Principles of Cost Accounting

17th Edition

ISBN: 9781305087408

Author: Edward J. Vanderbeck, Maria R. Mitchell

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 3, Problem 5P

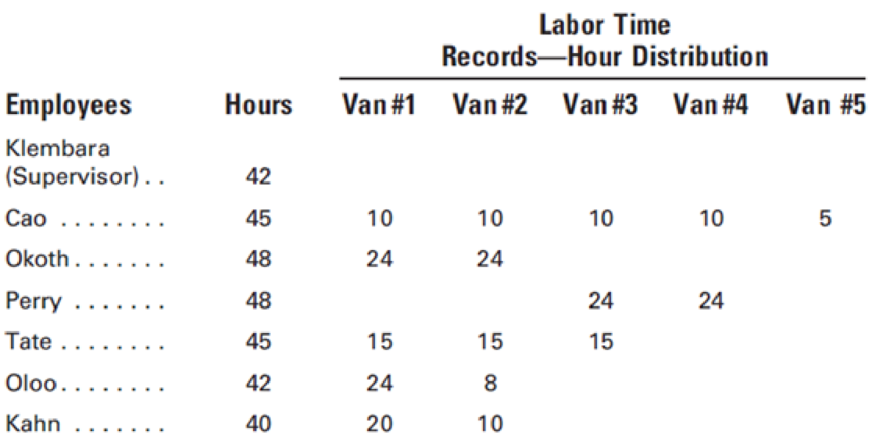

A rush order was accepted by Bartley's Conversions for five van conversions. The labor time records for the week ended January 27 show the following (Hours not worked on vans are idle time and are not charged to the job.):

All employees are paid $20 per hour, except Klembara, who receives $25 per hour. All overtime premium pay, except Klembara's, is chargeable to the job, and all employees, including Klembara, receive time-and-a-half for overtime hours.

Required:

- 1. Calculate the total payroll and total net earnings for the week. Assume that an 18% deduction for federal income tax is required in addition to FICA deductions. Assume that none of the employees has achieved the maximums for FICA and unemployment taxes.

- 2. Prepare the journal entries to record and pay the payroll.

- 3. Prepare the

journal entry to distribute the payroll to the appropriate accounts. - 4. Determine the dollar amount of labor that is chargeable to each van, assuming that the overtime costs are proportionate to the regular hours used on the vans. (First compute an average labor rate for each worker, including overtime premium, and then use that rate to charge all workers' hours to vans.) Round the labor rates to the nearest whole cent.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Please give answer

5 POINTS

What is the direct materials price variance

Chapter 3 Solutions

Principles of Cost Accounting

Ch. 3 - What is the difference between direct and indirect...Ch. 3 - Prob. 2QCh. 3 - Prob. 3QCh. 3 - In production work teams, output is dependent upon...Ch. 3 - Define productivity.Ch. 3 - Prob. 6QCh. 3 - Prob. 7QCh. 3 - Prob. 8QCh. 3 - Prob. 9QCh. 3 - What are the sources for posting direct labor cost...

Ch. 3 - What are the sources for posting indirect labor...Ch. 3 - In accounting for labor costs, what is the...Ch. 3 - Prob. 13QCh. 3 - Prob. 14QCh. 3 - Besides FICA, FUTA and state unemployment taxes,...Ch. 3 - Prob. 16QCh. 3 - Prob. 17QCh. 3 - Prob. 18QCh. 3 - What is a shift premium, and how is it usually...Ch. 3 - Prob. 20QCh. 3 - Prob. 21QCh. 3 - Prob. 22QCh. 3 - Prob. 23QCh. 3 - Prob. 24QCh. 3 - Prob. 25QCh. 3 - R. Herbert of Crestview Manufacturing Co. is paid...Ch. 3 - Recording payroll Using the earnings data...Ch. 3 - Prob. 3ECh. 3 - Peggy Nolan earns 20 per hour for up to 300 units...Ch. 3 - Overtime Allocation Arlin Fabrication Company...Ch. 3 - Prob. 6ECh. 3 - Davis, Inc. paid wages to its employees during the...Ch. 3 - Recording the payroll and payroll taxes Using the...Ch. 3 - Prob. 9ECh. 3 - The total wages and salaries earned by all...Ch. 3 - The total wages and salaries earned by all...Ch. 3 - A weekly payroll summary made from labor time...Ch. 3 - Prob. 13ECh. 3 - Accounting for bonus and vacation pay Cathy Muench...Ch. 3 - Prob. 15ECh. 3 - Prob. 16ECh. 3 - Payroll computation with incentive bonus Fifteen...Ch. 3 - Prob. 2PCh. 3 - Prob. 3PCh. 3 - Payroll for piece-rate wage system Collier...Ch. 3 - A rush order was accepted by Bartley's Conversions...Ch. 3 - The following form is used by Matsuto...Ch. 3 - Payment and distribution of payroll The general...Ch. 3 - Prob. 8PCh. 3 - An analysis of the payroll for the month of...Ch. 3 - Prob. 10PCh. 3 - Prob. 11PCh. 3 - Prob. 12PCh. 3 - Prob. 13PCh. 3 - Using the information in P3-13, prepare the...Ch. 3 - Pan-Am Manufacturing Co. prepares cost estimates...Ch. 3 - Incentive wage plan David Kelley is considering...Ch. 3 - Huron Manufacturing Co. uses a job order cost...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- hi expert please help mearrow_forwardDaughdrill Corporation is developing direct labor standards. The basic direct labor wage rate is $10.95 per hour. Employment taxes are 9% of the basic wage rate. Fringe benefits are $4.00 per direct labor hour. The standard rate per direct labor-hour should be: a. $5.96 b. $4.99 c. $10.95 d. $15.94arrow_forwardWhat must be its real rate of interestarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Step 5: Base Pay Structure; Author: GreggU;https://www.youtube.com/watch?v=CnBsWsY6O7k;License: Standard Youtube License