Concept explainers

Payment and distribution of payroll

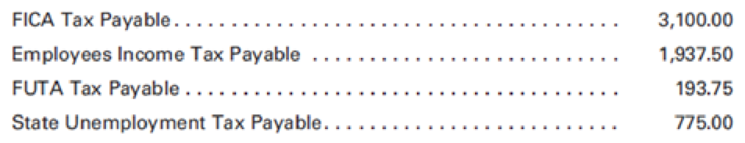

The general ledger of Berskshire Mountain Manufacturing Inc. showed the following credit balances on January 15:

Direct labor earnings amounted to $10,500 from January 16 to 31. Indirect labor was $5,700, and sales and administrative salaries for the same period amounted to $3,800. All wages are subject to FICA, FUTA, state

Required:

- 1. Prepare the journal entries for the following:

- a. Recording the payroll.

- b. Paying the payroll.

- c. Recording the employer’s payroll tax liability.

- d. Distributing the payroll costs for January 16–31.

- 2. Prepare the

journal entry to record the payment of the amounts due for the month to the government for FICA and income tax withholdings. - 3. Calculate the amount of total earnings for the period from January 1 to 15.

- 4. Should the same person be responsible for computing the payroll, paying the payroll and making the entry to distribute the payroll? Why or why not?

1.

Pass journal entry to record the foregoing transactions.

Explanation of Solution

Journal entry: Journal entry is a set of economic events which can be measured in monetary terms. These are recorded chronologically and systematically.

Payroll Account: A payroll account is a separate checking account for the company to record the payment of the payroll checks to their employees. A payroll account includes the money a company pays to their employees like salaries, wages, bonuses and withheld taxes.

Pass journal entry to record the foregoing transactions.

| Date | Description | Post Ref | Debit ($) | Credit($) |

| a. | Payroll | 20,000 | ||

| FICA tax payable | 1,600 | |||

| Employees income tax payable | 2,000 | |||

| Wages payable | 16,400 | |||

| (To record the payroll) | ||||

| b. | Wages payable | 16,400 | ||

| Cash | 16,400 | |||

| (To record payment of payroll ) | ||||

| c. | Factory overhead | 2,106 | ||

| Payroll tax expense | 494 | |||

| FICA tax payable | 1,600 | |||

| Federal unemployment tax payable | 200 | |||

| State unemployment tax payable | 800 | |||

| (To record employer’s payroll tax liability) | ||||

| d. | Work in process | 10,500 | ||

| Factory overhead | 5,700 | |||

| Sales and administrative salaries | 3,800 | |||

| Payroll | 20,000 | |||

| (To record the distribution of payroll cost) |

Table (1)

Working Notes (1): Calculate the factory overhead.

(2) Calculate the payroll tax expense.

2.

Pass journal entry to record the payment of the due amount.

Explanation of Solution

Pass journal entry to record the payment of the due amount.

| Date | Description | Post Ref | Debit ($) | Credit($) |

| FICA tax payable | 6,300 | |||

| Employees income tax payable | 3,937.50 | |||

| Cash | 10,237.50 | |||

| (To record the payment of due amount) |

Table (2)

Working Notes (1): Calculate the FICA tax payable.

(2) Calculate the employee income tax payable.

3.

Compute the amount of total earnings from January 1st to 15th.

Explanation of Solution

Compute the amount of total earnings.

Therefore, the amount of total earnings is $19.375.

4.

Explain whether the same person is responsible for computing and paying the payroll or not.

Explanation of Solution

Payroll is computed by the payroll department. For paying the payroll, treasury department is responsible and to record the entry for distribution of payroll. To prevent theft and to provide checks for each department’s work a better internal control is required.

Want to see more full solutions like this?

Chapter 3 Solutions

Principles of Cost Accounting

- I need the correct answer to this general accounting problem using the standard accounting approach.arrow_forwardCan you help me solve this general accounting question using valid accounting techniques?arrow_forwardI need guidance with this general accounting problem using the right accounting principles.arrow_forward

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning