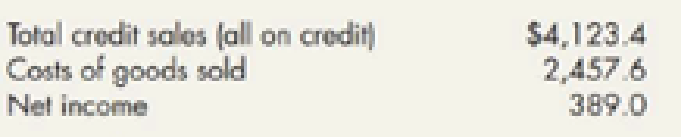

Ratios Analyses: McCormick Refer to the information for McCormick above. Additional information for 20X3 it as follows (amounts in millions):

Required:

Next Level Compute the following for 20X3. Provide a brief description of what each ratio reveals about McCormick

- 1. return on common equity

- 2. debt-to-assets

- 3. debt-toequity

- 4. current

- 5. quick (McCormick uses cash and equivalents, short-term securities and receivables in their quick ratio calculation.)

- 6. inventory turnover days

- 7.

accounts receivable turnover days - 8. accounts payable turnover days

- 9. operating cycle (in days)

- 10. total asset turnover

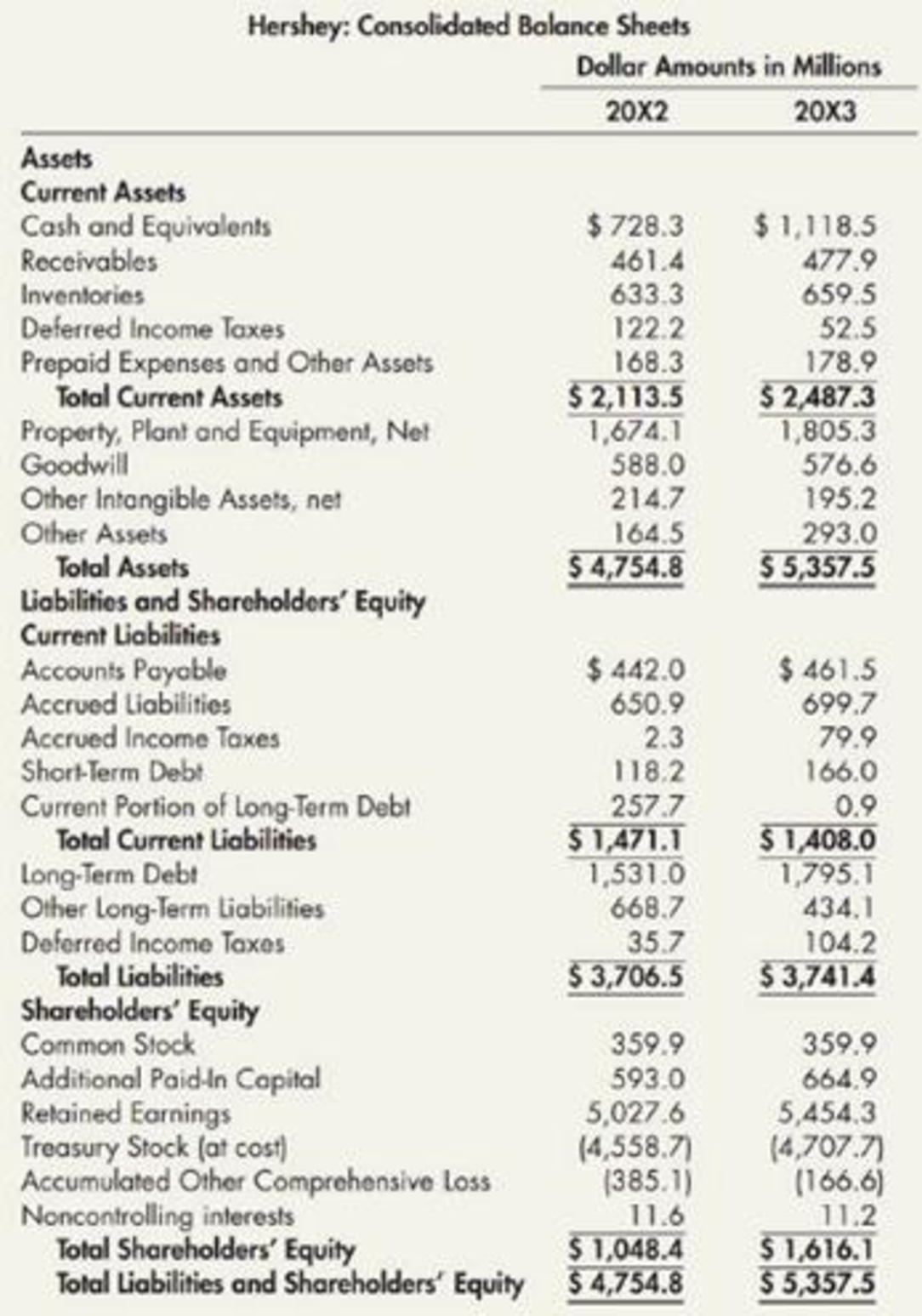

Use the following information for 14-17 and 14-18:

The Hershey Company is one of the world’s leading producers of chocolates, candies, and confections. It sells chocolates and candies, mints and gums, baking ingredients, toppings, and beverages. Hershey’s consolidated

Requirement 1:

Determine the return on common equity ratio of C&C Incorporation for 20X3.

Explanation of Solution

Determine the return on common equity ratio of C&C Incorporation for 20X3:

Step 1: Calculate the average total common stockholders’ equity.

Step 2: Calculate the return on common equity ratio of C&C Incorporation for 20X3.

Hence, the return on common equity ratio of C&C Incorporation for 20X3 is 0.213.

Comment:

Return on common equity ratio indicates that C&C Incorporation generated a 21.3% return for its common shareholders.

Requirement 2:

Determine the debt-to-assets ratio of C&C Incorporation for 20X3.

Explanation of Solution

Determine the debt-to-assets ratio of C&C Incorporation for 20X3:

Hence, the debt-to-assets ratio of C&C Incorporation for 20X3 is 0.562.

Comment:

Debt-to-assets ratio indicates that C&C Incorporation’s 56.2% of total assets are financed by its creditors.

Requirement 3:

Determine the debt-to-equity ratio of C&C Incorporation for 20X3.

Explanation of Solution

Determine the debt-to-equity ratio of C&C Incorporation for 20X3:

Hence, the debt-to- equity ratio of C&C Incorporation for 20X3 is 1.28.

Comment:

Debt-to-assets ratio indicates that C&C Incorporation has $1.28 in total liabilities for every of $1.00 in equity.

Requirement 4:

Determine the current ratio of C&C Incorporation for 20X3.

Explanation of Solution

Determine the current ratio of C&C Incorporation for 20X3:

Hence, the current ratio of C&C Incorporation for 20X3 is 1.29.

Comment:

Current ratio indicates that C&C Incorporation has $1.29 in current assets for every of $1.00 in current liabilities.

Requirement 5:

Determine the quick ratio of C&C Incorporation for 20X3.

Explanation of Solution

Determine the quick ratio of C&C Incorporation for 20X3:

Hence, the quick ratio of C&C Incorporation for 20X3 is 0.53.

Comment:

Quick ratio indicates that C&C Incorporation has $0.53 in quick assets (cash and receivables) for every of $1.00 in current liabilities.

Requirement 6:

Determine the inventory turnover in days of C&C Incorporation for 20X3.

Explanation of Solution

Determine the inventory turnover in days of C&C Incorporation for 20X3:

Step 1: Calculate the average inventory.

Step 2: Calculate the inventory turnover.

Step 3: Calculate the inventory turnover in days of C&C Incorporation for 20X3.

Hence, the inventory turnover days of C&C Incorporation for 20X3 are 95.93 days.

Comment:

On an average C&C Incorporation takes 100 days to convert inventory into sales in the operation cycle.

Requirement 7:

Determine the accounts receivable turnover in days of C&C Incorporation for 20X3.

Explanation of Solution

Determine the accounts receivable turnover in days of C&C Incorporation for 20X3:

Step 1: Calculate the average accounts receivable.

Step 2: Calculate the accounts receivable turnover.

Step 3: Calculate the accounts receivable turnover in days of C&C Incorporation for 20X3.

Hence, the accounts receivable turnover days of C&C Incorporation for 20X3 are

Comment:

On an average C&C Incorporation takes 43 days to collect its receivables from its customers.

Requirement 8:

Determine the accounts payable turnover in days of C&C Incorporation for 20X3.

Explanation of Solution

Determine the accounts payable turnover in days of C&C Incorporation for 20X3:

Step 1: Determine the amount of inventory purchases.

Step 2: Calculate the average accounts payable.

Step 3: Calculate the accounts payable turnover.

Step 4: Determine the accounts payable turnover in days.

Hence, the accounts payable turnover in days of C&C Incorporation for 20X3 is 55.3 days.

Comment:

On an average C&C Incorporation takes 55 days to pay its payables to its suppliers.

Requirement 9:

Determine the operating cycle in days of C&C Incorporation for 20X3.

Explanation of Solution

Determine the operating cycle in days of C&C Incorporation for 20X3:

Hence, the operating cycle in days of C&C Incorporation for 20X3 is 83.2 days.

Comment:

C&C Incorporation takes 83.2days to complete an operating cycle (the purchase of inventory and collection of cash from accounts receivable).

Requirement 10:

Determine the total assets turnover ratio of C&C Incorporation for 20X3.

Explanation of Solution

Determine the total assets turnover ratio of C&C Incorporation for 20X3:

Step 1: Calculate average total assets.

Step 2: Calculate the total assets turnover ratio of C&C Incorporation for 20X3.

Hence, the total assets turnover ratio of C&C Incorporation for 20X3 is 0.96.

Comment:

Total assets turnover ratio indicates that C&C Incorporation has generated $0.96 in sales for every of $1.00 in assets

Want to see more full solutions like this?

Chapter 4 Solutions

Intermediate Accounting: Reporting And Analysis

- Please given step by step explanation general Accounting questionarrow_forwardLarkspur Manufacturing Company observed that, during its busiest month of 2022, maintenance costs totaled $18,500, resulting from the production of 40,000 units. During its slowest month, $13,000 in maintenance costs were incurred, resulting from the production of 25,000 units. Use the high-low method to estimate the maintenance cost that the company will incur if it produces 30,000 units. (Calculation in 2 decimal)arrow_forwardWhat is the correct option?arrow_forward

- The Blue Jay Corporation has annual sales of $5,200, total debt of $1,500, total equity of $2,800, and a profit margin of 8 percent. What is the return on assets? Provide Right Answerarrow_forwardI want to this question answer general accountingarrow_forwardWhat cost does cosmo manufacturing record for the new machine?arrow_forward

- Financial Accounting 5.8: Firm X and Firm Y have debt-total asset ratios of 40% and 30% and returns on total assets of 9% and 11%, respectively. What is the return on equity for Firm X and Firm Y?arrow_forwardI need this question answer general Accounting questionarrow_forwardBella's Florist purchased a delivery truck for $25,000. The company was given a $3,000 cash discount by the dealer and paid $1,200 sales tax. Annual insurance on the truck is $600. As a result of the purchase, by how much will Bella's Florist increase its truck account?arrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning