Comprehensive:

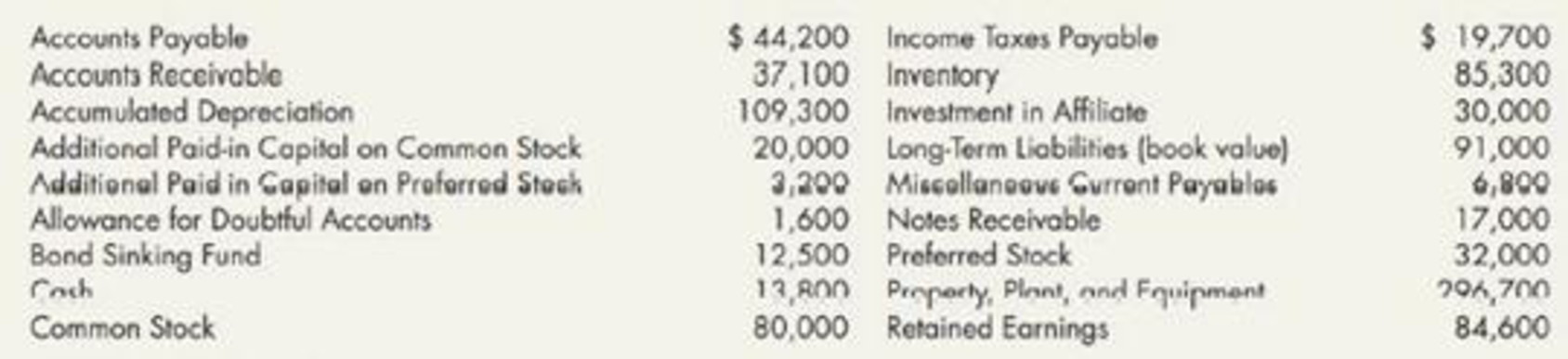

Additional information:

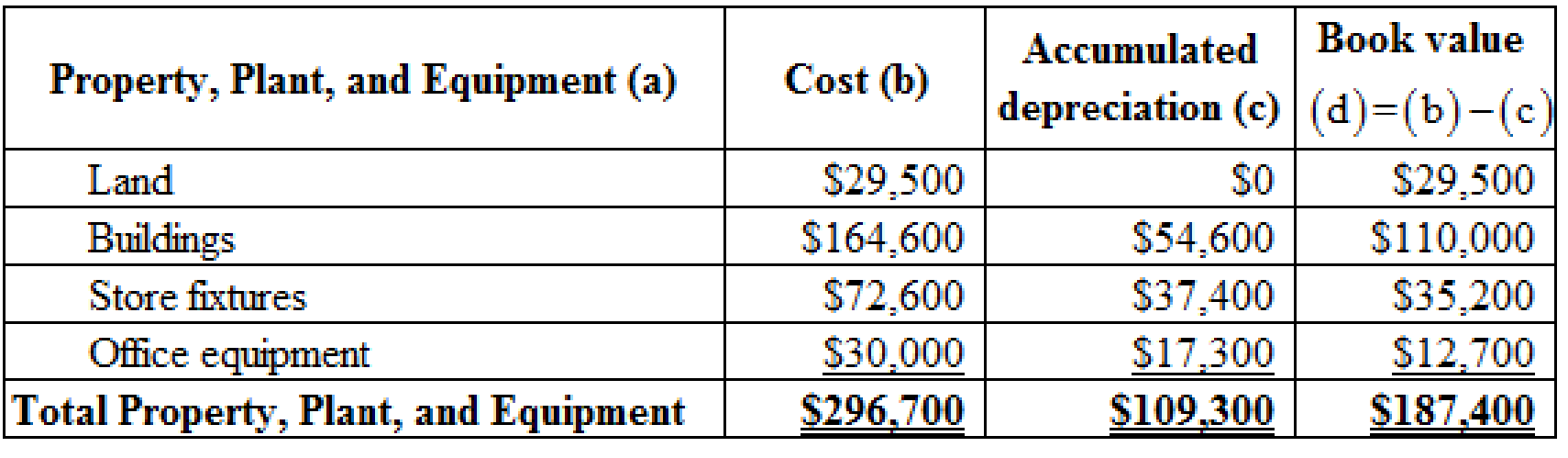

- 1. The company reports on the balance sheet the net book value of property and equipment and long-term liabilities (known as control accounts). The related details are disclosed in the notes.

- 2. The straight-line method is used to

depreciate property and equipment based upon cost, estimated residual value, and estimated life. The costs of the assets in this account are: land, $29,500; buildings, $164,600; store fixtures, $72,600; and office equipment, $30,000. - 3. The

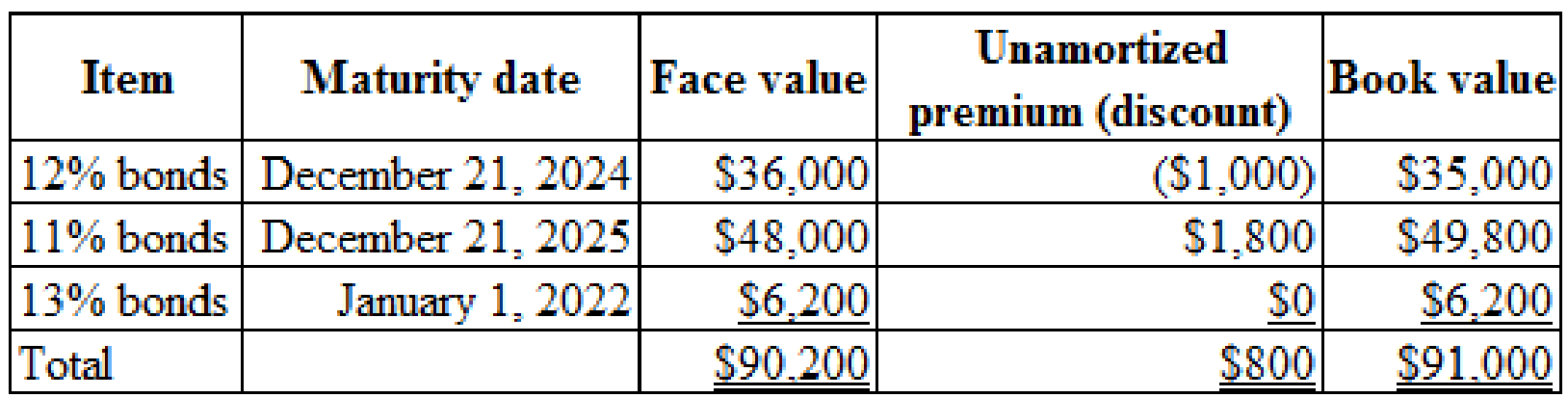

accumulated depreciation breakdown is as follows: buildings, $54,600; store fixtures, $37,400; and office equipment, $17,300. - 4. The long term debt includes 12%, $36,000 face

value bonds that mature on December 31, 2024, and have an unamortized bond discount of $1,000; 11%, $48,000 face value bonds that mature on December 31, 2025, have a premium on bonds payable of $1,800, and whose retirement is being funded by a bond sinking fund; and a 13% note payable that has a face value of $6,200 and matures on January 1, 2022. - 5. The non-interest-bearing note receivable matures on June 1, 2023.

- 6. Inventory is listed at lower of cost or market; cost is determined on the basis of average cost.

- 7. The investment in affiliate is carried at cost. The company has guaranteed the interest on 12%, $50,000, 15-year bonds issued by this affiliate, Jay Company.

- 8. Common stock has a $10 par value per share, 10,000 shares are authorized, and 1,000 shares were issued during 2019 at a price of $13 per share, resulting in 8,000 shares issued at year-end.

- 9.

Preferred stock has a $50 par value per share, 2,000 shares are authorized, and 140 shares were issued during 2019 at a price of $55 per share, resulting in 640 shares issued at year-end. - 10. On January 15, 2020, before the December 31, 2019, balance sheet was issued, a building with a cost of $20,000 and a book value of $7,000 was totally destroyed. Insurance proceeds will amount to only $5,000.

- 11. Net income and dividends declared and paid during the year were $50,500 and $21,000, respectively.

Required:

1. Prepare Stone Boat’s December 31, 2019, balance sheet (including appropriate parenthetical notations).

2. Prepare a statement of shareholders’ equity for 2019. (Hint: Work back from the ending account balances.)

3. Prepare notes that itemize the balance sheet control accounts and those necessary to disclose any company accounting policies,

4. Next Level Compute the debt-to-assets ratio at the cud of 2019. What is your evaluation of this ratio if it was 39% at the end of 2018?

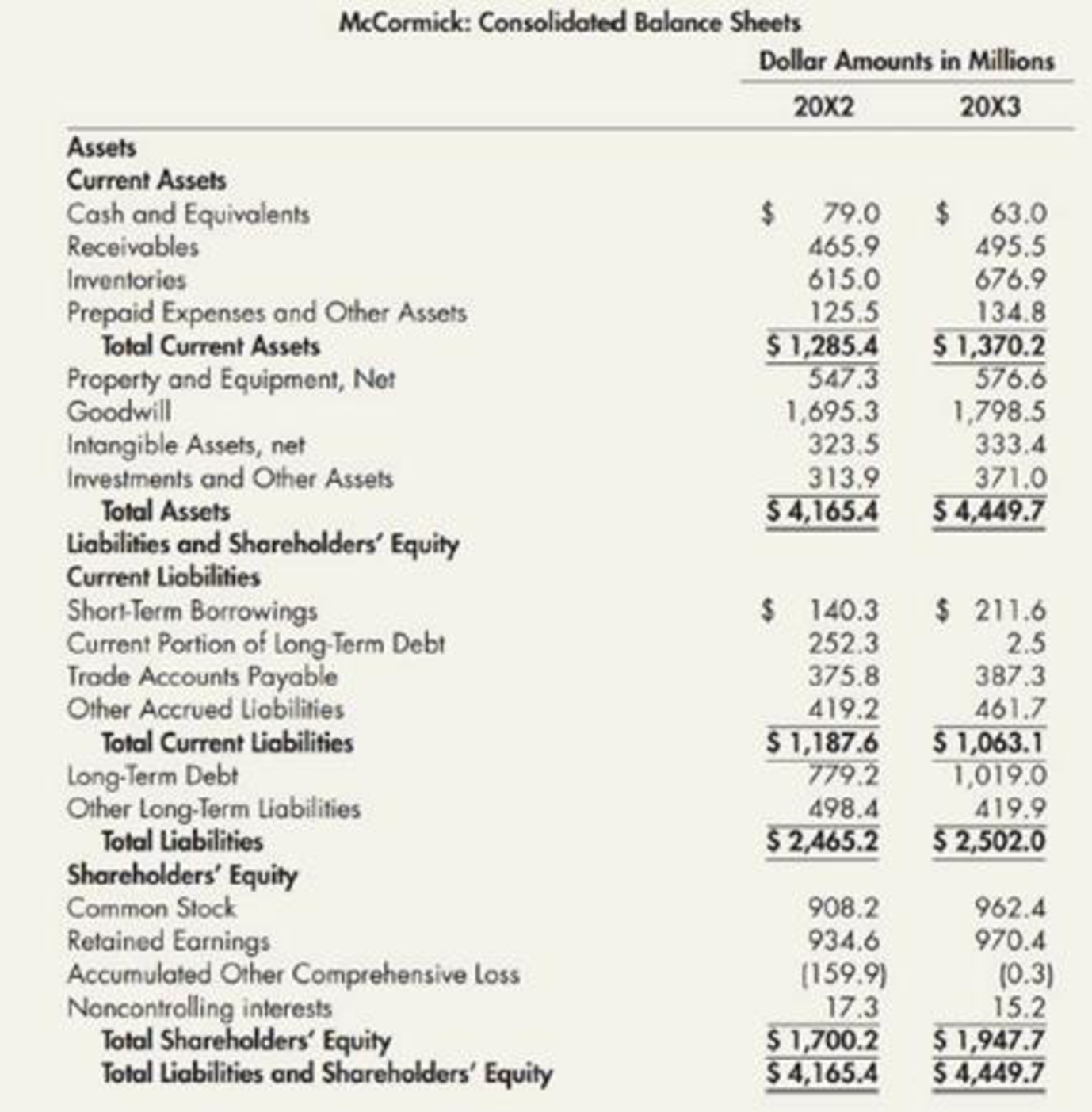

Use the following information for P4–15 and P4–16:

McCormick & Company, Inc. is one of the world’s leading producers of spices, herbs, seasonings, condiments, and other flavorings for foods. Its products are sold to consumers, with sonic of the leading brands of spices and seasonings, as well as to industrial producers of foods. McCormick’s consolidated balance sheets for 20X2 and 20X3 follow.

1.

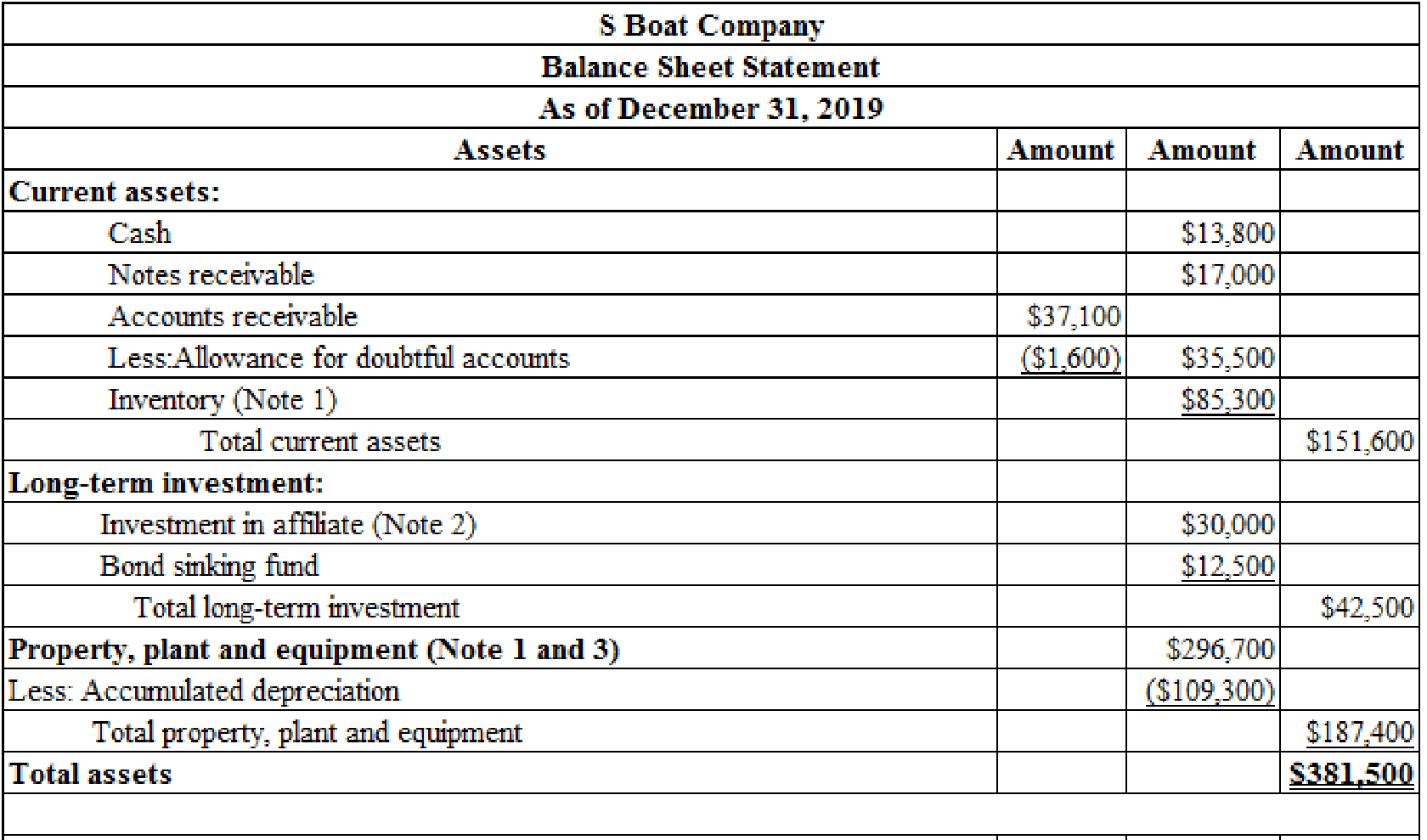

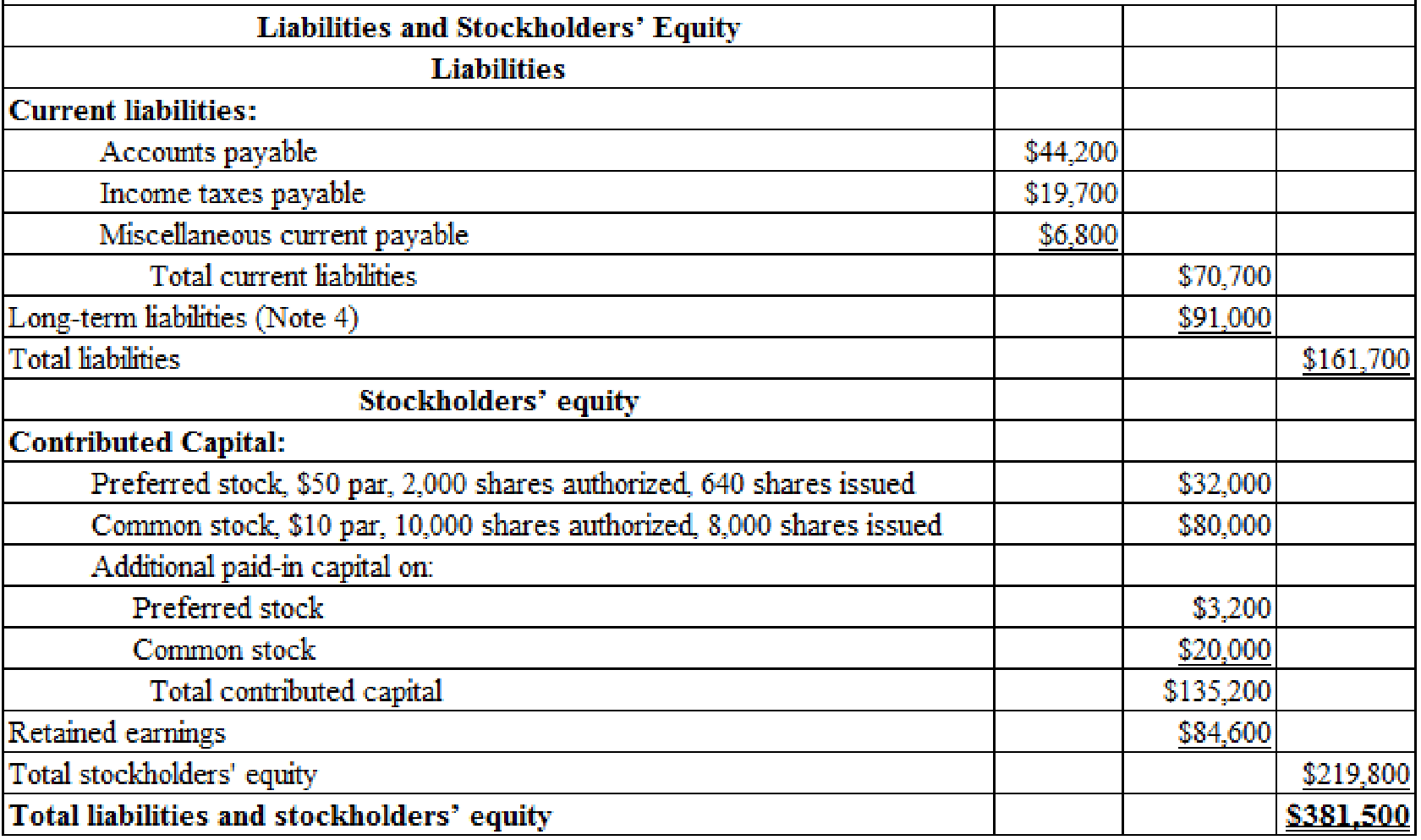

Prepare a balance sheet for S Boat Company as of December 31, 2019.

Explanation of Solution

Balance sheet: This financial statement reports a company’s resources (assets) and claims of creditors (liabilities) and stockholders (stockholders’ equity) over those resources. The resources of the company are assets which include money contributed by stockholders and creditors. Hence, the main elements of the balance sheet are assets, liabilities, and stockholders’ equity.

Prepare a balance sheet for S Boat Company as of December 31, 2019:

Table (1)

2

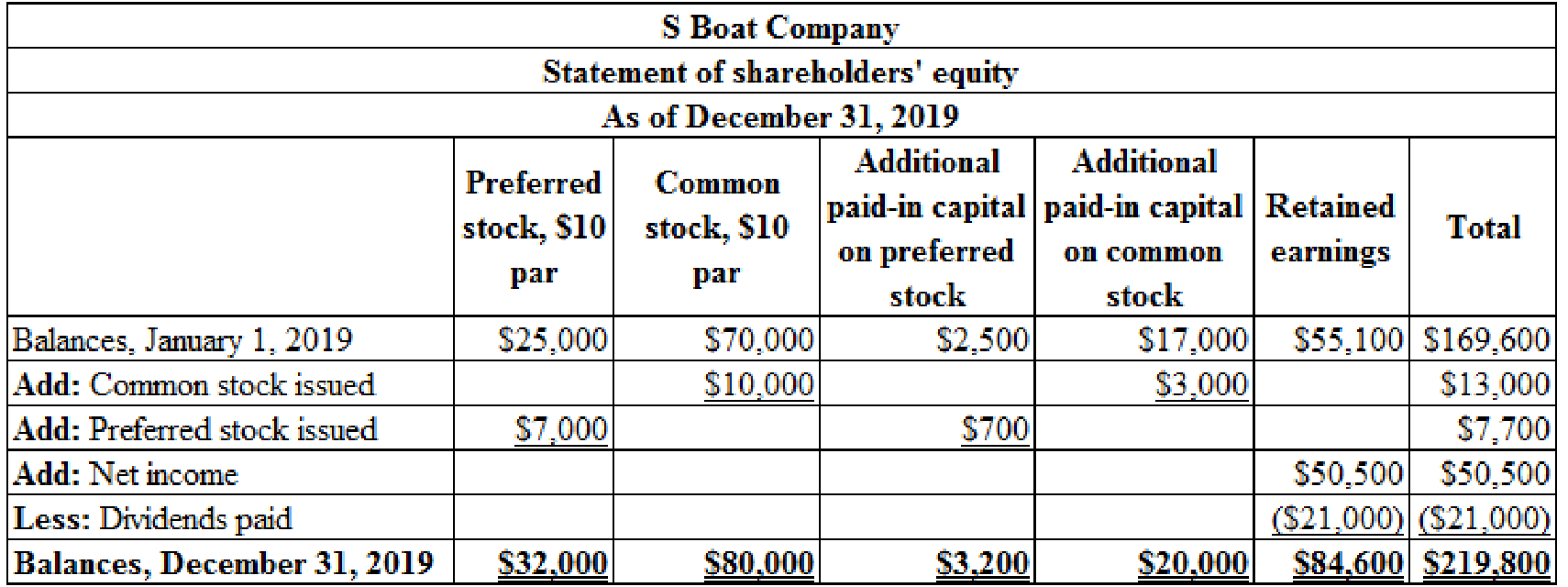

Prepare a statement of shareholders’ equity for the year 2019.

Explanation of Solution

Statement of Stockholders’ Equity:

Statement of Stockholders’ Equity is prepared to find out the changes and ending balance of contributed capital, treasury stock, retained earnings, and other comprehensive income in the business. The amount of stockholders’ equity is increased by issuance of stock and net income of the company and decreased by the payment of dividends and repurchase of treasury stock.

Prepare a statement of shareholders’ equity for the year 2019:

Table (2)

Working notes:

Determine the amount of common stock issued at par, during 2019:

Determine the amount of preference stock issued at par, during 2019:

Determine the amount of additional paid-in common stock, during 2019:

Determine the amount of additional paid-in preferred stock, during 2019:

Note: Statement of retained earnings is prepared back from ending accounts balances.

3.

Prepare notes that itemize the balance sheet control accounts and explain how it will helps to disclose any company accounting policies, contingent liabilities and subsequent events.

Explanation of Solution

Note 1:

Summary of significant accounting policies:

- Inventories are recorded at market price or cost price whichever is less.

- Straight line method is followed for depreciation of property, plant, and equipment based upon cost, estimated residual value, and useful life.

Note 2:

Guarantee to affiliate:

The company has been guaranteed by the affiliate Company J that it will be paid 12% interest on $50,000, 15-year bond.

Note 3:

Components of inventories:

The amount of inventories reported in the balance sheet is made up of the following components:

Table (3)

Note 4:

Components of long-term liabilities:

The amount of long-term liabilities reported in the balance sheet is made up of the following components:

Table (4)

Note 5:

Subsequent event:

On January 15, 2020, a building was totally destroyed. Its cost and book value are $20,000 and $7,000 respectively. However, insurance proceeds will amount to $5,000. This event has not been recorded in the balance sheet, as this event has been occurred after the balance sheet date.

4.

Determine debt-to-assets ratio of S Boat Company at the end of the year 2019.

Explanation of Solution

Debt-to-assets ratio:

Debt to assets ratio provides the relationship between the total liabilities and total assets. It helps the company to determine the amount of debt used to finance the assets.

The following formula is used to calculate debt-to-assets ratio:

Determine debt-to-assets ratio of S Boat Company at the end of the year 2019:

Hence, the debt-to-assets ratio of S Boat Company at the end of the year 2019 is 42.4%.

Evaluation:

If the debt-to-assets ratio is 39% at the end of 2018, then it has been increased by over 3% in 2019. An increase in this ratio indicates that the investors and creditors risk is increased, because of higher payment of interest has to be made by the company. The shareholder gets benefited, if the company generates a higher return on the additional debt equity than the interest paid.

Want to see more full solutions like this?

Chapter 4 Solutions

Intermediate Accounting: Reporting And Analysis

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning