The City of Castleton’s General Fund had the following post-closing

During the year ended June 30, 2020, the following transactions, in summary form, with subsidiary ledger detail omitted, occurred:

- 1. The budget for FY 2020 provided for General Fund estimated revenues totaling $3,140,000 and appropriations totaling $3,100,000.

- 2. The city council authorized temporary borrowing of $500,000 in the form of a 120-day tax anticipation note. The loan was obtained from a local bank at a discount of 6 percent per annum (debit Expenditures for the discount in the General Fund journal and Expenses—General Government in the governmental activities journal).

- 3. The property tax levy for FY 2020 was recorded. Net assessed valuation of taxable property for the year was $43,000,000, and the tax rate was $5 per $100. It was estimated that 3 percent of the levy would be uncollectible.

- 4. Purchase orders and contracts were issued to vendors and others in the amount of $2,060,000.

- 5. $1,961,000 of current taxes, $103,270 of delinquent taxes, and $3,570 of interest and penalties were collected. The delinquent taxes and associated interest and penalties were collected more than 60 days after the prior year-end.

- 6. Additional interest and penalties on delinquent taxes were accrued in the amount of $3,430, of which 30 percent was estimated to be uncollectible.

- 7. Because of a change in state law, the city was notified that it will receive $80,000 less in intergovernmental revenues than was budgeted.

- 8. Delinquent taxes of $12,792 were deemed uncollectible and written off. The associated interest and penalties of $952 also were written off.

- 9. Total payroll during the year was $819,490. Of that amount, $62,690 was withheld for employees’ FICA tax liability, $103,710 for employees’ federal income tax liability, and $34,400 for state taxes; the balance was paid to employees in cash.

- 10. The employer’s FICA tax liability was recorded for $62,690.

- 11. Revenues from sources other than taxes were collected in the amount of $947,000.

- 12. Amounts due the federal government as of June 30, 2020, and amounts due for FICA taxes and state and federal withholding taxes during the year were vouchered.

- 13. Purchase orders and contracts encumbered in the amount of $1,988,040 were filled at a net cost of $1,987,570, which was vouchered.

- 14. Vouchers payable totaling $2,201,660 were paid after deducting a credit for purchases discount of $8,030 (credit Expenditures).

- 15. The tax anticipation note of $500,000 was repaid.

- 16. All unpaid current year’s property taxes became delinquent. The balances of the current taxes receivables and related uncollectibles were transferred to delinquent accounts. The City uses the 60-day rule for all revenues and does not expect to collect any delinquent property taxes or interest and penalties in the first 60 days of the next fiscal year.

- 17. A physical inventory of materials and supplies at June 30, 2020, showed a total of $9,100. Inventory is recorded using the purchases method in the General Fund; the consumption method is used at the government-wide level. (Note: A periodic inventory system is used both in the General Fund and at the government-wide level. When inventory was purchased during the year, Expenditures were debited in the General Fund journal and Inventory of Supplies was debited in the governmental activities journal.)

Required

- a. Record in general journal form the effect of the above transactions on the General Fund and governmental activities for the year ended June 30, 2020. Do not record subsidiary ledger debits and credits.

- b. Record in general

journal form entries to close the budgetary and operating statement accounts in the General Fund only. Do not close the governmental activities accounts. - c. Prepare a General Fund

balance sheet as of June 30, 2020. - d. Prepare a statement of revenues, expenditures, and changes in fund balance for the year ended June 30, 2020. Do not prepare the government-wide financial statements.

a.

Journalize the given transactions in General Fund and governmental activities in the general journals for the year ended June 30, 2020.

Explanation of Solution

General Fund: The chief operating fund of state and local government used to record the departmental operating activities and government support services is referred to as General Fund, or General Operating Fund, or General Revenue Fund. The activities recorded in General Funds are police, fire, public works, recreation, education, culture, social services, city office, finance, personnel, and data processing.

Journalize the given transactions in General Fund and governmental activities in the general journals for the year ended June 30, 2020.

1.

Entry to record estimated revenues and appropriations:

| General Ledger | |||

| Debits | Credits | ||

| General Fund: | |||

| Estimated Revenues | $3,140,000 | ||

| Appropriations | $3,100,000 | ||

| Budgetary Fund Balance | 40,000 | ||

Table (1)

2.

Entry to record the receipt of temporary borrowing as loan:

| General Ledger | |||

| Debits | Credits | ||

| General Fund: | |||

| Cash | $490,000 | ||

| Expenditures–2020 | $10,000 | ||

| Tax Anticipation Notes Payable | $500,000 | ||

| Governmental Activities: | |||

| Cash | $490,000 | ||

| Expenses–General Government | $10,000 | ||

| Tax Anticipation Notes Payable | $500,000 | ||

Table (2)

Note: The local bank charged 6% discount per year on the temporary borrowing of $500,000 which amounts to $10,000

3.

Entries to record property tax levy:

| General Ledger | |||

| Debits | Credits | ||

| General Fund: | |||

| Taxes Receivable–Current | $2,150,000 | ||

| Allowance for Uncollectible Current Taxes | $64,500 | ||

| Revenues | $2,085,500 | ||

| Governmental Activities: | |||

| Taxes Receivable–Current | $2,150,000 | ||

| Allowance for Uncollectible Current Taxes | $64,500 | ||

| Revenues | $2,085,500 | ||

Table (3)

Working Notes:

Compute gross tax levied.

Compute uncollectible taxes.

4.

Entry to record supplies ordered at an estimated cost:

| General Ledger | |||

| Debits | Credits | ||

| General Fund: | |||

| Encumbrances–2020 | $2,060,000 | ||

| Encumbrances Outstanding–2020 | $2,060,000 | ||

Table (4)

5.

Entry to record collection of delinquent taxes, interest, and penalties:

| General Ledger | |||

| Debits | Credits | ||

| General Fund and Governmental Activities: | |||

| Cash | $2,067,840 | ||

| Taxes Receivable–Current | $1,961,000 | ||

| Taxes Receivable–Delinquent | $103,270 | ||

| Interest and Penalties Receivable on Taxes | $3,570 | ||

| General Fund: | |||

| Deferred Inflows of Resources–Unavailable Revenues | $106,840 | ||

| Revenues | $106,840 | ||

Note: The delinquent taxes and interest and penalties are recorded as Deferred Inflows of Resources–Unavailable Revenues because those taxes are collected after 60-day after the end of prior period.

Table (5)

6.

Entry to record accrued interest and penalties:

| General Ledger | |||

| Debits | Credits | ||

| General Fund: | |||

| Interest and Penalties Receivable on Taxes | $3,430 | ||

| Allowance for Uncollectible Interest and Penalties | $1,029 | ||

| Revenues | $2,401 | ||

| Governmental Activities: | |||

| Interest and Penalties Receivable on Taxes | $3,430 | ||

| Allowance for Uncollectible Interest and Penalties | $1,029 | ||

| General Revenues–Interest and Penalties on Delinquent Taxes | $2,401 | ||

Table (6)

7.

Entry to record decrease in the revenues than was budgeted:

| General Ledger | |||

| Debits | Credits | ||

| General Fund: | |||

| Budgetary Fund Balance | $80,000 | ||

| Estimated Revenues | $80,000 | ||

Table (7)

8.

Entry to record delinquent taxes, interest and penalties as uncollectible and written off:

| General Ledger | |||

| Debits | Credits | ||

| General Fund and Governmental Activities: | |||

| Allowance for Uncollectible Delinquent Taxes | $12,792 | ||

| Allowance for Uncollectible Interest and Penalties | $952 | ||

| Taxes Receivable–Delinquent | $12,792 | ||

| Interest and Penalties Receivable on Taxes | $952 | ||

Table (8)

9.

Entry to record payment of payroll taxes:

| General Ledger | |||

| Debits | Credits | ||

| General Fund: | |||

| Expenditures–2020 | $819,490 | ||

| Due to Federal Government | $166,400 | ||

| Due to State Government | $34,400 | ||

| Cash | $618,690 | ||

| Governmental Activities: | |||

| Expenses | $819,490 | ||

| Due to Federal Government | $166,400 | ||

| Due to State Government | $34,400 | ||

| Cash | $618,690 | ||

Table (9)

10.

Entry to record employer’s FICA tax liability:

| General Ledger | |||

| Debits | Credits | ||

| General Fund: | |||

| Expenditures–2020 | $62,690 | ||

| Due to Federal Government | $62,690 | ||

| Governmental Activities: | |||

| Expenses | $62,690 | ||

| Due to Federal Government | $62,690 | ||

Table (10)

11.

Entry to record revenues other than taxes:

| General Ledger | |||

| Debits | Credits | ||

| General Fund: | |||

| Cash | $947,000 | ||

| Revenues | $947,000 | ||

| Governmental Activities: | |||

| Cash | $947,000 | ||

| Revenues (program or general) | $947,000 | ||

Table (11)

12.

Entry to record FICA and state and federal withholding taxes:

| General Ledger | |||

| Debits | Credits | ||

| General Fund and Governmental Activities: | |||

| Due to Federal Government | $258,580 | ||

| Due to State Government | $34,400 | ||

| Vouchers Payable | $292,980 | ||

Table (12)

13.

Entry to record purchase orders encumbered:

| General Ledger | |||

| Debits | Credits | ||

| General Fund: | |||

| Encumbrances Outstanding–2020 | $1,988,040 | ||

| Encumbrances–2020 | $1,988,040 | ||

| Expenditures–2020 | $1,987,570 | ||

| Vouchers Payable | $1,987,570 | ||

| Governmental Activities: | |||

| Expenses | $1,987,570 | ||

| Vouchers Payable | $1,987,570 | ||

Table (13)

14.

Entry to record payment of vouchers payable:

| General Ledger | |||

| Debits | Credits | ||

| General Fund: | |||

| Vouchers Payable | $2,201,660 | ||

| Cash | $2,193,630 | ||

| Expenditures–2020 | $8,030 | ||

| Governmental Activities: | |||

| Vouchers Payable | $2,201,660 | ||

| Cash | $2,193,630 | ||

| Expenses | $8,030 | ||

Table (14)

15.

Entry to record the repayment of the tax anticipation notes:

| General Ledger | |||

| Debits | Credits | ||

| General Fund and Governmental Activities: | |||

| Tax Anticipation Notes Payable | $500,000 | ||

| Cash | $500,000 | ||

Table (15)

16.

Entries to record reclassification of uncollected taxes as delinquent taxes:

| General Ledger | |||

| Debits | Credits | ||

| General Fund and Governmental Activities: | |||

| Taxes Receivable–Delinquent | $189,000 | ||

| Allowance for Uncollectible Current Taxes | $64,500 | ||

| Taxes Receivable–Current | $189,000 | ||

| Allowance for Uncollectible Delinquent Taxes | $64,500 | ||

| General Fund: | |||

| Revenues | $126,901 | ||

| Deferred Inflows of Resources–Unavailable Revenues | $126,901 | ||

Table (16)

Note: The uncollected taxes amount to $189,000

17.

Entry to record the repayment of the tax anticipation notes:

| General Ledger | |||

| Debits | Credits | ||

| General Fund: | |||

| Inventory Supplies | $3,000 | ||

| Fund Balance–Nonspendable–Inventory of Supplies | $3,000 | ||

Table (17)

b.

Prepare journal entries to close budgetary and operating statement accounts in the General Fund.

Explanation of Solution

Prepare journal entries to close budgetary and operating statement accounts in the General Fund.

| General Ledger | |||

| Debits | Credits | ||

| General Fund: | |||

| Appropriations | $3,100,000 | ||

| Estimated Revenues | $3,060,000 | ||

| Budgetary Fund Balance | $40,000 | ||

| Revenues | $3,014,840 | ||

| Expenditures–2020 | $2,871,720 | ||

| Fund Balance–Unassigned | $143,120 | ||

Table (18)

c.

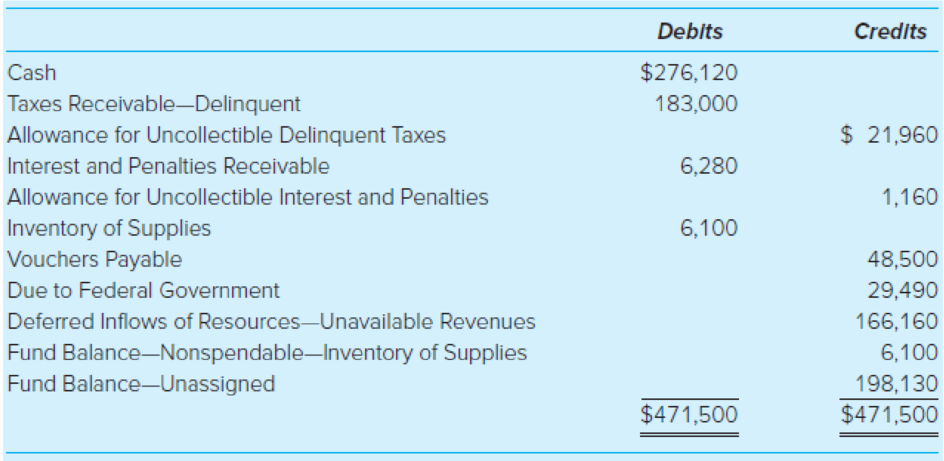

Prepare General Fund balance sheet of City C as of June 30, 2020.

Explanation of Solution

General Fund balance sheet: This is the financial statement that reports the financial position of the General Fund, and includes the sections assets, liabilities, deferred inflows of resources, and fund balances.

Prepare General Fund balance sheet of City C as of June 30, 2020.

| City C | ||

| General Fund Balance Sheet | ||

| As of June 30, 2020 | ||

| Assets | ||

| Cash | $468,640 | |

| Taxes receivable–Delinquent | $255,938 | |

| Less: Allowance for uncollectible taxes–Delinquent | $73,668 | $182,270 |

| Interest and penalties receivable | $5,188 | |

| Less: Allowance for uncollectible interest and penalties | $1,237 | $3,951 |

| Inventory of supplies | $9,100 | |

| Total Assets | $663,961 | |

| Liabilities, Deferred Inflows of Resources and Fund Balances | ||

| Liabilities and deferred inflows of resources: | ||

| Vouchers payable | $127,390 | |

| Deferred inflows of resources–Unavailable revenues | $186,221 | |

| Total liabilities and deferred inflows of resources | $313,611 | |

| Fund balances: | ||

| Nonspendable–inventory of supplies | $9,100 | |

| Unassigned | $341,250 | |

| Total fund balances | $350,350 | |

| Total liabilities, deferred inflows of resources, and fund balances | $663,961 | |

Table (19)

d.

Prepare a statement of revenues, expenditures, and changes in fund balance of General Fund for City C for the year ended June 30, 2020.

Explanation of Solution

Statement of revenues, expenditures, and changes in fund balance: This is the operating statement that accounts for the revenues and expenditures, and changes in the fund balances of the governmental funds.

Prepare a statement of revenues, expenditures, and changes in fund balance of General Fund for City C for the year ended June 30, 2020.

| City C | |

| Statement of Revenues, Expenditures, and Changes in Fund Balance | |

| For the Year Ended June 30, 2020 | |

| Revenues | |

| Taxes | $2,064,270 |

| Interest and penalties on taxes | 3,570 |

| Other sources | 947,000 |

| Total Revenues | $3,014,840 |

| Expenditures | |

| Salaries and wages | $882,180 |

| Interest on note payable | 10,000 |

| Other | 1,979,540 |

| Total Expenditures | $2,871,720 |

| Excess (deficiency) of revenues over expenditures | 143,120 |

| Increase in inventory of supplies | 3,000 |

| Fund balances–January 1, 2020 | 204,230 |

| Fund Balances–December 31, 2020 | $350,350 |

Table (20)

Want to see more full solutions like this?

Chapter 4 Solutions

Accounting For Governmental & Nonprofit Entities

- Calculate the asset turnover for the year 2016 of this general accounting questionarrow_forwardWhat is the unit contribution margin of this general accounting question?arrow_forwardHow much cash is received for accrued interest on May 1 by the bond issuer on these financial accounting question?arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education