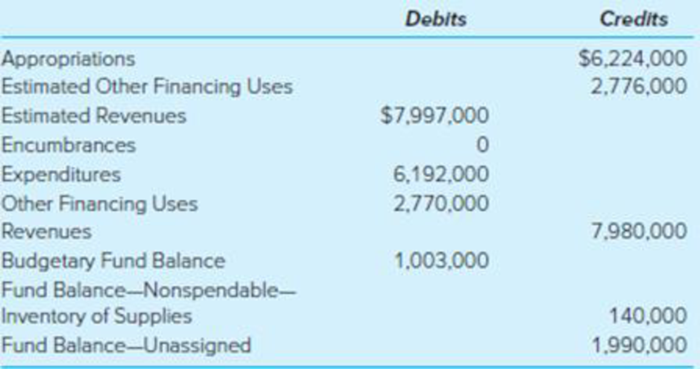

At the end of the current fiscal year, the City of Columbus General Fund pre-adjusted

The City of Columbus uses the purchases method of accounting for its inventory of supplies in the General Fund. The city uses a periodic inventory system in which the amount of inventory used during the year and the amount on hand at the end of the year are determined by a physical inventory. During the year, $220,000 of supplies were purchased and recorded as expenditures. These purchases are included in the final expenditures balance of $6,192,000 shown above. The physical inventory revealed a supplies balance of $152,000 at the end of the fiscal year, an increase of $12,000 from the prior year.

Required

- a. Provide the required

adjusting journal entry (or entries) in the General Fund general journal at the end of the year. - b. Provide the required journal entries in the General Fund general journal to close the operating statement and budgetary accounts at the end of the year.

Want to see the full answer?

Check out a sample textbook solution

Chapter 4 Solutions

Accounting For Governmental & Nonprofit Entities

- cost accountingarrow_forwardA copy machine cost $78,000 when new and has accumulated depreciation of $72,000. Suppose Print and Photo Center sold the machine for $6,000. What is the result of this disposal transaction? Give me Answerarrow_forwardA copy machine cost $78,000 when new and has accumulated depreciation of $72,000. Suppose Print and Photo Center sold the machine for $6,000. What is the result of this disposal transaction?arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education