Introduction To Managerial Accounting

8th Edition

ISBN: 9781259917066

Author: BREWER, Peter C., Garrison, Ray H., Noreen, Eric W.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 4, Problem 7F15

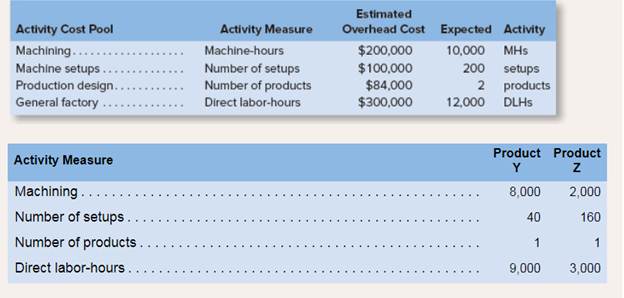

Greenvood Company manufactures two products−14,000 units of Product Y and 6,000 units of

Product Z. The company uses a plantwide

Implementing an activity-based costing (ABC) system that allocates all of its manufacturing overhead to four cost pools. The following additional information is available for the company as a whole and for

Products Y and Z:

Which of the four activities is a batch-level activity? Why?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Please help me with this question general Accounting

Correct option? ?

Help

Chapter 4 Solutions

Introduction To Managerial Accounting

Ch. 4 - What are the three common approaches for assigning...Ch. 4 - Why does activity-based costing appeal to some...Ch. 4 - Why do departmental overheadrates something result...Ch. 4 - What are the four hierarchical levels of activity...Ch. 4 - Why activity-based costing is described as a...Ch. 4 - Why do overhead costs often shift from high-volume...Ch. 4 - What are the three major ways in which...Ch. 4 - What are the major limitations of activity-based...Ch. 4 - Prob. 1AECh. 4 - Prob. 2AE

Ch. 4 - Change the data in red so that the Data area looks...Ch. 4 - Prob. 1F15Ch. 4 - Prob. 2F15Ch. 4 - Prob. 3F15Ch. 4 - Greenvood Company manufactures two products14,000...Ch. 4 - Prob. 5F15Ch. 4 - Prob. 6F15Ch. 4 - Greenvood Company manufactures two products14,000...Ch. 4 - Prob. 8F15Ch. 4 - Greenwood Company manufactures two products14,000...Ch. 4 - Prob. 10F15Ch. 4 - Prob. 11F15Ch. 4 - Greenwood Company manufactures two products14,000...Ch. 4 - Prob. 13F15Ch. 4 - Prob. 14F15Ch. 4 - Greenwood Company manufactures two products14,000...Ch. 4 - ABC Cost Hierarchy L041 The following activities...Ch. 4 - Compute Activity Rates L042 Rustafson Corporation...Ch. 4 - Compute ABC Product Costs L043 Lamer Corporation...Ch. 4 - Contrast ABC and Conventional Product Costs L044...Ch. 4 - Assigning Overhead to Products in ABC L042, L043...Ch. 4 - Cost Hierarchy and Activity Measures L041 Various...Ch. 4 - Contrast ABC and Conventional Product Costs L042,...Ch. 4 - Prob. 8ECh. 4 - Prob. 9ECh. 4 - Rocky Mountain Corporation makes two types of...Ch. 4 - Contrasting Activity-Based Costing and...Ch. 4 - Contrasting ABC and Conventional Product cost...Ch. 4 - ABC Cost Hierarchy L041 Mitchell Corporation...Ch. 4 - Prob. 14PCh. 4 - Prob. 15PCh. 4 - Contrasting ABC and Conventional Product Costs...Ch. 4 - Contrast Activity-Based Costing and Conventional...Ch. 4 - Adria Company recently implemented an...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Don't use ai given answer accounting questionsarrow_forwardThe profit Willarrow_forwardABC is an all-equity firm that has 44,200 shares of stock outstanding at a market price of $14.70 per share. The firm is considering a capital structure with 53% debt at a rate of 5% and use the proceeds to repurchase shares. Determine the shares outstanding once the debt is issued. Hii tutor give me Answerarrow_forward

- ABC is an all-equity firm that has 44,200 shares of stock outstanding at a market price of $14.70 per share. The firm is considering a capital structure with 53% debt at a rate of 5% and use the proceeds to repurchase shares. Determine the shares outstanding once the debt is issued. I want answerarrow_forwardAt the beginning of the yeararrow_forwardHii ticher please given correct answer general Accountingarrow_forward

- ABC is an all-equity firm that has 44,200 shares of stock outstanding at a market price of $14.70 per share. The firm is considering a capital structure with 53% debt at a rate of 5% and use the proceeds to repurchase shares. Determine the shares outstanding once the debt is issued. Financial Accounting problemarrow_forwardGeneral Accountarrow_forwardExpress the answer with 3 decimal placesarrow_forward

- ABC is an all-equity firm that has 44,200 shares of stock outstanding at a market price of $14.70 per share. The firm is considering a capital structure with 53% debt at a rate of 5% and use the proceeds to repurchase shares. Determine the shares outstanding once the debt is issued. General Accounting problemarrow_forwardABC is an all-equity firm that has 44,200 shares of stock outstanding at a market price of $14.70 per share. The firm is considering a capital structure with 53% debt at a rate of 5% and use the proceeds to repurchase shares. Determine the shares outstanding once the debt is issued.arrow_forwardWhat is the total manufacturing costsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

What is variance analysis?; Author: Corporate finance institute;https://www.youtube.com/watch?v=SMTa1lZu7Qw;License: Standard YouTube License, CC-BY