Principles of Cost Accounting

17th Edition

ISBN: 9781305087408

Author: Edward J. Vanderbeck, Maria R. Mitchell

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 3, Problem 7E

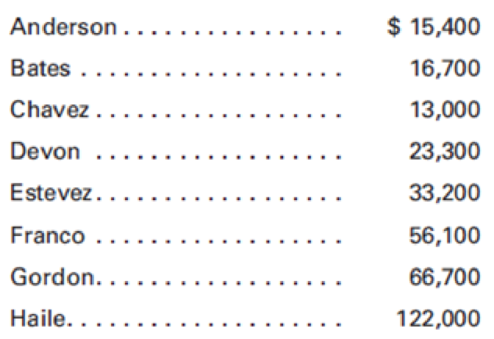

Davis, Inc. paid wages to its employees during the year as follows:

- a. How much of the total payroll is exempt from the FICA rate of 8%?

- b. How much of the total payroll is exempt from federal and state

unemployment taxes? - c. How much of the total payroll is exempt from federal income tax withholding?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

I need help finding the accurate solution to this general accounting problem with valid methods.

Hi expert please given correct answer with accounting question

The Evangeline Company makes two products, X and Y, from a common input, Z. In March, Evangeline used 30,000 pounds of Z to make 20,000 pounds of X and 10,000 pounds of Y. The cost of Z was $1.00 per pound and X and Y can be sold for $7.50 and $10.00, respectively; Evangeline incurred additional processing costs of $30,000 to further process X and $20,000 to further process Y. Using the net realizable value method, how much of the cost of Z should be allocated to X?

Multiple Choice

$22,000

None of the choices is correct.

$20,000

$18,000

$16,000

Chapter 3 Solutions

Principles of Cost Accounting

Ch. 3 - What is the difference between direct and indirect...Ch. 3 - Prob. 2QCh. 3 - Prob. 3QCh. 3 - In production work teams, output is dependent upon...Ch. 3 - Define productivity.Ch. 3 - Prob. 6QCh. 3 - Prob. 7QCh. 3 - Prob. 8QCh. 3 - Prob. 9QCh. 3 - What are the sources for posting direct labor cost...

Ch. 3 - What are the sources for posting indirect labor...Ch. 3 - In accounting for labor costs, what is the...Ch. 3 - Prob. 13QCh. 3 - Prob. 14QCh. 3 - Besides FICA, FUTA and state unemployment taxes,...Ch. 3 - Prob. 16QCh. 3 - Prob. 17QCh. 3 - Prob. 18QCh. 3 - What is a shift premium, and how is it usually...Ch. 3 - Prob. 20QCh. 3 - Prob. 21QCh. 3 - Prob. 22QCh. 3 - Prob. 23QCh. 3 - Prob. 24QCh. 3 - Prob. 25QCh. 3 - R. Herbert of Crestview Manufacturing Co. is paid...Ch. 3 - Recording payroll Using the earnings data...Ch. 3 - Prob. 3ECh. 3 - Peggy Nolan earns 20 per hour for up to 300 units...Ch. 3 - Overtime Allocation Arlin Fabrication Company...Ch. 3 - Prob. 6ECh. 3 - Davis, Inc. paid wages to its employees during the...Ch. 3 - Recording the payroll and payroll taxes Using the...Ch. 3 - Prob. 9ECh. 3 - The total wages and salaries earned by all...Ch. 3 - The total wages and salaries earned by all...Ch. 3 - A weekly payroll summary made from labor time...Ch. 3 - Prob. 13ECh. 3 - Accounting for bonus and vacation pay Cathy Muench...Ch. 3 - Prob. 15ECh. 3 - Prob. 16ECh. 3 - Payroll computation with incentive bonus Fifteen...Ch. 3 - Prob. 2PCh. 3 - Prob. 3PCh. 3 - Payroll for piece-rate wage system Collier...Ch. 3 - A rush order was accepted by Bartley's Conversions...Ch. 3 - The following form is used by Matsuto...Ch. 3 - Payment and distribution of payroll The general...Ch. 3 - Prob. 8PCh. 3 - An analysis of the payroll for the month of...Ch. 3 - Prob. 10PCh. 3 - Prob. 11PCh. 3 - Prob. 12PCh. 3 - Prob. 13PCh. 3 - Using the information in P3-13, prepare the...Ch. 3 - Pan-Am Manufacturing Co. prepares cost estimates...Ch. 3 - Incentive wage plan David Kelley is considering...Ch. 3 - Huron Manufacturing Co. uses a job order cost...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Solve this general accounting problemarrow_forwardCan you help me solve this general accounting question using the correct accounting procedures?arrow_forwardBrighton Co. had a Work-in-Process balance of $68,000 on January 1, 2023. The year-end balance of Work-in-Process was $51,000, and the Cost of Goods Manufactured was $510,000. Use this information to determine the total manufacturing costs incurred during the fiscal year 2023.arrow_forward

- Jackman Industries has two service departments, maintenance and power, and two operating departments, production and assembly. Management has decided to allocate maintenance costs on the basis of direct-labor hours in each department and power costs on the basis of machine hours. The following data were experienced by the company in the current period: Maintenance Power Production Assembly Direct labor hours 0 400 4,000 2,000 Machine hours 2,000 0 8,400 1,600 Department direct costs $ 9,000 $ 20,000 $ 70,000 $ 50,000 What is the total service cost allocated to the production department during the period if the direct method of cost allocation is used?Note: Do not round intermediate calculations. Multiple Choice $19,625 $22,800 None of the choices is correct. $ 6,200 $ 9,200arrow_forwardSpark Industries estimates that overhead costs for the next year will be $3,950,000 for indirect labor and $780,000 for factory utilities. The company uses machine hours as its overhead allocation base. If 120,000 machine hours are planned for the next year, what is the company's plantwide overhead rate? Help mearrow_forwardSolve with explanation and accounting questionarrow_forward

- Can you solve this general accounting problem with appropriate steps and explanations?arrow_forwardWhat characterizes modified unit attribution in cost structures? (a) Complexity adds no value (b) Cost drivers reflect multi-level operational relationships (c) Attribution remains constant (d) Single drivers explain all costs. MCQarrow_forwardI need assistance with this general accounting question using appropriate principles.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781305084087

Author:Cathy J. Scott

Publisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

College Accounting, Chapters 1-27 (New in Account...

Accounting

ISBN:9781305666160

Author:James A. Heintz, Robert W. Parry

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

What Is And How To Calculate FICA Taxes Explained, Social Security Taxes And Medicare Taxes; Author: Whats Up Dude;https://www.youtube.com/watch?v=fzK3KDDYCQw;License: Standard Youtube License