Concept explainers

(25–30 min.)

Underwood is eager to impress his new employer, and he knows that in 2017. Anderson’s upper management is under pressure to show a profit in a challenging competitive environment because they are hoping to be acquired by a large private equity firm sometime in 2018. At the end of 2016, Underwood decides to adjust the manufacturing overhead rate to 160% of direct labor cost. He explains to the company president that, because overhead was underallocated in 2016, this adjustment is necessary. Cost information for 2017 follows:

| Direct materials control, 1/1/2017 | 25,000 |

| Direct materials purchased, 2017 | 650,000 |

| Direct materials added to production, 2017 | 630,000 |

| Work in process control, 1/1/2017 | 280,000 |

| Direct manufacturing labor, 2017 | 880,000 |

| Cost of goods manufactured, 2017 | 2,900,000 |

| Finished goods control, 1/1/2017 | 320,000 |

| Finished goods control, 12/31/2017 | 290,000 |

| Manufacturing overhead costs, 2017 | 1,300,000 |

Anderson’s revenue for 2017 was $5,550,000, and the company’s selling and administrative expenses were $2,720,000.

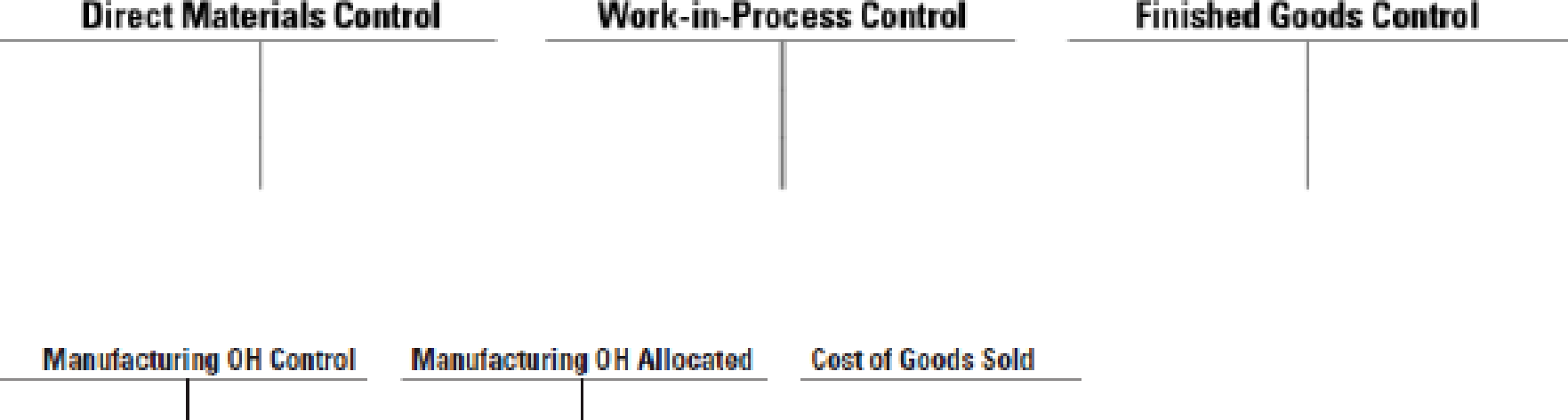

- 1. Insert the given information in the T-accounts below. Calculate the following amounts to complete the T-accounts:

Required

- a. Direct materials control, 12/31/2017

- b. Manufacturing overhead allocated, 2017

- c. Cost of goods sold, 2017

- 2. Calculate the amount of under- or overallocated manufacturing overhead.

- 3. Calculate Anderson’s net operating income under the following:

- a. Under- or overallocated manufacturing overhead is written off to cost of goods sold.

- b. Under- or overallocated manufacturing overhead is prorated based on the ending balances in work in process, finished goods, and cost of goods sold.

- 4. Underwood chooses option 3a above, stating that the amount is immaterial. Comment on the ethical implications of his choice. Do you think that there were any ethical issues when he established the manufacturing overhead rate for 2017 back in late 2016? Refer to the IMA Statement of Ethical Professional Practice.

Trending nowThis is a popular solution!

Learn your wayIncludes step-by-step video

Chapter 4 Solutions

EBK HORNGREN'S COST ACCOUNTING

Additional Business Textbook Solutions

Financial Accounting (12th Edition) (What's New in Accounting)

Operations Management

Fundamentals of Management (10th Edition)

Essentials of Corporate Finance (Mcgraw-hill/Irwin Series in Finance, Insurance, and Real Estate)

Financial Accounting, Student Value Edition (5th Edition)

Intermediate Accounting (2nd Edition)

- Quick answer of this accounting questionsarrow_forwardI need a expert not AI Step Amount Category Inventory 1. Beginning Balance, January 1 28,000 Beginning Balance Raw Materials 2. (+) Purchases (RM Purchases) 220,000 Addition Raw Materials 3. (-) Ending Balance 20,000 Ending Balance Raw Materials 4. = Transferred Out (RM used) (228,000) Transferred Out Raw Materials 5. (+) Direct Labor (152,000) Transferred Out Direct Labor 6. (+) Fixed Overhead 300,000 Addition Overhead 7. (+) Variable Overhead - Addition Overhead 8. = Total Factory Overhead (390,000) Transferred Out Overhead 9. Beginning Balance, January 1 40,000 Beginning Balance WIP 10. (+) Additions (RM used) 228,000 Addition WIP 11. (+) Additions (DL used) 152,000 Addition WIP 12. (+) Additions (OH used) 390,000 Addition WIP 13. (-) Ending Balance, December 31 55,000 Ending Balance WIP 14. = Transferred Out (COGM) (755,000)…arrow_forwardStep Amount Category Inventory 1. Beginning Balance, January 1 28,000 Beginning Balance Raw Materials 2. (+) Purchases (RM Purchases) 220,000 Addition Raw Materials 3. (-) Ending Balance 20,000 Ending Balance Raw Materials 4. = Transferred Out (RM used) (228,000) Transferred Out Raw Materials 5. (+) Direct Labor (152,000) Transferred Out Direct Labor 6. (+) Fixed Overhead 300,000 Addition Overhead 7. (+) Variable Overhead - Addition Overhead 8. = Total Factory Overhead (390,000) Transferred Out Overhead 9. Beginning Balance, January 1 40,000 Beginning Balance WIP 10. (+) Additions (RM used) 228,000 Addition WIP 11. (+) Additions (DL used) 152,000 Addition WIP 12. (+) Additions (OH used) 390,000 Addition WIP 13. (-) Ending Balance, December 31 55,000 Ending Balance WIP 14. = Transferred Out (COGM) (755,000) Transferred Out WIP 15.…arrow_forward

- Introduce yourself to your peers by sharing something unique about your background. Explain how you expect this course will help you move forward in your current or future career.arrow_forwardStep Amount Category Inventory 1. Beginning Balance, January 1 28,000 Beginning Balance Raw Materials 2. (+) Purchases (RM Purchases) 220,000 Addition Raw Materials 3. (-) Ending Balance 20,000 Ending Balance Raw Materials 4. = Transferred Out (RM used) (228,000) Transferred Out Raw Materials 5. (+) Direct Labor (152,000) Transferred Out Direct Labor 6. (+) Fixed Overhead 300,000 Addition Overhead 7. (+) Variable Overhead - Addition Overhead 8. = Total Factory Overhead (390,000) Transferred Out Overhead 9. Beginning Balance, January 1 40,000 Beginning Balance WIP 10. (+) Additions (RM used) 228,000 Addition WIP 11. (+) Additions (DL used) 152,000 Addition WIP 12. (+) Additions (OH used) 390,000 Addition WIP 13. (-) Ending Balance, December 31 55,000 Ending Balance WIP 14. = Transferred Out (COGM) (755,000) Transferred Out WIP 15.…arrow_forward1. Beginning Balance, January 1 28,000 Beginning Balance Raw Materials 2. (+) Purchases (RM Purchases) 220,000 Addition Raw Materials 3. (-) Ending Balance 20,000 Ending Balance Raw Materials 4. = Transferred Out (RM used) (228,000) Transferred Out Raw Materials 5. (+) Direct Labor (152,000) Transferred Out Direct Labor 6. (+) Fixed Overhead 300,000 Addition Overhead 7. (+) Variable Overhead ? Addition Overhead 8. = Total Factory Overhead (390,000) Transferred Out Overhead 9. Beginning Balance, January 1 40,000 Beginning Balance WIP 10. (+) Additions (RM used) 228,000 Addition WIP 11. (+) Additions (DL used) 152,000 Addition WIP 12. (+) Additions (OH used) 390,000 Addition WIP 13. (-) Ending Balance, December 31 55,000 Ending Balance WIP 14. = Transferred Out (COGM) (755,000) Transferred Out WIP 15. Beginning Balance, January 1…arrow_forward

- Palladium, Incorporated recently lost a portion of its records in an office fire. The following information was salvaged from the accounting records. Cost of Goods Sold $ 67,000 Work-in-Process Inventory, Beginning 11,300 Work-in-Process Inventory, Ending 9,400 Selling and Administrative Expense 16,000 Finished Goods Inventory, Ending 16,100 Finished Goods Inventory, Beginning ?question mark Direct Materials Used ?question mark Factory Overhead Applied 12,400 Operating Income 14,220 Direct Materials Inventory, Beginning 11,180 Direct Materials Inventory, Ending 6,140 Cost of Goods Manufactured 61,880 Direct labor cost incurred during the period amounted to 1.5 times the factory overhead. The Chief Financial Officer of Palladium, Incorporated has asked you to recalculate the following accounts and to report to him by the end of the day. What is the amount in the finished goods inventory at the beginning of the year?arrow_forwardWhich of the following statements is incorrect regarding manufacturing overhead? Multiple Choice Manufacturing overhead includes both fixed and variable costs. Manufacturing overhead is an indirect cost to units or products. Actual overhead costs are used in the cost accounting process. Actual overhead costs tend to remain relatively constant over various output levels.arrow_forwardPalladium, Incorporated recently lost a portion of its records in an office fire. The following information was salvaged from the accounting records. Cost of Goods Sold $ 72,500 Work-in-Process Inventory, Beginning 13,500 Work-in-Process Inventory, Ending 10,500 Selling and Administrative Expense 18,750 Finished Goods Inventory, Ending 19,125 Finished Goods Inventory, Beginning ?question mark Direct Materials Used ?question mark Factory Overhead Applied 13,500 Operating Income 14,825 Direct Materials Inventory, Beginning 11,675 Direct Materials Inventory, Ending 6,525 Cost of Goods Manufactured 67,050 Direct labor cost incurred during the period amounted to 1.5 times the factory overhead. The Chief Financial Officer of Palladium, Incorporated has asked you to recalculate the following accounts and to report to him by the end of the day. What is the amount of direct materials purchased?arrow_forward

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College