Use the following information for P4—17 and P4—18:

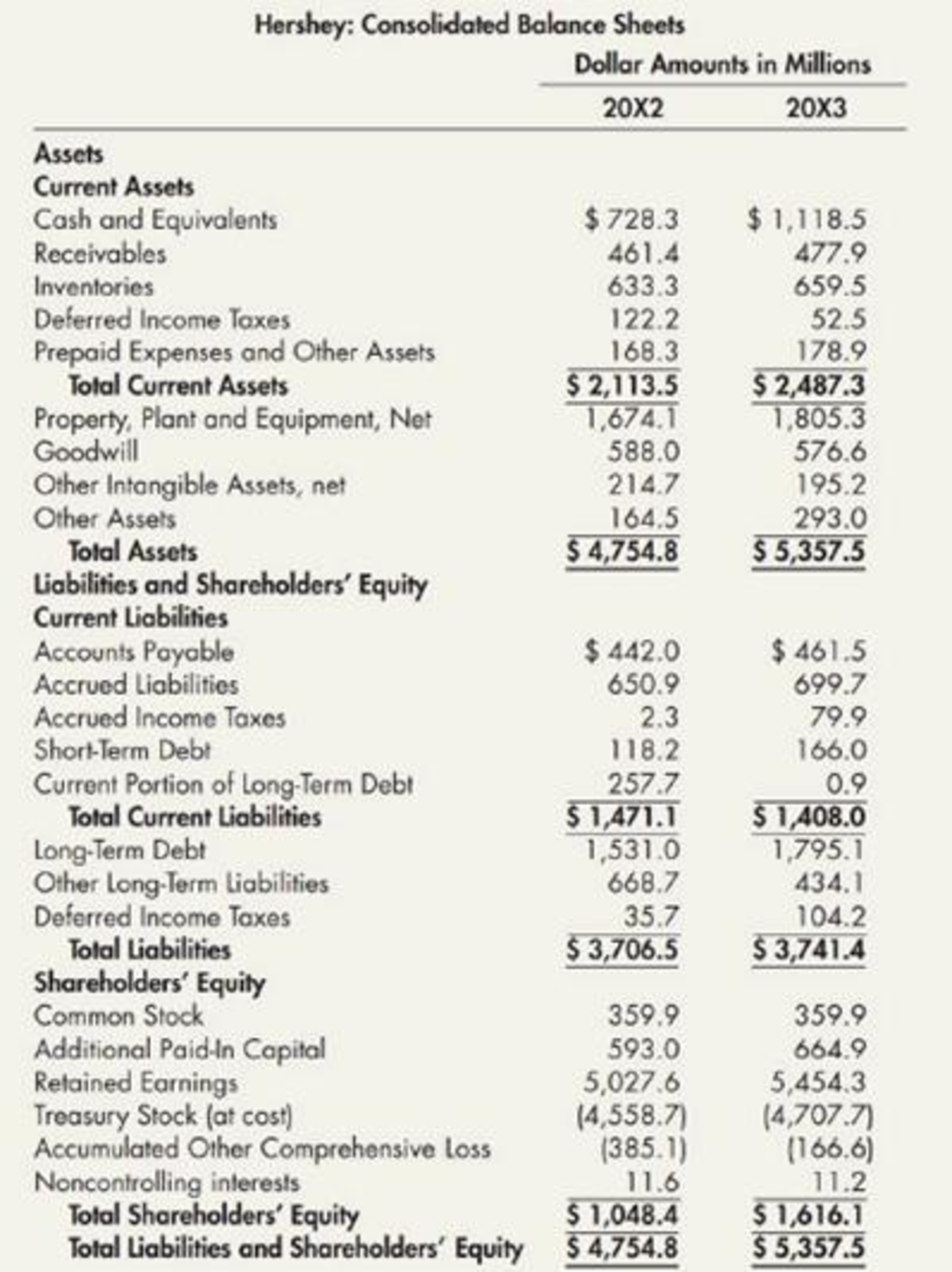

The Hershey Company is one of the world’s leading producers of chocolates, candies, and confections. It sells chocolates and candies, mints and gums, baking ingredients, toppings, and beverages. Hershey’s consolidated

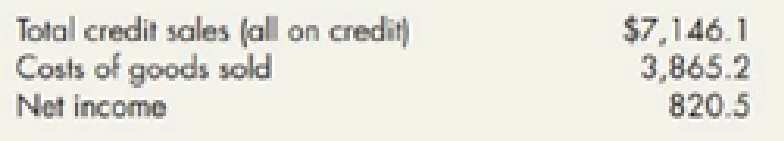

Ratios Analysis: Hershey Refer to the information for Hershey On the preceding page. Additional information for 20X3 is as follows (amounts in millions):

Required:

Next Level Compute the following ratios for 20X3. Provide a brief description of what each ratio reveals about Hershey.

- 1. return on common equity

- 2. debt-to-assets

- 3. debt-to-equity

- 4. current

- 5. quick (Hershey uses cash and equivalents, short terms securities, and receivables in their quick ratio calculation.)

- 6. inventory turnover days

- 7.

accounts receivable turnover days - 8. accounts payable turnover days

- 9. operating cycle (in days)

- 10. total asset turnover

Requirement 1:

Determine the return on common equity ratio of Company H for 20X3.

Explanation of Solution

Determine the return on common equity ratio of Company H for 20X3:

Step 1: Calculate the average total common stockholders’ equity.

Step 2: Calculate the return on common equity ratio of C&C Incorporation for 20X3.

Hence, the return on common equity ratio of Company H for 20X3 is 0.616.

Comment:

Return on common equity ratio indicates that Company H generated a 61.6% return for its common shareholders.

Requirement 2:

Determine the debt-to-assets ratio of Company H for 20X3.

Explanation of Solution

Determine the debt-to-assets ratio of Company H for 20X3:

Hence, the debt-to-assets ratio of Company H for 20X3 is 0.698.

Comment:

Debt-to-assets ratio indicates that Company H’s 69.8% of total assets are financed by its creditors.

Requirement 3:

Determine the debt-to-equity ratio of Company H for 20X3.

Explanation of Solution

Determine the debt-to-equity ratio of Company H for 20X3:

Hence, the debt-to- equity ratio of Company H for 20X3 is 2.32.

Comment:

Debt-to-assets ratio indicates that Company H has $2.32 in total liabilities for every of $1.00 in equity.

Requirement 4:

Determine the current ratio of Company H for 20X3.

Explanation of Solution

Determine the current ratio of Company H for 20X3:

Hence, the current ratio of Company H for 20X3 is 1.77.

Comment:

Current ratio indicates that Company H has $1.77 in current assets for every of $1.00 in current liabilities.

Requirement 5:

Determine the quick ratio of Company H for 20X3.

Explanation of Solution

Determine the quick ratio of Company H for 20X3:

Hence, the quick ratio of Company H for 20X3 is 1.13.

Comment:

Quick ratio indicates that Company H has $1.13 in quick assets (cash and receivables) for every of $1.00 in current liabilities.

Requirement 6:

Determine the inventory turnover in days of Company H for 20X3.

Explanation of Solution

Determine the inventory turnover in days of Company H for 20X3:

Step 1: Calculate the average inventory.

Step 2: Calculate the inventory turnover.

Step 3: Calculate the inventory turnover in days of C&C Incorporation for 20X3.

Hence, the inventory turnover days of Company H for 20X3 are 61 days.

Comment:

On an average Company H takes 61 days to convert inventory into sales in the operation cycle.

Requirement 7:

Determine the accounts receivable turnover in days of Company H for 20X3.

Explanation of Solution

Determine the accounts receivable turnover in days of Company H for 20X3:

Step 1: Calculate the average accounts receivable.

Step 2: Calculate the accounts receivable turnover.

Step 3: Calculate the accounts receivable turnover in days of C&C Incorporation for 20X3.

Hence, the accounts receivable turnover days of Company H for 20X3 are 24 days.

Comment:

On an average Company H takes 24 days to collect its receivables from its customers.

Requirement 8:

Determine the accounts payable turnover in days of Company H for 20X3.

Explanation of Solution

Determine the accounts payable turnover in days of Company H for 20X3.

Step 1: Determine the amount of inventory purchases.

Step 2: Calculate the average accounts payable.

Step 3: Calculate the accounts payable turnover.

Step 4: Determine the accounts payable turnover in days.

Hence, the accounts payable turnover in days of Company H for 20X3 is 42 days.

Comment:

On an average Company H takes 42 days to pay its payables to its suppliers.

Requirement 9:

Determine the operating cycle in days of Company H for 20X3.

Explanation of Solution

Determine the operating cycle in days of Company H for 20X3:

Hence, the operating cycle in days of Company H for 20X3 is 43 days.

Comment:

Company H takes 43days to complete an operating cycle (the purchase of inventory and collection of cash from accounts receivable).

Requirement 10:

Determine the total assets turnover ratio of Company H for 20X3.

Explanation of Solution

Determine the total assets turnover ratio of Company H for 20X3:

Step 1: Calculate average total assets.

Step 2: Calculate the total assets turnover ratio of C&C Incorporation for 20X3.

Hence, the total assets turnover ratio of Company H for 20X3 is 1.41.

Comment:

Total assets turnover ratio indicates that Company H has generated $1.41 in sales for every of $1.00 in assets

Want to see more full solutions like this?

Chapter 4 Solutions

Intermediate Accounting: Reporting And Analysis

- ??!!!arrow_forwardPlug Products owns 80 percent of the stock of Spark Filter Company, which it acquired at underlying book value on August 30, 20X6. At that date, the fair value of the noncontrolling interest was equal to 20 percent of the book value of Spark Filter. Summarized trial balance data for the two companies as of December 31, 20X8, are as follows: Plug Products Spark Filter Company Credit Debit Credit Debit Cash and Accounts Receivable $ 146,000 $ 95,000 Inventory 236,000 119,000 Buildings and Equipment (net) 288,000 187,000 Investment in Spark Filter Company 267,789 Cost of Goods Sold 172,000 137,000 Depreciation Expense 40,000 30,000 Current Liabilities $ 170,147 $ 53,947 Common Stock 192,000 73,000 Retained Earnings 460,000 216,000 Sales 275,053 225,053 Income from Spark Filter Company 52,589 Total $ 1,149,789 $ 1,149,789 $ 568,000 $ 568,000 On January 1, 20X8, Plug's inventory contained filters purchased…arrow_forwardGeneral Accountingarrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning