Concept explainers

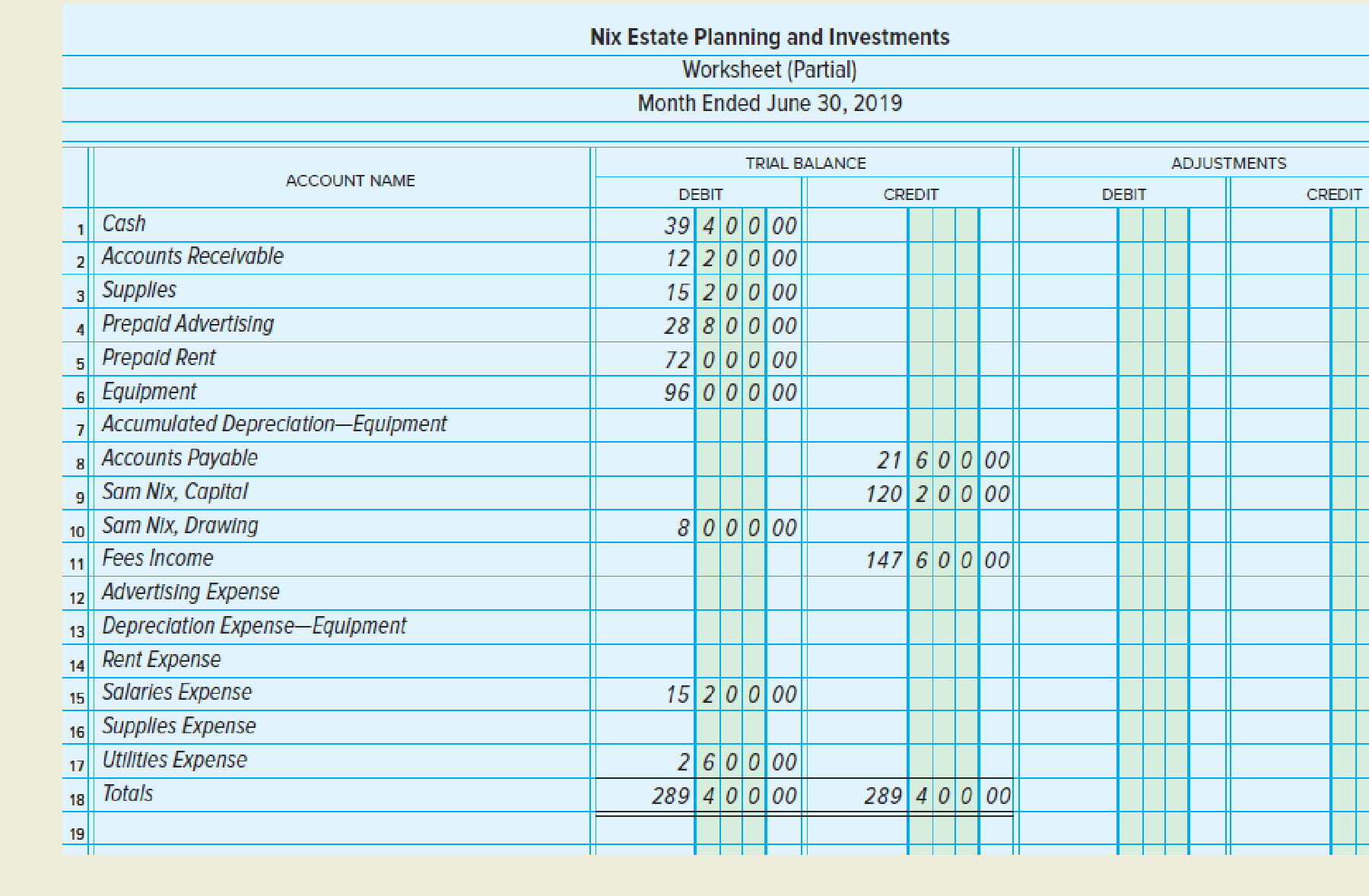

Sam Nix owns Nix Estate Planning and Investments. The

INSTRUCTIONS

- 1. Complete the worksheet for the month.

- 2. Prepare an income statement, statement of owner’s equity, and

balance sheet . No additional investments were made by the owner during the month. - 3. Journalize and

post the adjusting entries. Use 3 for the journal page number. Use the account numbers provided in Problem 5.4A.

End-of-month adjustments must account for the following:

- a. The supplies were purchased on June 1, 2019; inventory of supplies on June 30, 2019, showed a value of $6,000.

- b. The prepaid advertising contract was signed on June 1, 2019, and covers a four-month period.

- c. Rent of $6,000 expired during the month.

- d.

Depreciation is computed using the straight-line method. The equipment has an estimated useful life of five years with no salvage value.

Analyze: Why are the costs that reduce the value of equipment not directly posted to the asset account Equipment?

1.

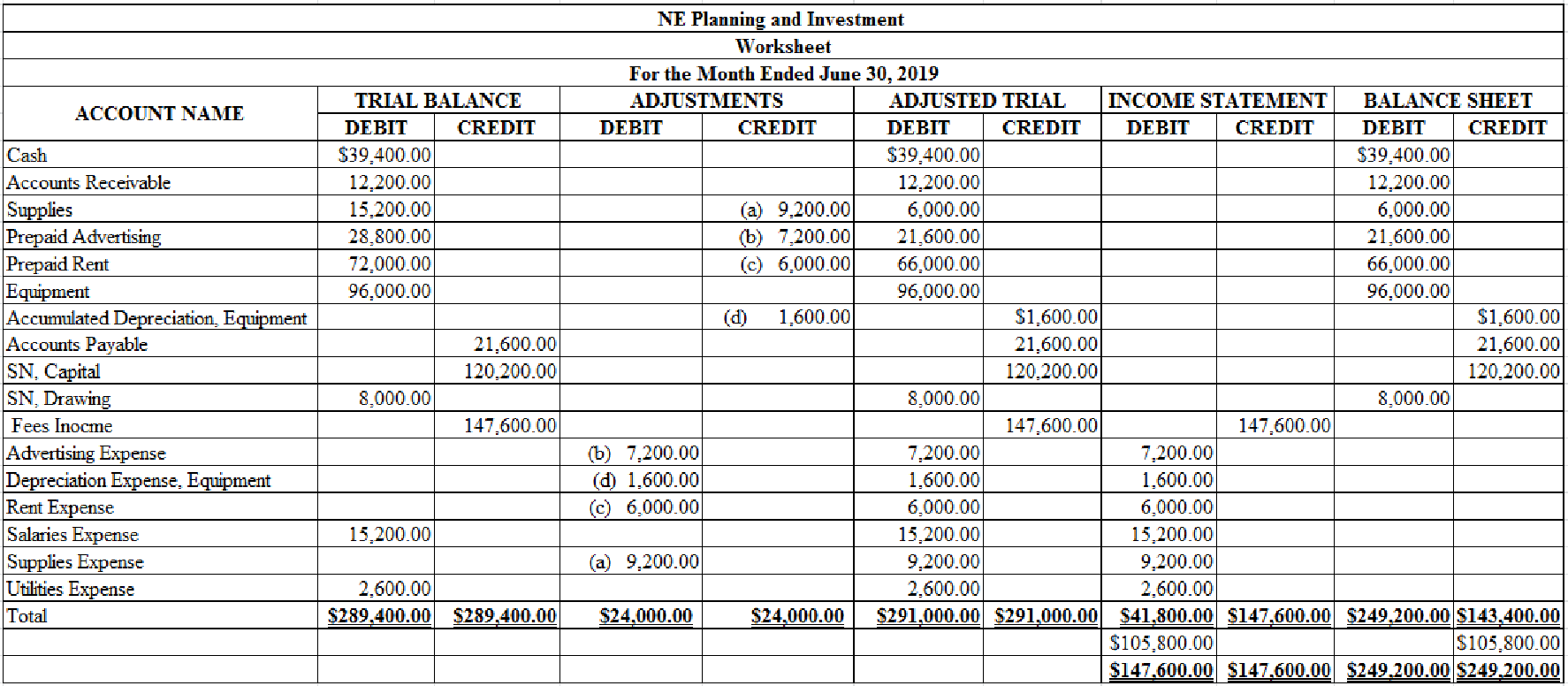

Complete the worksheet for NE Planning and Investment for the month ended June 30, 2019.

Explanation of Solution

Worksheet: Worksheet is an accounting tool that helps accountants to record adjustments and up-date balances required to prepare financial statements. Worksheet is a central place where trial balance, adjustments, adjusted trial balance, income statement, and balance sheet are presented.

Complete the worksheet for NE Planning and Investment for the month ended June 30, 2019.

Table (1)

2.

Prepare income statement, statement of owners’ equity, and balance sheet NE Planning and Investment for the month of June 30, 2019.

Explanation of Solution

Income statement: The financial statement which reports revenues and expenses from business operation and the result of those operations as net income or net loss for a particular time period is referred to as income statement.

Prepare an income statement for NE Planning and Investment for the month ended June 30, 2019.

| NE Planning and Investment | ||

| Income Statement | ||

| For the Month Ended June 30, 2019 | ||

| Revenues: | ||

| Fees Income | 147,600 | |

| Expenses: | ||

| Advertising Expense | $7,200 | |

| Depreciation Expense, Equipment | 1,600 | |

| Rent Expense | 6,000 | |

| Salaries Expense | 15,200 | |

| Supplies Expense | 9,200 | |

| Utilities Expense | 2,600 | |

| Total expenses | 41,800 | |

| Net income | $105,800 | |

Table (2)

Statement of owners’ equity: This statement reports the beginning owner’s equity and all the changes which led to ending owners’ equity. Additional capital, net income from income statement is added to, and drawings are deducted from beginning owner’s equity to arrive at the end result, ending owner’s equity.

Prepare a statement for NE Planning and Investment for the month ended June 30, 2019.

| NE Planning and Investment | ||

| Statement of Owners’ Equity | ||

| For the Month Ended June 30, 2019 | ||

| SN, Capital, June 1, 2019 | $120,200 | |

| Net income for January | 105,800 | |

| Less: Withdrawals for January | 8,000 | |

| Increase in capital | 97,800 | |

| SN, Capital, June 30, 2019 | $218,000 | |

Table (3)

Balance sheet: This financial statement reports a company’s resources (assets) and claims of creditors (liabilities) and owners (owners’ equity) over those resources. The resources of the company are assets which include money contributed by owners and creditors. Hence, the main elements of the balance sheet are assets, liabilities, and owners’ equity.

Prepare the balance sheet NE Planning and Investment as at June 30, 2019.

| NE Planning and Investment | ||

| Balance Sheet | ||

| June 30, 2019 | ||

| Assets | ||

| Cash | $39,400 | |

| Accounts Receivable | 12,200 | |

| Supplies | 6,000 | |

| Prepaid Advertising | 21,600 | |

| Prepaid Rent | 66,000 | |

| Equipment | $96,000 | |

| Less: Accumulated Depreciation | 1,600 | 94,400 |

| Total Assets | $239,600 | |

| Liabilities and owner’s equity | ||

| Liabilities | ||

| Accounts Payable | 21,600 | |

| Owners’ Equity | ||

| SN, Capital | 218,000 | |

| Total Liabilities and Owners’ Equity | $239,600 | |

Table (4)

3.

Prepare adjusting entry and post the transactions in general ledger.

Explanation of Solution

Adjusting entries: Adjusting entries are those entries which are recorded at the end of the year, to update the income statement accounts (revenue and expenses) and balance sheet accounts (assets, liabilities, and owners’ or stockholders’ equity) to maintain the records according to accrual basis principle and matching concept.

Journal entry: Journal entry is a set of economic events which can be measured in monetary terms. These are recorded chronologically and systematically.

Debit and credit rules:

- Debit an increase in asset account, increase in expense account, decrease in liability account, and decrease in stockholders’ equity accounts.

- Credit decrease in asset account, increase in revenue account, increase in liability account, and increase in stockholders’ equity accounts.

Prepare adjusting entry for supplies.

| GENERAL JOURNAL | Page 3 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| January 31, 2019 | Supplies expense | 517 | 9,200 | |

| Supplies | 121 | 9,200 | ||

| (to record supplies used) | ||||

Table (5)

Description:

- Supplies Expense is an expense account. Since expenses decrease equity, equity value is decreased, and a decrease in equity is debited.

- Supplies is an asset account. Since amount of supplies is used, asset account decreased, and a decrease in asset is credited.

Prepare adjusting entry for advertising expense:

| GENERAL JOURNAL | Page 3 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| January 31, 2019 | Advertising expense | 519 | 7,200 | |

| Prepaid Advertising | 130 | 7,200 | ||

| (to record part of prepaid advertising expired) | ||||

Table (6)

Description:

- Advertising Expense is an expense account. Since expenses decrease equity, equity value is decreased, and a decrease in equity is debited.

- Prepaid Advertising is an asset account. Since amount of advertising is expired, asset account decreased, and a decrease in asset is credited.

Prepare adjusting entry for rent expense:

| GENERAL JOURNAL | Page 3 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| January 31, 2019 | Rent expense | 520 | 6,000 | |

| Prepaid Rent | 131 | 6,000 | ||

| (to record part of prepaid rent expired) | ||||

Table (7)

Description:

- Rent Expense is an expense account. Since expenses decrease equity, equity value is decreased, and a decrease in equity is debited.

- Prepaid Rent is an asset account. Since amount of rent is expired, asset account decreased, and a decrease in asset is credited.

Prepare adjusting entry for depreciation expense-equipment:

| GENERAL JOURNAL | Page 3 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| January 31, 2019 | Depreciation expense-Equipment | 523 | 1,600 | |

| Accumulated depreciation-Equipment | 142 | 1,600 | ||

| (to record depreciation expense) | ||||

Table (8)

Description:

- Depreciation Expense, Equipment is an expense account. Since expenses decrease equity, equity value is decreased, and a decrease in equity is debited.

- Accumulated Depreciation, Equipment is a contra-asset account, and contra-asset accounts would have a normal credit balance, hence, the account is credited.

Post the above transactions in the general ledger.

| ACCOUNT Supplies ACCOUNT NO. 121 | |||||||

| Date | Description | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| January | 1 | Balance | 15,200 | 15,200 | |||

| 31 | Adjusting | 3 | 9,200 | 6,000 | |||

Table (9)

| ACCOUNT Prepaid Advertising ACCOUNT NO. 130 | |||||||

| Date | Description | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| January | 1 | Balance | 28,800 | 28,800 | |||

| 31 | Adjusting | 3 | 7,200 | 21,600 | |||

Table (10)

| ACCOUNT Prepaid Rent ACCOUNT NO. 131 | |||||||

| Date | Description | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| January | 1 | Balance | 72,000 | 72,000 | |||

| 31 | Adjusting | 3 | 6,000 | 66,000 | |||

Table (11)

| ACCOUNT Accumulated Depreciation - Equipment ACCOUNT NO. 142 | |||||||

| Date | Description | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| January | 1 | Balance | 0 | 0 | |||

| 31 | Adjusting | 3 | 1,600 | 1,600 | |||

Table (12)

| ACCOUNT Supplies Expense ACCOUNT NO. 517 | |||||||

| Date | Description | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| January | 1 | Balance | 0 | 0 | |||

| 31 | Adjusting | 3 | 9,200 | 9,200 | |||

Table (13)

| ACCOUNT Advertising Expense ACCOUNT NO. 519 | |||||||

| Date | Description | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| January | 1 | Balance | 0 | 0 | |||

| 31 | Adjusting | 3 | 7,200 | 7,200 | |||

Table (14)

| ACCOUNT Rent Expense ACCOUNT NO. 520 | |||||||

| Date | Description | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| January | 1 | Balance | 0 | 0 | |||

| 31 | Adjusting | 3 | 6,000 | 6,000 | |||

Table (15)

| ACCOUNT Depreciation Expense - Equipment ACCOUNT NO. 523 | |||||||

| Date | Description | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| January | 1 | Balance | 0 | 0 | |||

| 31 | Adjusting | 3 | 1,600 | 1,600 | |||

Table (16)

Analyze: The costs that reduce the value of the equipment is called as depreciation costs. Depreciation cost is not directly posted to the asset account; it is recorded separately as contra asset account. This is because as per GAAP (Generally Accepted Accounting Principle) the asset (equipment) is recorded at its original cost in the asset account until it is disposed.

Want to see more full solutions like this?

Chapter 5 Solutions

COLLEGE ACCOUNTING ETEXT+CONNECT ACCESS

- Provide answerarrow_forwardanswer ?? : General accounting questionarrow_forwardA truck costing $280,000 has a salvage value of $20,000 and a useful life of 8 years. The truck is expected to drive 600,000 miles during its lifetime. In year 1, it was driven 50,000 miles, and in year 2, it was driven 45,000 miles. Using the units of activity (units of production) method, compute the depreciation expense in year 2.arrow_forward

- Verano, Inc. provides the following financial data for 2023: • • Credit sales during the year: $4,500,000 . Accounts receivable (December 31, 2023): $410,000 Allowance for bad debts (December 31, 2023): $45,000 Bad debt expense for the year: $25,000 Required: What amount will Verano, Inc. report as the net realizable value (NRV) of accounts receivable on its year- end balance sheet?arrow_forwardHi expert please give me answer general accounting questionarrow_forwardWhat is the cost of goods soldarrow_forward

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub