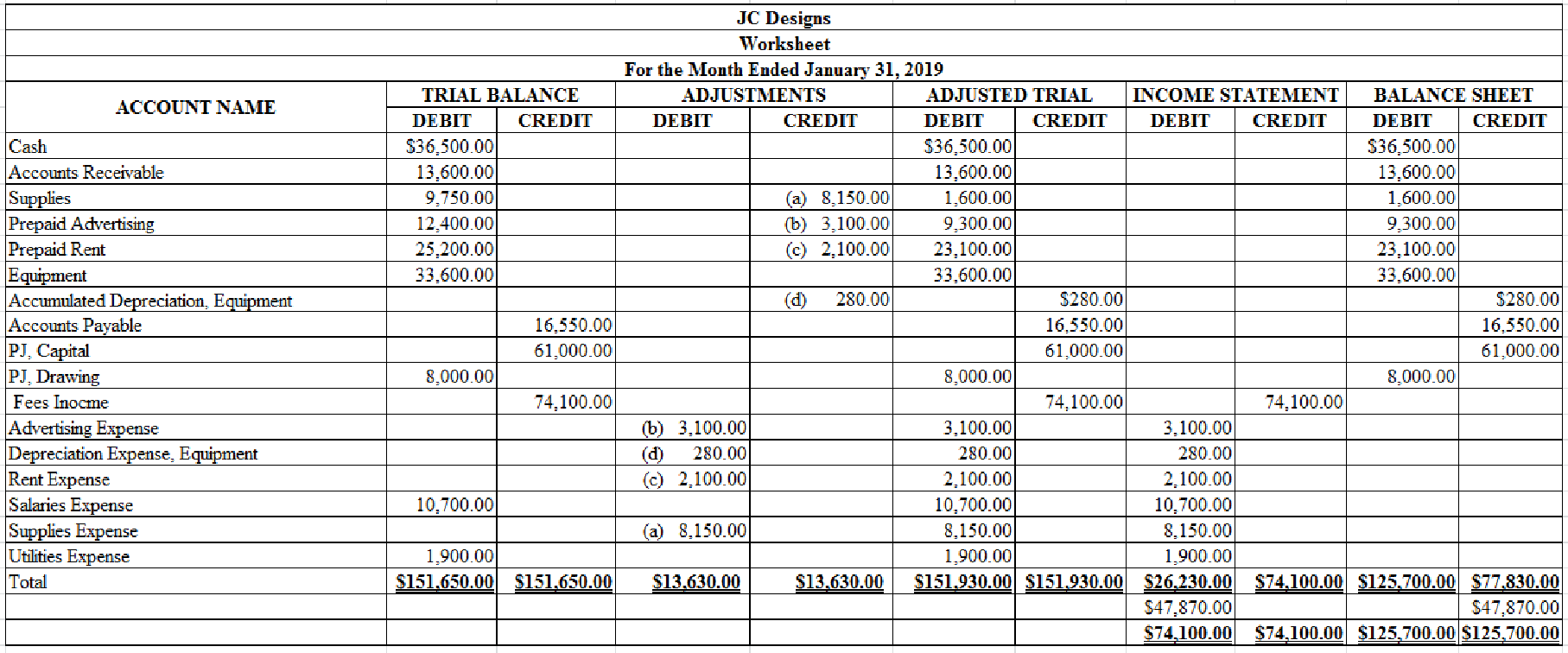

Complete the worksheet for JC Designs for the month ended January 31, 2019.

1.

Explanation of Solution

Worksheet: Worksheet is an accounting tool that helps accountants to record adjustments and up-date balances required to prepare financial statements. Worksheet is a central place where

Complete the worksheet for JC Designs for the month ended January 31, 2019.

Table (1)

2.

Prepare income statement, statement of owners’ equity, and balance sheet JC Designs for the month of January, 2019.

2.

Explanation of Solution

Income statement: The financial statement which reports revenues and expenses from business operation and the result of those operations as net income or net loss for a particular time period is referred to as income statement.

Prepare an income statement for JC Designs for the month ended January 31, 2019.

| JC Designs | ||

| Income Statement | ||

| For the Month Ended January 31, 2019 | ||

| Revenues: | ||

| Fees Income | 74,100 | |

| Expenses: | ||

| Advertising Expense | $3,100 | |

| | 280 | |

| Rent Expense | 2,100 | |

| Salaries Expense | 10,700 | |

| Supplies Expense | 8,150 | |

| Utilities Expense | 1,900 | |

| Total expenses | 26,230 | |

| Net income | $47,870 | |

Table (2)

Statement of owners’ equity: This statement reports the beginning owner’s equity and all the changes which led to ending owners’ equity. Additional capital, net income from income statement is added to, and drawings are deducted from beginning owner’s equity to arrive at the end result, ending owner’s equity.

Prepare a statement for JC Designs for the month ended January 31, 2019.

| JC Designs | ||

| Statement of Owners’ Equity | ||

| For the Month Ended January 31, 2019 | ||

| PJ, Capital, January 1, 2019 | $61,000 | |

| Net income for January | 47,870 | |

| Less: Withdrawals for January | 8,000 | |

| Increase in capital | 39,870 | |

| PJ, Capital, January 31, 2019 | $100,870 | |

Table (3)

Balance sheet: This financial statement reports a company’s resources (assets) and claims of creditors (liabilities) and owners (owners’ equity) over those resources. The resources of the company are assets which include money contributed by owners and creditors. Hence, the main elements of the balance sheet are assets, liabilities, and owners’ equity.

Prepare the balance sheet JC Designs as at January 31, 2019.

| JC Designs | ||

| Balance Sheet | ||

| January 31, 2019 | ||

| Assets | ||

| Cash | $36,500 | |

| Accounts Receivable | 13,600 | |

| Supplies | 1,600 | |

| Prepaid Advertising | 9,300 | |

| Prepaid Rent | 23,100 | |

| Equipment | $33,600 | |

| Less: | 280 | 33,320 |

| Total Assets | $117,420 | |

| Liabilities and owner’s equity | ||

| Liabilities | ||

| Accounts Payable | 16,550 | |

| Owners’ Equity | ||

| PJ, Capital | 100,870 | |

| Total Liabilities and Owners’ Equity | $117,420 | |

Table (4)

3.

Prepare adjusting entry and

3.

Explanation of Solution

Debit and credit rules:

- Debit an increase in asset account, increase in expense account, decrease in liability account, and decrease in stockholders’ equity accounts.

- Credit decrease in asset account, increase in revenue account, increase in liability account, and increase in stockholders’ equity accounts.

Prepare adjusting entry for supplies.

| GENERAL JOURNAL | Page 3 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| January 31, 2019 | Supplies expense | 517 | 8,150 | |

| Supplies | 121 | 8,150 | ||

| (to record supplies used) | ||||

Table (5)

Description:

- Supplies Expense is an expense account. Since expenses decrease equity, equity value is decreased, and a decrease in equity is debited.

- Supplies is an asset account. Since amount of supplies is used, asset account decreased, and a decrease in asset is credited.

Prepare adjusting entry for advertising expense:

| GENERAL JOURNAL | Page 3 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| January 31, 2019 | Advertising expense | 519 | 3,100 | |

| Prepaid Advertising | 130 | 3,100 | ||

| (to record part of prepaid advertising expired) | ||||

Table (6)

Description:

- Advertising Expense is an expense account. Since expenses decrease equity, equity value is decreased, and a decrease in equity is debited.

- Prepaid Advertising is an asset account. Since amount of advertising is expired, asset account decreased, and a decrease in asset is credited.

Prepare adjusting entry for rent expense:

| GENERAL JOURNAL | Page 3 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| January 31, 2019 | Rent expense | 520 | 2,100 | |

| Prepaid Rent | 131 | 2,100 | ||

| (to record part of prepaid rent expired) | ||||

Table (7)

Description:

- Rent Expense is an expense account. Since expenses decrease equity, equity value is decreased, and a decrease in equity is debited.

- Prepaid Rent is an asset account. Since amount of rent is expired, asset account decreased, and a decrease in asset is credited.

Prepare adjusting entry for depreciation expense-equipment:

| GENERAL JOURNAL | Page 3 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| January 31, 2019 | Depreciation expense-Equipment | 523 | 280 | |

| Accumulated depreciation-Equipment | 142 | 280 | ||

| (to record depreciation expense) | ||||

Table (8)

Description:

- Depreciation Expense, Equipment is an expense account. Since expenses decrease equity, equity value is decreased, and a decrease in equity is debited.

- Accumulated Depreciation, Equipment is a contra-asset account, and contra-asset accounts would have a normal credit balance, hence, the account is credited.

Post the above transactions in the general ledger.

| ACCOUNT Supplies ACCOUNT NO. 121 | |||||||

| Date | Description | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| January | 1 | Balance | 9,750 | 9,750 | |||

| 31 | Adjusting | 3 | 8,150 | 1,600 | |||

Table (9)

| ACCOUNT Prepaid Advertising ACCOUNT NO. 130 | |||||||

| Date | Description | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| January | 1 | Balance | 12,400 | 12,400 | |||

| 31 | Adjusting | 3 | 3,100 | 9,300 | |||

Table (10)

| ACCOUNT Prepaid Rent ACCOUNT NO. 131 | |||||||

| Date | Description | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| January | 1 | Balance | 25,200 | 25,200 | |||

| 31 | Adjusting | 3 | 2,100 | 23,100 | |||

Table (11)

| ACCOUNT Accumulated Depreciation - Equipment ACCOUNT NO. 142 | |||||||

| Date | Description | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| January | 1 | Balance | 0 | 0 | |||

| 31 | Adjusting | 3 | 280 | 280 | |||

Table (12)

| ACCOUNT Supplies Expense ACCOUNT NO. 517 | |||||||

| Date | Description | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| January | 1 | Balance | 0 | 0 | |||

| 31 | Adjusting | 3 | 8,150 | 8,150 | |||

Table (13)

| ACCOUNT Advertising Expense ACCOUNT NO. 519 | |||||||

| Date | Description | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| January | 1 | Balance | 0 | 0 | |||

| 31 | Adjusting | 3 | 3,100 | 3,100 | |||

Table (14)

| ACCOUNT Rent Expense ACCOUNT NO. 520 | |||||||

| Date | Description | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| January | 1 | Balance | 0 | 0 | |||

| 31 | Adjusting | 3 | 2,100 | 2,100 | |||

Table (15)

| ACCOUNT Depreciation Expense - Equipment ACCOUNT NO. 523 | |||||||

| Date | Description | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| January | 1 | Balance | 0 | 0 | |||

| 31 | Adjusting | 3 | 280 | 280 | |||

Table (16)

Analyze: If the adjusting entries are not made for the month, the net income would be overstated.

Want to see more full solutions like this?

Chapter 5 Solutions

COLLEGE ACCOUNTING ETEXT+CONNECT ACCESS

- 82. What role does assurance boundary definition play in attestation? a) Standard limits work always b) Boundaries never matter c) All areas need equal coverage d) Engagement scope limits determine verification responsibilitiesarrow_forwardCould you help me solve this financial accounting question using appropriate calculation techniques?arrow_forwardGiven solution for General accounting question not use aiarrow_forward

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage