Concept explainers

Exercise 3-4 Effect of inventory transactions on the income statement and statement of

During 2018, Hardy Merchandising Company purchased $40,000 of inventory on account. Hardy sold inventory on account that cost $24,500 for $38,000. Cash payments on accounts payable were $22,000. There was $26,000 cash collected from

Required

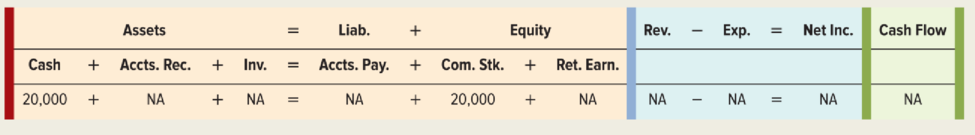

a. Identify the events described in the preceding paragraph and record them in a horizontal statements model like the following one.

b. What is the balance of accounts receivable at the end of 2018?

c. What is the balance of accounts payable at the end of 2018?

d. What are the amounts of gross margin and net income for 2018?

e. Determine the amount of net cash flow from operating activities.

f. Explain why net income and

g. Normally would these amounts be the same? Why or why not?

Trending nowThis is a popular solution!

Chapter 3 Solutions

Survey Of Accounting

- Please explain the solution to this general accounting problem using the correct accounting principles.arrow_forwardI need help finding the accurate solution to this financial accounting problem with valid methods.arrow_forwardPlease explain the solution to this general accounting problem with accurate principles.arrow_forward

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,