Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 4, Problem 11EB

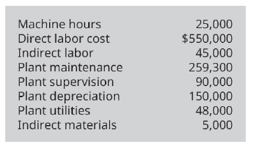

A company has the following information relating to its production costs:

Compute the actual and applied

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Given answer financial accounting question

What is the true answer? ?

None

Chapter 4 Solutions

Principles of Accounting Volume 2

Ch. 4 - Which of the following product situations is...Ch. 4 - A job order costing system is most likely used by...Ch. 4 - Which of the following is a prime cost? A....Ch. 4 - Which of the following is a conversion cost? raw...Ch. 4 - During production, to what are the costs in job...Ch. 4 - Which document lists the inventory that will be...Ch. 4 - Which document shows the cost of direct materials,...Ch. 4 - Which document lists the total direct materials...Ch. 4 - Which document lists the total direct labor used...Ch. 4 - Assigning indirect costs to specific jobs is...

Ch. 4 - In a job order cost system, which account shows...Ch. 4 - In a job order cost system, raw materials...Ch. 4 - In a job order cost system, overhead applied is...Ch. 4 - In a job order cost system, factory wage expense...Ch. 4 - In a job order cost system, utility expense...Ch. 4 - In a job order cost system, indirect labor...Ch. 4 - The activity base for service industries is most...Ch. 4 - A printing company manufactures notebooks of...Ch. 4 - Burnham Industries incurs these costs for the...Ch. 4 - Chocos Chocolates incurs these costs for the...Ch. 4 - How do job order costing and process costing...Ch. 4 - Why are product costs assigned to the product and...Ch. 4 - Is the cost of goods manufactured the same as the...Ch. 4 - From beginning to end, place these items in the...Ch. 4 - How is the predetermined overhead rate determined?Ch. 4 - How is the predetermined overhead rate applied?Ch. 4 - Why are the overhead costs first accumulated in...Ch. 4 - Why is the manufacturing overhead account debited...Ch. 4 - Match the concept on the left to its correct...Ch. 4 - When compared to manufacturing companies, service...Ch. 4 - Little Things manufactures toys. For each item...Ch. 4 - Table 4.3 shows a list of expenses involved in the...Ch. 4 - Burnham Industries incurs these costs for the...Ch. 4 - Marzons records show raw materials Inventory had a...Ch. 4 - Sterlings records show the work in process...Ch. 4 - Logo Gear purchased $2,250 worth of merchandise...Ch. 4 - A company estimates its manufacturing overhead...Ch. 4 - Job order cost sheets show the following costs...Ch. 4 - A new company started production. Job 10 was...Ch. 4 - K company production was working on Job 1 and Job...Ch. 4 - A company has the following transactions during...Ch. 4 - During the month, Job AB2 used specialized...Ch. 4 - Job 113 was completed at a cost of $5,000, and Job...Ch. 4 - A companys Individual job sheets show these costs:...Ch. 4 - A summary of material requisition slips and time...Ch. 4 - Abuah Goods manufactures clothing. For each item...Ch. 4 - Chocos Chocolates incurs the following costs for...Ch. 4 - The table shows a list of expenses involved in the...Ch. 4 - Masonrys records show the raw materials inventory...Ch. 4 - Steinways records show their work in process...Ch. 4 - Langstons purchased $3,100 of merchandise during...Ch. 4 - A company estimates its manufacturing overhead...Ch. 4 - Job order cost sheets show the following costs...Ch. 4 - A new company started production. Job 1 was...Ch. 4 - Inez has the following information relating to Job...Ch. 4 - A company has the following information relating...Ch. 4 - A company has the following transactions during...Ch. 4 - During the month, Job Arch2 used specialized...Ch. 4 - Job 113 was completed at a cost of $7,500, and Job...Ch. 4 - A companys individual job sheets show these costs:...Ch. 4 - A summary of materials requisition slips and time...Ch. 4 - For each item listed, state whether a job order...Ch. 4 - York Company Is a machine shop that estimated...Ch. 4 - Pocono Cement Forms expects $900,000 in overhead...Ch. 4 - Job cost sheets show the following information:...Ch. 4 - Complete the information in the cost computations...Ch. 4 - During the year, a company purchased raw materials...Ch. 4 - Freeman Furnishings has summarized its data as...Ch. 4 - Coops Stoops estimated its annual overhead to be...Ch. 4 - MountaIn Peaks applies overhead on the basis of...Ch. 4 - The actual overhead for a company is $74,539....Ch. 4 - When setting its predetermined overhead...Ch. 4 - The following data summarize the operations during...Ch. 4 - The following events occurred during March for...Ch. 4 - A movie production studio incurred the following...Ch. 4 - For each item listed, state whether a job order...Ch. 4 - Rulers Company is a neon sign company that...Ch. 4 - Event Forms expects $120,000 in overhead during...Ch. 4 - Summary information from a companys job cost...Ch. 4 - Complete the information in the cost computations...Ch. 4 - During the year, a company purchased raw materials...Ch. 4 - Freeman Furnishings has summarized its data as...Ch. 4 - Queen Bees Honey, Inc., estimated its annual...Ch. 4 - Mountain Tops applies overhead on the basis of...Ch. 4 - The actual overhead for a company is $73,175....Ch. 4 - When setting its predetermined overhead...Ch. 4 - The following data summarize the operations during...Ch. 4 - The Following events occurred during March for...Ch. 4 - A leather repair shop incurred the following...Ch. 4 - Can a company use both job order costing and...Ch. 4 - If a job order cost system tracks the direct...Ch. 4 - What are the similarities in calculating the cost...Ch. 4 - If a company bases its predetermined overhead rate...Ch. 4 - How do the job cost sheets act as a subsidiary...Ch. 4 - How is a job order cost system used in a service...

Additional Business Textbook Solutions

Find more solutions based on key concepts

15-18 Societal moral issue: Although enforcement of worker safety in Bangladesh is clearly lax, government offi...

Fundamentals of Management (10th Edition)

Explain how to derive a total expenditures (TE) curve.

Macroeconomics

(Interest rate determination) You’re looking at some corporate bonds issued by Ford, and you are trying to det...

Foundations Of Finance

Consider the sales data for Computer Success given in Problem 7. Use a 3-month weighted moving average to forec...

Operations Management: Processes and Supply Chains (12th Edition) (What's New in Operations Management)

Using the numbers in the preceding question, what is the size of Ectenias labor force? a. 50 b. 60 c. 70 d. 80

Principles of Economics (MindTap Course List)

E8-13 Identifying internal controls

Learning Objective 1

Consider each situation separately. Identify the missi...

Horngren's Accounting (12th Edition)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning  Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Cost Classifications - Managerial Accounting- Fixed Costs Variable Costs Direct & Indirect Costs; Author: Accounting Instruction, Help, & How To;https://www.youtube.com/watch?v=QQd1_gEF1yM;License: Standard Youtube License