Concept explainers

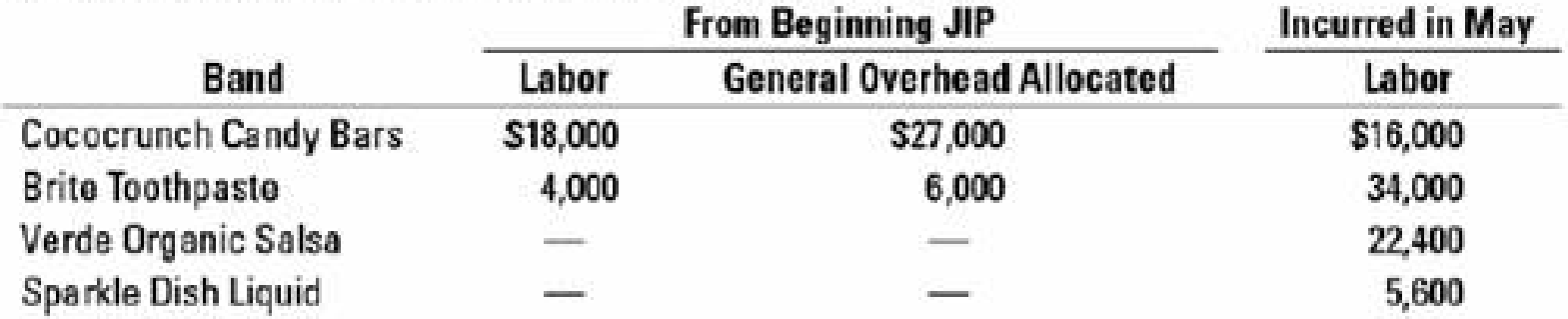

As of May 1, there were two jobs in progress: Cococrunch Candy Bars, and Brite Toothpaste. The jobs for Verde Organic Salsa and Sparkle Dish Liquid were started during May. The jobs for Cococrunch Candy Bars and Sparkle Dish Liquid were completed during May.

- 1. Calculate JIP at the end of May.

Required

- 2. Calculate CCJ for May.

- 3. Calculate under- or overallocated overhead at the end of May.

- 4. Calculate the ending balances in JIP and CCJ if the under- or overallocated overhead amount is as follows:

- a. Written off to CCJ

- b. Prorated based on the ending balances (before proration) in JIP and CCJ

- c. Prorated based on the overhead allocated in May in the ending balances of JIP and CCJ (before proration)

- 5. Which method would you choose? Explain. Would your choice depend on whether overhead cost is underallocated or overallocated? Explain.

Learn your wayIncludes step-by-step video

Chapter 4 Solutions

EBK HORNGREN'S COST ACCOUNTING

Additional Business Textbook Solutions

Financial Accounting (12th Edition) (What's New in Accounting)

Principles of Operations Management: Sustainability and Supply Chain Management (10th Edition)

Business Essentials (12th Edition) (What's New in Intro to Business)

Corporate Finance (4th Edition) (Pearson Series in Finance) - Standalone book

Horngren's Accounting (12th Edition)

Financial Accounting, Student Value Edition (5th Edition)

- Due Jan 26 11:59pm Module 2 Discussion Provide and discuss an example of a situation where a company would use a job cost sheet. As part of your analysis, be sure to explain the nature and importance of a job cost sheet. or Discuss the advantages and disadvantages of Job Order Costing. Be sure to include specific examples of the advantages/disadvantages that you discuss. 21 Replies, 18arrow_forwardNonearrow_forwardAbcarrow_forward

- choose 4 nuber from 1 to 5 with repetitions allowed to create the largest standard deviation posiiblearrow_forward1. Stampede Company has two service departments — purchasing and maintenance, and two production departments — fabrication and assembly. The distribution of each service department's efforts to the other departments is shown below: FROM TO Purchasing Maintenance Fabrication Assembly Purchasing 0% 45% 45% 10% Maintenance 55% 0% 30% 15% The direct operating costs of the departments (including both variable and fixed costs) were as follows: Purchasing $ 138,000 Maintenance 60,000 Fabrication 114,000 Assembly 90,000 The total cost accumulated in the fabrication department using the direct method is: 2. Bifurcator Company produces three products — X, Y, and Z — from a joint process. Each product may be sold at the split-off point or processed further. Additional processing requires no special facilities, and production costs of further processing are entirely variable and traceable to the products involved. Last year all three products were processed beyond…arrow_forward?????arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning