Concept explainers

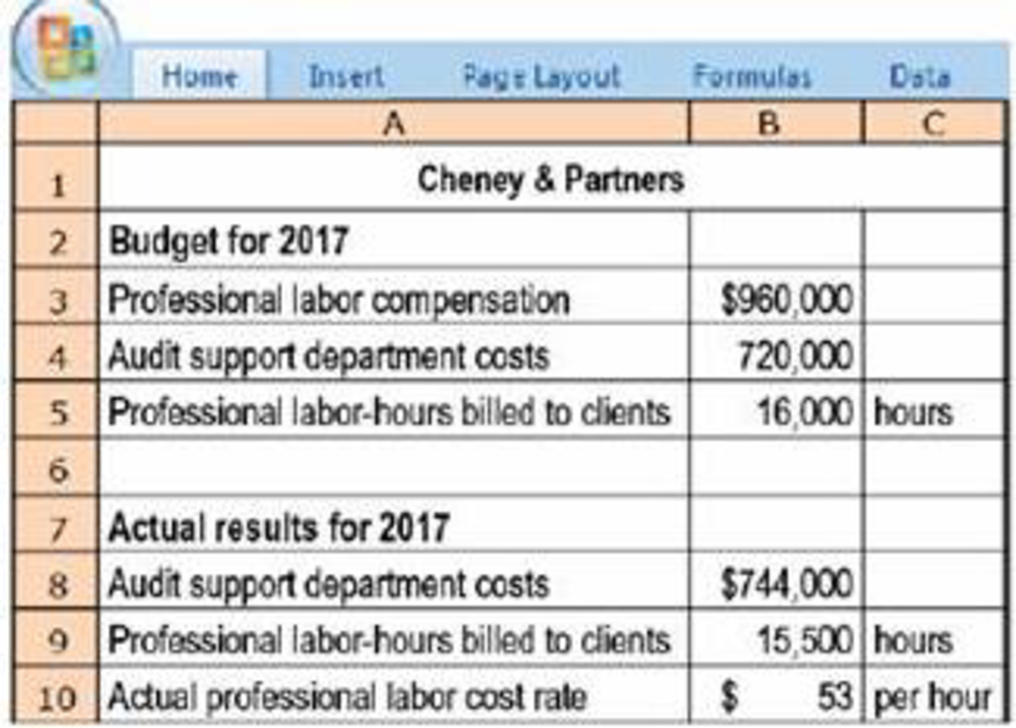

Budgeted and actual amounts for 2017 are as follows:

- 1. Compute the direct-cost rate and the indirect-cost rate per professional labor-hour for 2017 under (a) actual costing, (b) normal costing, and (c) the variation from normal costing that uses budgeted rates for direct costs.

Required

- 2. Which job-costing system would you recommend Cheney & Partners use? Explain.

- 3. Cheney’s 2017 audit of Pierre & Co. was budgeted to take 170 hours of professional labor time. The actual professional labor time spent on the audit was 185 hours. Compute the cost of the Pierre & Co. audit using (a) actual costing, (b) normal costing, and (c) the variation from normal costing that uses budgeted rates for direct costs. Explain any differences in the job cost.

Learn your wayIncludes step-by-step video

Chapter 4 Solutions

EBK HORNGREN'S COST ACCOUNTING

Additional Business Textbook Solutions

Horngren's Accounting (12th Edition)

Horngren's Accounting (11th Edition)

Intermediate Accounting (2nd Edition)

Construction Accounting And Financial Management (4th Edition)

Financial Accounting

Principles of Accounting Volume 2

- The scenario describes a task undertaken by Adam, the managing partner at Novak Accounting Services (NAS), who is assessing the profitability of the firm’s three operational divisions: Audit, Tax, and Advisory Services. These divisions receive support from three separate departments: Billing, Human Resources (HR), and IT. Each support department incurs specific costs and serves the operating divisions based on distinct cost drivers or allocation bases. Here are the details: •The Billing Department has incurred original costs of $66,000 but does not record any specific billing hours used by the operating divisions. •The Human Resources Department has expenses amounting to $113,000 and houses two employees. •The IT Department shows costs of $98,000 and has its services measured in hours used by various departments, totaling 200 hours for itself and distributing additional hours to the operating divisions—900 hours to Audit, 600 hours to Tax, and 300 hours to Advisory. For the…arrow_forwardA manufacturing company has two service and two production departments. Human Resources and Machine Repair are the service departments. The production departments are Grinding and Polishing. The following data have been estimated for next years operations: The direct charges identified with each of the departments are as follows: The human resources department services all departments of the company, and its costs are allocated using the numbers of employees within each department, while machine repair costs are allocable to Grinding and Polishing on the basis of machine hours. 1. Distribute the service department costs, using the direct method. 2. Distribute the service department costs, using the sequential distribution method, with the department servicing the greatest number of other departments distributed first.arrow_forwardThe following describes the job responsibilities of two employees of Barney Manufacturing. Joan Dennison, Cost Accounting Manager. Joan is responsible for measuring and collecting costs associated with the manufacture of the garden hose product line. She is also responsible for preparing periodic reports that compare the actual costs with planned costs. These reports are provided to the production line managers and the plant manager. Joan helps to explain and interpret the reports. Steven Swasey, Production Manager. Steven is responsible for the manufacture of the high-quality garden hose. He supervises the line workers, helps to develop the production schedule, and is responsible for seeing that production quotas are met. He is also held accountable for controlling manufacturing costs. Required: CONCEPTUAL CONNECTION Identify Joan and Steven as line or staff and explain your reasons.arrow_forward

- ! Required information [The following information applies to the questions displayed below.] JLR Enterprises provides consulting services throughout California and uses a job-order costing system to accumulate the cost of client projects. Traceable costs are charged directly to individual clients; in contrast, other costs incurred by JLR, but not identifiable with specific clients, are charged to jobs by using a predetermined overhead application rate. Clients are billed for directly chargeable costs, overhead, and a markup. JLR's director of cost management, Victor Anthony, anticipates the following costs for the upcoming year: Percentage of Cost Directly Traceable to Clients 80% 60% 90% 90% 50% Type Professional staff salaries Administrative support staff Travel Photocopying Other operating costs Total Cost $ 2,500,000 300,000 250,000 50,000 100,000 $ 3,200,000 The firm's partners desire to make a $640,000 profit for the firm and plan to add a percentage markup on total cost to…arrow_forwardElizabeth Flanigan and Associates is an engineering and design firm that specializes in developing plans for recycling plants for municipalities. The firm uses a job costing system to accumulate the cost associated with each design project. Flanigan employs three levels of employee: senior engineers, associate engineers, and clerical staff. The salary cost of the senior en- gineers and the associate engineers is assigned to each project as direct labor. The salary cost of the clerical staff is included in overhead, along with the cost of engineering supplies, automobile travel, and equipment depreciation. The cost of airline travel, motels, building permits, and fees from other consultants is charged to each project as direct materials. Overhead is applied to projects using a predetermined overhead rate based on total engineering hours. The rate is $5 per hour. The six different salary levels for the employees of Elizabeth Flanigan and Associates are listed below. The hourly rate is…arrow_forwardTech Solutions is a consulting firm that uses a job-order costing system. Its direct materials consist of hardware and software that it purchases and installs on behalf of its clients. The firm's direct labor includes salaries of consultants that work at the client's job site, and its overhead consists of costs such as depreciation, utilities, and insurance related to the office headquarters as well as the office supplies that are consumed serving clients. Tech Solutions computes its predetermined overhead rate annually on the basis of direct labor-hours. At the beginning of the year, it estimated that 92,500 direct labor-hours would be required for the period's estimated level of client service. The company also estimated $1,156,250 of fixed overhead cost for the coming period and variable overhead of $0.50 per direct labor-hour. The firm's actual overhead cost for the year was $1,177,550 and its actual total direct labor was 97,750 hours. Required: 1. Compute the predetermined…arrow_forward

- Tech Solutions is a consulting firm that uses a job-order costing system. Its direct materials consist of hardware and software that it purchases and installs on behalf of its clients. The firm’s direct labor includes salaries of consultants that work at the client’s job site, and its overhead consists of costs such as depreciation, utilities, and insurance related to the office headquarters as well as the office supplies that are consumed serving clients. Tech Solutions computes its predetermined overhead rate annually on the basis of direct labor-hours. At the beginning of the year, it estimated that 77,500 direct labor-hours would be required for the period’s estimated level of client service. The company also estimated $775,000 of fixed overhead cost for the coming period and variable overhead of $0.50 per direct labor-hour. The firm’s actual overhead cost for the year was $789,800 and its actual total direct labor was 83,350 hours. Required: 1. Compute the predetermined…arrow_forwardTech Solutions is a consulting firm that uses a job - order costing system. Its direct materials consist of hardware and software that it purchases and installs on behalf of its clients. The firm's direct labor includes salaries of consultants that work at the client's job site, and its overhead consists of costs such as depreciation, utilities, and insurance related to the office headquarters as well as the office supplies that are consumed serving clients. Tech Solutions computes its predetermined overhead rate annually on the basis of direct labor - hours. At the beginning of the year, it estimated that 55,000 direct labor - hours would be required for the period's estimated level of client service. The company also estimated $302, 500 of fixed overhead cost for the coming period and variable overhead of $0.50 per direct labor - hour. The firm's actual overhead cost for the year was $321, 300 and its actual total direct labor was 58, 850 hours. Required: 1. Compute the predetermined…arrow_forwardTech Solutions is a consulting firm that uses a job-order costing system. Its direct materials consist of hardware and software that it purchases and installs on behalf of its clients. The firm's direct labor includes salaries of consultants that work at the client's job site, and its overhead consists of costs such as depreciation, utilities, and insurance related to the office headquarters as well as the office supplies that are consumed serving clients. Tech Solutions computes its predetermined overhead rate annually on the basis of direct labor-hours. At the beginning of the year, it estimated that 100,000 direct labor-hours would be required for the period's estimated level of client service. The company also estimated $1,400,000 of foxed overhead cost for the coming period and variable overhead of $0.50 per direct labor-hour. The firm's actual overhead cost for the year was $1,418,700 and its actual total direct labor was 104,000 hours. Required: 1. Compute the predetermined…arrow_forward

- Tech Solutions is a consulting firm that uses a job-order costing system. Its direct materials consist of hardware and software that it purchases and Installs on behalf of its clients. The firm's direct labor Includes salaries of consultants that work at the client's job site, and its overhead consists of costs such as depreciation, utilities, and Insurance related to the office headquarters as well as the office supplies that are consumed serving clients. Tech Solutions computes its predetermined overhead rate annually on the basis of direct labor-hours. At the beginning of the year, it estimated that 92,500 direct labor-hours would be required for the period's estimated level of client service. The company also estimated $1,156,250 of fixed overhead cost for the coming period and variable overhead of $0.50 per direct labor-hour. The firm's actual overhead cost for the year was $1,177,550 and its actual total direct labor was 97,750 hours. Required: 1. Compute the predetermined…arrow_forwardTech Solutions is a consulting firm that uses a job-order costing system. Its direct materials consist of hardware and software that it purchases and installs on behalf of its clients. The firm's direct labor includes salaries of consultants that work at the client's job site, and its overhead consists of costs such as depreciation, utilities, and insurance related to the office headquarters as well as the office supplies that are consumed serving clients. Tech Solutions computes its predetermined overhead rate annually on the basis of direct labor-hours. At the beginning of the year, it estimated that 75,000 direct labor-hours would be required for the period's estimated level of client service. The company also estimated $712,500 of fixed overhead cost for the coming period and variable overhead of $0.50 per direct labor-hour. The firm's actual overhead cost for the year was $731,500 and its actual total direct labor was 80,650 hours. Required: 1. Compute the predetermined overhead…arrow_forwardTech Solutions is a consulting firm that uses a job-order costing system. Its direct materials consist of hardware and software that it purchases and installs on behalf of its clients. The firm’s direct labor includes salaries of consultants that work at the client’s job site, and its overhead consists of costs such as depreciation, utilities, and insurance related to the office headquarters as well as the office supplies that are consumed serving clients. Tech Solutions computes its predetermined overhead rate annually on the basis of direct labor-hours. At the beginning of the year, it estimated that 87,500 direct labor-hours would be required for the period’s estimated level of client service. The company also estimated $1,006,250 of fixed overhead cost for the coming period and variable overhead of $0.50 per direct labor-hour. The firm’s actual overhead cost for the year was $1,025,150 and its actual total direct labor was 92,400 hours. Required: 1. Compute the predetermined…arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,