Principles of Cost Accounting

17th Edition

ISBN: 9781305087408

Author: Edward J. Vanderbeck, Maria R. Mitchell

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 4, Problem 18P

Phillips Products, Inc. had a remaining credit balance of $10,000 in its under- and overapplied factory

Required:

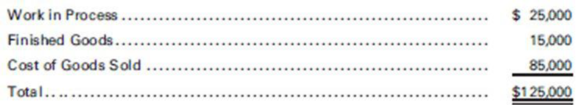

- 1. Prepare the closing entry for the $10,000 of overapplied overhead, assuming that the balance is not considered to be material.

- 2. Prepare the closing entry for the $10,000 of overapplied overhead, assuming that the balance is considered to be material.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

The manufacturing overhead cost for the current year will be?

The predetermined manufacturing overhead rate per direct labor hour is?

Direct materials purchase in November is

Chapter 4 Solutions

Principles of Cost Accounting

Ch. 4 - What are factory overhead expenses, and what...Ch. 4 - What are three categories of factory overhead...Ch. 4 - What are the distinguishing characteristics of...Ch. 4 - When a products cost is composed of fixed and...Ch. 4 - What effect does a change in volume have on total...Ch. 4 - Distinguish between a step-variable cost and a...Ch. 4 - What is the basic premise underlying the high-low...Ch. 4 - What are the advantages and disadvantages of the...Ch. 4 - Differentiate between an independent variable and...Ch. 4 - Prob. 10Q

Ch. 4 - What is a flexible budget, and how can management...Ch. 4 - How does accounting for factory overhead differ in...Ch. 4 - What is the function and use of each of the two...Ch. 4 - What are two types of departments found in a...Ch. 4 - What are the two most frequently used methods of...Ch. 4 - When using the sequential distribution method of...Ch. 4 - When using the sequential distribution method of...Ch. 4 - Is it possible to close the total factory overhead...Ch. 4 - What are the shortcomings of waiting until the...Ch. 4 - What are the two types of budget data needed to...Ch. 4 - Prob. 21QCh. 4 - What factory operating conditions and data are...Ch. 4 - Prob. 23QCh. 4 - How does activity-based costing differ from...Ch. 4 - What steps must a company take to successfully...Ch. 4 - What is the relationship between activity-based...Ch. 4 - Prob. 27QCh. 4 - Prob. 28QCh. 4 - If the factory overhead control account has a...Ch. 4 - Prob. 30QCh. 4 - Classify each of the following items of factory...Ch. 4 - Ames Automotive Company has accumulated the...Ch. 4 - Prob. 3ECh. 4 - Using the data in E4-2 and spreadsheet software,...Ch. 4 - El Paso Products Company has accumulated the...Ch. 4 - Computing unit costs at different levels of...Ch. 4 - Identifying basis for distribution of service...Ch. 4 - A manufacturing company has two service and two...Ch. 4 - A manufacturing company has two service and two...Ch. 4 - Compute the total job cost for each of the...Ch. 4 - Classify each of the following items of factory...Ch. 4 - Job 25AX required 5,000 for direct materials,...Ch. 4 - Job 19AB required 10,000 for direct materials,...Ch. 4 - Match each of the following cost pools with the...Ch. 4 - The books of Petry Products Co. revealed that the...Ch. 4 - The general ledger of Lawson Lumber Co. contains...Ch. 4 - Nelson Fabrication Inc. had a remaining credit...Ch. 4 - Housley Paints Co. had a remaining debit balance...Ch. 4 - The cost behavior patterns below are lettered A...Ch. 4 - Miller Minerals Co. manufactures a product that...Ch. 4 - Scattergraph method Using the data in P4-2 and a...Ch. 4 - Using the data in P4-2 and Microsoft Excel: 1....Ch. 4 - Listed below are the budgeted factory overhead...Ch. 4 - Menlo Materials is divided into five departments,...Ch. 4 - Distribution of service department costs to...Ch. 4 - Journalizing the distribution of service...Ch. 4 - Channel Products Inc. uses the job order cost...Ch. 4 - Determining job costcalculation of predetermined...Ch. 4 - Focus Fabrication Co. uses ABC. The factory...Ch. 4 - Mansfield Manufacturing Co. uses ABC. The factory...Ch. 4 - Hughes Products Inc. uses a job order cost system....Ch. 4 - Abbey Products Company is studying the results of...Ch. 4 - The following information, taken from the books of...Ch. 4 - Rockford Company has four departmental accounts:...Ch. 4 - Luna Manufacturing Inc. completed Job 2525 on May...Ch. 4 - Phillips Products, Inc. had a remaining credit...Ch. 4 - Nathan Industries had a remaining debit balance of...Ch. 4 - Chrome Solutions Company manufactures special...Ch. 4 - Activity-based Costing

Video Options Ltd....

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Hello tutor please provide this question solution general accountingarrow_forwardPlease help me correct my mistakes. for the T account of 2022 and 2023, the ONLY options for accounts names are blank, bad debt expense, collections, credit sales and write offs Jayco Inc. started its operations in 2022. Its sales during 2022, all on account, totalled $700,000. The company collected $500,000 in cash from customers during the year and wrote off $8,000 in uncollectible accounts. The company set up an allowance for doubtful accounts at December 31, 2022, its fiscal year-end, and determined the account balance to be $14,000. The unadjusted balances of selected accounts at December 31, 2023 are as follows: Accounts receivable $ 300,000 Allowance for doubtful accounts (debit) 10,000 Sales revenue (including 80 percent in sales on account) 800,000 Aging of the accounts receivable on December 31, 2023, resulted in an estimate of $11,000 in potentially uncollectible accounts. Required: 1. Prepare the journal entries to record all the…arrow_forward4 PTSarrow_forward

- The magnitude of operating leverage for Roshan Enterprises is 3.2 when sales are $200,000 and net income is $40,000. If sales decrease by 5%, net income is expected to decrease by what amount?arrow_forwardWant to this question answer general Accountingarrow_forwardSelby Industries has a standard requirement of 4 direct labor hours for each unit produced and pays $12 per hour. During the last month, the company produced 1,200 units of its product and paid a total of $60,480 in direct labor wages. The labor efficiency variance was $720 favorable. What was the direct labor rate variance? Helparrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:9781285866307

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:9781337119207

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY