Concept explainers

Effect of cash discounts on financial statements: Perpetual system

Expert Computers was started in 2018. The company experienced the following accounting events during its first year of operation:

1. Started business when it acquired $40,000 cash from the issue of common stock.

2. Purchased merchandise with a list price of $32,000 on account, terms 2/10, n/30.

3. Paid off one-half of the accounts payable balance within the discount period.

4. Sold merchandise on account for $28,000. Credit terms were 1/20, n/30. The merchandise had cost Expert Computers $16,000.

5. Collected cash from the

6. Paid $2,100 cash for operating expenses.

7. Paid the balance due on accounts payable. The payment was not made within the discount period.

Required

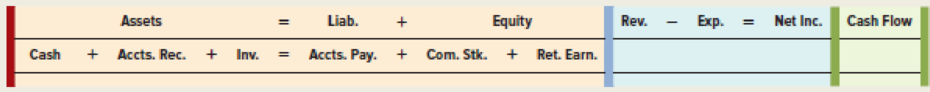

a. Record the events in a horizontal statements model like the following one.

b. What is the amount of gross margin for the period? What is the net income for the period?

c. Why would Expert Computers sell merchandise with the terms 1/20, n/30?

d. What do the terms 2/10, n/30 in Event 2 mean to Expert Computers?

Want to see the full answer?

Check out a sample textbook solution

Chapter 3 Solutions

Survey Of Accounting

- I need help with this general accounting problem using proper accounting guidelines.arrow_forwardI am looking for the correct answer to this general accounting problem using valid accounting standards.arrow_forwardCalculate break-even sales in units given: Fixed Costs = $10,000; Selling Price per unit = $25; Variable Cost per unit = $15. need helparrow_forward

- I am looking for the correct answer to this general accounting problem using valid accounting standards.arrow_forwardA product costs $25 to make. The company wants a 20% profit margin. What should be the selling price?arrow_forwardCalculate break-even sales in units given: Fixed Costs = $10,000; Selling Price per unit = $25; Variable Cost per unit = $15.arrow_forward

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub