College Accounting, Chapters 1-27

23rd Edition

ISBN: 9781337794756

Author: HEINTZ, James A.

Publisher: Cengage Learning,

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

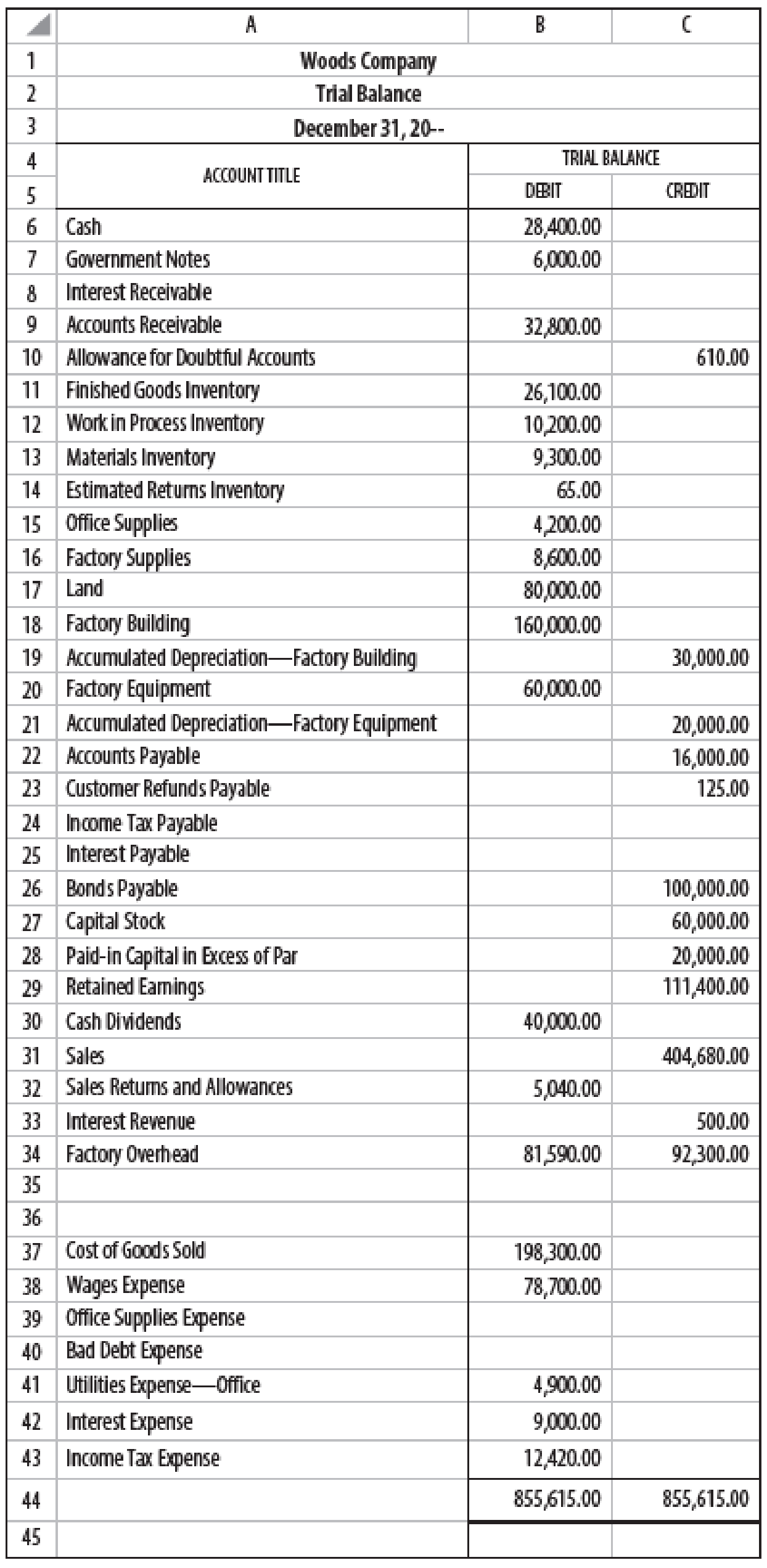

Chapter 27, Problem 6SPB

SPREADSHEET,

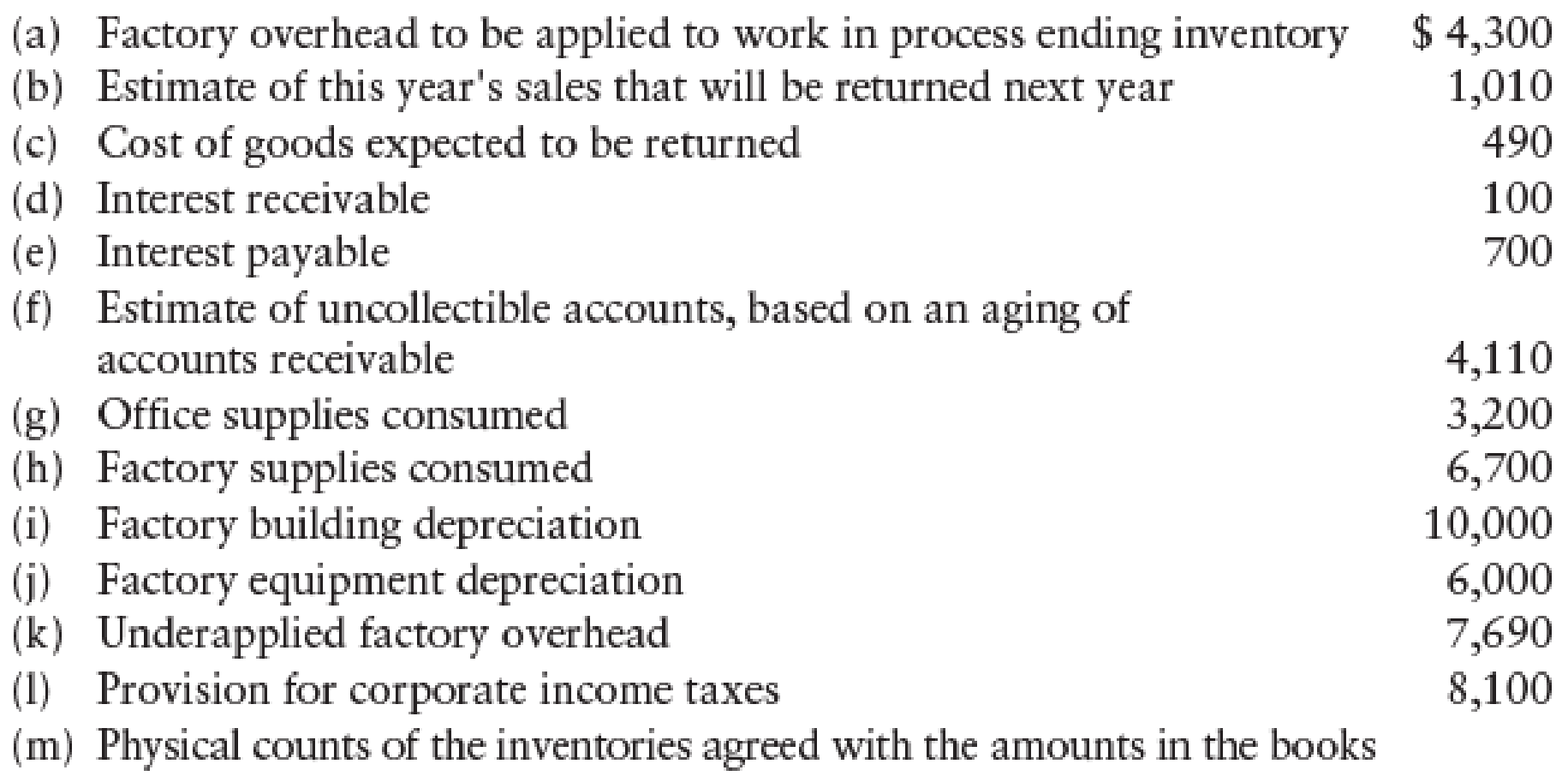

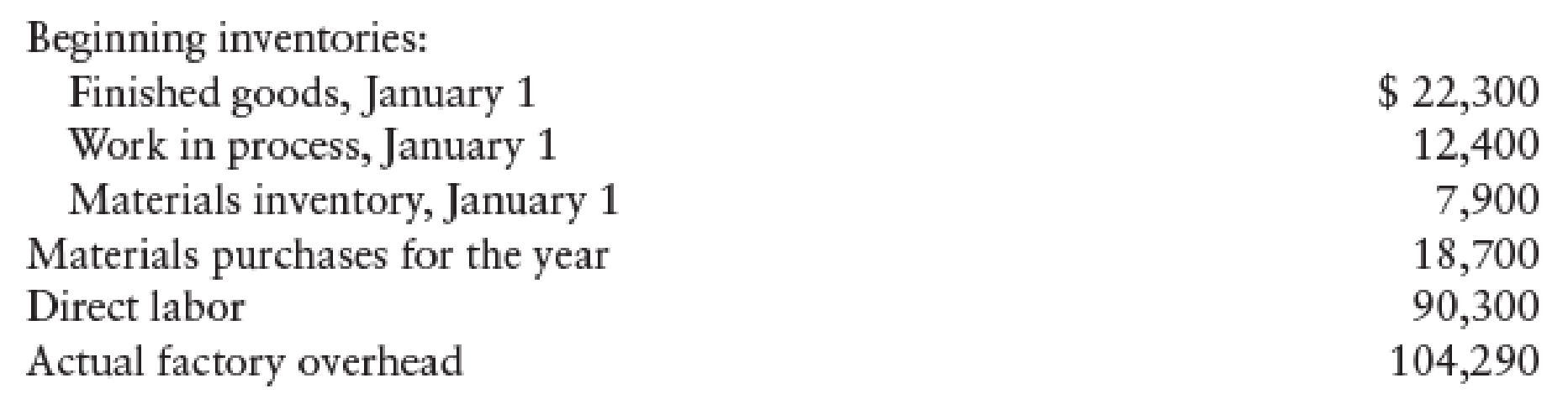

Additional information needed to prepare the financial statements is as follows:

Assume that all materials inventory items are direct materials.

Required

- 1. Prepare a spreadsheet.

- 2. Prepare the following financial statements and schedule:

- (a) income statement

- (b) schedule of cost of goods manufactured

- (c) statement of

retained earnings - (d)

balance sheet

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Determine the missing value

Accurate answer

Can you help me with accounting questions

Chapter 27 Solutions

College Accounting, Chapters 1-27

Ch. 27 - Under the perpetual inventory system, Cost of...Ch. 27 - Prob. 2TFCh. 27 - On the spreadsheet, the factory overhead account...Ch. 27 - Prob. 4TFCh. 27 - The adjustment for factory overhead applied to...Ch. 27 - LO2 The adjustment for the amount of factory...Ch. 27 - The adjustment for depreciation expense for the...Ch. 27 - At the end of the accounting period, a credit...Ch. 27 - Prob. 4MCCh. 27 - Prob. 5MC

Ch. 27 - LO2 Prepare adjusting entries at December 31 for J...Ch. 27 - Prob. 2CECh. 27 - Prob. 3CECh. 27 - Prob. 1RQCh. 27 - Prob. 2RQCh. 27 - Prob. 3RQCh. 27 - Prob. 4RQCh. 27 - Prob. 5RQCh. 27 - What are the distinctive features of ToyJoys...Ch. 27 - Prob. 7RQCh. 27 - Prob. 8RQCh. 27 - Prob. 9RQCh. 27 - ADJUSTING ENTRIES INCLUDING ADJUSTMENT FOR...Ch. 27 - Prob. 2SEACh. 27 - Prob. 3SEACh. 27 - CLOSING JOURNAL ENTRIES Prepare closing journal...Ch. 27 - REVERSING JOURNAL ENTRIES Prepare reversing...Ch. 27 - SPRE ADSHEET, ADJUSTING ENTRIES, AND FIN ANCIAL...Ch. 27 - FINANCIAL STATEMENTS The adjusted trial balance...Ch. 27 - ADJUSTING. CLOSING. AND REVERSING ENTRIES A...Ch. 27 - ADJUSTING ENTRIES INCLUDING ADJUSTMENT FOR...Ch. 27 - Prob. 2SEBCh. 27 - ADJUSTING JOURNAL ENTRIES FOR A MANUFACTURING...Ch. 27 - Prob. 4SEBCh. 27 - REVERSING ENTRIES Prepare reversing journal...Ch. 27 - SPREADSHEET, ADJUSTING ENTRIES, AND FINANCIAL...Ch. 27 - FINANCIAL STATEMENTS The adjusted trial balance...Ch. 27 - Prob. 8SPBCh. 27 - Prob. 1MYWCh. 27 - Reese Manufacturing Company manufactures and sells...Ch. 27 - Drafts of the condensed income statement and...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Phoenix Industries has twelve million shares outstanding, generates free cash flows of $75 million each year, and has a cost of capital of 12%. It also has $50 million of cash on hand. Phoenix wants to decide whether to repurchase stock or invest the cash in a project that generates free cash flows of $3 million each year. Should Phoenix invest or repurchase the shares? A) Repurchase B) Invest C) Indifferent between options D) Cannot say for surearrow_forwardgeneral accountingarrow_forwardANSWER?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

College Accounting, Chapters 1-27 (New in Account...

Accounting

ISBN:9781305666160

Author:James A. Heintz, Robert W. Parry

Publisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781305084087

Author:Cathy J. Scott

Publisher:Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY