Ratios and Financial Planning at S&S Air, Inc.

Chris Guthrie was recently hired by S&S Air, Inc., to assist the company with its financial planning and to evaluate the company’s performance. Chris graduated from college five years ago with a finance degree. He has been employed in the finance department of a Fortune 500 company since then.

S&S Air was founded 10 years ago by friends Mark Sexton and Todd Story. The company has manufactured and sold light airplanes over this period, and the company’s products have received high reviews for safety and reliability. The company has a niche market in that it sells primarily to individuals who own and fly their own airplanes. The company has two models, the Birdie, which sells for $53,000, and the Eagle, which sells for $78,000.

While the company manufactures aircraft, its operations are different from commercial aircraft companies. S&S Air builds aircraft to order. By using prefabricated parts, the company is able to complete the manufacture of an airplane in only five weeks. The company also receives a deposit on each order, as well as another partial payment before the order is complete. In contrast, a commercial airplane may take one and one-half to two years to manufacture once the order is placed.

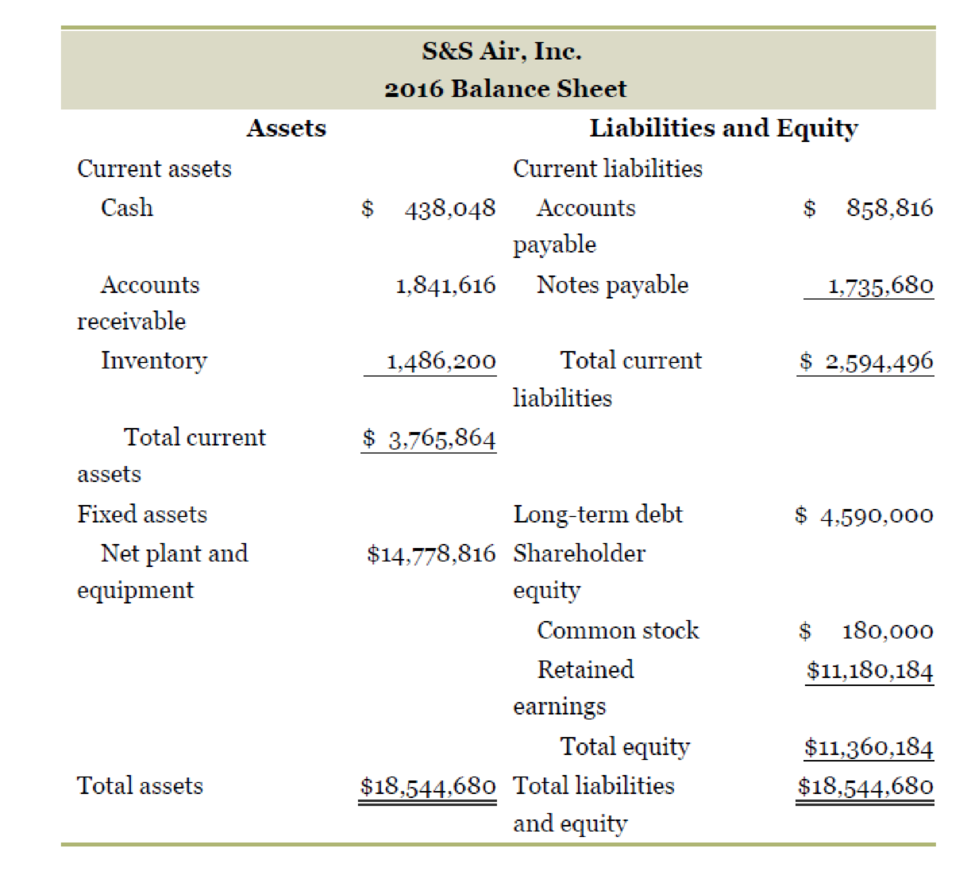

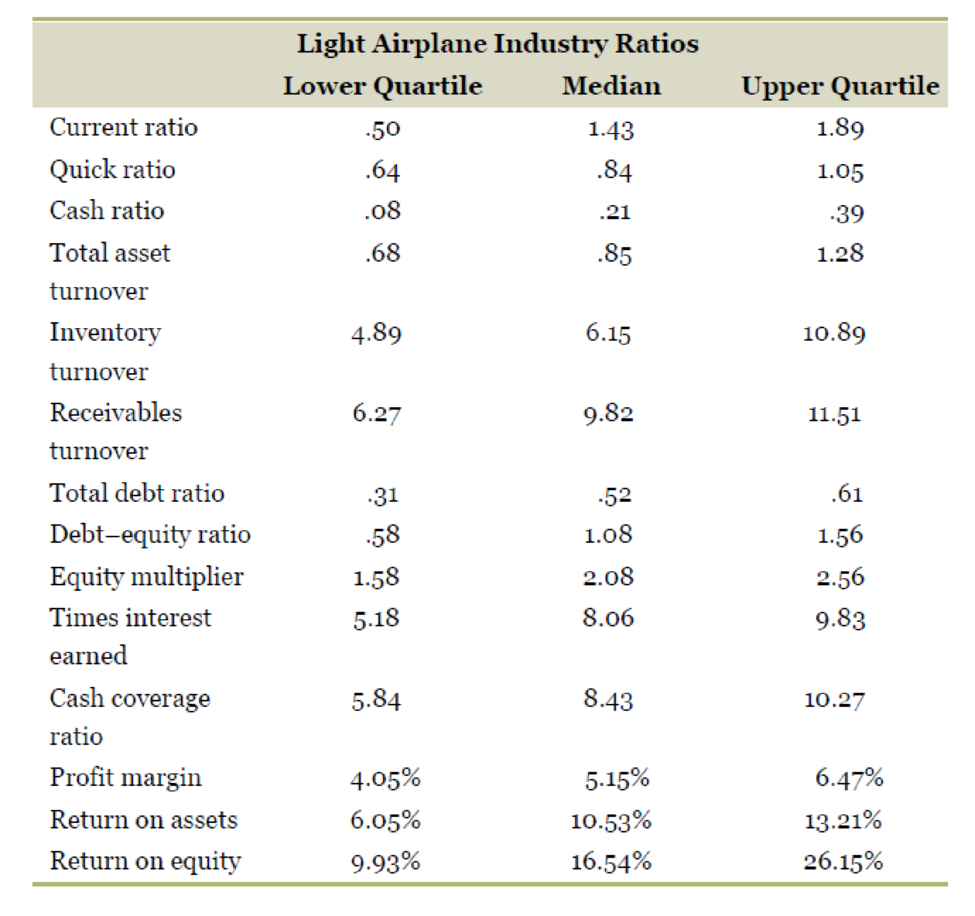

Mark and Todd have provided the following financial statements. Chris has gathered the industry ratios for the light airplane manufacturing industry.

| S&S Air. Inc. 2016 Income Statement |

|

| Sales | $24,092,400 |

| Cost of goods sold | 17,982,000 |

| Other expenses | 2,878,800 |

| Depreciation | 786,000 |

| EBIT | $ 2,445,600 |

| Interest | 434,400 |

| Taxable income | $ 2,011,200 |

| Taxes (40%) | 804,480 |

| Net income | $ 1,206,720 |

| Dividends | $246,000 |

| Additions to | 960,720 |

4. Calculate the Internal growth rate and sustainable growth rate for S&S Air. What do these numbers mean?

Want to see the full answer?

Check out a sample textbook solution

Chapter 3 Solutions

Essentials of Corporate Finance (Mcgraw-hill/Irwin Series in Finance, Insurance, and Real Estate)

- Lindsay is 30 years old and has a new job in web development. She wants to make sure that she is financially sound by the age of 55, so she plans to invest the same amount into a retirement account at the end of every year for the next 25 years. (a) Construct a data table in Excel that will show Lindsay the balance of her retirement account for various levels of annual investment and return. If Lindsay invests $10,000 at return of 6%, what would be the balance at the end of the 25th year? Note that because Lindsay invests at the end of the year, there is no interest earned on the contribution for the year in which she contributes. Round your answer to a whole dollar amount. $ (b) Develop a two-way table for annual investment amounts of $5,000 to $20,000 in increments of $1,000 and for returns of 0% to 12% in increments of 1%. From the 2-way table, what are the minimum annual investments Lindsay must contribute for annual rates ranging from 6% to 11%, if she wants to…arrow_forwardDoes Airbnb have any impaired assets? If so, what are they?arrow_forward1. Consider two assets with the following returns: State Prob. of state R1 R2 1 2/3 .03 .05 2 1/3 .09 .02arrow_forward

- Bright wood! Seating sells reclining chairs for $55.00 per unit. The variable cost is 322 per unit. Each reclining chair requires 5 direct labor hours and 3 machine hours to produce. ibution margin pemachine hon Wrightwood Manufacturing has a break-even point of 1,500 units. The sales price per unit is $18. and the variable cost per us $13. If the company sells 3,500 units, what will its net income be? Crestwood Industries provides the following budget data for its Processing Department for the year 2022: ⚫ Manufacturing Overhead Costs=250 ⚫ Direct Labor Costs $1,234,500 Determine the manufacturing overhead application rate under the base of Direct Labor Costs. Modesto Accessories manufactures two types of wallets leather and canvas. The company allocates manufacturing overhead using a single plant wide rate with direct labor cost as the allocation base. $48 Estimated Overhead Costs = 30,600 Direct Labor Cost per Leather Wallet Direct Labor Cost per Canvas Wallet = $52 Number of…arrow_forwardNo Aiarrow_forwardNo aiarrow_forward

- List and discuss the various values for bonds discussed in the chapter. Additionally, explain in detail what is meant by "Yield to Maturity".arrow_forwardProvide Answer of This Financial Accounting Question And Please Don't Use Ai Becouse In all Ai give Wrong Answer. And Provide All Question Answer If you will use AI will give unhelpful.arrow_forwardYou plan to save $X per year for 6 years, with your first savings contribution in 1 year. You and your heirs then plan to withdraw $43,246 per year forever, with your first withdrawal expected in 7 years. What is X if the expected return per year is 18.15 percent per year? Input instructions: Round your answer to the nearest dollar. 59 $arrow_forward

- Are there assets for which a value might be considered to be hard to determine?arrow_forwardYou plan to save $X per year for 7 years, with your first savings contribution in 1 year. You and your heirs then plan to make annual withdrawals forever, with your first withdrawal expected in 8 years. The first withdrawal is expected to be $43,596 and all subsequent withdrawals are expected to increase annually by 1.84 percent forever. What is X if the expected return per year is 11.34 percent per year? Input instructions: Round your answer to the nearest dollar. $arrow_forwardYou plan to save $41,274 per year for 4 years, with your first savings contribution later today. You then plan to make X withdrawals of $41,502 per year, with your first withdrawal expected in 4 years. What is X if the expected return per year is 8.28 percent per year? Input instructions: Round your answer to at least 2 decimal places.arrow_forward

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education