Concept explainers

Kelly Jones is a financial analyst for Wolverine Manufacturing, a company that produces engine bearings for the automotive industry. Wolverine is in the process of hammering out a new labor agreement with its unionized workforce. One of the major concerns of the labor union is the funding of Wolverine’s retirement plan for its hourly employees. The union believes the company has not been contributing enough money to this fund to cover the benefits it will need to pay to retiring employees. Because of this, the union wants the company to contribute approximately $1.5 million dollars in additional money to this fund over the next 20 years. These extra contributions would begin with an extra payment of $20,000 at the end of 1 year with annual payments increasing by 12.35% per year for the next 19 years.

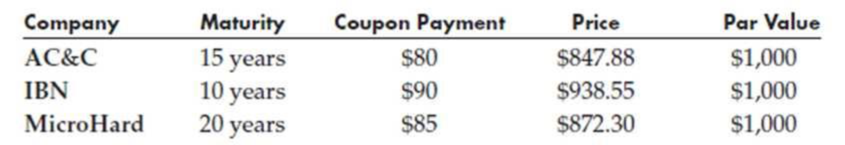

The union has asked the company to set up a sinking fund to cover the extra annual payments to the retirement fund. The Wolverines’ CFO and the union’s chief negotiator have agreed that AAA rated bonds recently issued by three different companies may be used to establish this fund. The following table summarizes the provisions of these bonds.

According to this table, Wolverine may buy bonds issued by AC&C for $847.88 per bond. Each AC&C bond will pay the bondholder $80 per year for the next 15 years, plus an extra payment of $1,000 (the par value) in the fifteenth year. Similar interpretations apply to the information for the IBN and MicroHard bonds. A

Wolverine’s CFO has asked Kelly to determine how much money the company would have to invest and which bonds the company should buy in order to meet the labor union’s demands.

If you were Kelly, what would you tell the CFO?

Want to see the full answer?

Check out a sample textbook solution

Chapter 3 Solutions

Spreadsheet Modeling and Decision Analysis: A Practical Introduction to Business Analytics

- Province/Territory Ontario Quebec British Columbia Alberta Saskatchewan Manitoba Nova Scotia Newfoundland and Labrador Number of Firms 2017 2019 2020 58 54 70 16 19 20 16 17 13 5 6 3 2 1 1 2 2 1 1 1 1 0 0 1 What makes these companies leaders is that they grew rapidly. It does not matter whether they are high-tech or old-economy companies, manufacturing or service companies, they all are exceptional. A remarkable assortment of products and services are offered by these companies. Examples include trucking, car parts, exterior painting services, steeped tea, gaming, sustainable office furniture, business performance consultants, and construction management. Dana 12arrow_forwardelijah wants to start a carpet cleaning business. to do so, he needs to purchase a carpet cleaner and advertise. he estimates the cleaner will cost $400 and advertising will cost $1,600 initially. the cleaning solution is fairly cheap, costing only $5 per room cleaned. he also thinks he will have $3 in gas on average for each client. if he charges $40 per room cleaned and cleans an average of 2 rooms per house, how many houses will he have to clean before breaking even? if taxes are 25% of profits, how many rooms will he have to clean before making $5,000 profit? answer the question by making a cvp worksheet similar to the depreciation sheets. make sure it works well, uses cell references and functions/formulas when appropriate, and looks nice.arrow_forwardWhat insights can you gain from working in a laundry business while maintaining a balance in your personal life? What about the joy of doing your work?arrow_forward

- How can you improve your lost and found system in laundry business? Like if there's a customer who has a missing garments and another customer found it accidentally in their clothes?arrow_forwardthe government is about to build a coop housing project in an open land where rich elites are living,suggest some survey questions for the rich elites on citing the coop housing project in their neigbourhood.arrow_forwardsuggest a A PITCH TO CONVINCE CAPE BRETON UNIVERSITY USING THEIR MISSIO STATEMENT ,VISION STATEMENT AND VALUES TO TELL THE SCHOOL WHY THEY SHOULD SUPPORT THE COOP HOUSING PROJECT INITIATIVE WITH RESOURCES OTHER THAN FINANCE.arrow_forward

- DRAW UP A PITCH TO CONVINCE CAPE BRETON UNIVERSITY USING THEIR MISSIO STATEMENT ,VISION STATEMENT AND VALUES TO TELL THE SCHOOL WHY THEY SHOULD SUPPORT THE COOP HOUSING PROJECT INITIATIVE WITH RESOURCES OTHER THAN FINANCE.arrow_forwardPlease original work (Please dont add any AI sentences) Background information: LEGO was founded in 1932. The word LEGO is from the Danish words LEg GOdt (play well). Later, it was realized that in Latin the word means “I put together”. The firm initially made wooden toys as well as other wood products stepladders, ironing boards, stools, etc. In 1947, the LEGO Group bought a plastic injection-molding machine for toy production and in 1949 the first LEGO Automatic Binding Brick with four and eight studs appeared. LEGO flourished for many years with its innovative toys. However, in 2004, innovation almost bankrupted the Danish toymaker. LEGO had become concerned about low-cost copies of its plastic building products so it sought to diversify into different activities including: theme parks, Clikits craft sets, action figures (Galidor), and a television show among other efforts. All of these were unprofitable and were eventually discontinued. Today, LEGO is growing in an overall…arrow_forwardPlease original work Talk about your current organization’s greatest needs for creating a balanced scorecard for management consulting firm, and steps you would take to design the balance scorecard. Please cite in text references and add weblinks.arrow_forward

- Please original work How do you think organizations can effectively balance short-term resource constraints with the need for long-term investments in areas like technology and employee development, especially when both are critical to achieving strategic goals? Please cite in text references and add weblinksarrow_forwardImportanc of the process Tuckman's model”(Forming, Storming, Norming, Performing, and Adjourning)arrow_forwardReview the article: Defining the Motivations and Capabilitied of Young Intrapreneurs: Literature Review and Research Opportunities 1. Discuss the differences and similarities of Entrepreneurship and Intrapreneurship. 2. How might your current organization or a former organization that you have been a member of incorporate the elements of Intrapreneurship? 3. Discuss the future of Intrapreneurship List referencesarrow_forward

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage,

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage, Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning

Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning