COST ACCOUNTING W/CONNECT

6th Edition

ISBN: 9781264022021

Author: LANEN

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 4, Problem 50E

Dropping Product Lines

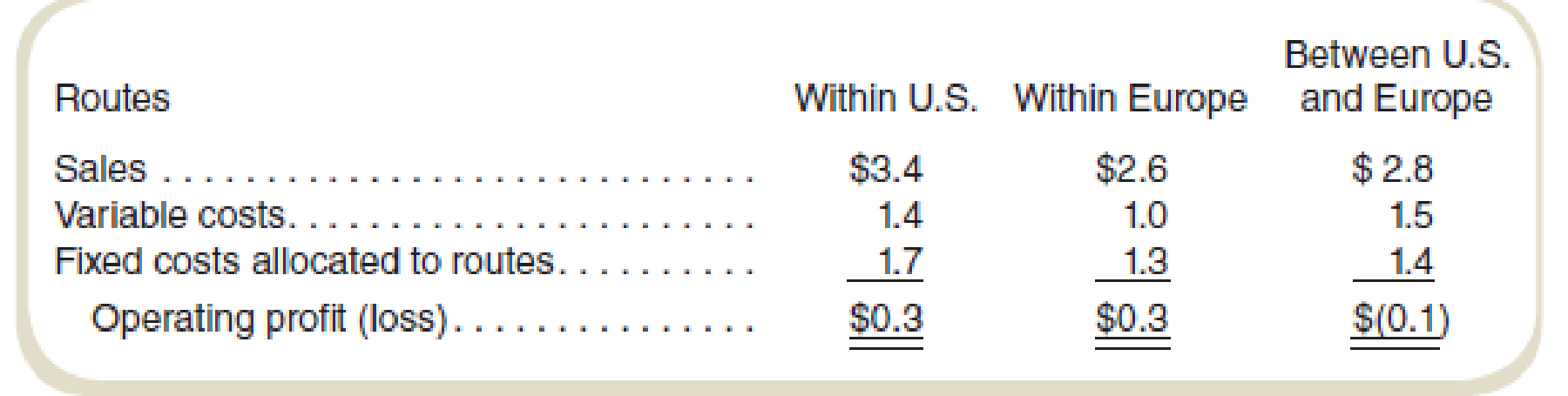

Freeflight Airlines is presently operating at 70 percent of capacity. Management of the airline is considering dropping Freeflight’s routes between Europe and the United States. If these routes are dropped, the revenue associated with the routes would be lost and the related variable costs saved. In addition, the company’s total fixed costs would be reduced by 20 percent.

Segmented income statements for a typical month appear as follows (all amounts in millions of dollars):

Required

Prepare a differential cost schedule like the one in Exhibit 4.8 to indicate whether Freeflight should drop the routes between Europe and the United States.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

hi expert please help me

Calculate pankaj's net income for the year

Calculate cash conversion cycle of this financial accounting question

Chapter 4 Solutions

COST ACCOUNTING W/CONNECT

Ch. 4 - Fixed costs are often defined as fixed over the...Ch. 4 - What is the difference between a sunk cost and a...Ch. 4 - Are sunk costs ever differential costs? Explain.Ch. 4 - What is the difference between short-run and...Ch. 4 - What costs are included in the full cost of a...Ch. 4 - What costs are included in the full cost of a...Ch. 4 - What costs should be considered for a special...Ch. 4 - What are life-cycle product costing and pricing?Ch. 4 - Prob. 9RQCh. 4 - What do the terms target cost and target price...

Ch. 4 - What is predatory pricing? Why is it illegal in...Ch. 4 - What is dumping? What role would a cost accountant...Ch. 4 - What is price discrimination? How could a cost...Ch. 4 - If we want to maximize profit, why do we use unit...Ch. 4 - A company has learned that a particular input...Ch. 4 - Why are production constraints important in...Ch. 4 - What are some nonfinancial factors in decisions to...Ch. 4 - Prob. 18RQCh. 4 - Prob. 19CADQCh. 4 - Prob. 20CADQCh. 4 - As a marketing manager for an airline, would you...Ch. 4 - Prob. 22CADQCh. 4 - You buy an airline ticket to New York City to see...Ch. 4 - Consider the Business Application item,...Ch. 4 - One of your acquaintances notes, This whole...Ch. 4 - A manager in your organization just received a...Ch. 4 - Many airline frequent-flier programs upgrade elite...Ch. 4 - Consider the opportunity costs you identified in...Ch. 4 - Prob. 29CADQCh. 4 - Prob. 30CADQCh. 4 - Prob. 31CADQCh. 4 - Prob. 32CADQCh. 4 - Prob. 33CADQCh. 4 - Prob. 34CADQCh. 4 - Prob. 35CADQCh. 4 - Prob. 36ECh. 4 - Prob. 37ECh. 4 - Pricing Decisions Assume that MTA Sandwiches sells...Ch. 4 - Pricing Decisions Rutkey Collectibles is a small...Ch. 4 - Prob. 40ECh. 4 - Special Order Fairmount Travel Gear produces...Ch. 4 - Target Costing and Pricing Sids Skins makes a...Ch. 4 - Target Costing and Pricing Domingo Corporation...Ch. 4 - Target Costing and Purchasing Decisions Mira Mesa...Ch. 4 - Target Costing Kearney, Inc., makes kitchen tools....Ch. 4 - Make-or-Buy Decisions Mobility Partners makes...Ch. 4 - Make-or-Buy Decisions Mels Meals 2 Go purchases...Ch. 4 - Prob. 49ECh. 4 - Dropping Product Lines Freeflight Airlines is...Ch. 4 - Pappy’s Toys makes two models of a metal...Ch. 4 - Christine’s Chronographs makes two models of a...Ch. 4 - Unter Components manufactures low-cost navigation...Ch. 4 - Special Orders Sherene Nili manages a company that...Ch. 4 - Prob. 55PCh. 4 - M. Anthony, LLP, produces music in a studio in...Ch. 4 - Davis Kitchen Supply produces stoves for...Ch. 4 - Make or Buy King City Specialty Bikes (KCSB)...Ch. 4 - Prob. 59PCh. 4 - Prob. 60PCh. 4 - Prob. 61PCh. 4 - Prob. 62PCh. 4 - Prob. 63PCh. 4 - Agnew Manufacturing produces and sells three...Ch. 4 - Prob. 65PCh. 4 - Power Music owns five music stores, where it sells...Ch. 4 - You have been asked to assist the management of...Ch. 4 - Prob. 68PCh. 4 - Prob. 69PCh. 4 - Prob. 70PCh. 4 - Prob. 71PCh. 4 - Prob. 72PCh. 4 - Slavin Corporation manufactures two products,...Ch. 4 - Prob. 74PCh. 4 - Prob. 75P

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Karan Financial Services has total sales of $890,000, costs of $365,000, depreciation expense of $57,000, and an interest expense of $42,000. The company has a tax rate of 30%. What is Karan Financial Services' net income?arrow_forwardDon't use ai given answer accounting questionsarrow_forwardFinancial Accounting: At an output level of 53,000 units, you calculate that the degree of operating leverage is 1.75. If output rises to 82,420 units, what will the percentage change in operating cash flow be? Help me with thisarrow_forward

- Gnomes R Us just paid a dividend of $3.22 per share. The company has a dividend payout ratio of 64 percent. If the PE ratio is 18.2 times, what is the stock price?arrow_forwardGnomes R Us just paid a dividend of $3.22 per share. The company has a dividend payout ratio of 64 percent. If the PE ratio is 18.2 times, what is the stock price? Ansarrow_forwardGnomes R Us just paid a dividend of $3.22 per share. The company has a dividend payout ratio of 64 percent. If the PE ratio is 18.2 times, what is the stock price? General Account 1arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Fixed Asset Replacement Decision 1235; Author: Accounting Instruction, Help, & How To;https://www.youtube.com/watch?v=LJRzn9K8Nwk;License: Standard Youtube License