Make or Buy

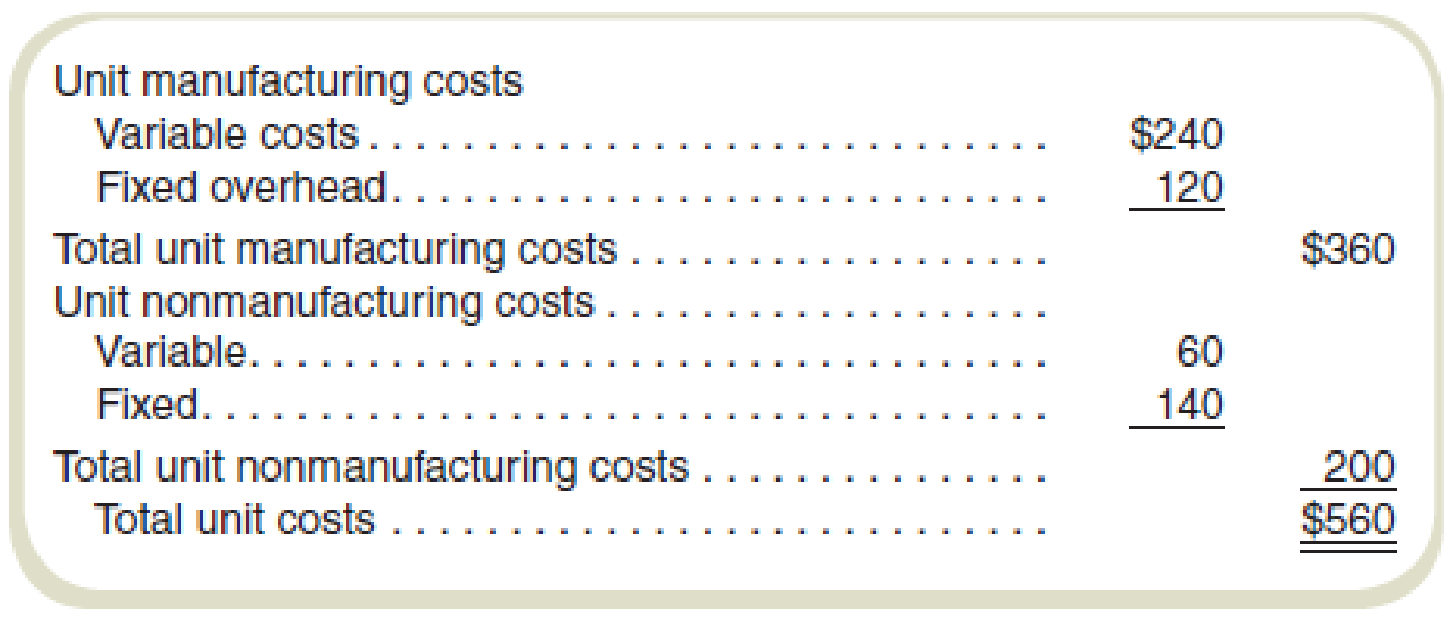

King City Specialty Bikes (KCSB) produces high-end bicycles. The costs to manufacture and market the bicycles at the company’s volume of 2,000 units per month are shown in the following table:

The company has the capacity to produce 2,000 units per month and always operates at full capacity. The bicycles sell for $600 per unit.

Required

- a. KCSB receives a proposal from an outside contractor who will assemble 800 of the 2,000 bicycles per month and ship them directly to KCSB’s customers as orders are received from KCSB’s sales force. KCSB would provide the materials for each bicycle, but the outside contractor would assemble, box, and ship the bicycles. The variable

manufacturing costs would be reduced by 40 percent for the 800 bicycles assembled by the outside contractor. KCSB’s fixed nonmanufacturing costs would be unaffected, but its variable nonmanufacturing costs would be cut by 60 percent for these 800 units produced by the outside contractor. KCSB’s plant would operate at 60 percent of its normal level, and total fixed manufacturing costs would be cut by 20 percent. What in-house unit cost should be compared with the quotation received from the outside contractor? Should the proposal be accepted for a price (that is, payment to the contractor) of $140 per unit? - b. Assume the same facts as in requirement (a) but assume that the idle facilities would be used to produce 80 specialty racing bicycles per month. These racing bicycles could be sold for $8,000 each, while the costs of production would be $5,600 per unit variable manufacturing cost. Variable marketing costs would be $200 per unit. Fixed nonmanufacturing and manufacturing costs would be unchanged whether the original 2,000 regular bicycles were manufactured or the mix of 1,200 regular bicycles plus 80 racing bicycles was produced. Considering this opportunity to use the freed-up space, what is the maximum purchase price per unit that KCSB should be willing to pay the outside contractor to assemble regular bicycles? Should the contractor’s proposal of $140 per unit be accepted?

a.

Calculate the in-house unit cost that should be compared with the quotation received from the outside contractor. Recommend Company K whether it should accept the offer or not.

Answer to Problem 58P

The cost that should be compared with the supplier’s proposal is $192. Yes, Company K should accept the offer.

Explanation of Solution

Acceptance of the offer:

An offer should be accepted when the profit after accepting the offer will increase the profitability of the company. An offer should be accepted in the scenario when the cost of the product is reduced after accepting the offer.

Calculate the cost that should be compared to the supplier’s proposal:

Thus, the cost that should be compared with the supplier’s proposal is $192.

Working note 1:

Calculate the cost of in-house production:

| Particulars |

Number of bicycles (a) |

Per unit cost (b) |

Total cost |

| Variable costs: | |||

| Manufacturing costs | 2,000 | $240 | $480,000 |

| Non-manufacturing costs | 2,000 | $60 | $120,000 |

| Total variable costs(a) | $300 | $600,000 | |

| Fixed costs: | |||

| Manufacturing costs | 2,000 | $120 | $240,000 |

| Non-manufacturing costs | 2,000 | $140 | $280,000 |

| Total fixed costs(b) | 2,000 | $260 | $520,000 |

| Total costs | $1,120,000 |

Table: (1)

Working note 2:

Calculate the cost of the contract:

| Particulars |

Number of bicycles (a) |

Per unit cost (b) |

Total cost |

| Variable costs: | |||

| In-house assembly | 1,200 | $300 | $360,000 |

| Outside contract | 800 | $168(3) | $134,400 |

| Total variable costs(a) | $468 | $494,400 | |

| Fixed costs: | |||

| Manufacturing costs (80% of $240,000) | $192,000 | ||

| Non-manufacturing costs | $280,000 | ||

| Total fixed costs(b) | $472,000 | ||

| Total costs | $966,400 |

Table: (2)

Working note 3:

Calculate the in-house assembly cost per unit:

Recommend Company K should accept the offer or not.

The total cost without accepting the offer is $1,120,000, and the total cost after accepting the offer is $966,400. Company K is saving $153,600

The supplier is offering a price of $14 per unit. The management of Company K should accept the offer because it is saving $192 and only paying $140 per unit.

Thus, Company K should accept the offer.

b.

Calculate the maximum amount that the Company K should pay to the outside contractor. Suggest whether the management should accept the offer not.

Answer to Problem 58P

Company K should accept the offer because the profit is increased by $169,600 when it accepts the offer.

Explanation of Solution

Acceptance of the offer:

An offer should be accepted when the profit after accepting the offer will increase the profitability of the company. An offer should be accepted in the scenario when the cost of the product is reduced after accepting the offer.

| Particulars |

Status quo (a) |

Alternate proposal: assemble 80 units (b) |

Difference |

| Revenue: | |||

| Regular bicycle (5) | $1,200,000 | $1,200,000 | No change |

| Racing bicycle (5) | $640,000 | $640,000 higher | |

| Total revenue(a) | $1,200,000 | $1,840,000 | $640,000 higher |

| Variable costs: | |||

| Regular cycle (variable costs) (4) | $600,000 | $494,400 | $105,600 lower |

| Racing bicycle (manufacturing)(4) | $112,000 | $112,000 higher | |

| Racing bicycle (marketing) (4) | $448,000 | $448,000 higher | |

| Supplier payment | $16,000 | $16,000 higher | |

| Total variable costs(b) | $600,000 | $1,070,400 | $470,400 higher |

| Fixed costs: | |||

| Total fixed costs [c] | $520,000 | $520,000 | No change |

| Total costs | $1,120,000 | $1,590,400 | $470,400 higher |

| Operating profit | $80,000 | $249,600 | $169,600 higher |

Table: (3)

Thus, Company K should accept the offer because the profit is increased by $169,600 when it accepts the offer.

Working note 4:

| Particulars |

Units (a) |

Cost per unit (b) |

Amount |

| Variable costs regular bicycle | $2,000 | $300 | $600,000 |

| Supplier payment | $800 | $140 | $112,000 |

| Racing bicycle (manufacturing) | $80 | $5,600 | $448,000 |

| Racing bicycle (marketing) | $80 | $200 | $16,000 |

Table: (4)

Working note 5:

Calculate the revenue:

| Particulars | Units | Price per unit | Amount |

| Regular cycle | 2000 | $600 | $1,200,000 |

| Racing cycle | 80 | $8,000 | $640,000 |

Table: (5)

Want to see more full solutions like this?

Chapter 4 Solutions

COST ACCOUNTING W/CONNECT

- Compute the tax liability of both companies on these financial accounting questionarrow_forwardRegal Properties (RP) just acquired land and a building for a single sum of $500,000. An independent appraisal determined the fair values of the assets (if purchased separately) at $350,000 for the land and $250,000 for the building. Prepare the journal entry in table format to record the purchase of the land and building.arrow_forwardYou work for a beverage company that sells coffee and tea. Your boss has asked you to help set up thecompany’s new database using Microsoft Access and then perform some queries in Access to determineinformation that your boss needs to give to the senior management. You are given a flat file(Beverage_Co_Sp25.xls) with the company’s sales information. When you open the file, you notice that it is notset up in efficient tables. You must create efficient tables in Excel before importing the data into MicrosoftAccess. Then, you need to run queries to gather the information your boss needs.Excel InstructionsYou will need to create 5 efficient tables from the one worksheet in the Excel file you have been given:Customers, Employees, Sales, Inventory, and SalesItems. You will need to determine which columns need to beincluded in each table and delete any duplicates and blank rows in the tables.Furthermore, once you have created the Sales table, make sure to change the name of the…arrow_forward

- Provide correct answer general accounting questionarrow_forwardMeric Mining Inc. recently reported $16,300 of sales, $7,900 in operating costs other than depreciation, and $1,600 in depreciation. The company had no amortization charges, it had outstanding $6,550 of bonds that carry a 6.50% interest rate, and its federal-plus-state income tax rate was 40%. How much was the firm's net income after taxes? Meric uses the same depreciation expense for tax and stockholder reporting purposes.arrow_forwardThe total cost to be accounted for under the weighted average method?arrow_forward

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning  Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning