Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 4, Problem 2EA

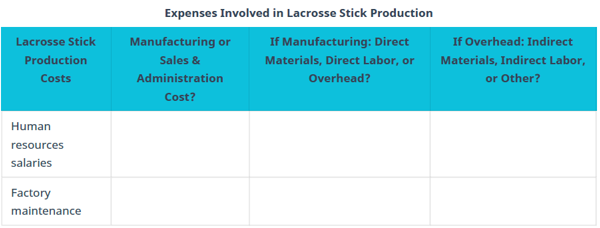

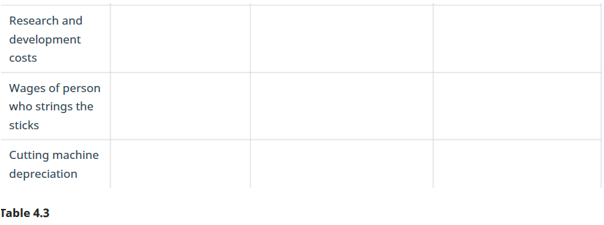

Table 4.3 shows a list of expenses involved in the production of custom, professional lacrosse sticks.

- For each Item listed, state whether the cost should be applied to manufacturing or sales and administration.

- 1f the cost is a

manufacturing cost , state whether It Is direct materials, direct labor, or manufacturingoverhead . - If the cost is a manufacturing overhead cost, state whether it is indirect materials, indirect labor, or another type of manufacturing overhead.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

For each of the transactions above, indicate the amount of the adjusting entry on the elements of the balance sheet and income statement.Note: Enter negative amounts with a minus sign.

Need help with this question solution general accounting

Don't use ai given answer accounting questions

Chapter 4 Solutions

Principles of Accounting Volume 2

Ch. 4 - Which of the following product situations is...Ch. 4 - A job order costing system is most likely used by...Ch. 4 - Which of the following is a prime cost? A....Ch. 4 - Which of the following is a conversion cost? raw...Ch. 4 - During production, to what are the costs in job...Ch. 4 - Which document lists the inventory that will be...Ch. 4 - Which document shows the cost of direct materials,...Ch. 4 - Which document lists the total direct materials...Ch. 4 - Which document lists the total direct labor used...Ch. 4 - Assigning indirect costs to specific jobs is...

Ch. 4 - In a job order cost system, which account shows...Ch. 4 - In a job order cost system, raw materials...Ch. 4 - In a job order cost system, overhead applied is...Ch. 4 - In a job order cost system, factory wage expense...Ch. 4 - In a job order cost system, utility expense...Ch. 4 - In a job order cost system, indirect labor...Ch. 4 - The activity base for service industries is most...Ch. 4 - A printing company manufactures notebooks of...Ch. 4 - Burnham Industries incurs these costs for the...Ch. 4 - Chocos Chocolates incurs these costs for the...Ch. 4 - How do job order costing and process costing...Ch. 4 - Why are product costs assigned to the product and...Ch. 4 - Is the cost of goods manufactured the same as the...Ch. 4 - From beginning to end, place these items in the...Ch. 4 - How is the predetermined overhead rate determined?Ch. 4 - How is the predetermined overhead rate applied?Ch. 4 - Why are the overhead costs first accumulated in...Ch. 4 - Why is the manufacturing overhead account debited...Ch. 4 - Match the concept on the left to its correct...Ch. 4 - When compared to manufacturing companies, service...Ch. 4 - Little Things manufactures toys. For each item...Ch. 4 - Table 4.3 shows a list of expenses involved in the...Ch. 4 - Burnham Industries incurs these costs for the...Ch. 4 - Marzons records show raw materials Inventory had a...Ch. 4 - Sterlings records show the work in process...Ch. 4 - Logo Gear purchased $2,250 worth of merchandise...Ch. 4 - A company estimates its manufacturing overhead...Ch. 4 - Job order cost sheets show the following costs...Ch. 4 - A new company started production. Job 10 was...Ch. 4 - K company production was working on Job 1 and Job...Ch. 4 - A company has the following transactions during...Ch. 4 - During the month, Job AB2 used specialized...Ch. 4 - Job 113 was completed at a cost of $5,000, and Job...Ch. 4 - A companys Individual job sheets show these costs:...Ch. 4 - A summary of material requisition slips and time...Ch. 4 - Abuah Goods manufactures clothing. For each item...Ch. 4 - Chocos Chocolates incurs the following costs for...Ch. 4 - The table shows a list of expenses involved in the...Ch. 4 - Masonrys records show the raw materials inventory...Ch. 4 - Steinways records show their work in process...Ch. 4 - Langstons purchased $3,100 of merchandise during...Ch. 4 - A company estimates its manufacturing overhead...Ch. 4 - Job order cost sheets show the following costs...Ch. 4 - A new company started production. Job 1 was...Ch. 4 - Inez has the following information relating to Job...Ch. 4 - A company has the following information relating...Ch. 4 - A company has the following transactions during...Ch. 4 - During the month, Job Arch2 used specialized...Ch. 4 - Job 113 was completed at a cost of $7,500, and Job...Ch. 4 - A companys individual job sheets show these costs:...Ch. 4 - A summary of materials requisition slips and time...Ch. 4 - For each item listed, state whether a job order...Ch. 4 - York Company Is a machine shop that estimated...Ch. 4 - Pocono Cement Forms expects $900,000 in overhead...Ch. 4 - Job cost sheets show the following information:...Ch. 4 - Complete the information in the cost computations...Ch. 4 - During the year, a company purchased raw materials...Ch. 4 - Freeman Furnishings has summarized its data as...Ch. 4 - Coops Stoops estimated its annual overhead to be...Ch. 4 - MountaIn Peaks applies overhead on the basis of...Ch. 4 - The actual overhead for a company is $74,539....Ch. 4 - When setting its predetermined overhead...Ch. 4 - The following data summarize the operations during...Ch. 4 - The following events occurred during March for...Ch. 4 - A movie production studio incurred the following...Ch. 4 - For each item listed, state whether a job order...Ch. 4 - Rulers Company is a neon sign company that...Ch. 4 - Event Forms expects $120,000 in overhead during...Ch. 4 - Summary information from a companys job cost...Ch. 4 - Complete the information in the cost computations...Ch. 4 - During the year, a company purchased raw materials...Ch. 4 - Freeman Furnishings has summarized its data as...Ch. 4 - Queen Bees Honey, Inc., estimated its annual...Ch. 4 - Mountain Tops applies overhead on the basis of...Ch. 4 - The actual overhead for a company is $73,175....Ch. 4 - When setting its predetermined overhead...Ch. 4 - The following data summarize the operations during...Ch. 4 - The Following events occurred during March for...Ch. 4 - A leather repair shop incurred the following...Ch. 4 - Can a company use both job order costing and...Ch. 4 - If a job order cost system tracks the direct...Ch. 4 - What are the similarities in calculating the cost...Ch. 4 - If a company bases its predetermined overhead rate...Ch. 4 - How do the job cost sheets act as a subsidiary...Ch. 4 - How is a job order cost system used in a service...

Additional Business Textbook Solutions

Find more solutions based on key concepts

Create an Excel spreadsheet on your own that can make combination forecasts for Problem 18. Create a combinatio...

Operations Management: Processes and Supply Chains (12th Edition) (What's New in Operations Management)

The annual report is considered by some to be the single most important printed document that companies produce...

Accounting Information Systems (14th Edition)

*24. How does the average-cost method of inventory costing differ between a perpetual inventory system and a pe...

Financial Accounting: Tools for Business Decision Making, 8th Edition

FIFO, Perpetual Basis. Spider incorporated provided the following information regarding its inventory for the c...

Intermediate Accounting (2nd Edition)

Name the five steps in process costing when equivalent units are computed.

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- I want to correct answer general accounting questionarrow_forwardKindly help me with accounting questionsarrow_forwardDuo Corporation is evaluating a project with the following cash flows: Year 0 1 2 3 Cash Flow -$ 30,000 12,200 14,900 16,800 4 5 13,900 -10,400 The company uses an interest rate of 8 percent on all of its projects. a. Calculate the MIRR of the project using the discounting approach. Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. b. Calculate the MIRR of the project using the reinvestment approach. Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. c. Calculate the MIRR of the project using the combination approach. Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. a. Discounting approach MIRR b. Reinvestment approach MIRR c. Combination approach MIRR % % %arrow_forward

- Provide correct answer general accounting questionarrow_forwardNeed help with this question solution general accountingarrow_forwardConsider a four-year project with the following information: Initial fixed asset investment = $555,000; straight-line depreciation to zero over the four-year life; zero salvage value; price = $37; variable costs = $25; fixed costs = $230,000; quantity sold = 79,000 units; tax rate = 24 percent. How sensitive is OCF to changes in quantity sold?arrow_forward

- Light emitting diodes (LED) light bulbs have become required in recent years, but do they make financial sense? Suppose a typical 60-watt incandescent light bulb costs $.39 and lasts 1,000 hours. A 15-watt LED, which provides the same light, costs $3.10 and lasts for 12,000 hours. A kilowatt-hour of electricity costs $.115. A kilowatt-hour is 1,000 watts for 1 hour. If you require a return of 11 percent and use a light fixture 500 hours per year, what is the equivalent annual cost of each light bulb? Note: A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.arrow_forwardRecently, Abercrombie & Fitch has been implementing a turnaround strategy since its sales had been falling for the past few years (11% decrease in 2014, 8% in 2015, and just 3% in 2016.) One part of Abercrombie's new strategy has been to abandon its logo-adorned merchandise, replacing it with a subtler look. Abercrombie wrote down $20.6 million of inventory, including logo-adorned merchandise, during the year ending January 30, 2016. Some of this inventory dated back to late 2013. The write-down was net of the amount it would be able to recover selling the inventory at a discount. The write-down is significant; Abercrombie's reported net income after this write-down was $35.6 million. Interestingly, Abercrombie excluded the inventory write-down from its non-GAAP income measures presented to investors; GAAP earnings were also included in the same report. Question: From an investor standpoint, do you think that the effect of the inventory write-down should be considered when…arrow_forwardFinancial accountingarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Cost Classifications - Managerial Accounting- Fixed Costs Variable Costs Direct & Indirect Costs; Author: Accounting Instruction, Help, & How To;https://www.youtube.com/watch?v=QQd1_gEF1yM;License: Standard Youtube License