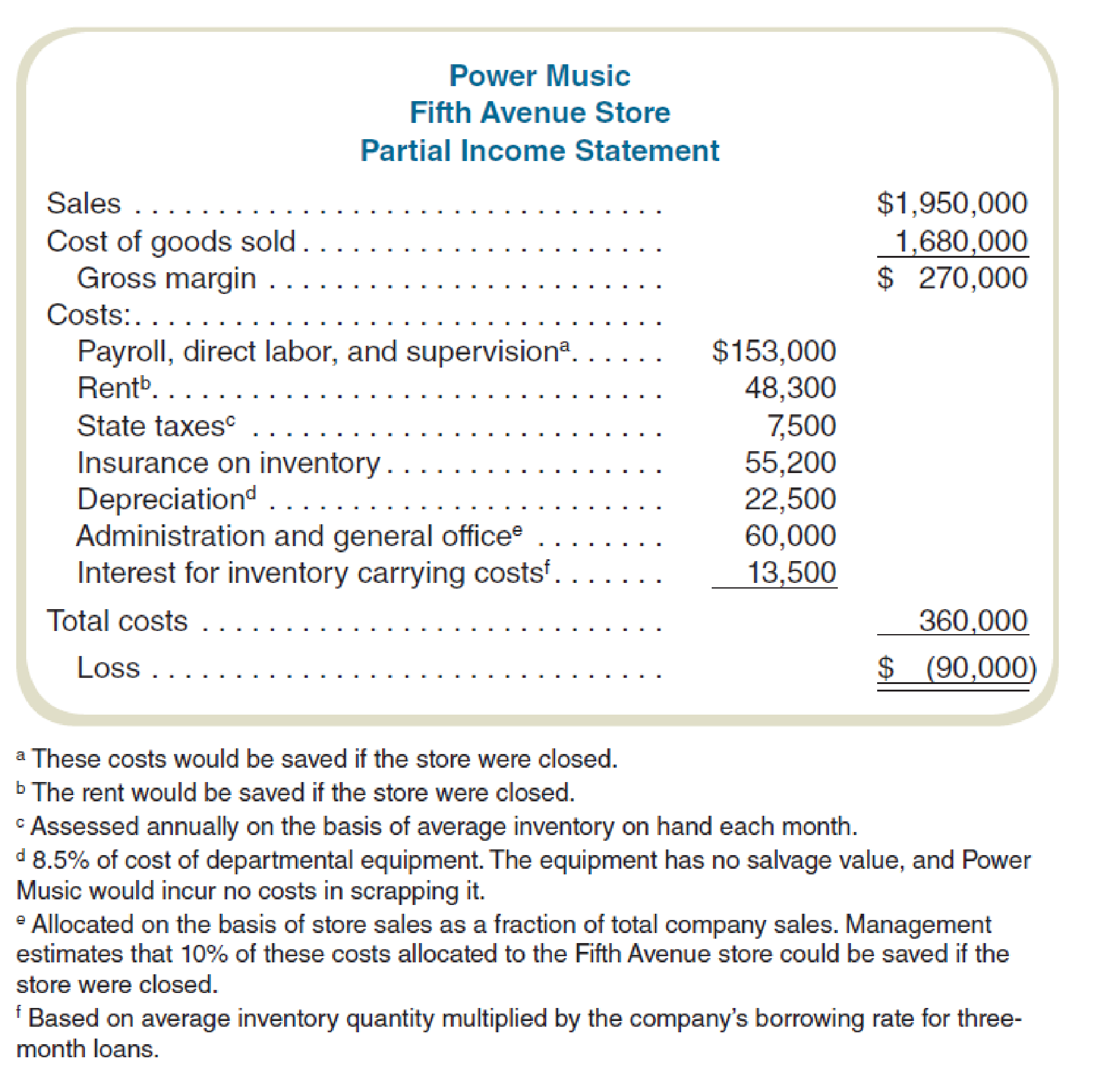

Power Music owns five music stores, where it sells music, instruments, and supplies. In addition, it rents instruments. At the end of last year, the new accounts showed that although the business as a whole was profitable, the Fifth Avenue store had shown a substantial loss. The income statement for the Fifth Avenue store for last month follows:

Analysis of these results has led management to consider closing the Fifth Avenue store. Members of the management team agree that keeping the Fifth Avenue store open is not essential to maintaining good customer relations and supporting the rest of the company’s business. In other words, eliminating the Fifth Avenue store is not expected to affect the amount of business done by the other stores.

Required

What action do you recommend to Power Music’s management? Write a short report to management recommending whether or not to close the Fifth Avenue store. Include the reasons for your recommendation.

Want to see the full answer?

Check out a sample textbook solution

Chapter 4 Solutions

COST ACCOUNTING W/CONNECT

- What cost does cosmo manufacturing record for the new machine?arrow_forwardFinancial Accounting 5.8: Firm X and Firm Y have debt-total asset ratios of 40% and 30% and returns on total assets of 9% and 11%, respectively. What is the return on equity for Firm X and Firm Y?arrow_forwardI need this question answer general Accounting questionarrow_forward

- Bella's Florist purchased a delivery truck for $25,000. The company was given a $3,000 cash discount by the dealer and paid $1,200 sales tax. Annual insurance on the truck is $600. As a result of the purchase, by how much will Bella's Florist increase its truck account?arrow_forwardcompute the cash conversion cycle for both years.arrow_forwardAnswer? ? Financial accounting questionarrow_forward

- Financial Accounting 5.8: Firm X and Firm Y have debt-total asset ratios of 40% and 30% and returns on total assets of 9% and 11%, respectively. What is the return on equity for Firm X and Firm Y? Want answerarrow_forwardBella's Florist purchased a delivery truck for $25,000. The company was given a $3,000 cash discount by the dealer and paid $1,200 sales tax. Annual insurance on the truck is $600. As a result of the purchase, by how much will Bella's Florist increase its truck account? Answerarrow_forwardHii ticher given true answer general Accounting questionarrow_forward

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning