Concept explainers

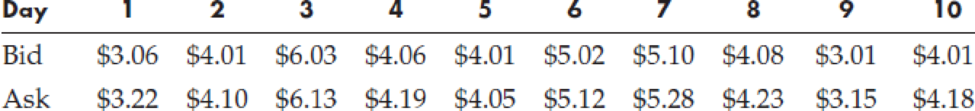

A natural gas trading company wants to develop an optimal trading plan for the next 10 days. The following table summarizes the estimated prices (per thousand cubic feet (cf)) at which the company can buy and sell natural gas during this time. The company may buy gas at the “Ask” price and sell gas at the “Bid” price.

The company currently has 150,000 cf of gas in storage and has a maximum storage capacity of 300,000 cf. To maintain the required pressure in the gas transmission pipeline system, the company can inject no more than 200,000 cf into the storage facility each day and can extract no more than 180,000 cf per day. Assume extractions occur in the morning and injections occur in the evening. The owner of the storage facility charges a storage fee of 5% of the market (bid) value of the average daily gas inventory. (The average daily inventory is computed as the average of each day’s beginning and ending inventory.)

- a. Create a spreadsheet model for this problem and solve it.

- b. What is the optimal solution?

- c. Assuming price forecasts for natural gas change on a daily basis, how would you suggest the company in this problem actually use your model?

Trending nowThis is a popular solution!

Chapter 3 Solutions

Spreadsheet Modeling and Decision Analysis: A Practical Introduction to Business Analytics

- Importanc of the process Tuckman's model”(Forming, Storming, Norming, Performing, and Adjourning)arrow_forwardReview the article: Defining the Motivations and Capabilitied of Young Intrapreneurs: Literature Review and Research Opportunities 1. Discuss the differences and similarities of Entrepreneurship and Intrapreneurship. 2. How might your current organization or a former organization that you have been a member of incorporate the elements of Intrapreneurship? 3. Discuss the future of Intrapreneurship List referencesarrow_forwardRoles for Human Resource Departments Analyze HRM functions. Describe and detail each one of these functions. Why are the specific roles associated to HRM important? List referencesarrow_forward

- Employees and Entrepreneurs share many skills, mindsets and values. Even if you are employed by an organization, you may have an entrepreneurial mindset and entrepreneurial traits. How do you envision yourself within an organization, as an employee rather tahan an entrepreneur? Discuss the traits and values that support this?arrow_forwardPlease original work Talk about your need for creating a balanced scorecard in a management consulting firm and the steps you would take to design the balance scorecard. Please cite in text resources and weblinksarrow_forwardThink of a team in which you have participated in a professional setting (the number of individuals should be more than one person and includes you. Also, the team could have been virtual, collocated, or a mixture of virtual and collocated). Think back on how the team formed from the first day until the end of the project or when the work function was completed. Describe what took place. Do you feel your team followed any part of Tuckman's model? Consider what was discussed regarding high-performing teams in the lesson this week in the Team Performance Domain section. It was explained that high-performing project teams are characterized by different factors. Based on the factors listed about high-performance teams, which two factors do you feel your team could have improved upon and why?arrow_forward

- Please original work Background information: Innovation can be simply defined as the introduction of something new or different in the workplace. Creativity on the other hand could be described as the use of the imagination for original ideas. Talk about the difference between innovation and creativity in the workplace and the role that technology plays in fostering both innovation and creativity Please cite in text resources and add weblinksarrow_forwardIn procurement evolution, which statement below should i choose to be themost relevant to ‘limited integration phaseSupply management is often viewed as a lower-level support function.It is the final and most advanced phase of procurement evolution.Supply managers' primary role is to ensure enough supply capacity exists.Supply management is a key part of the organisational structure with a strongexternal customer focus.arrow_forwardWhich of the following stages of P2P process is believed most critical for the spendperformance of procurement?Supplier evaluation and selection stagePayment and settlement stageRecognition of needs stageClarification of needs stagearrow_forward

- Which of the following statements is most accurate in describing ‘preferredsuppliers’?A preferred supplier involves a lower-level risk but still has a significant spend with thebuyer.They will be asked to compete with other suppliers for better price and conditions.They refer the strategic partners of the company.They are the core suppliersarrow_forwardThe primary purpose of this coordination is to establish company-wide agreementsto leverage volumes to obtain lower costs from volume discounts.” Which phase ofprocurement evolution is more relevant to the statement?Phase 1 Basic beginningPhase 2 Moderate developmentPhase 4 Fully integrated supply chainPhase 3 Limited integrationarrow_forwardAmong the phases of procurement evolution, the phase that ‘focuses on supplybaseoptimisation, and more attention is paid to total quality management (TQM) than toother progressive supply management strategies’ is more relevant to ___________.Phase 1 Basic beginningPhase 3 Limited integrationPhase 4 Fully integrated supply chainPhase 2 Moderate developmentarrow_forward

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage,

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage, Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning

Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning