Spreadsheet Modeling and Decision Analysis: A Practical Introduction to Business Analytics

7th Edition

ISBN: 9781285418681

Author: Cliff Ragsdale

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Chapter 3, Problem 43QP

a)

Summary Introduction

Toformulate: A linear programming model for the problem.

a)

Expert Solution

Explanation of Solution

Formulation:

b)

Summary Introduction

Todevelop: A spreadsheet model and solve using solver.

b)

Expert Solution

Explanation of Solution

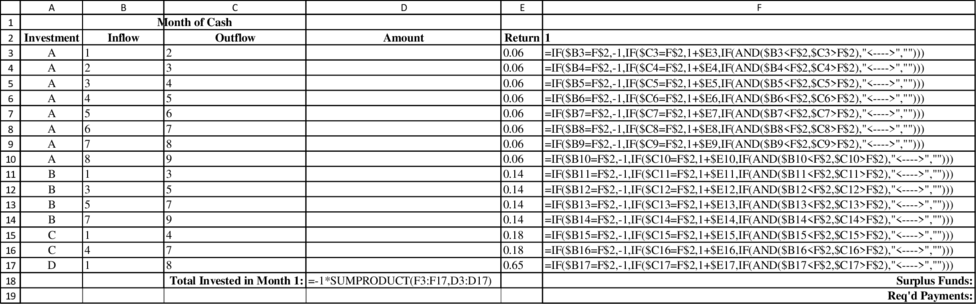

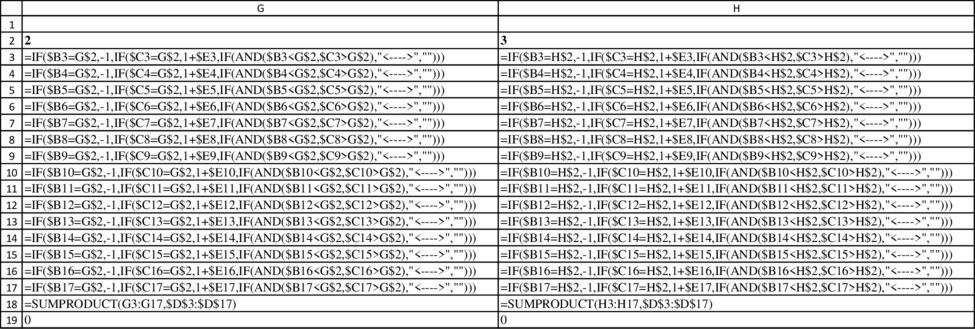

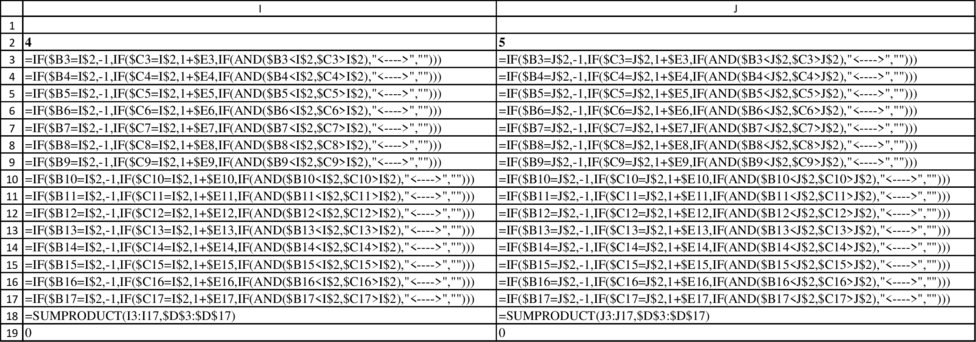

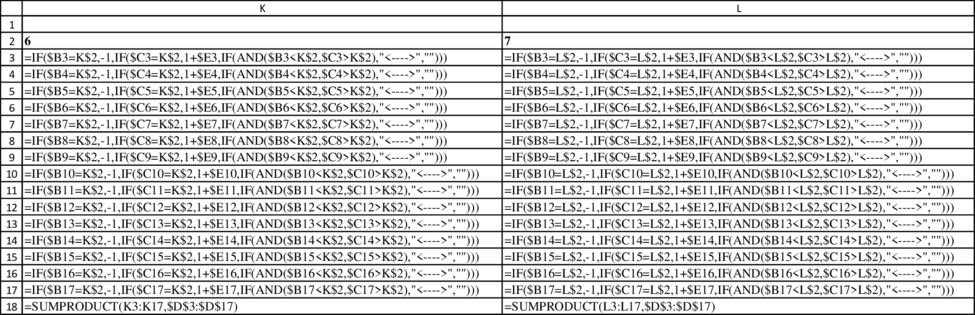

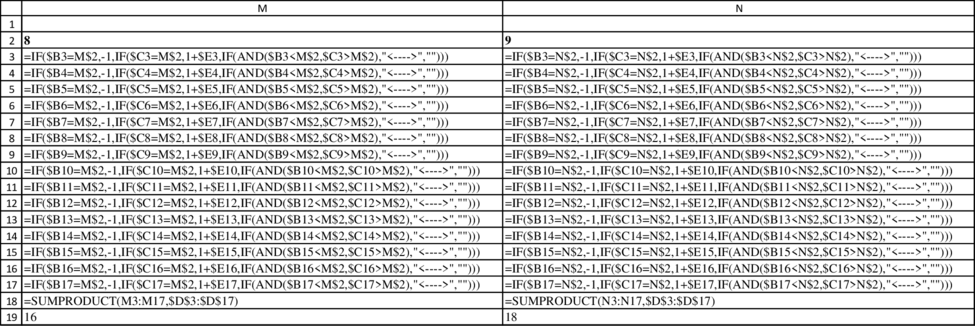

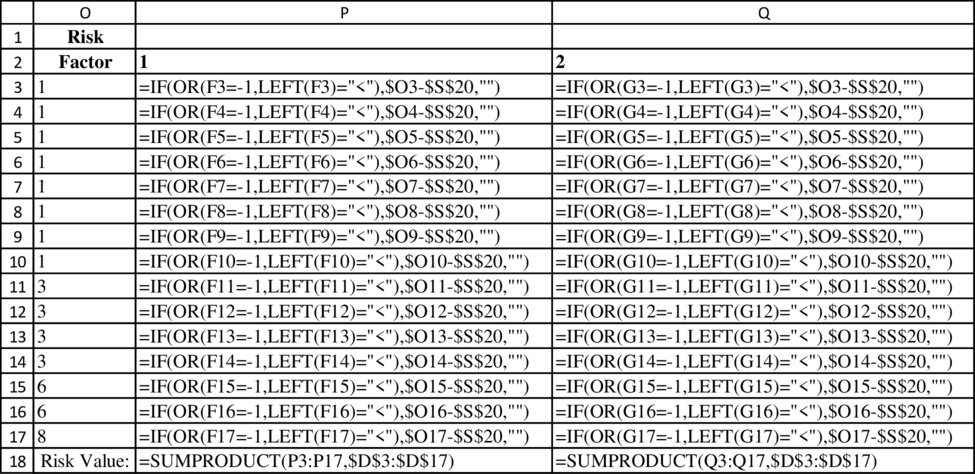

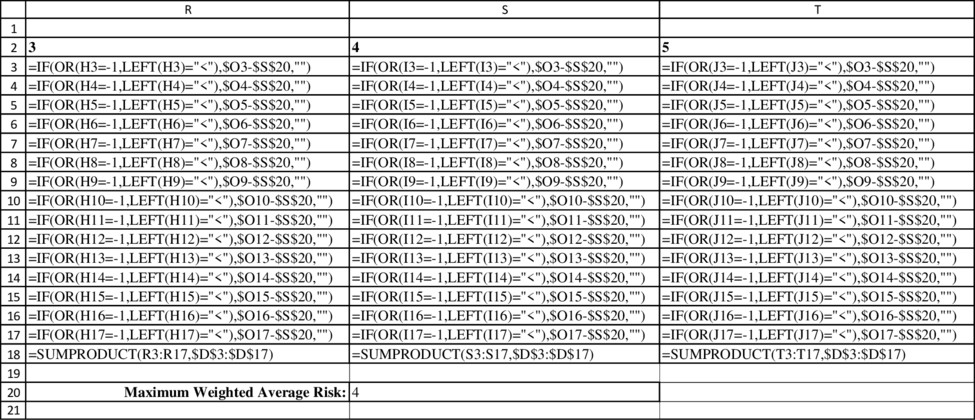

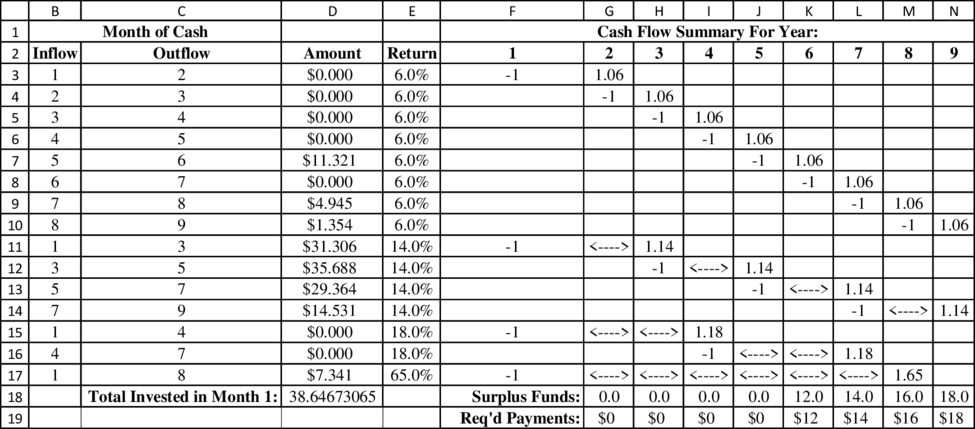

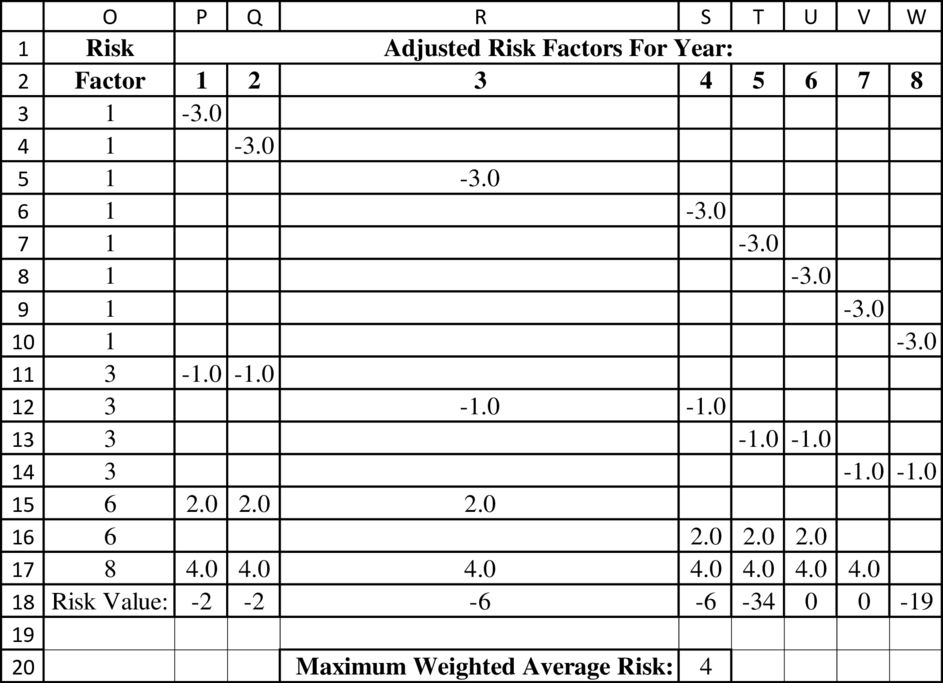

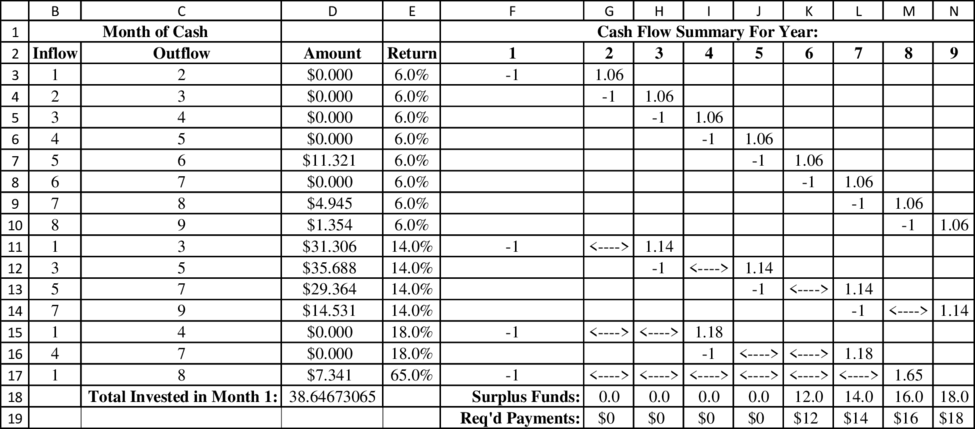

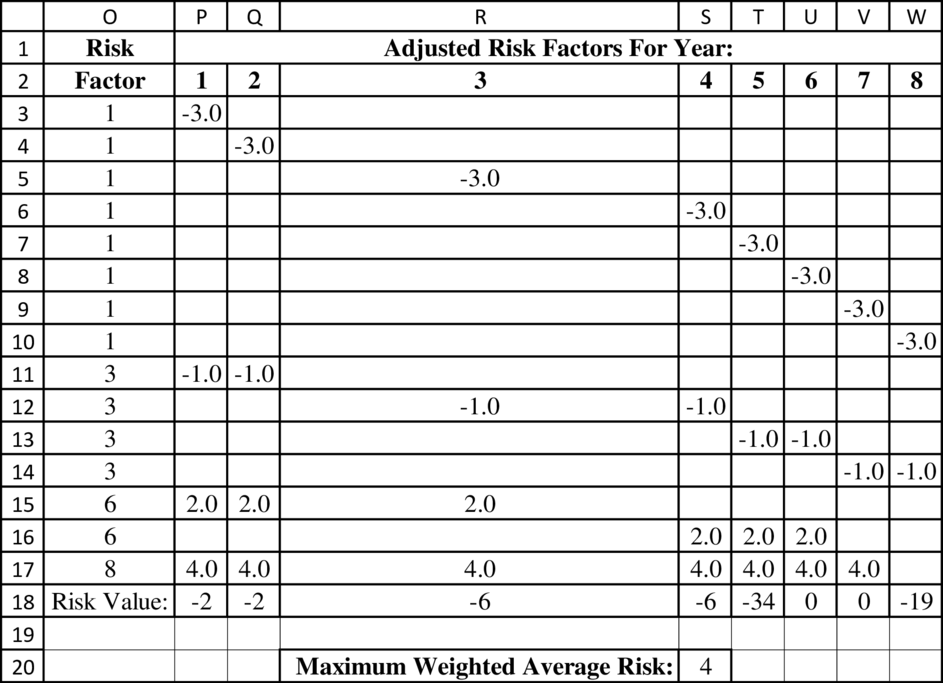

Model:

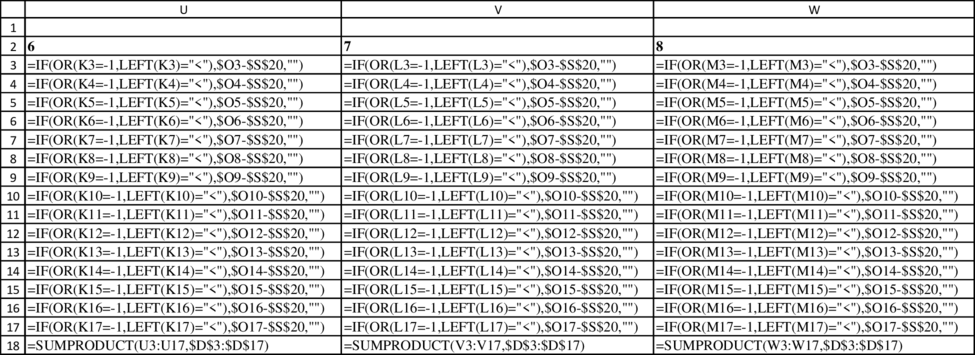

Formulae:

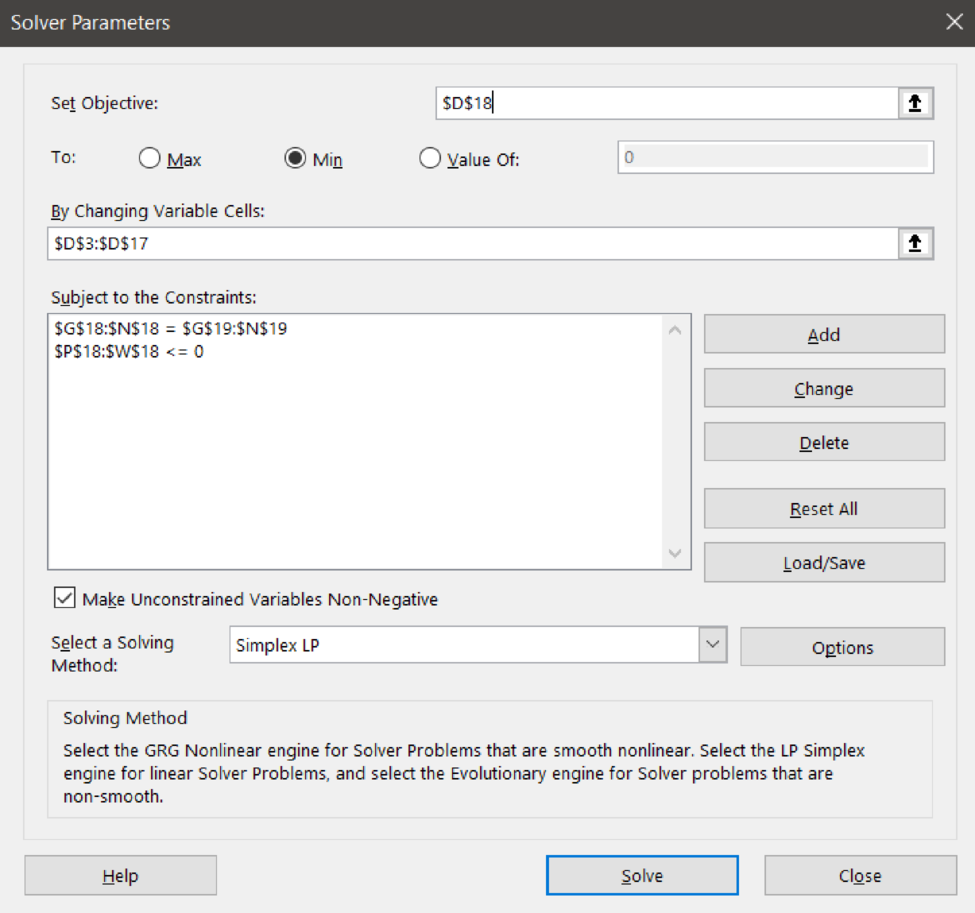

Solver input:

Answer:

c)

Summary Introduction

Toidentify: The optimal solution.

c)

Expert Solution

Explanation of Solution

Optimal solution:

Want to see more full solutions like this?

Subscribe now to access step-by-step solutions to millions of textbook problems written by subject matter experts!

Students have asked these similar questions

High Incidence of Pressure Injuries Due to Delayed Risk Identification: The unit currently relies on manual assessments and paper-based documentation to identify patients at risk of pressure injuries. This often leads to delayed interventions, increasing patient discomfort, length of stay, and costs. An electronic risk assessment and monitoring system could enable earlier identification and timely preventive care. Focus on describing in more detail the business nature of the problem.

what is the core problem, how do you know, and what will the organization get out of it if this problem is solved?

Among the various alternative work scheduling options that are out there, which would you prefer to follow and why?

Do you think working hours will get longer or shorter in the future? Why?

Would you be willing to trade off scheduling flexibility and balance for slightly reduced compensation? What factors would be important to you in such an arrangement?

Chapter 3 Solutions

Spreadsheet Modeling and Decision Analysis: A Practical Introduction to Business Analytics

Ch. 3 - Prob. 1QPCh. 3 - Prob. 2QPCh. 3 - Prob. 3QPCh. 3 - Prob. 4QPCh. 3 - Prob. 5QPCh. 3 - Prob. 6QPCh. 3 - Prob. 7QPCh. 3 - Prob. 8QPCh. 3 - Prob. 9QPCh. 3 - Prob. 10QP

Ch. 3 - Prob. 11QPCh. 3 - Prob. 12QPCh. 3 - Prob. 13QPCh. 3 - Prob. 14QPCh. 3 - Prob. 15QPCh. 3 - Prob. 16QPCh. 3 - Tuckered Outfitters plans to market a custom brand...Ch. 3 - Prob. 18QPCh. 3 - Prob. 19QPCh. 3 - Prob. 20QPCh. 3 - Prob. 21QPCh. 3 - Prob. 22QPCh. 3 - Prob. 23QPCh. 3 - Prob. 24QPCh. 3 - Prob. 25QPCh. 3 - A manufacturer of prefabricated homes has decided...Ch. 3 - Prob. 27QPCh. 3 - Prob. 28QPCh. 3 - Prob. 29QPCh. 3 - Prob. 30QPCh. 3 - Prob. 31QPCh. 3 - Prob. 32QPCh. 3 - Prob. 33QPCh. 3 - Prob. 34QPCh. 3 - Prob. 35QPCh. 3 - Prob. 36QPCh. 3 - Prob. 37QPCh. 3 - Prob. 38QPCh. 3 - Prob. 39QPCh. 3 - Prob. 40QPCh. 3 - Prob. 41QPCh. 3 - Prob. 42QPCh. 3 - Prob. 43QPCh. 3 - A natural gas trading company wants to develop an...Ch. 3 - Prob. 45QPCh. 3 - Prob. 46QPCh. 3 - The CFO for Eagle Beach Wear and Gift Shop is in...Ch. 3 - Prob. 48QPCh. 3 - Prob. 1.1CCh. 3 - Prob. 1.2CCh. 3 - Prob. 1.3CCh. 3 - Prob. 1.4CCh. 3 - Prob. 2.1CCh. 3 - Prob. 2.2CCh. 3 - Prob. 2.3CCh. 3 - Prob. 2.4CCh. 3 - Prob. 2.5CCh. 3 - Kelly Jones is a financial analyst for Wolverine...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, management and related others by exploring similar questions and additional content below.Similar questions

- Read the scenario below and answer ALL the questions that follow. As a growing small-to-medium enterprise (SME) in South Africa, your company is navigating new challenges around employee engagement, adapting to environmental pressures, and staying competitive within the industry. To support sustainable growth, the company aims to conduct a comprehensive research study on employee engagement, benchmarking against competitor practices and broader industry trends. This research will explore how external factors, such as market competition, economic conditions, and industry regulations, affect employee satisfaction and productivity. In addition, the study will investigate internal dynamics that could influence engagement, including company culture, communication practices, and career development opportunities. As the business strategic partner, you are required to develop a detailed research proposal with a focus on how your findings could support strategic initiatives to enhance the…arrow_forwardhttps://www.youtube.com/watch?v=JJxBySZwBAI&t=11s At what point in the process was there a human completing job tasks? Why?Why is the AI application being used in this industry setting?arrow_forwardhttps://www.youtube.com/watch?v=JJxBySZwBAI&t=11s Describe the specific job tasks that the AI system was completing.arrow_forward

- https://www.youtube.com/watch?v=JJxBySZwBAI&t=11s Briefly describe the AI application and its context (i.e. industry setting) presented in the video.arrow_forwardhttps://www.youtube.com/watch?v=JJxBySZwBAI&t=11s Briefly describe the AI application and its context (i.e. industry setting) presented in the video. Describe the specific job tasks that the AI system was completing. At what point in the process was there a human completing job tasks? Why? Why is the AI application being used in this industry setting?arrow_forwardhttps://www.youtube.com/watch?v=JJxBySZwBAI&t=11s Do you think the use of AI in this industry setting is beneficial? Why or why not? Describe three challenges a manager in this industry setting might encounter when managing the workflow. For each challenge include a brief observation as to why you think it would be a challenge.arrow_forward

- (a).Elaborate the types of e-commerce that have been implemented in local business firms. Your answer must include suitable examples wherever necessary. (b). What is the difference between a spreadsheet and a database? List three differences between them. please write in essay form, give introduction, body and conclusionarrow_forwardWrite elaborate notes on the following terms: (a). Data Warehouses (b). Telecommunication networksarrow_forwardDifferentiate between the following: (a). Information systems literacy and computer literacy (b). Internet application of “Business-to-Business” and “Business-to-Consumer”(c). “Telecommunication processor” and “Telecommunication channel”.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage,

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage,

Practical Management Science

Operations Management

ISBN:9781337406659

Author:WINSTON, Wayne L.

Publisher:Cengage,