Accounting For Governmental & Nonprofit Entities

18th Edition

ISBN: 9781259917059

Author: RECK, Jacqueline L., Lowensohn, Suzanne L., NEELY, Daniel G.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 4, Problem 17.5EP

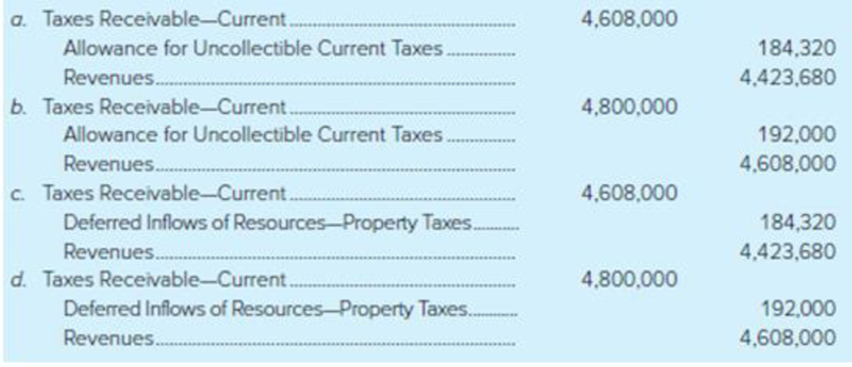

Garden City has calculated that General Fund property tax revenues of $4,608,000 are required for the current fiscal year. Over the past several years, the city has collected 96 percent of all property taxes levied. The city levied property taxes in the amount that will generate the required $4,608,000. Which of the following general

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

What is value of retained earning

Accounts receivable:4750, Accounts payable:3050

Give me correct answer this general accounting question

Chapter 4 Solutions

Accounting For Governmental & Nonprofit Entities

Ch. 4 - Last month a local government collected property...Ch. 4 - When preparing the statement or schedule of...Ch. 4 - Prob. 3QCh. 4 - Prob. 4QCh. 4 - If the General Fund of a certain city needs...Ch. 4 - Prob. 6QCh. 4 - Explain why some governments may account for...Ch. 4 - Prob. 8QCh. 4 - Prob. 9QCh. 4 - Prob. 10Q

Ch. 4 - A government reports Deferred Inflows of...Ch. 4 - Prob. 13CCh. 4 - Prob. 15CCh. 4 - Choose the best answer. When equipment is...Ch. 4 - Prob. 17.2EPCh. 4 - Goods for which a purchase order had been placed...Ch. 4 - Prob. 17.4EPCh. 4 - Garden City has calculated that General Fund...Ch. 4 - Prob. 17.6EPCh. 4 - Prob. 17.7EPCh. 4 - Prob. 17.8EPCh. 4 - Carroll City levies 200,000 of property taxes for...Ch. 4 - Prob. 17.10EPCh. 4 - During the current year, the City of Hickory Hills...Ch. 4 - On July 1, 2020, the beginning of its fiscal year,...Ch. 4 - Prob. 20EPCh. 4 - Prob. 21EPCh. 4 - At the end of the current fiscal year, the City of...Ch. 4 - The City of Waterville applied for a grant from...Ch. 4 - The following transactions occurred during the...Ch. 4 - The following transactions affected various funds...Ch. 4 - The following events and transactions relate to...Ch. 4 - The City of Castletons General Fund had the...Ch. 4 - Prob. 28EP

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Hi experts please provide solution this general accounting questionarrow_forwardOn July 1, Archer Ltd. has retained earnings of $45,320. Revenues for July were $8,250. Expenses for July were $3,140. In July, the company paid out a total of $1,120 in dividends to its shareholders. What is the value of retained earnings on July 31?arrow_forwardWhich inventory costing method is prohibited under IFRS? a) FIFO b) Weighted average c) LIFO d) Specific identificationarrow_forward

- What is the value of the retained earning account at the end of the year?arrow_forwardA company sold office furniture costing $12,700 with accumulated depreciation of $10,150 for $2,200 cash. The entry to record the sale would include a gain or loss of what amount?arrow_forwardLattimer enterprises reported the following information for the year please answer the general accounting questionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education

How to Calculate your Income Tax? Step-by-Step Guide for Income Tax Calculation; Author: ETMONEY;https://www.youtube.com/watch?v=QdJKpSXCYmQ;License: Standard YouTube License, CC-BY

How to Calculate Federal Income Tax; Author: Edspira;https://www.youtube.com/watch?v=2LrvRqOEYk8;License: Standard Youtube License