Concept explainers

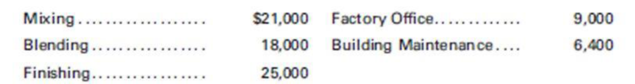

Menlo Materials is divided into five departments, Mixing, Blending, Finishing, Factory Office, and Building Maintenance. The first three departments are engaged in production work. Factory Office and Building Maintenance are service departments. During the month of June, the following factory

The bases for distributing service department expenses to the other departments follow:

Building Maintenance–On the basis of floor space occupied by the other departments as follows: Mixing. 10,000 sq ft; Blending. 4,500 sq ft; Finishing, 10,500 sq ft; and Factory Office. 7,000 sq ft.

Factory Office–On the basis of number of employees as follows: Mixing, 30; Blending, 20; and Finishing, 50.

Required:

Prepare a schedule showing the distribution of the service departments’ expenses using the direct distribution method.

Trending nowThis is a popular solution!

Chapter 4 Solutions

Principles of Cost Accounting

- Please provide the solution to this general accounting question using proper accounting principles.arrow_forwardPlease provide the correct answer to this general accounting problem using accurate calculations.arrow_forwardI am looking for help with this general accounting question using proper accounting standards.arrow_forward

- I am looking for help with this general accounting question using proper accounting standards.arrow_forwardI need help finding the accurate solution to this general accounting problem with valid methods.arrow_forwardCan you explain this general accounting question using accurate calculation methods?arrow_forward

- Can you explain this general accounting question using accurate calculation methods?arrow_forwardPlease provide the correct answer to this general accounting problem using accurate calculations.arrow_forwardI am looking for help with this general accounting question using proper accounting standards.arrow_forward

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub