Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 4, Problem 15EB

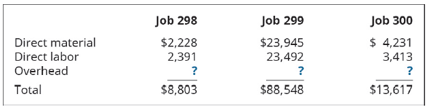

A company’s individual job sheets show these costs:

Overhead is applied at 1.75 times the direct labor cost. Use the data on the cost sheets to perform these tasks:

- Apply overhead to each of the jobs.

- Prepare an entry to record the assignment of direct material to work in process.

- Prepare an entry to record the assignment of direct labor to work in process.

- Prepare an entry to record the assignment of manufacturing overhead to work in process.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

The following transactions involving intangible assets of Oriole Corporation occurred on or near December 31, 2025.

1.) Oriole paid Grand Company $520,000 for the exclusive right to market a particular product, using the Grand name and logo in promotional material. The franchise runs for as long as Oriole is in business.

2.) Oriole spent $654,000 developing a new manufacturing process. It has applied for a patent, and it believes that its application will be successful.

3.) In January 2026, Oriole's application for a patent (#2 above) was granted. Legal and registration costs incurred were $247,800. The patent runs for 20 years. The manufacturing process will be useful to Oriole for 10 years.

4.) Oriole incurred $168,000 in successfully defending one of its patents in an infringement suit. The patent expires during December 2029. Oriole incurred

5.) $446,400 in an unsuccessful patent defense. As a result of the adverse verdict, the patent, with a remaining unamortized cost of…

None

Please provide the solution to this general accounting question with accurate financial calculations.

Chapter 4 Solutions

Principles of Accounting Volume 2

Ch. 4 - Which of the following product situations is...Ch. 4 - A job order costing system is most likely used by...Ch. 4 - Which of the following is a prime cost? A....Ch. 4 - Which of the following is a conversion cost? raw...Ch. 4 - During production, to what are the costs in job...Ch. 4 - Which document lists the inventory that will be...Ch. 4 - Which document shows the cost of direct materials,...Ch. 4 - Which document lists the total direct materials...Ch. 4 - Which document lists the total direct labor used...Ch. 4 - Assigning indirect costs to specific jobs is...

Ch. 4 - In a job order cost system, which account shows...Ch. 4 - In a job order cost system, raw materials...Ch. 4 - In a job order cost system, overhead applied is...Ch. 4 - In a job order cost system, factory wage expense...Ch. 4 - In a job order cost system, utility expense...Ch. 4 - In a job order cost system, indirect labor...Ch. 4 - The activity base for service industries is most...Ch. 4 - A printing company manufactures notebooks of...Ch. 4 - Burnham Industries incurs these costs for the...Ch. 4 - Chocos Chocolates incurs these costs for the...Ch. 4 - How do job order costing and process costing...Ch. 4 - Why are product costs assigned to the product and...Ch. 4 - Is the cost of goods manufactured the same as the...Ch. 4 - From beginning to end, place these items in the...Ch. 4 - How is the predetermined overhead rate determined?Ch. 4 - How is the predetermined overhead rate applied?Ch. 4 - Why are the overhead costs first accumulated in...Ch. 4 - Why is the manufacturing overhead account debited...Ch. 4 - Match the concept on the left to its correct...Ch. 4 - When compared to manufacturing companies, service...Ch. 4 - Little Things manufactures toys. For each item...Ch. 4 - Table 4.3 shows a list of expenses involved in the...Ch. 4 - Burnham Industries incurs these costs for the...Ch. 4 - Marzons records show raw materials Inventory had a...Ch. 4 - Sterlings records show the work in process...Ch. 4 - Logo Gear purchased $2,250 worth of merchandise...Ch. 4 - A company estimates its manufacturing overhead...Ch. 4 - Job order cost sheets show the following costs...Ch. 4 - A new company started production. Job 10 was...Ch. 4 - K company production was working on Job 1 and Job...Ch. 4 - A company has the following transactions during...Ch. 4 - During the month, Job AB2 used specialized...Ch. 4 - Job 113 was completed at a cost of $5,000, and Job...Ch. 4 - A companys Individual job sheets show these costs:...Ch. 4 - A summary of material requisition slips and time...Ch. 4 - Abuah Goods manufactures clothing. For each item...Ch. 4 - Chocos Chocolates incurs the following costs for...Ch. 4 - The table shows a list of expenses involved in the...Ch. 4 - Masonrys records show the raw materials inventory...Ch. 4 - Steinways records show their work in process...Ch. 4 - Langstons purchased $3,100 of merchandise during...Ch. 4 - A company estimates its manufacturing overhead...Ch. 4 - Job order cost sheets show the following costs...Ch. 4 - A new company started production. Job 1 was...Ch. 4 - Inez has the following information relating to Job...Ch. 4 - A company has the following information relating...Ch. 4 - A company has the following transactions during...Ch. 4 - During the month, Job Arch2 used specialized...Ch. 4 - Job 113 was completed at a cost of $7,500, and Job...Ch. 4 - A companys individual job sheets show these costs:...Ch. 4 - A summary of materials requisition slips and time...Ch. 4 - For each item listed, state whether a job order...Ch. 4 - York Company Is a machine shop that estimated...Ch. 4 - Pocono Cement Forms expects $900,000 in overhead...Ch. 4 - Job cost sheets show the following information:...Ch. 4 - Complete the information in the cost computations...Ch. 4 - During the year, a company purchased raw materials...Ch. 4 - Freeman Furnishings has summarized its data as...Ch. 4 - Coops Stoops estimated its annual overhead to be...Ch. 4 - MountaIn Peaks applies overhead on the basis of...Ch. 4 - The actual overhead for a company is $74,539....Ch. 4 - When setting its predetermined overhead...Ch. 4 - The following data summarize the operations during...Ch. 4 - The following events occurred during March for...Ch. 4 - A movie production studio incurred the following...Ch. 4 - For each item listed, state whether a job order...Ch. 4 - Rulers Company is a neon sign company that...Ch. 4 - Event Forms expects $120,000 in overhead during...Ch. 4 - Summary information from a companys job cost...Ch. 4 - Complete the information in the cost computations...Ch. 4 - During the year, a company purchased raw materials...Ch. 4 - Freeman Furnishings has summarized its data as...Ch. 4 - Queen Bees Honey, Inc., estimated its annual...Ch. 4 - Mountain Tops applies overhead on the basis of...Ch. 4 - The actual overhead for a company is $73,175....Ch. 4 - When setting its predetermined overhead...Ch. 4 - The following data summarize the operations during...Ch. 4 - The Following events occurred during March for...Ch. 4 - A leather repair shop incurred the following...Ch. 4 - Can a company use both job order costing and...Ch. 4 - If a job order cost system tracks the direct...Ch. 4 - What are the similarities in calculating the cost...Ch. 4 - If a company bases its predetermined overhead rate...Ch. 4 - How do the job cost sheets act as a subsidiary...Ch. 4 - How is a job order cost system used in a service...

Additional Business Textbook Solutions

Find more solutions based on key concepts

1-13. Identify a product, either a good or a service, that will take advantage of this opportunity. Although yo...

Business Essentials (12th Edition) (What's New in Intro to Business)

The present value of bankruptcy costs and the delta of the firm’s assets. Introduction: A delta is characterize...

Corporate Finance (4th Edition) (Pearson Series in Finance) - Standalone book

Explain how to derive a total expenditures (TE) curve.

Macroeconomics

1.10 Brown’s, a local bakery, is worried about increased costs—particularly energy. Last year’s records can pro...

Operations Management

3. Which method almost always produces the most depreciation in the first year?

a. Units-of-production

b. Strai...

Horngren's Financial & Managerial Accounting, The Financial Chapters (Book & Access Card)

1-1. Define marketing and outline the steps in the marketing process. (AASCB: Communication)

Marketing: An Introduction (13th Edition)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- I need help with this general accounting question using the proper accounting approach.arrow_forwardPlease provide the correct answer to this general accounting problem using valid calculations.arrow_forwardCan you explain the correct methodology to solve this general accounting problem?arrow_forward

- Can you solve this general accounting question with the appropriate accounting analysis techniques?arrow_forwardCan you solve this general accounting problem using appropriate accounting principles?arrow_forwardPlease help me solve this general accounting question using the right accounting principles.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning  Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Cost Accounting - Definition, Purpose, Types, How it Works?; Author: WallStreetMojo;https://www.youtube.com/watch?v=AwrwUf8vYEY;License: Standard YouTube License, CC-BY